Bitget Automated Trading: Using AI and Futures Grids to Create Trading Bots

Introduction

Bitget is a leading cryptocurrency exchange that offers a variety of services, including spot trading markets, US dollar debt-funded futures market, and the option to use Bitcoin, Ethereum, or even XRP to open positions with the coin margin option.

One of the standout features of Bitget is its automated trading bots, which can execute trades 24/7, capitalize on market fluctuation, and help you achieve constant profits even when you're not in front of the computer.

What is a Trading Bot?

A trading bot is a software program that interacts directly with financial exchanges and places buy or sell orders on your behalf, based on the market data it analyzes. They're designed to execute trades faster and more efficiently than a human trader could.

What is a Safety Order?

A safety order is a tool used in trading to prevent further losses when the market goes against your position. It's essentially an order set to buy or sell a security when its price reaches a certain level, thus 'safeguarding' your trade from incurring more loss.

Getting Started

To get started with Bitget, you can sign up for an account on their platform by using an email and password.

Creating Your Own Trading Bot

Bitget offers two options for creating your own trading bot: Grid and Futures Martingale.

Grid

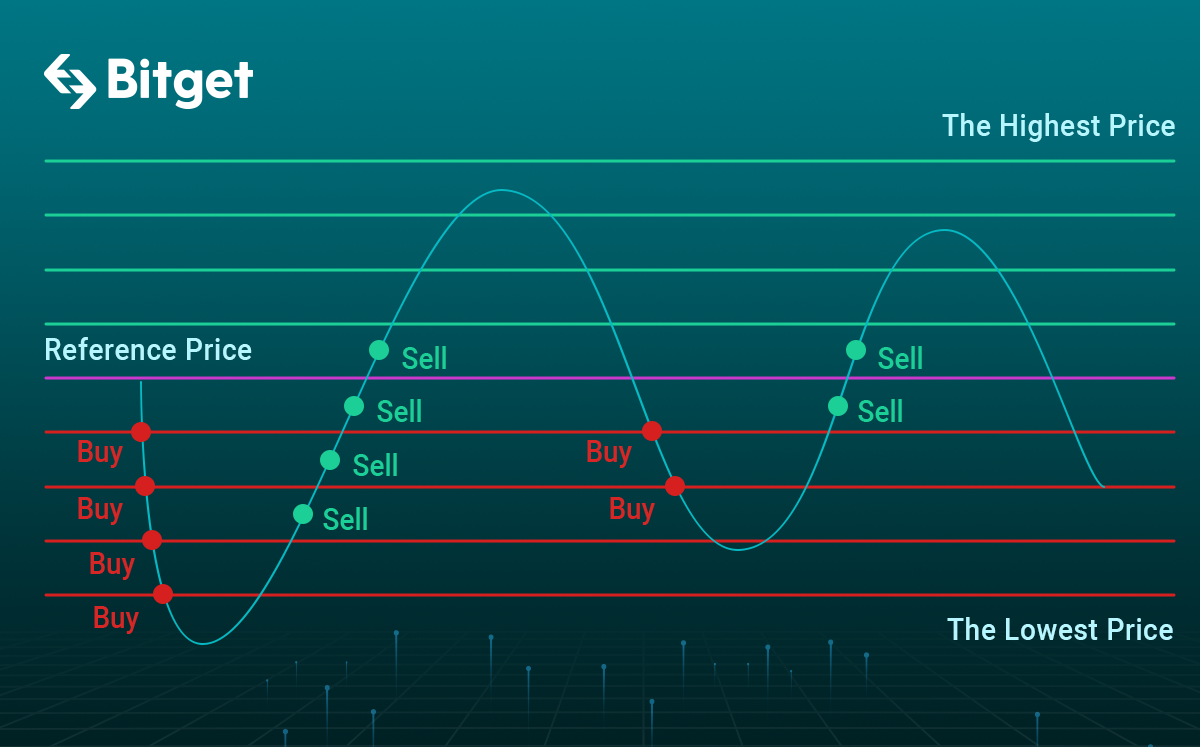

The Grid option allows you to create automated levels in the chart which will automatically long or short whenever the price touches that specific level. The bot will also close that position after a certain profit.

Futures Martingale

The Futures Martingale strategy is designed to react to significant price changes. For example, if the price drops by 10%, you can set the bot to automatically enter a long position to catch a potential reversal. Conversely, if the price rises by 10%, the bot can automatically enter a short position for the same reason.

The key difference between Futures Grid trading and Futures Martingale trading is that Futures Grid involves predetermined levels, while Futures Martingale reacts to a percentage of pump or dump.

Why Use a Trading Bot?

Bitcoin is a highly volatile asset, with rapid up and down movements. Sometimes, these movements can occur when you're not able to monitor the markets. A trading bot can help you capitalize on these movements, executing trades even when you're not able to do so yourself.

Setting Up a Grid Trading Bot

Once you have an account on Bitget, you can start setting up your trading bot. Here's how you can do it:

- Click on 'Trading Bots' on the Bitget platform.

- Select 'Futures Grid'. This will take you to a page where you can see the Bitcoin chart and the Futures Grid options.

- You can choose between two options: AI (Artificial Intelligence) and Manual. The AI option uses Bitget's artificial intelligence to set up the bot, while the Manual option allows you to set up the bot yourself.

- Below these options, you can select the trading pair. For this guide, we will focus on Bitcoin.

Using AI for Grid Trading

The AI option provides several pre-set strategies that you can choose from. Each strategy shows a 30-day APY (Annual Percentage Yield), the type of strategy (aggressive, balanced, etc.), the type of positions it opens (long or short), the leverage it uses, and the number of people following the strategy.

When you select a strategy, you can see the grid that the AI is using. The grid shows the points at which the bot will go long on Bitcoin. The bot takes a lot of trades during this range every time Bitcoin touches one of these support levels, allowing you to profit without having to monitor the markets constantly.

Setting Up the AI Bot

- Select the amount of margin you want to enter. The minimum margin is $340.

- Select the leverage you want to use. Higher leverage will reduce the required margin.

- Select the amount you want to set into the strategy.

- Click on 'Create an Order'.

- Confirm the parameters. These include the trading pair, the price range, the number of grids, the profit per grid, your margin, the estimated liquidation price, the position mode, and the leverage.

- Click on 'Confirm'. You are now following the trading strategy.

Setting Up a Futures Martingale Bot

The Futures Martingale bot works differently from the Grid bot. Instead of working with a grid, it looks at the amount of increase or decrease in Bitcoin's value. Here's how you can set it up:

- Click on 'Trading Bots' on the Bitget platform.

- Select 'Futures Martingale'. This will take you to a page where you can see the Bitcoin chart and the Futures Martingale options.

- You can choose between two options: AI (Artificial Intelligence) and Manual. The AI option uses Bitget's artificial intelligence to set up the bot, while the Manual option allows you to set up the bot yourself.

- Below these options, you can select the trading pair. For this guide, we will focus on Bitcoin.

Using AI for Futures Martingale

The AI option provides several pre-set strategies that you can choose from. Each strategy shows a 30-day APY (Annual Percentage Yield), the type of strategy (aggressive, balanced, etc.), the type of positions it opens (long or short), the leverage it uses, and the number of people following the strategy.

When you select a strategy, you can see the base order and the conditions under which the bot will open a long position. For example, the bot may open a 5x long position once the price action goes down by 1%.

Setting Up the AI Bot

- Select the amount of margin you want to enter. The minimum margin is $340.

- Select the leverage you want to use. Higher leverage will reduce the required margin.

- Select the amount you want to set into the strategy.

- Click on 'Create an Order'.

- Confirm the parameters. These include the trading pair, the price range, the number of grids, the profit per grid, your margin, the estimated liquidation price, the position mode, and the leverage.

- Click on 'Confirm'. You are now following the trading strategy.

Setting Up a Manual Futures Martingale Bot

- Click on 'Manual'.

- Select your trading pair.

- Choose whether you want to go long or short.

- Set the trigger requirement. For example, you might want to go long when Bitcoin drops 2%.

- Set the leverage. For example, you might want to use a 5x leverage.

- Set the maximum safety orders. For example, you might want to set a maximum of 9 safety orders.

- Set when you want to take profits. For example, you might want to take profits at 10%.

- Click on 'Create an Order'.

- Confirm the parameters. These include the trading pair, the trigger requirement, the leverage, the maximum safety orders, and when you want to take profits.

- Click on 'Confirm'. You are now following the trading strategy.

Monitoring Your Bots

Once your bots are up and running, you can monitor their performance on the Bitget platform. You can see the profit each bot has made and whether they are currently in a position. If you want to stop following a bot's strategy, simply click on 'Terminate' and confirm.

Conclusion

Trading bots on Bitget can be a powerful tool for capitalizing on market movements, even when you're not able to monitor the markets constantly. However, it's important to remember that trading involves risks, especially when using leverage. Always do your own research and understand the risks before starting to trade. For more information about Bitget read our Bitget review.

Thank you for reading this guide, we hope it helps you in setting up and using trading bots on Bitget. If you'd like to get started setting up your own trading bot you can create an account on Bitget.