The Psychology of Risk Management: A Deep Dive into the Trader's Mind

In the intricate world of trading, where numbers and charts dominate the landscape, there lies an often-overlooked dimension: the human psyche. The decisions traders make, the risks they take, and the strategies they employ are deeply intertwined with psychological factors. This article delves into the psychological underpinnings of risk management in trading, shedding light on phenomena like overconfidence and loss aversion.

Overconfidence: The Double-Edged Sword

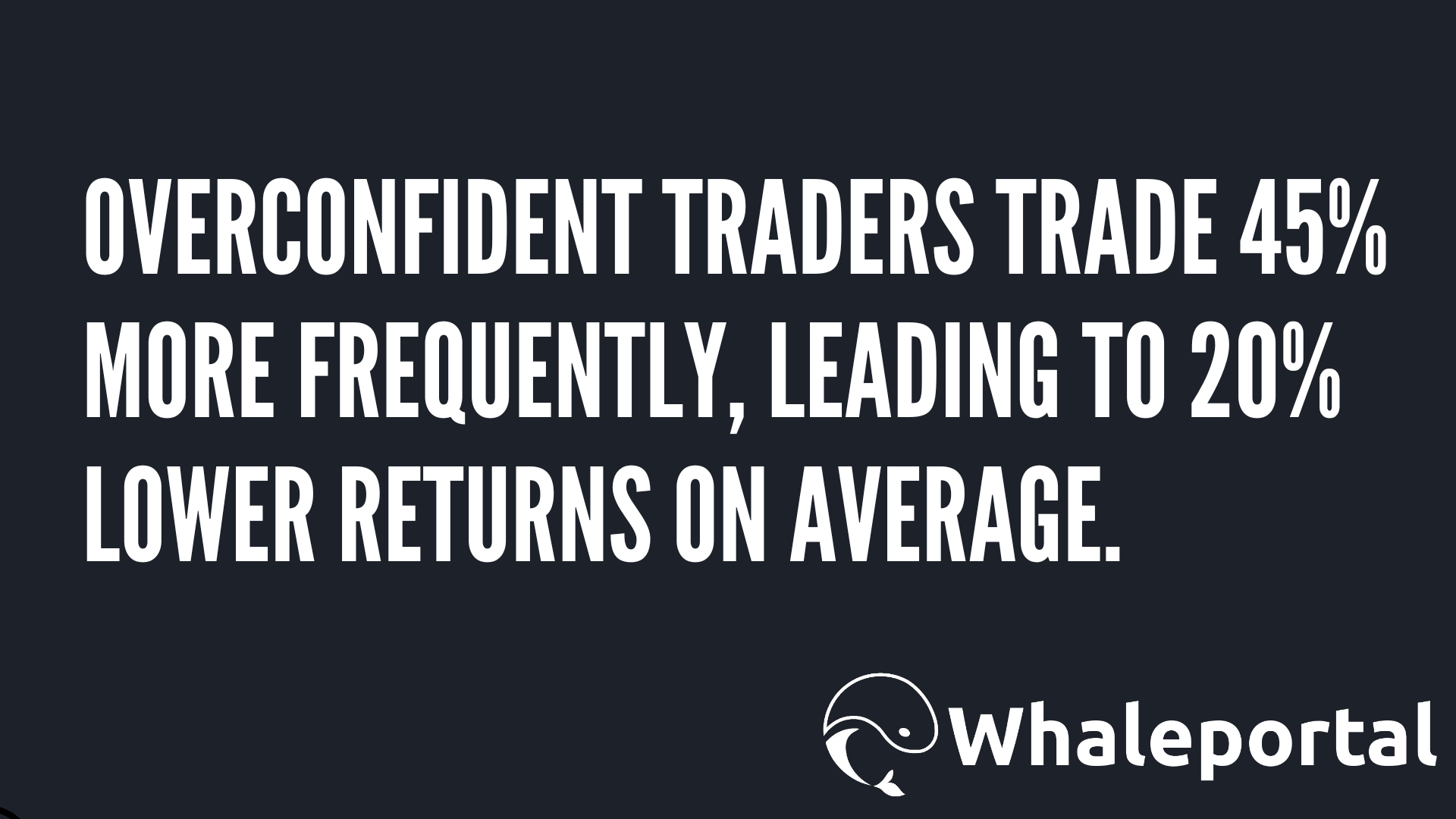

Overconfidence is a cognitive bias where an individual overestimates their abilities or the accuracy of their information. In the realm of trading, this can manifest as a trader believing they can predict market movements with greater accuracy than is realistically possible. A seminal study by Barber and Odean (2001) found that overconfident traders trade more frequently, leading to lower returns(Footnote 1).

This overestimation of one's abilities can lead traders to take on excessive risks, believing that their insights are superior to others in the market. However, the market's unpredictable nature often proves otherwise, leading to potential significant losses.

Loss Aversion: The Fear of Letting Go

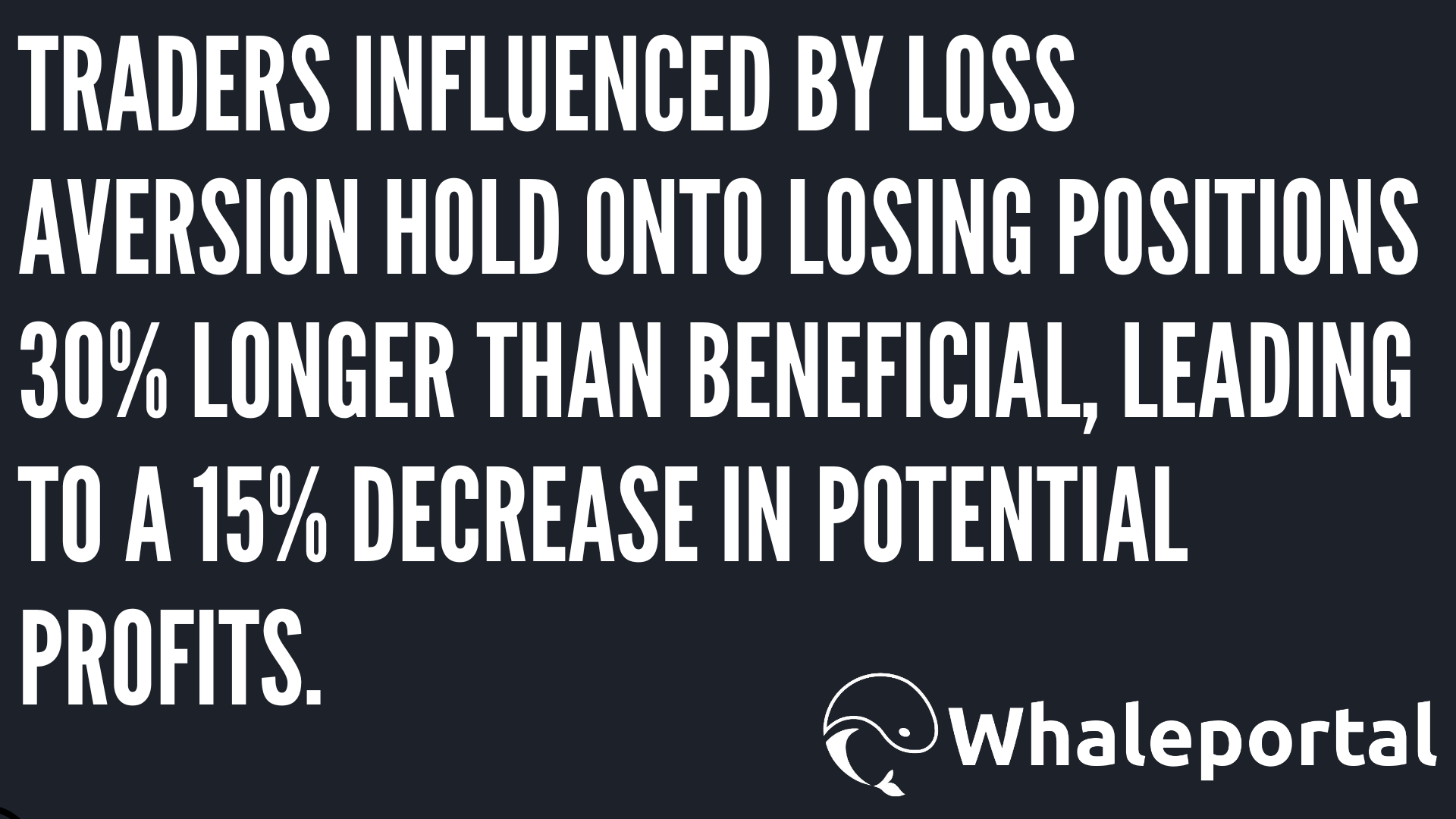

Loss aversion, a concept introduced by Kahneman and Tversky in their groundbreaking Prospect Theory, posits that people feel the pain of losses more acutely than they feel the pleasure of equivalent gains(footnote 2). In trading, this can lead to detrimental behaviors. Traders might hold onto losing positions for too long, hoping the market will turn in their favor, or they might sell winning positions too early, fearing potential future losses.

This psychological quirk can significantly impact a trader's risk management strategy. Instead of making decisions based on objective data and analysis, traders influenced by loss aversion might make emotionally-driven decisions, often to their detriment.

The Role of Experience and Training

While these psychological biases can influence traders, experience and training play a crucial role in mitigating their effects. A study by Glaser and Weber (2007) found that experienced traders were less susceptible to overconfidence than their less-experienced counterparts(footnote 3). This suggests that as traders gain experience and undergo rigorous training, they develop a more realistic assessment of their abilities and the inherent risks of trading.

Conclusion

The world of trading is not just about numbers and data; it's also about understanding the human psyche. Recognizing and addressing the psychological factors that influence trading decisions can be the difference between success and failure in the markets. As traders become more aware of these biases and work to counteract them, they can develop more effective risk management strategies, leading to better outcomes in their trading endeavors.

Footnotes

-

Barber, B. M., & Odean, T. (2001). Boys will be boys: Gender, overconfidence, and common stock investment. The Quarterly Journal of Economics, 116(1), 261-292. Link

-

Kahneman, D., & Tversky, A. (1979). Prospect Theory: An Analysis of Decision under Risk. Econometrica, 47(2), 263-291. Link

-

Glaser, M., & Weber, M. (2007). Overconfidence and trading volume. The Geneva Risk and Insurance Review, 32(1), 1-36. Link