Learn everything about all

Whaleportal Charts

The Bitcoin Balance on Exchanges is showing the number of Bitcoins that are being held on exchanges. Whaleportal is tracking...

The Open Interest is the amount of funds that are in a contract at one specific moment. If you open a contract...

The Crypto Fear and Greed Index is a sentiment indicator. It tells you whether the sentiment in the crypto markets is...

The Bitcoin Premium index tracks the premium or discount of Bitcoin perpetual contracts relative to the spot index price per minute. The premium...

The funding rates are one of the most popular and successful indicators for Bitcoin derivative traders. The funding rates show...

The "Taker buy/sell ratio" shows us the ratio between the long and short volumes in the derivatives market. When the value is greater than...

Blogs

Discover the best TradingView alternative for crypto traders. WhalePortal offers real-time exchange data, sentiment heatmaps, and unique crypto charts.

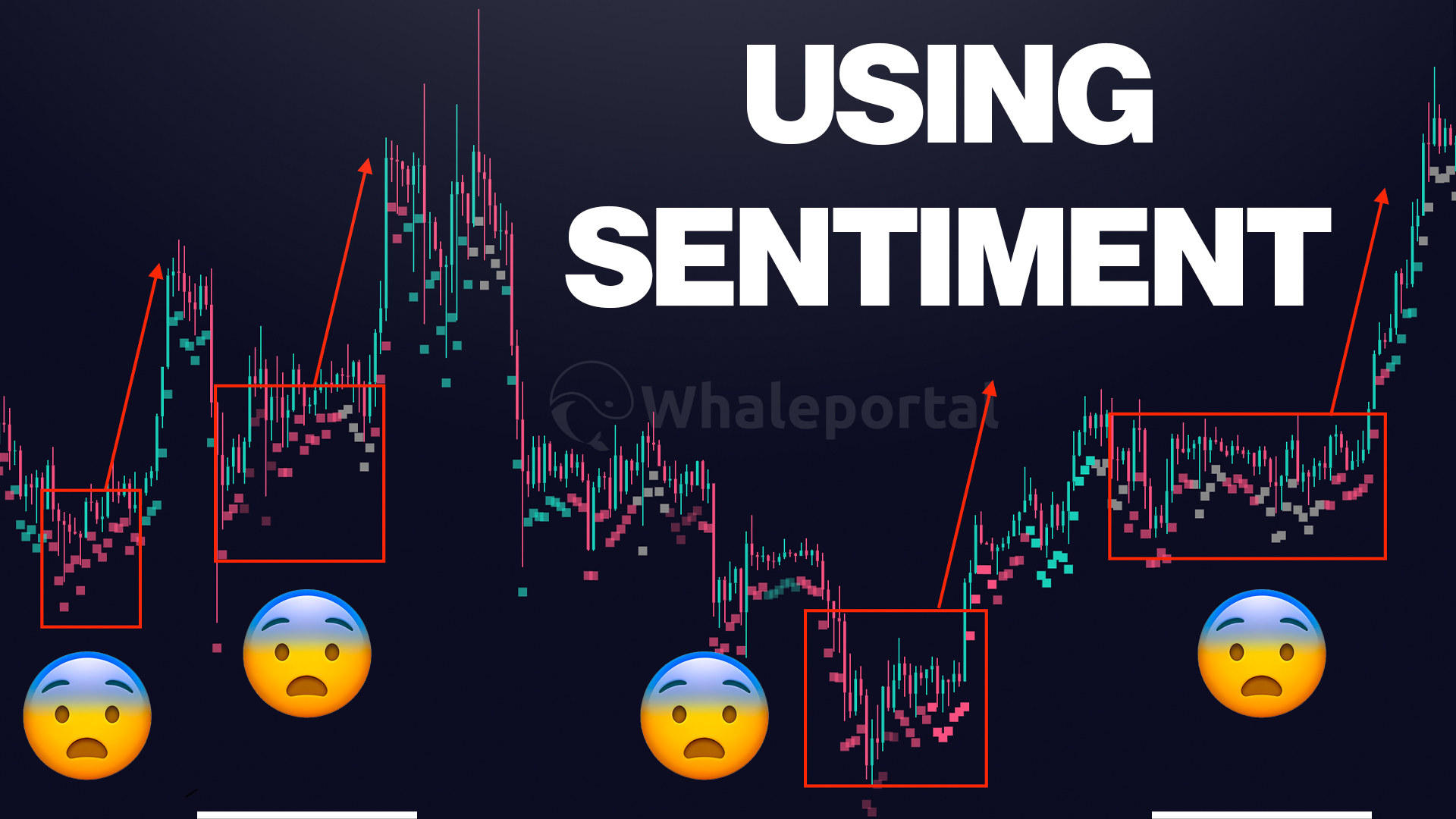

Learn how to read crypto market sentiment using data-driven tools like the Fear and Greed Index, funding rates, premium index, and sentiment heatmaps. Quantify sentiment data and analyze the emotional state of the markets.

Compare ApeX Omni vs dYdX to find out which decentralized exchange is better in 2025. Explore fees, liquidity, trading pairs, copy trading, vaults, and user experience.

Discover the best ways to earn passive income with crypto in 2025, including staking, copy trading, and decentralized vaults. Compare risk, rewards, and top platforms like Bybit, Aave, Apex, and dYdX.

Learn how crypto vaults work in 2025. Discover passive income strategies with Apex Omni & dYdX. Compare risks, returns, and the best DeFi vaults.

Discover the best crypto deposit bonuses of 2025. Compare Bybit, BTCC, MEXC, and more. Learn how to claim rewards despite hidden rules.

Discover how decentralized copy trading works on DEXs like Apex Omni and dYdX. Learn the differences from centralized platforms, explore Vaults, and see if it's right for you.

Discover the most mentioned coins in prophetic visions, including XRP and LUNC. Is a wealth transfer tied to crypto already unfolding?

Discover how Apex Omni Vaults bring decentralized copy-trading to life. Trade or invest without KYC, enjoy full fund control and earn passive income securely and transparently on-chain.

Learn how the BTCC deposit bonus works, what the rules are, and why it’s one of the most straightforward crypto bonuses with no KYC, no tricky conditions, and 10% extra on your first deposit.

Trade stocks, gold, and oil using crypto. Explore platforms like Bybit and BTCC, compare KYC requirements, and find the best no-bank, no-fiat trading options.

Learn how to use the Altcoin Season Index to identify profitable trading opportunities, time your Bitcoin-to-altcoin rotation, and manage risk effectively.

Discover the best no-KYC crypto exchanges of 2025 for private, low-cost trading. Compare fees, features, and withdrawal limits of Bitunix, BTCC, and Apex Omni.

Learn how to complete Bybit KYC verification in 2025, including using a Palau ID. Discover Bybit’s KYC levels, troubleshooting tips, and alternative exchanges like Apex Omni and Bitunix if KYC isn’t an option.

Learn how to trade on Apex Omni, Bybit’s decentralized exchange. This step-by-step tutorial covers wallet connection, deposits, trading, and withdrawals.

Unlock up to $4,800 in bonuses with Phemex! Our Phemex Deposit Bonus Guide shows you how to qualify, use your bonus,and enhance your trading experience. Sign up now with code 'H2YHK' to claim your bonus today!

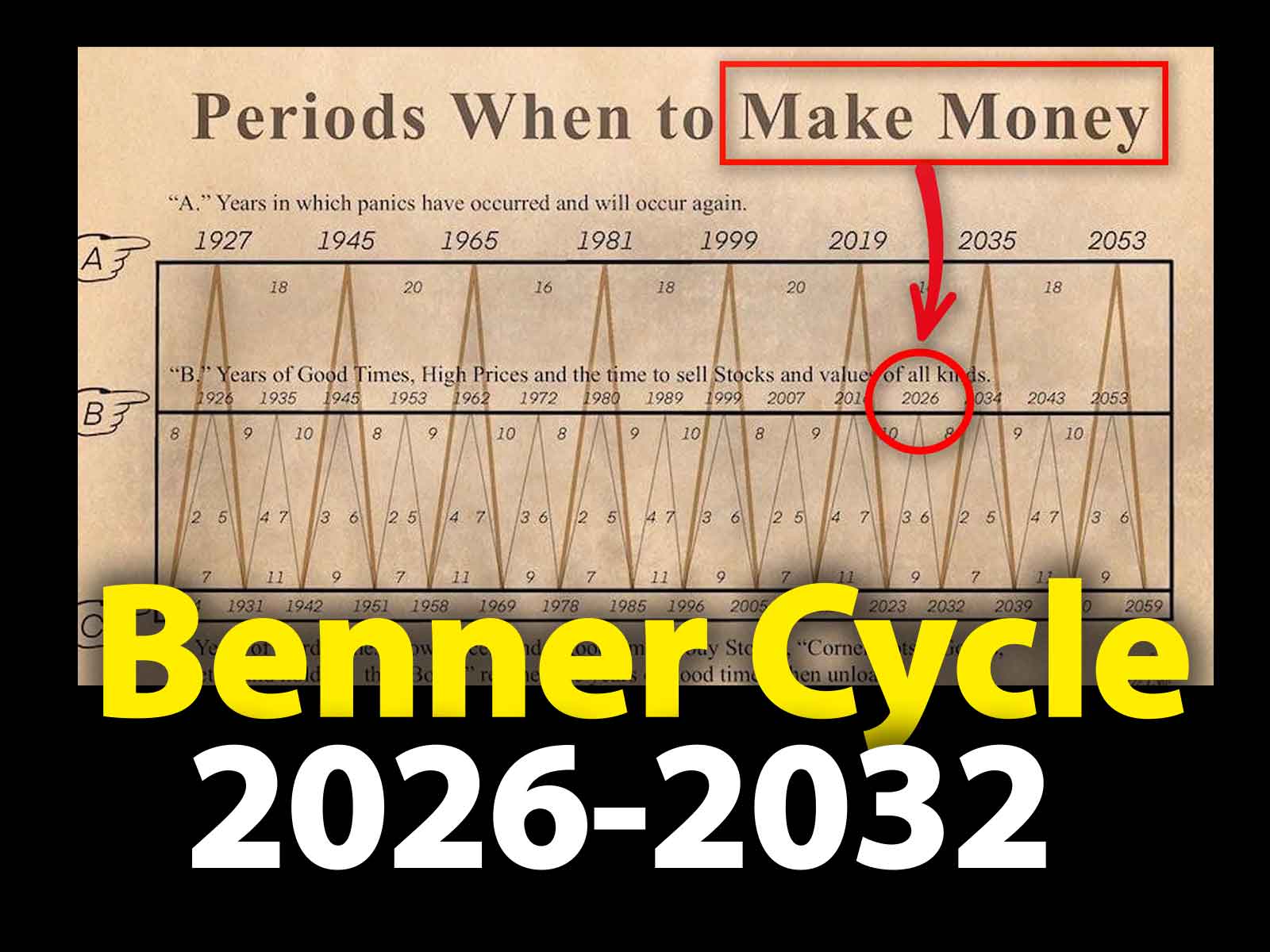

Discover the Benner Cycle and Sunspot Cycles in this article. Learn how these patterns have predicted past market trends and how they may help forecast the next recession, suggesting "good times" until 2026 followed by potential downturns until 2032.

Avoid common mistakes when using liquidation heatmaps! Learn how to interpret them correctly, avoid false signals, and improve your trading strategy with key insights.

Learn what the Premium Index is, how it works, and why it matters for crypto traders. Discover how to use it with funding rates to spot market trends and improve your trading strategy.

Claim up to $1,000 in Bitunix deposit bonuses and enjoy 30% lower trading fees with VIP3 status. No KYC is required and no VPN, start trading instantly.

Discover the best decentralized crypto exchanges of 2025, including Apex Omni, dYdX, Uniswap, and more. Compare features, fees, and security to find the perfect DEX for your trading needs!

Are no-KYC crypto exchanges safe? Explore the pros and cons of trading without identity verification, the best no-KYC exchanges in 2025, and how to stay secure while trading.

Claim up to $30,000 in Bybit deposit bonuses and maximize your trading potential. This guide covers everything you need to know about KYC verification, deposit requirements, and how to use the Bybit bonus effectively.

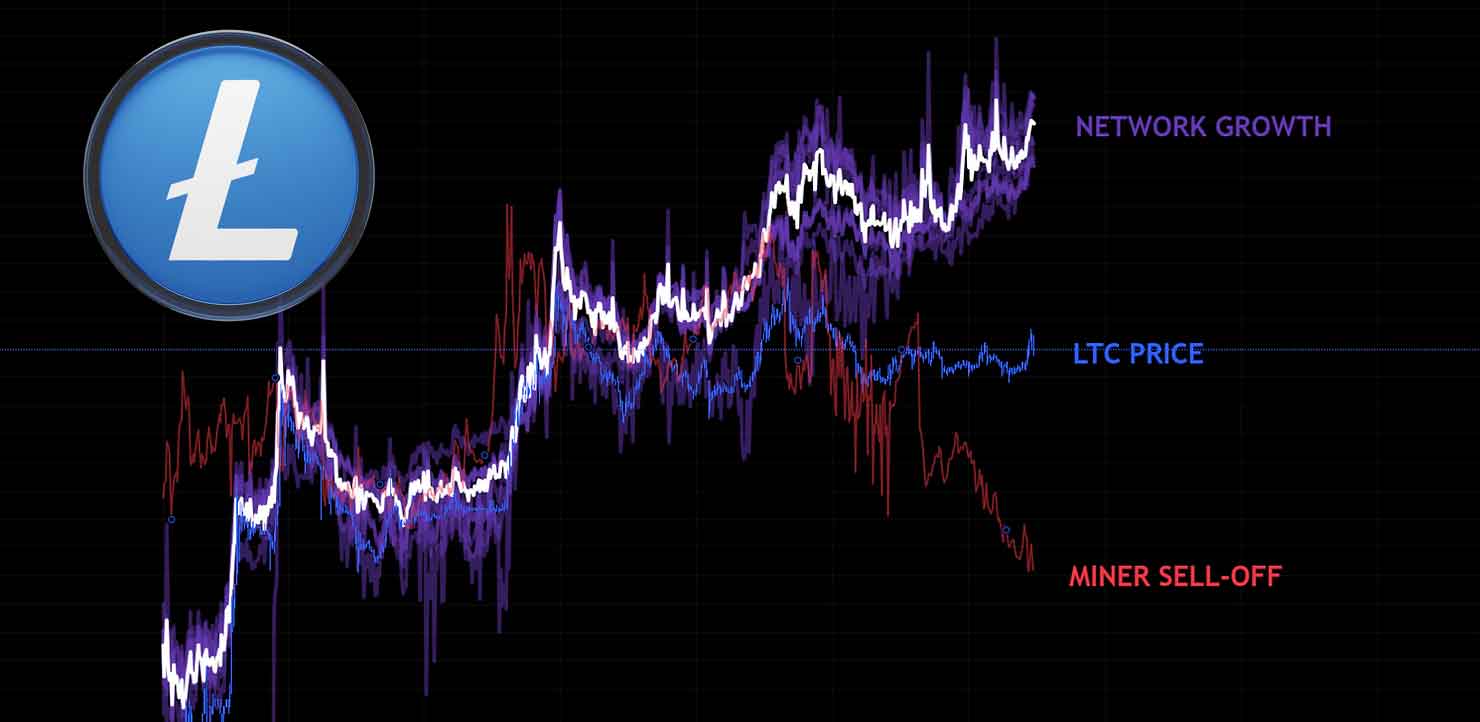

Litecoin could be poised to emerge as one of the next Dino tokens to take off in 2025, following a prolonged period of consolidation since the 2017 bull market.

Discover how Whaleportal helps traders overcome emotional barriers and improve trading psychology, as described in Mark Douglas' Trading in the Zone. Learn how sentiment analysis can lead to better decision-making and consistent profits.

In this article we'll dive into order book depth and order book heatmaps. How can you use the order book for your trading?

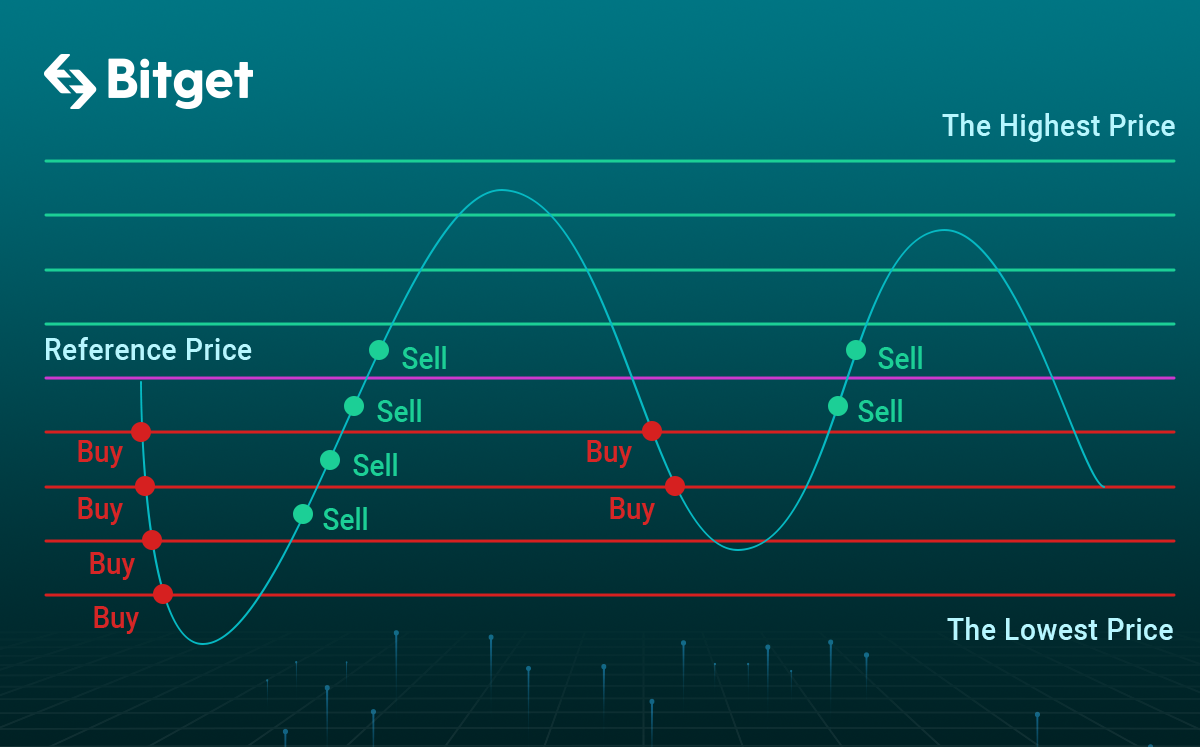

Grid trading automates buying and selling in sideways crypto markets. Learn how this strategy works and how it helps simplify trading and manage risks.

Discover ApeX Omni's unique features, from easy multichain trading to a generous deposit bonus, offering a simple and secure decentralized exchange experience compared to Apex Pro.

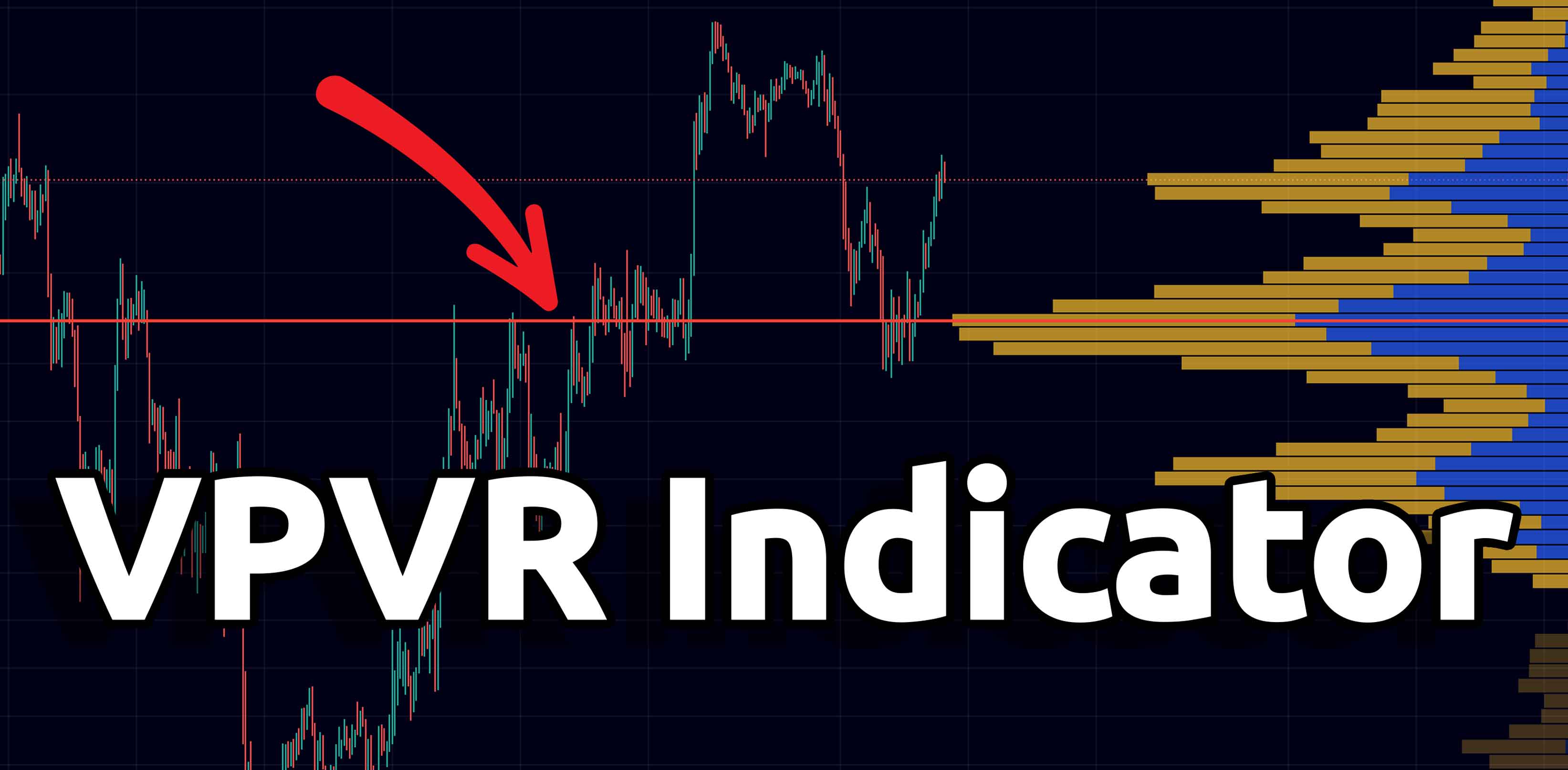

Learn how to use the Volume Profile Visible Range (VPVR) indicator in cryptocurrency trading to analyze volume distribution, identify support and resistance levels, and confirm trends for more informed decisions.

Discover how the Taker buy/sell ratio reveals trader sentiment and market conditions. Learn to use this metric for better trading decisions and spot trends with Whaleportal’s insights.

Deribit Exchange Account Setup - Create an account, verify it through KYC and deposit funds.

PrimeXBT Account Setup - Create an account, Verify (KYC), and deposit your first funds. We also cover how to claim your deposit bonus.

Phemex Account Setup, how to create an account on Phemex Exchange, claim your deposit bonus, verify KYC, and deposit your first funds.

CoinW Account Setup. How to create an account on CoinW Exchange, Verify your account, claim your deposit bonus and deposit funds into your account.

The Bybit $30,000 Deposit Bonus, how to get this deposit bonus and is it worth it? This article is all about Bybit Deposit Bonuses.

To create a Bitget account, you need to sign up on their website, verify your identity with government-issued documents, and complete specific tasks to claim bonuses, while also ensuring the exchange supports your country.

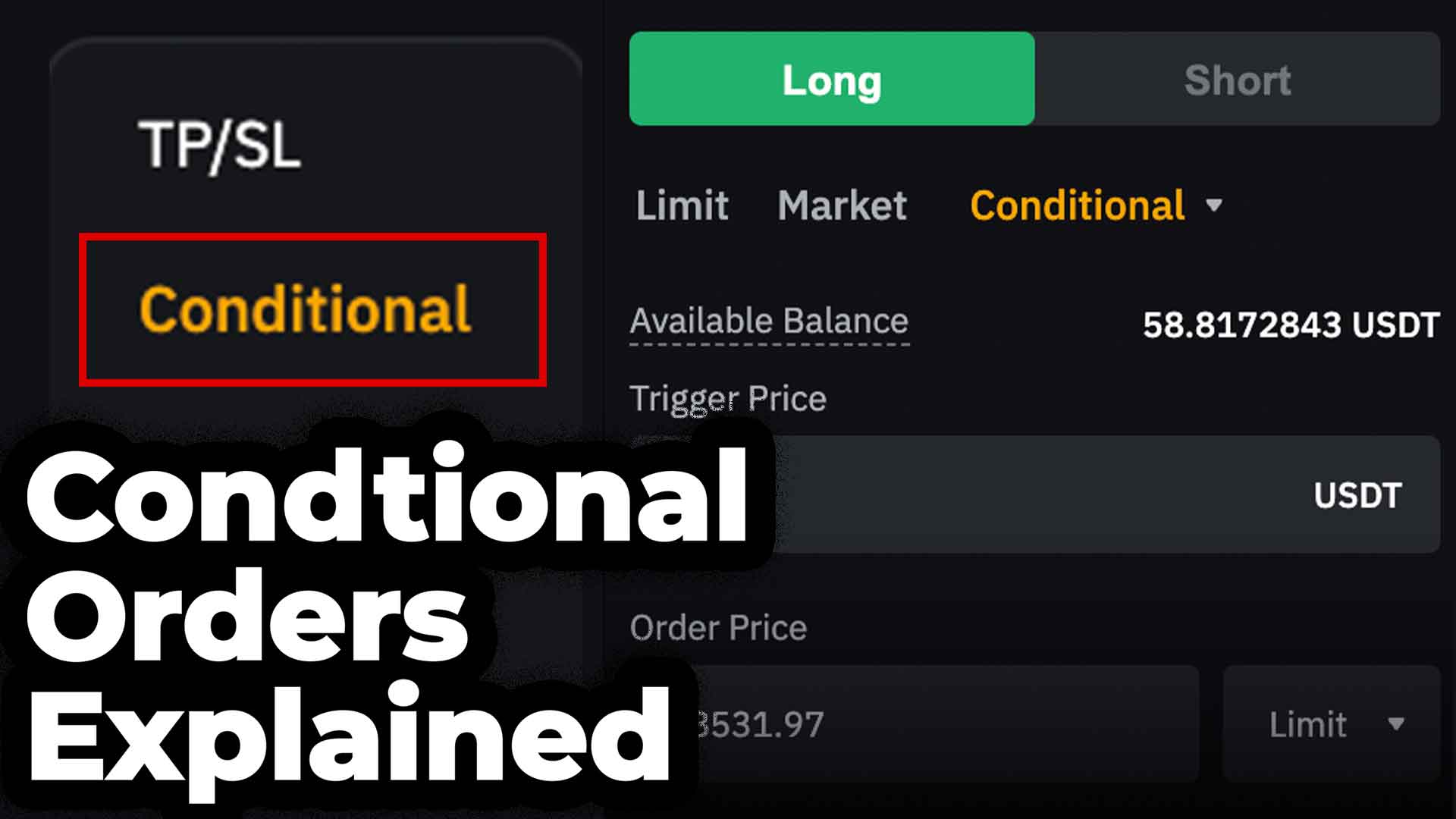

Bybit Conditional order tutorial. In this article, we'll explain exactly what a conditional order is and why traders are using a conditional order in their trading strategy.

In this article, we explain how to setup your Bybit account. We'll go step-by-step through the process of creating an account, completing KYC verification, claiming a deposit bonus, and deposit funds into your account.

Which exchanges charge more fees, Bybit or Binance? In this article we'll compare the Bybit fees with Binance fees and have a look at which exchange charges lower fees.

In this article we will compare the Bybit exchange with the Apex Pro exchange, we will have a look at the pros and cons of both exchanges. You will know the most important differences between these exchanges.

Bybit P2P trading guide, in this article we'll guide you through the process of Bybit peer-to-peer (P2P) trading along with the necessary steps to buy and sell crypto on Bybit.

In this article we'll dive into the price prediction and analysis that where being shared onWhaleAlerts using the Whaleportal PRO charts.

From Dual Asset, Double-Win, Discount Buy, and Smart Leverage, Bybit structured products can help grow your assets. In this article we'll explain all these structured products that Bybit is offering

Liquidation heatmaps can really help traders in making price predictions on Bitcoin. Let’s dive into the mechanics of these liquidation heat maps and look why they carry such valuable information.

Bybit is a leading crypto trading platform, continually providing investors with advanced trading tools. Bybit Dual Asset is a latest offering by Bybit structured products to give crypto trading a new dimension.

In this article, we will explore some of the most reliable indicators for direct buy and sell signals for Bitcoin and crypto. We'll look at the strengths and flaws of these indicators and look at which data might increase their reliability.

TradingView's webhook functionality integrated with Bybit enables traders to automate their strategies and receive real-time alerts on Bybit.

Here's your guide on how to use Bybit in the US. Can you use Bybit in the United States? Is it safe to use in the US? What are some Bybit alternatives?

Effective risk management strategies for crypto traders are as crucial as trading itself. Proper risk management can enhance profitability and give traders greater peace of mind.

Social media sentiment directly influences cryptocurrency prices leading to a rapid buy/sell ratio that drives market volatility.

Apex Pro Exchange is a very easy-to-use DEX and definitely recommended for the ones that are not able to use a centralised exchange like Bybit or want to have the advantage of self-custody over their own funds. Create an account on Apex Pro today and find out for yourself if you like it. If you want to have a visual step-by-step guide on how to use Apex Pro you can watch this Apex Pro video Tutorial.

Bitcoin spot ETF inflow chart compared to the Bitcoin price. Is there any correlation between Bitcoin spot ETF inflows and the Bitcoin price?

The sentiment is the dominant emotional state of the traders and investors in the markets. Traders can use this to make price predictions on Bitcoin. In this article we'll dive into how you can analyse the sentiment in the crypto markets and use it into your advantage.

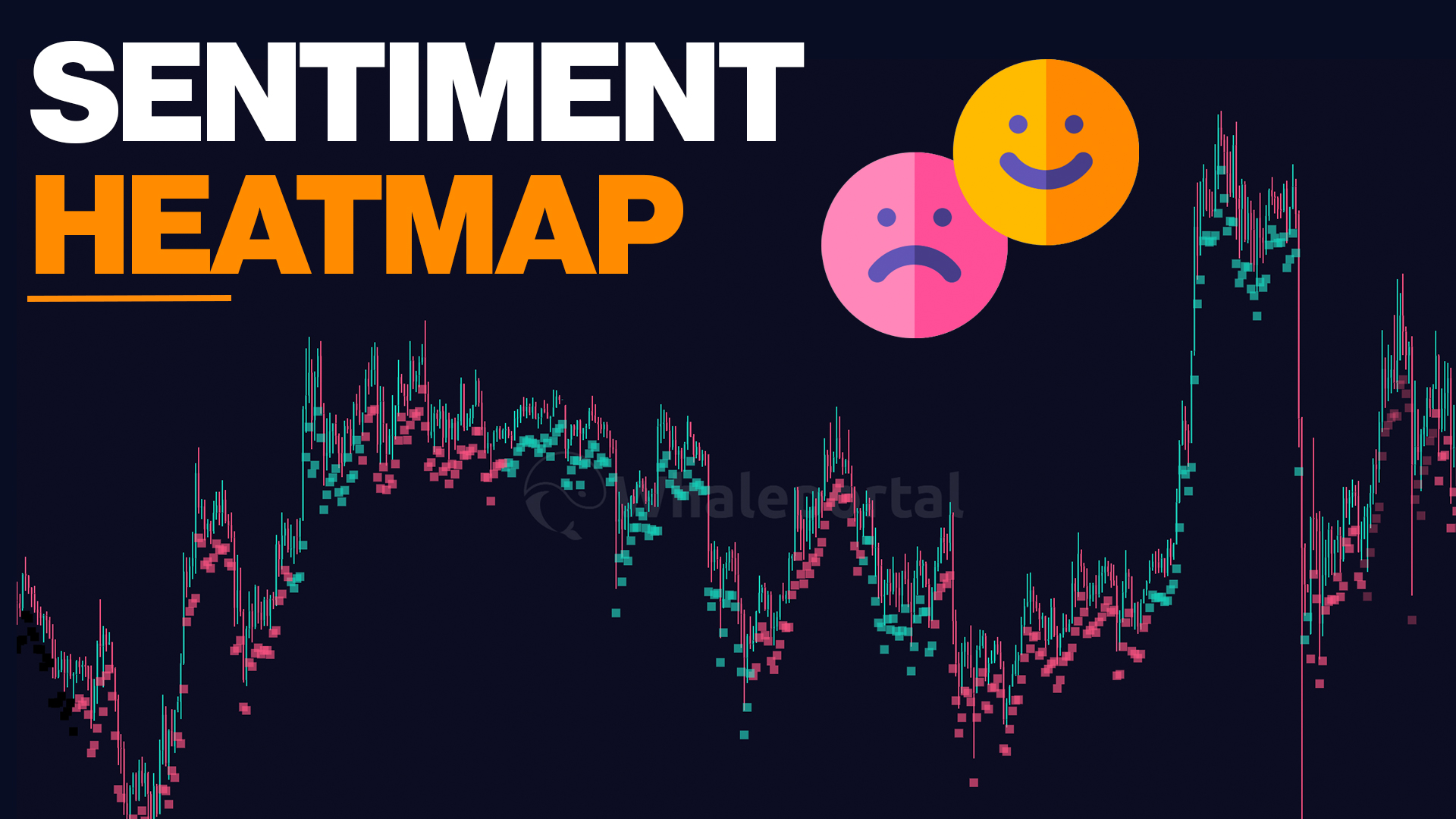

Crypto sentiment online is analysed and plotted on the charts as a heatmap. The sentiment heatmap on Whaleportal.

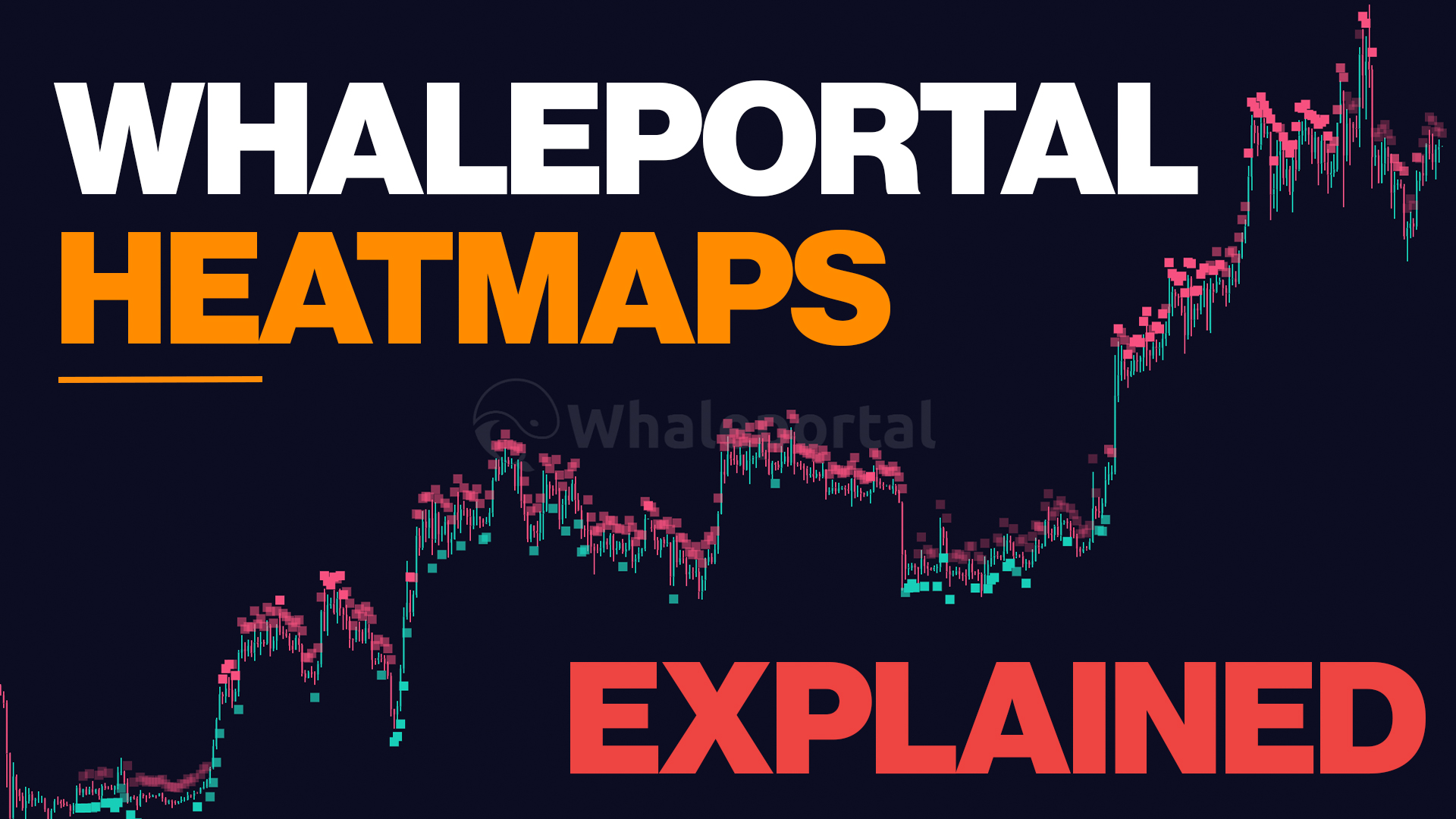

Whaleportal heatmaps are visual representations of buying and selling pressure on the charts of Bitcoin and other cryptocurrencies.

Meta Description: Explore the psychological dimensions of risk management in trading. Understand how overconfidence and loss aversion influence trading decisions and learn how experience and training can mitigate these effects.

Discover the latest enhancements of WhalePortal's dashboard, designed for an optimal Bitcoin futures trading experience. Dive into new features, sleek design updates, and advanced metrics in our detailed walkthrough. Elevate your trading journey with WhalePortal.

Explore the top five indicators crucial for Bitcoin day trading, including the RSI, VPVR, moving averages, funding rates, and the Premium Index. Enhance your trading strategy with these tools and track them seamlessly on Whaleportal.

Explore the top 10 Telegram channels for crypto signals in 2023, including the innovative Whaleportal Alerts. These channels provide real-time insights, market analysis, and trading indications, catering to various trading needs. Learn how to effectively manage assets, set targets, and maximize profits in the ever-changing world of cryptocurrency.

Explore the intriguing world of Bitcoin trading with our comprehensive guide on understanding and leveraging the Bitcoin 4-Year Cycle using the Whaleportal trading dashboard. Discover how key metrics can help predict market trends and make strategic trading decisions that align with your investment goals.

Discover how to use open interest to your advantage in Bitcoin trading with Whaleportal. This beginner and intermediate trader-friendly guide explains the concept of open interest, its significance, and how to utilize it for market sentiment analysis, price reversal prediction, and spotting trading opportunities. Enhance your trading strategies with Whaleportal's real-time data tools

Learn how to use Bitget's automated trading features in this beginner-friendly guide. Discover how to set up AI and Futures Grid trading bots, understand safety orders, and monitor your bots' performance. Start capitalizing on market fluctuations today!

Explore our comprehensive guide to Bitcoin futures trading on Whaleportal. Understand key indicators like Bitcoin Balance on Exchanges, Open Interest, Fear and Greed Index, Premium Index, Funding Rates, and Taker Buy/Sell Ratio. Learn how to interpret these indicators and apply them in real-world trading scenarios through detailed case studies. Discover advanced strategies that combine multiple indicators for a more comprehensive market view. This guide provides the knowledge and tools to enhance your trading strategies and make more informed decisions in the dynamic world of Bitcoin futures trading.

Explore the impact of the Taker Buy/Sell Ratio on Bitcoin trading in our latest blog post. Learn how this key market indicator can enhance your trading strategies and provide valuable insights into market sentiment. Dive into the world of Bitcoin trading with WhalePortal.

Explore the significant role of funding rates in Bitcoin futures trading. Understand how they influence trading decisions, reflect market sentiment, and vary across exchanges like Bitget, Binance, Bybit, and more. Learn how WhalePortal's real-time data can help you make informed, strategic trading decisions.

Explore the intricate world of Bitcoin trading with our comprehensive guide. Understand the role of Bitcoin whales, their influence on market trends, and how to monitor their activity using Whaleportal. Dive deep into whale metrics and leverage this knowledge to enhance your trading strategies. This guide is a must-read for anyone eager to navigate the complex and exciting landscape of cryptocurrency trading.

Overcome analysis paralysis in crypto trading with WhalePortal. Learn about the concept, backed by research and studies, and discover how WhalePortal empowers traders to make data-driven decisions with confidence. Enhance your trading performance and break free from the psychological trap of analysis paralysis.

This article explores the relationship between investor sentiment, as captured by the Crypto Fear and Greed Index, and Bitcoin returns.

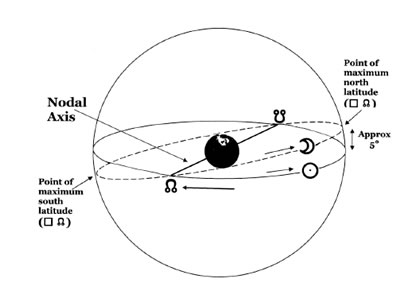

The 18.6-year cycle also known as the McWhirter cycle is an economic market cycles based on the position of the north node going through various constellations.

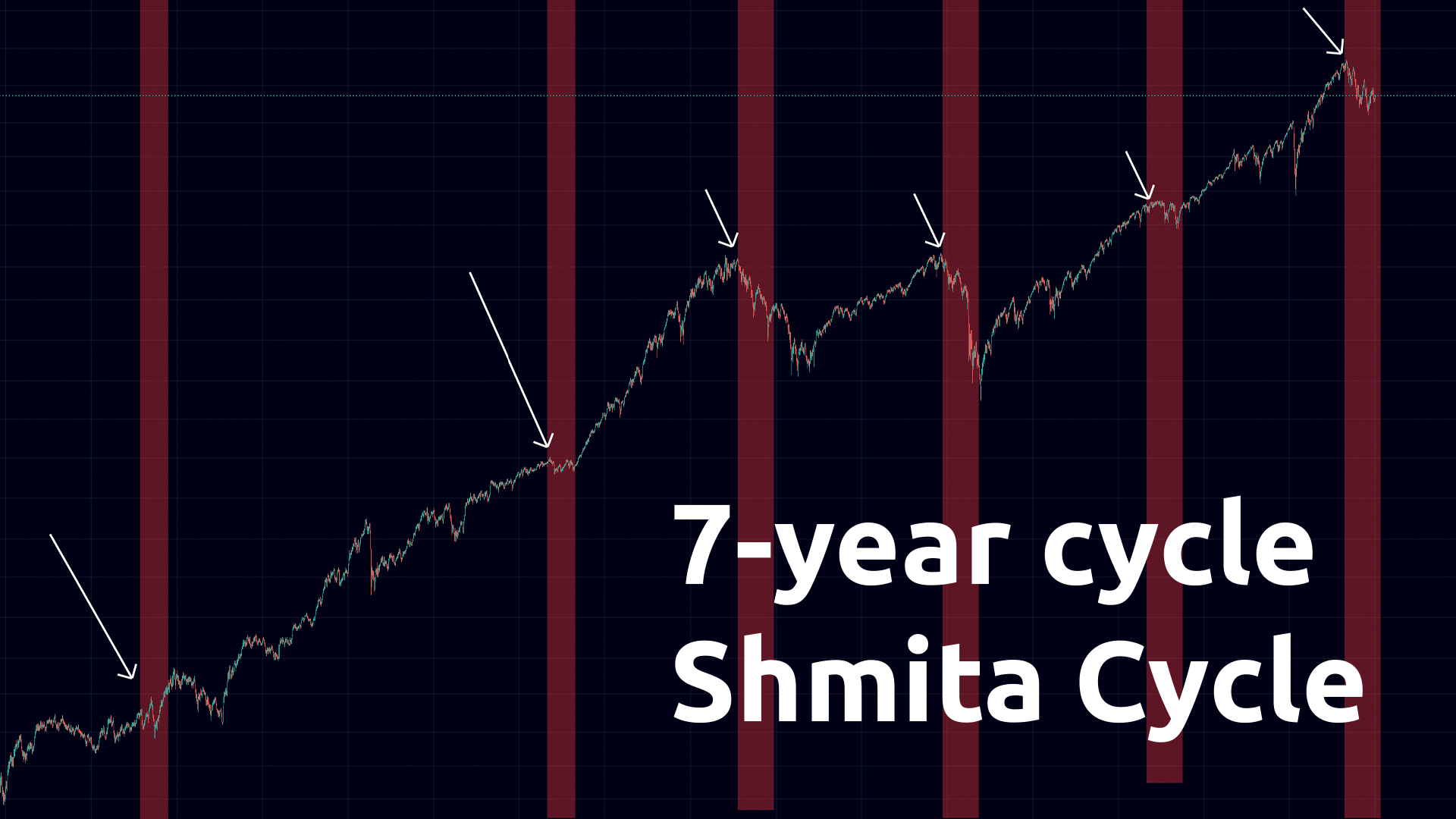

The Shemitah Cycle is a 7-year cycle that investors use to predict market crashes and recessions. Most significant market crashes and recessions have occurred during a Shemitah year

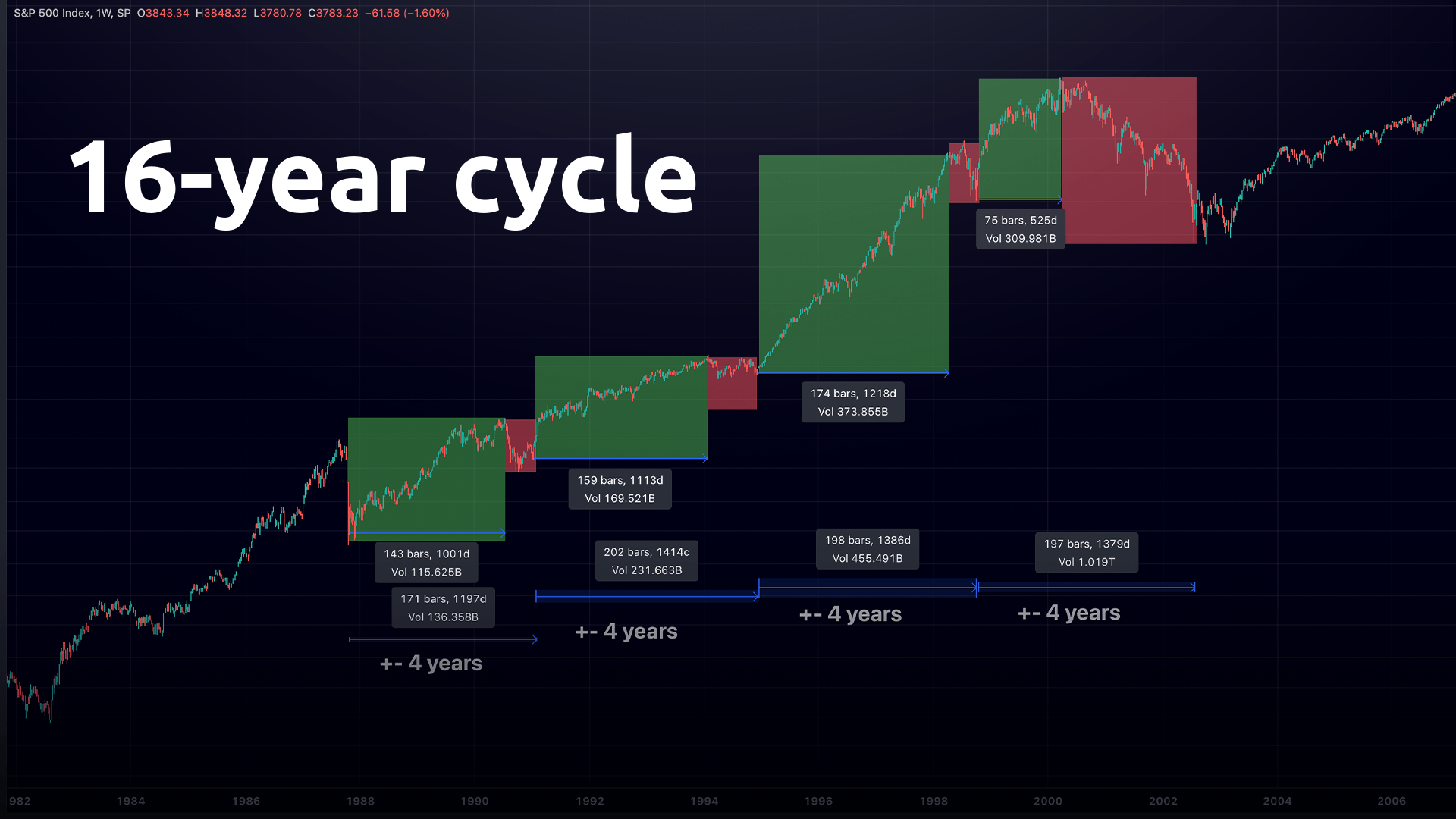

The Bitcoin 16-year cycle is an asset class cycle of 16 years. Many technologies have followed this 16-year cycle in the past, for example, the dot-com bubble.

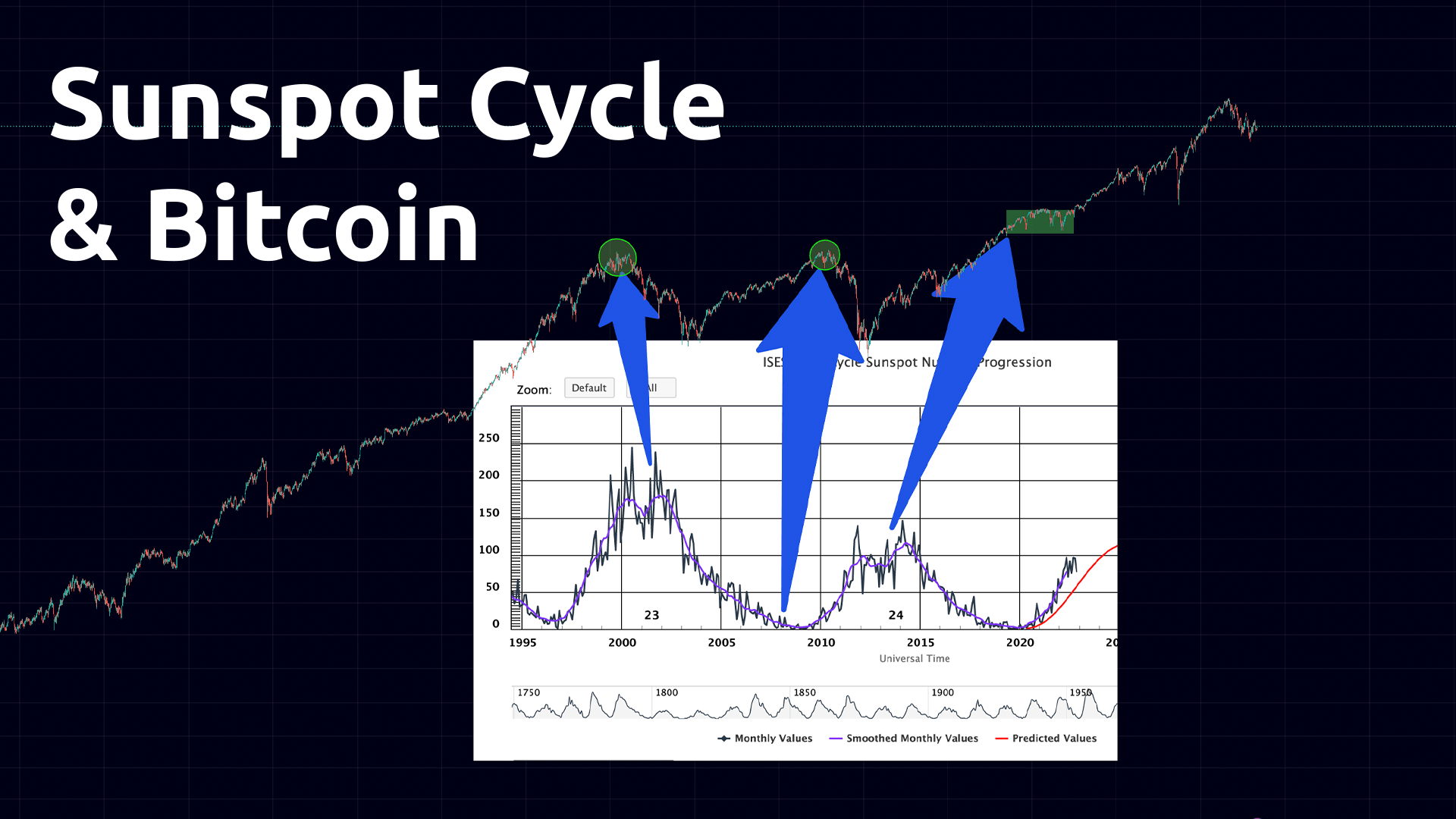

This article explains the correlation between solar activity (sunspot cycles) and the financial markets. It also focuses on the Bitcoin price in correlation to the sunspot cycle and if you can use the sunspot cycle to predict the future of the financial markets.