Deribit

Deribit

Visit DeribitTrading volume (24h)

$1,941,471,244.374Open interest

$14,378,666,874.438An exceptional cryptocurrency derivatives platform, Deribit excels in the crypto options market with its institutional-level services. It features a high-capacity matching engine, reduced latency, sophisticated risk management, and substantial liquidity, positioning itself as an indispensable player within the industry.

Rating

83Location

PanamaContract types

USDC and Coin-marginedMaker fee

0 %Taker fee

0.05 %Max leverage

50xUS allowed

NoDeposit methods

BTC, ETH and USDCAverage funding fee (BTC)

0.0197%Table of contents

- Deribit: In-Depth Review

- Background

- Key Features

- High-Performance API and Hosting Solutions

- Innovative Trading and Order Mechanisms

- Market Maker Protection and Margin Modes

- Advanced Trading Tools and Subaccounts

- Robust Security and Custody Solutions:

- Incremental Liquidation

- Portfolio Margin

- Position Builder

- Insurance Fund

- Deribit Mobile App

- Deribit API

- Comprehensive Customer Support

- Low Latency

- Trading Options

- Deribit Testnet

- Affiliate Program

- Deribit’s UI, Futures and Options Exchange

- Deribit’s Native Safety and Security Protocols

- Deribit's Fee Structure

- Deribit’s Sign-up Process

- Deribit’s Key Funding and Withdrawal Mechanisms

- Is Deribit Safe and Suitable for Beginners?

- Conclusion — Is Deribit the Right Choice for You?

Deribit: In-Depth Review

Deribit is a top-tier crypto derivatives exchange specializing in options, futures, perpetual swaps, linear contracts, volatility trading contracts for several cryptocurrencies including popular options like Bitcoin, Ethereum, etc. The platform's user-friendly trading dashboard, coupled with its deep liquidity and low latency, have propelled it to become the market's go-to venue for crypto options trading. Deribit has >90% market share in the crypto options space measured in open interest as well as traded volume.

Background

Deribit is headquartered in Panama and is currently in the process of obtaining a full market product license to commence its operations in Dubai. Initially launched as a Bitcoin futures and options platform, the exchange has gained prominence for its various options trading features and options.

Deribit was established 202016 by a team of Bitcoin enthusiasts and experienced traders boasting a solid financial industry background. The company's CEO, John Jansen, a former trader from the Amsterdam options exchange, has assembled a team composed of experts in both cryptocurrency and traditional finance. Their collective experience spans regulated derivatives markets, brokerage services, and options market making.

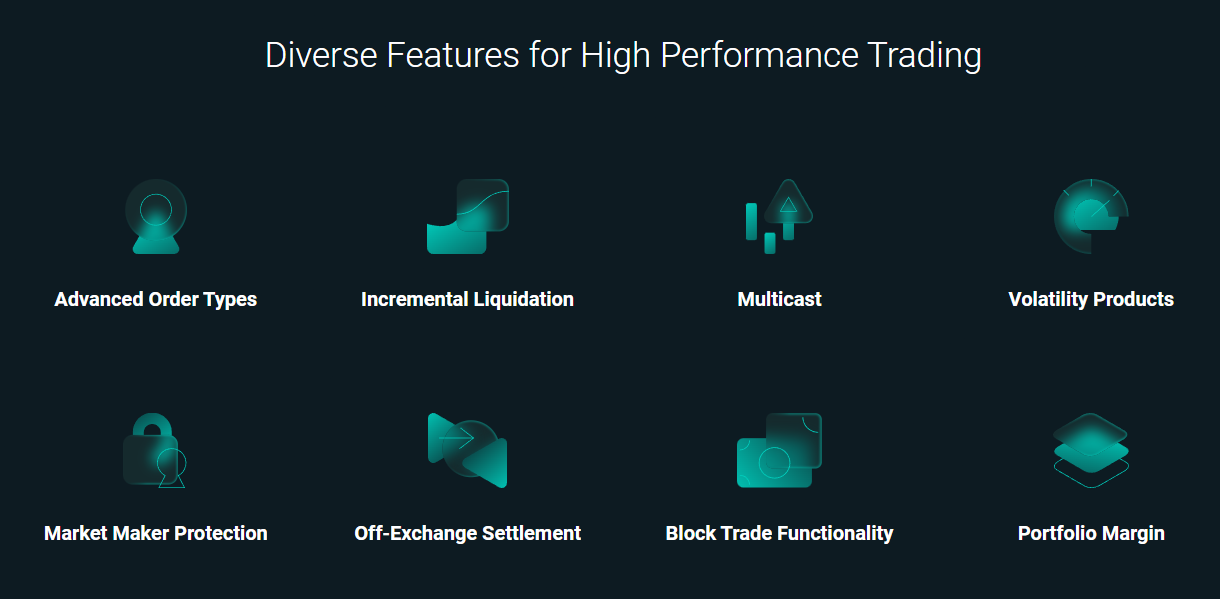

Key Features

High-Performance API and Hosting Solutions

Deribit's API stands due to its excellent performance, which is second to none in the exchange world. Data is provided through fast and ubiquitous WebSockets and FIX protocols, and the market data API is further enhanced by the platform’s unique and extremely fast Multicast module. It is a one-of-a-kind in the industry and is available via AWS hosting solutions. In addition to this, Deribit offers Colocation and Cross-connect solutions for every client through several hosting partners, enabling users to place their servers close to the exchange, thus optimizing the API’s performance.

Innovative Trading and Order Mechanisms

A unique aspect of Deribit is its DVOL index and tradeable futures based on this index. This allows traders to profit from volatility without reserving substantial funds for strategies like straddles, strangles, condors, or butterflies. The exchange also features a unique perpetuals funding mechanism, where Deribit accredits funding every millisecond, as opposed to the typical 8-hour period. This keeps the price closer to the index and eliminates pre-funding surges often seen on other exchanges.

The GTD order type, not commonly found in crypto exchanges, complements the usual GTC, IOC, FOK order types on Deribit (mentioned below as well). This feature enables the keeping of orders up until Deribit’s 08:00 UTC settlement. Advanced Options orders mechanism can be priced in USD or even IV% value, updated automatically by Deribit's engine throughout the order's lifespan.

Market Maker Protection and Margin Modes

Deribit offers a Market Maker Protection mechanism that enables high-volume clients to safely quote larger quantities of orders under any condition and limit exposure above a certain quantity within a certain timeframe. This reduces the risk of too many trades within a short time span. The Portfolio Margin mode enables effective use of capital by sharing margin between instruments in the same coin and subaccount. This makes strategies like Condors, Butterflies, and other combinations require less margin.

Advanced Trading Tools and Subaccounts

Deribit's user interface features unique panels like the Volatility Surface and Options Pricer that assist traders in selecting suitable combinations for the current market conditions. The platform also supports customizable UI panels and tabs, adding or removing features for flexibility.

Moreover, Blocktrading (explained in greater detail below) allows traders to settle any significant trade or combination with a counterparty over-the-counter, using a pre-agreed price. Subaccounts provide traders with the ability to isolate different strategies and manage them separately, useful for risk management or even for different traders using their own logins via different email addresses.

Robust Security and Custody Solutions:

Deribit places a high emphasis on security with its 2FA security feature, which is flexible and allows multiple Yubikey devices or TOTP authenticators to be added. High trade volume clients or "Market Makers" have access to advanced financial security features such as custodial provider integration. This feature is available for both corporate and individual clients. Further, to mitigate counterparty risks, Deribit has integrated with Cobo and Copper custodians, allowing clients to keep funds off the exchange, minimize third-party risk, and avoid dependence on blockchain processing times.

Incremental Liquidation

As a platform specializing in options and futures trading, Deribit requires each account to maintain a minimum level of assets to cover future contractual obligations. This minimum requirement is determined by Deribit's proprietary risk engine. If the risk engine determines that a trader's positions lack sufficient coverage based on market conditions, Deribit will automatically initiate the liquidation of account assets. What makes this setup unique is that Deribit liquidates position incrementally, at 12.5% size.

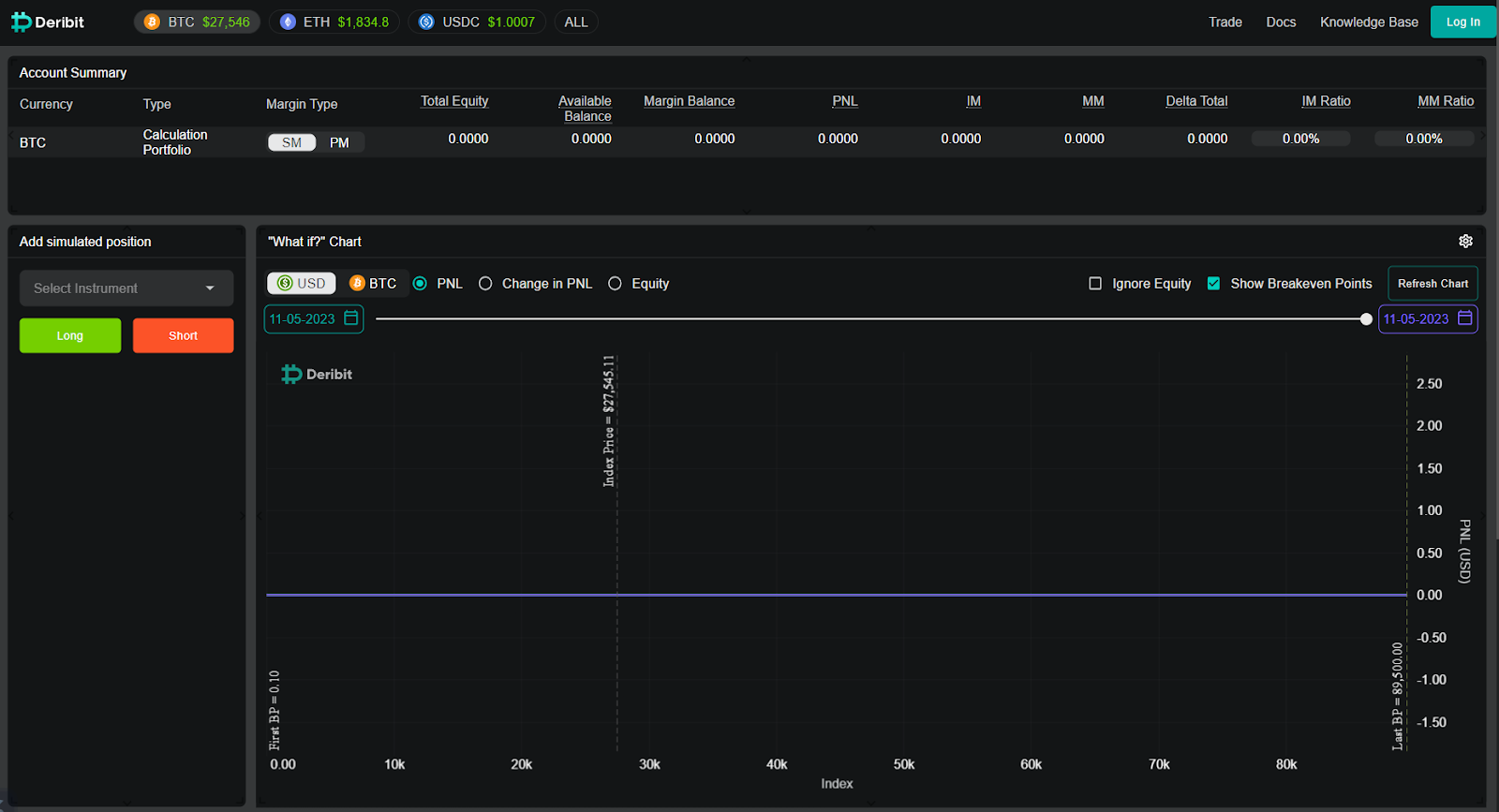

Portfolio Margin

Portfolio Margin (PM) uses a risk-based model to determine margin requirements by valuing a portfolio over a range of underlying price and volatility moves. This model considers positions in futures and options combined, potentially reducing the margin requirements of a portfolio. By using Portfolio Margin, traders and market makers who maintain a balanced portfolio of hedged positions can benefit from lower margin requirements and increased leverage.

PM is only available for BTC and ETH, while USDC always remains on Standard Margin. Both BTC and ETH can be switched between Standard or Portfolio Margin per main or subaccount. It is not possible to have BTC on a different margin type than ETH for a specific main or subaccount. This approach allows traders and market makers with diversified portfolios to better manage their risks and take advantage of the potential benefits associated with Portfolio Margin.

Lastly, for PM enabled accounts, liquidation can come in the form of delta-hedging the position by opening Futures orders.

Position Builder

Deribit provides a position builder tool that allows traders to plan and visualize their trades in advance. Using the interface, traders can enter any options or futures trade, selecting from various strike prices and expiration dates. The position builder generates a profit/loss graph, providing a visual representation of the trade's profitability and how it evolves over time. This tool helps traders better understand and analyze the potential outcomes of their positions.

Insurance Fund

The Deribit insurance fund consists of three separate pools of BTC, ETH and USDC. It serves as a reserve in case of ‘trader position bankruptcies’. This helps protect traders from the potential losses caused by other investors who cannot cover their margin requirements. The fund is financed by the fees charged by Deribit for liquidation orders, which are added to the insurance fund every hour. As long as there is a non-zero amount of BTC, ETH and USDC in the fund, traders can withdraw unrealized profits on futures contracts. If the fund becomes depleted, the losses from the bankrupt traders will be "socialized" among the winning traders, effectively distributing the losses among them. The insurance fund functions as a collective risk mitigation tool.

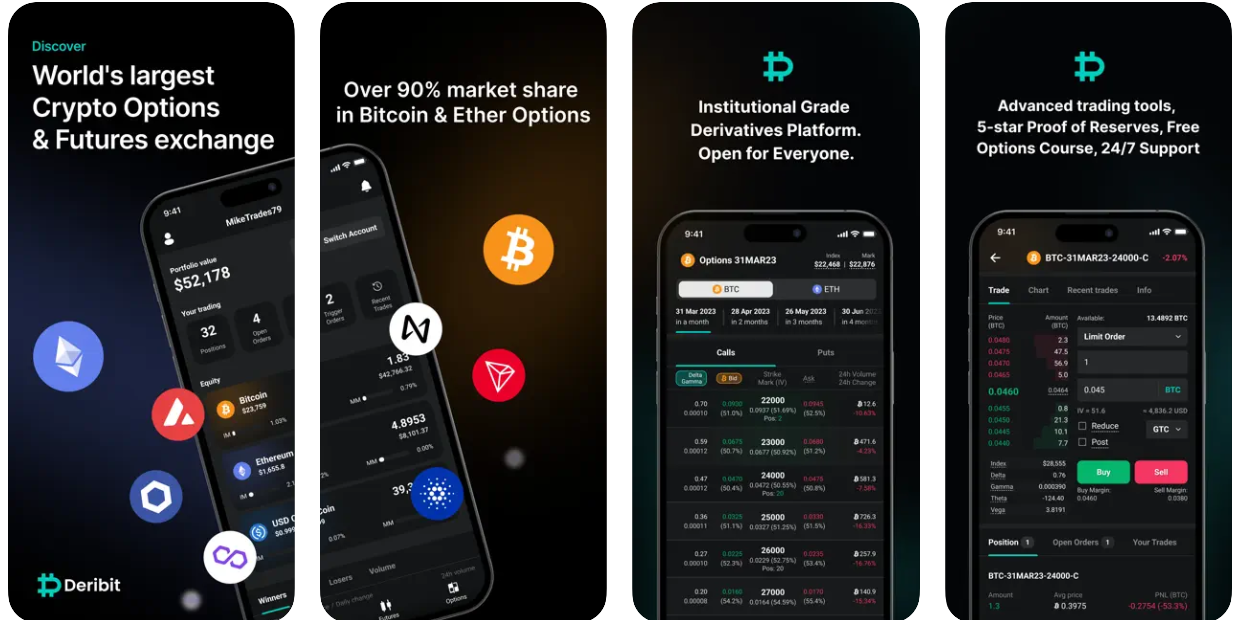

Deribit Mobile App

Deribit's native mobile app is available for both iOS and Android devices, providing users with convenient access to the options and futures exchanges on the go. The app offers a range of functionalities, including the ability to view market data, utilize the Deribit trade engine, manage positions, and place orders, similar to the web-based platform. A quick look online shows us that the app has generally received positive feedback and is not restricted in app store regardless of one’s location.

Deribit API

Deribit offers four different interfaces to access their API: JSON-RPC over Websocket, JSON-RPC over HTTP, Multicast and FIX (Financial Information eXchange). They provide a testing environment at test.deribit.com for users to test the API, and all examples in the documentation refer to this environment. To access the production environment, users should switch to www.deribit.com. Keep in mind that both environments are separate and require distinct accounts and credentials (API keys) for authentication when using private methods. Test credentials will not work in the production environment and vice versa.

Comprehensive Customer Support

Deribit provides customer support through various channels, including email and a dedicated Telegram support channel. They also maintain an active Twitter account where they share updates and interact with users. While they do not have an online contact form like some other exchanges, their email support is responsive, and their extensive KnowledgeBase module addresses many common questions and concerns.

Deribit places a high priority on customer satisfaction and loyalty. This was demonstrated when the exchange reimbursed customers $1.3 million during a flash crash on October 31, 2019. The incident occurred due to a bug in the trading platform's BTC index calculation mechanism, causing a temporary price drop from $9,150 to $7,720 before recovering within minutes. Similar efficient remedial measures were also actioned by the Deribit team back in 2022 when a group of hackers managed to steal $28 million from the platform.

Lastly, it bears mentioning that Deibit provides real-time updates via Telegram — with an associated link provided immediately — as soon as an issue is encountered. This allows users to be well prepared if their funds are threatened by a nefarious third party.

Low Latency

Deribit prioritizes technological advancements, enabling users to trade with less than 1ms latency through their trade matching engine. Additionally, Deribit works with premium trading service operators like 1Token, 3Commas, Alertatron, Actant, Caspian, CoinRule, HAASOnline, Mudrex, Mercury, among several others. The platform utilizes cold storage to secure approximately 99% of user assets. Moreover, the platform uses Fireblocks’ hot wallet storage setup to ensure the safety of all held funds.

Trading Options

Deribit offers a comprehensive range of trading options, giving users access to both Options and Futures exchanges. The platform specializes in leveraged trading, offering up to 10x leverage for options and up to 50x leverage for BTC and ETH futures. Linears and DVOL contracts are however margined in an alternative manner, offering different leverage.

Deribit Testnet

Deribit offers a live testnet for users, a feature not available on many exchanges. This separate demo account can be accessed at test.deribit.com. After signing up and creating an account, you will receive 10 BTC as demo funds. Users can trade these funds as they would on a live account and test their strategies. The testnet is ideal for beginners learning about options and futures or experienced traders wanting to familiarize themselves with the Deribit user interface.

The testnet also benefits users looking to develop bots on the Deribit API, allowing them to refine their algorithms before using them on live accounts.

Affiliate Program

Deribit's affiliate program allows users to earn a commission by referring new users to the platform. Referrals who sign up and start trading on Deribit receive a 10% discount on their trading fees for up to 6 months. Affiliates earn 20% of the referred users' trading fees for the first 6 months, and 10% in perpetuity after that. This program is more generous than some competitor affiliate programs and offers users an opportunity to earn passive income by promoting the platform. To participate in the affiliate program, users can obtain an affiliate link from the affiliate section of their account and share it with potential referrals.

Deribit’s UI, Futures and Options Exchange

Deribit is a highly functional and intuitive platform, offering an attractive user interface (UI) compared to other futures exchanges. The platform features a left sidebar with menus for markets, FAQs, and other essential documentation. It supports multiple languages and provides extensive account management options, such as sub-accounts and detailed trading statistics. Night owls can switch to a dark theme via the top right corner of the platform.

Moreover, Deribit comes replete with additional features such as:

- User-configured tabs: They allow clients to tailor their trading experience per their needs and requirements.

- Implied volatility surface: This is a 3D representation of option implied volatility by strike and time until expiration. It gives a trader detailed information regarding volatility through one image.

- Fully customizable panels: Helps users devise an interface that helps make the trading process smoother and more personalized.

The platform also offers extensive documentation and content to help users start trading. These include overviews of trading instruments and general information about the exchange. Several video tutorials too are available to help users navigate through the aforementioned processes.

Futures Exchange

Deribit's futures exchange will be familiar to those who have traded futures on other popular platforms. The markets change according to the expiry date of the futures contract, allowing users to go long or short as a "buy" or "sell." Deribit also offers:

- DVOL: Deribit Implied Volatility Index (DVOL) is Deribit’s signature invention. It allows traders to gain exposure to pure implied volatility and comes in the form of tradable futures on a volatility index

- Perpetual futures: Contracts without an expiry date, similar to CFDs (Contracts for Differences) and spread betting derivatives.

- Perpetual Inverse contracts: A type of perpetual contracts, which are resolved in the underlying cryptocurrency as opposed to a fiat currency. These contracts afford traders the opportunity to assume long or short positions on the price of a cryptocurrency, enabling the utilization of leverage and capitalizing on both upward and downward price fluctuations.

- Linear futures: They allow exposure to the price of an asset, without needing to hold the asset directly as it only requires USDC as margin.

The Deribit Perpetual Futures exchange features order books, recent trades, and an order form in one place, with current orders and live trades just below. It can be configured per the users requirements in the new UI. Lastly, the platform looks the same for futures contracts with set expiry times and the Ethereum market. Deribit has integrated TradingView charting technology, providing advanced tools, indicators, and charting software for technical analysts.

Options Exchange

The options exchange displays option markets with different expiries, option types, and strikes, as well as additional information like volatility, Delta, and open interest. The platform offers a wealth of information, allowing users to filter markets according to price, open interest, or option "Greeks" (Delta, Theta, Gamma, etc.). Users can trade specific options using search criteria or selecting an option in the order form.

Order Forms

Deribit offers a range of order options for both futures and options instruments. For futures, users can place limit, market, stop-market, marketlimit, take profit, trailing stop, and stop-limit orders. Additionally, the platform provides three order life options:

- Good-Till-Cleared (GTC): This limit order remains open indefinitely. It is closed only when it is either manually canceled or when the order is executed. GTC is useful for traders who want complete control over their orders but may not be ideal for rapid execution.

- Fill-Or-Kill (FOK): This order type executes an order immediately and in its entirety, or not at all. In other words, there cannot be partial orders. FOK is ideal for traders who require the entire order to be filled and don't want any remaining portions left open.

- Immediate-Or-Kill (IOC): Similar to the FOK order, the IOC order allows for partial execution. It will execute the part of the order that can be filled and cancel any remaining unfilled portions. This order type is suitable for traders who want immediate execution but are open to partial order fills.

- Good Till Day (GTD): This order is active until its specified date unless it has already been fulfilled or canceled (by 08:00am UTC)

Additional order parameters include "Post," "Hidden," and "Reduce":

- Post orders are always entered as "maker" orders in the order book.

- Hidden orders do not appear on the order book.

- Reduce orders only decrease the size of your position.

Users have most of the same parameters for option orders except for stop orders and hidden orders. A unique feature of the option order form is the ability to define the Implied Volatility (IV) of the option, adjusting the price users are willing to pay.

Deribit provides a wide range of order types and advanced functionalities that allow traders to customize their strategies according to their preferences and risk tolerance. In this regard, the platform allows users to create and trade ‘ComboOrders,’ which are essentially combinations of different instruments that can be executed with one trade/request/transaction.

Moreover, Deribit can facilitate block trades, which are private transactions between two parties that bypass the public exchange and utilize their own liquidity. That said, these trades are still shown as part of the “recent trades” section that is available for viewing publicly.

The block trade feature is particularly useful for executing larger trades, typically starting from $100,000, such as over-the-counter (OTC) transactions. Traders can directly negotiate and agree upon block trades with other counterparties ahead of time. Block trades are available for both options and futures contracts.

Lastly, as mentioned earlier, the platform's integration of TradingView charting technology ensures that technical analysts have access to the best tools and indicators, while the options exchange offers a wealth of information for more sophisticated traders. This, in conclusion, Deribit is an impressive platform with a user-friendly interface, extensive account management options, and advanced trading tools. It caters to beginners and experienced traders, offering them comprehensive documentation and support to not only navigate the platform but also make informed trading decisions.

Deribit’s Native Safety and Security Protocols

Exchange Security

Deribit prioritizes the security of customer funds by storing over 95% of them in cold storage, which helps protect against potential cybersecurity breaches. This approach was instrumental in containing the impact of the November 1, 2022 hack, which was restricted to the platform's BTC, ETH, and USDC hot wallets. To further enhance user account security, Deribit offers two-factor authentication. Additionally, as noted earlier, Deribit operates an insurance fund that ensures winners receive their full payouts and prevents losing traders from ending up with negative equity. The size of the insurance fund can be viewed on the trading dashboard.

Deribit permits leveraged trading, allowing traders to take positions larger than their account balances. To prevent traders from incurring losses greater than their ability to pay, the platform automatically liquidates positions when margin requirements are no longer met. In such cases, the insurance fund steps in to cover the deficit left by the losing party, guaranteeing the winning party receives their full payout. Deribit also has an extensive bounty program, encouraging white hat hackers to identify vulnerabilities before malicious actors exploit them.

User Security

Recognizing that users can be the weakest link in account security, Deribit offers multiple features to enhance individual security. All communication with the Deribit server is conducted via an SSL connection, which users can verify by checking the padlock icon in their browser address bar. Additionally, two-factor authentication is available but not enabled by default.

Other security options include IP pinning and customizable session timeouts, which can be adjusted from the standard one-week inactivity period to a shorter duration if desired. Moreover, it is worth mentioning that Deribit’s custody partners include Cobo, a leading custody provider in Asia, and Copper, a firm offering custody, trading, and prime brokerage for over 100 digital assets with security, speed, and control for its clients.

Despite these security features, it is essential to remember the golden rule of cryptocurrency: if you don't control the keys, you don't control the coins. In this regard, it is best to avoid keeping large amounts of cryptocurrency on any exchange.

Deribit's Fee Structure

Deribit operates on a maker-taker fee model, meaning that orders providing liquidity could have different fees compared to orders taking liquidity. Fees differ per product and are calculated as a percentage of the underlying asset of the contract. There are two types of orders: maker orders, which add liquidity to the order book and are not executed instantly, and taker orders, which remove liquidity from the order book and are executed instantly against other orders.

Trading fees vary for different contracts, with maker and taker fees ranging from -0.01% to 0.05% for various futures and perpetuals. Options fees are 0.03% of the underlying asset per contract, capped at 12.5% of the option's price. Spot trading fees are 0%. Deribit offers reduced fees for option combos, with the second option leg(s) fee discounted by 100% as long as specific conditions are met. For futures and perpetual spreads, a 50% discount is applied to the cheapest taker leg.

Deribit charges a fixed fee of 0.025% for BTC and ETH futures and perpetual block trades, regardless of the maker or taker role. Volume discounts are available and visible in the account menu. Futures and options deliveries incur additional fees, with daily options and weekly futures exempt. Liquidation fees are also charged, with additional fees for futures, perpetuals, and options automatically added to the insurance fund.

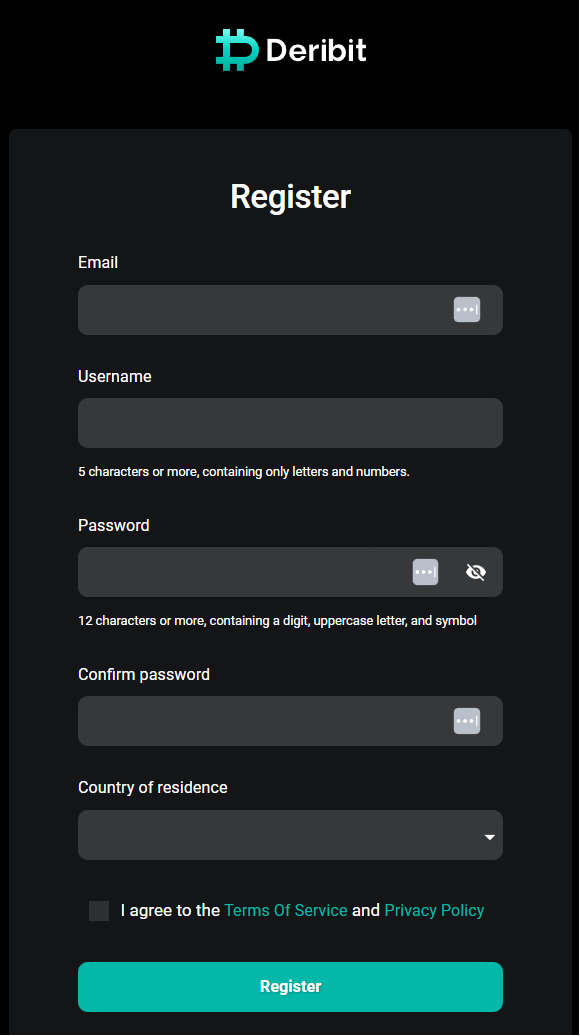

Deribit’s Sign-up Process

To sign up for Deribit, one needs to visit their registration page and provide the necessary details. After receiving a confirmation email, your account will be fully functional, and you can begin trading. It is recommended to enable two-factor authentication for added security.

Deribit offers two types of accounts: Individual and Corporate. Here is a step-by-step guide to help you open an account on Deribit:

Individual Account

- Navigate to the Deribit website and click on "Sign Up" or "Create Account."

- Provide your email address, username, password, and country of residence.

- Confirm your email address, and you will gain access to the trading dashboard.

- Complete identity verification by submitting your name, birth date, home address, country of residence, proof of address, and a government-issued ID.

- Use your device's camera to confirm your identity. Deribit's software will compare your image to the photo on your government-issued ID.

- Once your ID verification is complete and your account is verified, you can begin trading on the platform.

Corporate Account

- Follow steps 1-3 from the Individual Account section.

- During the sign-up process, select the option to create a Corporate Account.

- Complete a more detailed KYC procedure to comply with the exchange's AML/KYC rules. This process involves declaring the ultimate beneficial owners (UBOs) and controlling individuals, such as directors.

- Once your corporate account has been verified, you can begin trading on the platform.

Please note that Deribit is currently not available to customers in the United States, Canada, Guam, Iran, Iraq, Japan, among others. A full list of the countries where Deribit is currently unavailable can be accessed by clicking the following link.

Deribit’s Key Funding and Withdrawal Mechanisms

As a crypto-only exchange, Deribit does not support fiat currency funding. Users with fiat funds must first use a fiat gateway exchange, such as Bitstamp, Coinbase, or Kraken, to obtain Bitcoin, Ethereum or USDC.

To deposit funds, one must generate a deposit address by clicking the "Deposit" button in the top right corner of the online panel. After sending the funds to this address, Deribit requires one confirmation before crediting your account. This is faster than most exchanges, which typically require at least three confirmations.

Withdrawals are straightforward: create a new wallet profile with a name and external wallet address, then process the withdrawal. The exchange no longer supports realtime withdrawals, with all such processes now having to be processed manually ( transactions may take up to ~24 hours in extreme cases).

Is Deribit Safe and Suitable for Beginners?

Deribit takes several measures to ensure the safety of its users' funds. About 99% of all ETH, BTC and USDC is held in cold storage, which enhances the platform's resilience to hacking attempts but may lead to slower customer withdrawals. Additionally, Deribit incorporates two-factor authentication (2FA) for added security, although it must be enabled manually after login. IP pinning and adjustable session timeouts provide extra layers of protection for user accounts.

As for suitability for beginners, Deribit operates in the more complex world of derivatives, making it potentially less suitable for newcomers. Margin trading and leveraged trades introduce additional risks, making futures and options trading more appropriate for experienced traders. Nonetheless, Deribit offers a live testnet that allows users to practice trading with 10 BTC in demo funds, learn various strategies, and familiarize themselves with the interface and analytical tools. The platform also provides several resources, such as a blog, a Docs page, an FAQ page in the members section, and a YouTube channel with explanatory videos.

Conclusion — Is Deribit the Right Choice for You?

Deribit is a specialized platform providing users with a comprehensive suite of futures and options trading opportunities. It has successfully positioned itself with an array of competitive advantages and has therefore managed to carve out a niche in this growing market.

The platform maintains a strong focus on security and user experience while acknowledging the complexity of its services. As a result, Deribit offers resources like written guides, videos, and test accounts to help users familiarize themselves with its features. While Deribit does not support fiat payments and restricts access to certain jurisdictions, these limitations are common within the cryptocurrency industry.

Deribit is a compelling alternative to other Bitcoin futures trading exchanges, boasting an extensive range of features designed to attract experienced traders. For those new to the world of cryptocurrency trading, its offering such as its ‘IQ Option’ may offer a more accessible starting point. However, for individuals determined to venture into Bitcoin futures trading, Deribit's educational resources and practice accounts can provide a solid foundation.

In conclusion, Deribit is a robust platform tailored for Bitcoin derivative traders and represents an excellent choice for those looking to explore this growing market. While it may not be the ideal starting point for complete beginners, it offers all of the resources and support necessary for traders to grow and succeed in the world of Bitcoin derivativ