Best Crypto Exchange for Companies and Institutional Users (2025 Guide)

If you’re managing a trading company or looking to invest your corporate treasury in Bitcoin or other cryptocurrencies, choosing the right platform is critical. Regulatory compliance, asset security, and institutional-grade features all play a vital role in protecting your capital and ensuring smooth operations. In this article, we’ll explore the best crypto exchanges specifically designed for companies and institutional investors, highlighting the key features that matter most for professional use.

TLDR

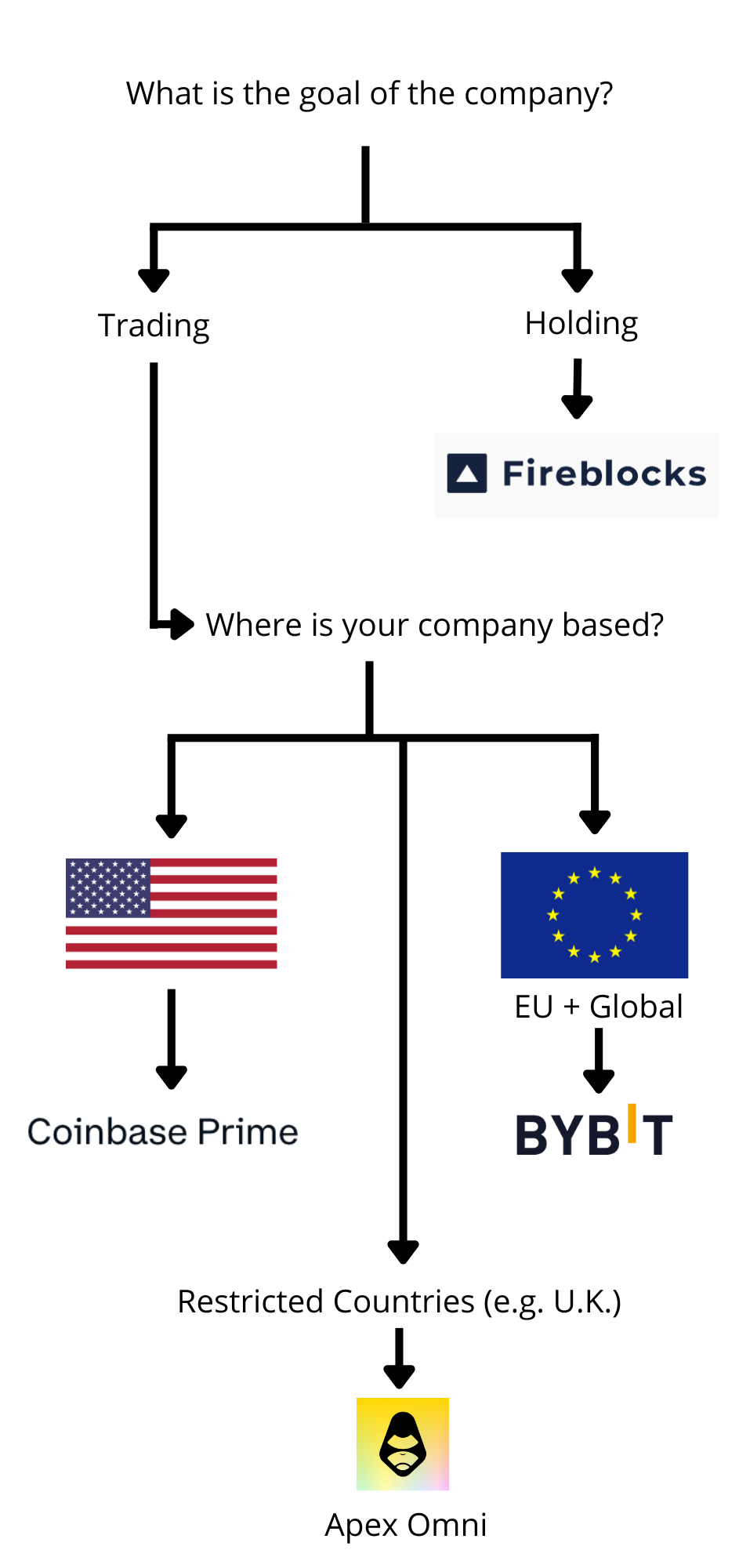

Company Based in the U.S? --> Coinbase Prime

Company Based Outside the U.S.? --> Bybit Institutional

Company in a Restricted Country? --> Apex Omni

Just Holding for Company Treasury? --> FireBlocks

What Do Institutional Users and Companies Need from a Crypto Exchange?

This question varies by the needs of the company. So, depending on the needs of the company, whether it wants to actively trade or just buy and hold, the following point carries different weights with it, but all of them are pretty important for companies to take into consideration when picking an exchange to trade or hold the company treasury.

Security & Custody

One of the most important factors when choosing a crypto exchange for institutional use is security and long-term reputation. It’s risky to rely on a platform that’s only been around for a year and hasn’t proven its resilience through market cycles. History has shown that even institutional-focused exchanges can collapse under pressure, the most notable example being FTX, which catered to high-profile clients before becoming insolvent.

When assessing an exchange, security should be top of mind. Ask critical questions like:

- Does the exchange use multi-signature wallets?

- Are funds held in cold storage?

- Do they publish proof of reserves?

A well-established exchange with proven safety is a non-negotiable for any institutional user.

Liquidity and Order Execution

The importance of liquidity and order execution depends on the specific needs of the institutional client. For active traders or those executing large order sizes, high liquidity is crucial to avoid slippage and ensure smooth trade execution. Most major exchanges today offer sufficient liquidity, and there are tools available, such as iceberg orders, to further minimize slippage and market impact.

For automated trading strategies or high-frequency execution, liquidity and execution speed become key factors in selecting an exchange. However, for company treasuries or institutions making less frequent trades, this is generally less critical, as most reputable exchanges already meet the required liquidity standards for such use cases.

Regulatory Compliance

For big companies and institutions, it’s important that an exchange follows the rules of the countries where it operates. A good exchange should have a clear and safe KYC (Know Your Customer) process to check who is using the platform. As well as a way to create a company account and verify through company or corporate KYC.

The more the exchange is regulated, the safer it is for institutions. It also lowers the risk of legal problems. Working with an exchange that has a good relationship with government regulators helps make sure everything is done properly and reduces surprises.

Account Management

Having a dedicated account manager is important so that questions and issues can be handled quickly and efficiently. Some companies may also need account delegation, where multiple team members, like traders or analysts, can access the account with limited permissions.

For example, a trader might be allowed to place orders but not withdraw funds. This kind of setup is useful for larger teams or active trading operations. On the other hand, for a buy-and-hold strategy, advanced account access controls may not be as important.

The need for account management features depends on the structure and goals of the institutional client.

API Access

API access is essential for institutions that automate their trading strategies. This doesn’t only apply to high-frequency or active strategies like market making, but also to automated long-term strategies such as dollar-cost averaging (DCA).

For example, an institution may want to automatically buy $20,000 in Bitcoin and $10,000 in Ethereum on the first of every month. With API access, this process can be fully automated, saving time and reducing manual errors.

Most major exchanges support API access and provide detailed documentation, making it easier for institutions to connect their systems and execute trades efficiently.

Fiat On-ramps and Bank Integration

For institutional clients, fiat on-ramps and smooth bank integration are essential. You need to know whether the exchange supports bank transfers for deposits and withdrawals, and whether it allows seamless transfers to and from your company’s business bank account.

Key questions to consider include:

- Can you deposit large amounts via wire transfer or SEPA/SWIFT?

- Are withdrawals to a corporate bank account supported?

- How long do transfers typically take?

- Are there any limits, fees, or compliance checks involved?

Exchanges that offer local banking partners, fast settlement times, and strong fiat gateways provide a much better experience for institutions that regularly move capital between fiat and crypto.

OTC Trading Services

OTC (Over-The-Counter) trading is useful for institutional clients who want to invest large amounts without affecting the price on the spot market. Instead of placing a big order that moves the market and causes slippage, they can buy directly from the exchange through OTC. This way, they get a fixed price for the entire trade. For example, if you buy millions worth of Bitcoin on the spot market, the price can change during the order because you’re using up the available liquidity. OTC trading avoids that by keeping the entry price stable.

Advanced Reporting and Tax Tools

For institutional clients, having access to detailed reports and tax tools is essential. These features make it much easier to track performance, generate tax reports, and maintain financial oversight. Exchanges that offer advanced reporting tools provide a big advantage, simplifying the entire accounting process.

Top Crypto Exchanges for Institutional Users in 2025

Coinbase Institutional (Coinbase Prime)

Best for: Companies, asset managers, and institutions that want a safe and regulated platform based in the U.S.

Coinbase Institutional is one of the most trusted crypto exchanges in the world. It’s a public company listed on the NASDAQ, which means it must follow strict rules and is regularly checked by regulators. This gives many businesses and institutions more confidence when using the platform. Taker fees can range from 0.0075% to 0.014% for high-volume traders on the international exchange, and maker fees can be even lower.

Main Features:

- Coinbase Prime – A special platform made for institutions that includes trading, safe storage, and useful tools in one place.

- Secure Custody – Your crypto is stored in cold wallets (offline), protected by insurance, and held by a licensed company (Coinbase Custody Trust).

- High Liquidity – Easy access to large amounts of crypto without big price changes. Also includes an OTC desk for large trades.

- Regulation – Fully legal and registered in the U.S. with strong KYC and AML processes.

- Reporting Tools – Create clear reports for accounting, taxes, or audits.

- Customer Support – Direct access to a support team that helps businesses and large clients.

- API Access – Set up automated trading or connect Coinbase to your business systems.

Pros:

- Very safe and trusted platform

- Follows U.S. laws and regulations

- Great for professional use by funds, companies, and institutions

- Easy to connect and track activity with their tools

Cons:

- Higher trading fees than some offshore exchanges

- Not available in every country

- Fewer coins compared to platforms like Bybit

- No Margin Trading

Bybit Institutional / VIP Program

Best for: Companies and professional traders who focus on crypto derivatives, copy trading, or want advanced trading tools. Market makers, automated trading strategies for companies not based in the United States.

Bybit Institutional is a top choice for companies that want advanced trading tools, more trading pairs, and are based outside the United States.

Bybit is well known for its strong derivatives trading platform, high liquidity, and good customer support. It’s often seen as one of the best exchanges for professional traders and businesses that trade actively.

Main Features:

- Sub-Accounts – Create multiple trading accounts under one master account. Useful for teams or managing different strategies.

- VIP Program – Lower trading fees for high-volume traders, plus priority support and extra benefits.

- Advanced Trading Tools – Fast and reliable trading engine, API access, bots, and custom order types.

- Copy Trading for Funds – Companies can create strategies and let others copy them, or copy top traders themselves.

- Security – Uses cold wallet storage and multi-signature protection. Regular audits and a proof-of-reserves system are also available.

- OTC Desk – For large crypto purchases or sales without moving the market.

Pros:

- Very strong in derivatives and trading tools

- Easy-to-use sub-accounts and bots

- Good support for professional traders and teams

- Lower fees for VIP and institutional clients

Cons:

- Not available in some countries (like the U.S.)

- Fewer compliance features than U.S.-based platforms

- More focused on trading than on custody or reporting

Depending on your trading volume and VIP level, you can reduce your derivatives trading fees on Bybit down to 0%, meaning no fees at the highest tier. For a step-by-step guide, check out our tutorial on how to create a Bybit corporate account.

Fireblocks (For Custody & Settlement, Not Trading)

Best for: Companies and institutions that need secure storage and fast, safe transfers of crypto assets

Fireblocks is not a crypto exchange, but a security and infrastructure platform used by many top exchanges, banks, and asset managers. It helps businesses store crypto safely and move funds between wallets, exchanges, and partners without risk.

Fireblocks is trusted by over 1,800 institutions and handles billions in transactions every day. If your company manages large amounts of crypto or needs to protect client funds, Fireblocks is one of the best tools out there.

Main Features:

- MPC Wallet Technology – A Very secure way to store crypto using multi-party computation (no private key stored in one place)

- Institutional-Grade Custody – Cold storage options and full control over wallet access

- Secure Transfers – Move funds between exchanges, partners, or wallets through the Fireblocks network, instantly and safely

- Compliance & Controls – Set user roles, approval flows, and rules for who can move funds

- Integrations – Works with over 50 exchanges, including Binance, Coinbase, and Bybit

Pros:

- Extremely secure for storing and transferring crypto

- Used by large banks, exchanges, and funds

- Easy to connect with other platforms

Cons:

- Not a trading platform, it does not offer buying or selling of crypto

- More useful for larger companies and funds, not small businesses

Decentralised Option: Apex Omni

Best for: Companies and crypto-native funds looking for a decentralized platform for automated trading.

Apex Omni is a decentralized exchange (DEX) built by the team behind Bybit, and it shares a similar look, feel, and trading experience. However, unlike centralized exchanges, Apex Omni is fully non-custodial, meaning your company keeps full control over its funds

This makes Apex Omni a strong option for crypto-native businesses or funds located in regions where Bybit is restricted, but still want access to professional-level trading and automation.

Main Features:

- Vaults (Automated Copy Trading) – Companies can follow or create trading strategies that run automatically on-chain

- Decentralized and Non-Custodial – No KYC, no account approval, and full control over company assets

- Built on Starknet – Fast and low-fee trading with Ethereum-grade security

- Bybit-style Interface – Easy for existing Bybit users to switch over and start trading

- Smart Contract-Based – All trades and vaults are transparent and visible on-chain

Important Notes for Companies:

- Less regulation: There’s no centralized oversight, so your compliance team will need to handle audits and security checks in-house

- No fiat support: All activity is done in crypto

- Still early-stage: Fewer trading pairs and tools compared to large centralized platforms

Pros:

- Great alternative for firms in restricted countries

- Offers powerful automated trading without giving up control of funds

- Built by a trusted team (Bybit), with a similar user experience

Cons:

- Not regulated like centralized exchanges

- Companies must handle their own security and reporting

- More suitable for crypto-native teams with DeFi experience

Exchange Comparison For Institutional Users

If your company is mainly focused on secure crypto storage, Fireblocks is an excellent choice for safeguarding treasury assets. But if you're planning to engage in active trading, it’s important to compare the leading exchange options to find the best fit. Let's compare.

|

Metric |

Coinbase Prime |

Bybit Institutional |

Apex Omni |

|

Regulated |

Yes (U.S.) |

Yes (But not U.S.) |

No |

|

Custody |

Safe (Cold storage + Proof Of Reserves) |

Safe (Cold storage + Proof Of Reserves) |

Non-custodial (Self-custody) |

|

Automated Trading |

Yes |

Yes |

Yes |

|

Copy Trading |

No |

Yes |

Yes |

|

Fiat support |

Yes |

Yes |

No |

|

OTC Services |

Yes |

Yes |

No |

|

API Access |

Yes |

Yes |

Yes |

|

KYC Required |

Yes |

Yes |

No |

|

Main Use Case |

Secure and Regulated Trading |

Derivatives and advanced trading |

Derivatives and advanced trading |

|

Best for |

U.S.-based institutions |

Companies Outside U.S. |

Firms in Restricted Countries |

|

Limitations |

Higher fees, fewer coins |

Not available in U.S. |

Not regulated, no fiat |

Factors to Consider When Choosing an Institutional Exchange

The best exchange will vary depending on your company’s needs.

Let’s go over the main factors to consider when choosing a crypto exchange as a business or institution.

Jurisdiction

If the company is based in the U.S., you’d probably want to look at a U.S.-regulated exchange like Coinbase. For companies outside of the U.S., you might want to look at different options like Bybit Institutional accounts, as they have some advantages in terms of trading fees and trading pairs.

Company Goals

If your company plans to hold crypto as part of its treasury, it may be best to use a Coinbase Institutional account or a custody solution like Fireblocks. These platforms offer strong security and are well-suited for long-term storage.

However, if your company is actively trading and needs access to a wider range of assets and services, Bybit, or Bybit EU for European companies, might be a better fit. It offers more trading pairs and is generally more focused on trading companies.

For companies that want to automate trading while maintaining full control over their funds, a decentralized exchange like Apex Omni can also be an option. These platforms allow you to trade without giving up custody, but they are less regulated and do not provide built-in reporting tools, so your company will need to handle accounting and compliance independently.

By contrast, exchanges like Coinbase and Bybit offer some level of integrated reporting and support for institutional clients.

Volume

Trading volume matters, especially if your company places large orders.

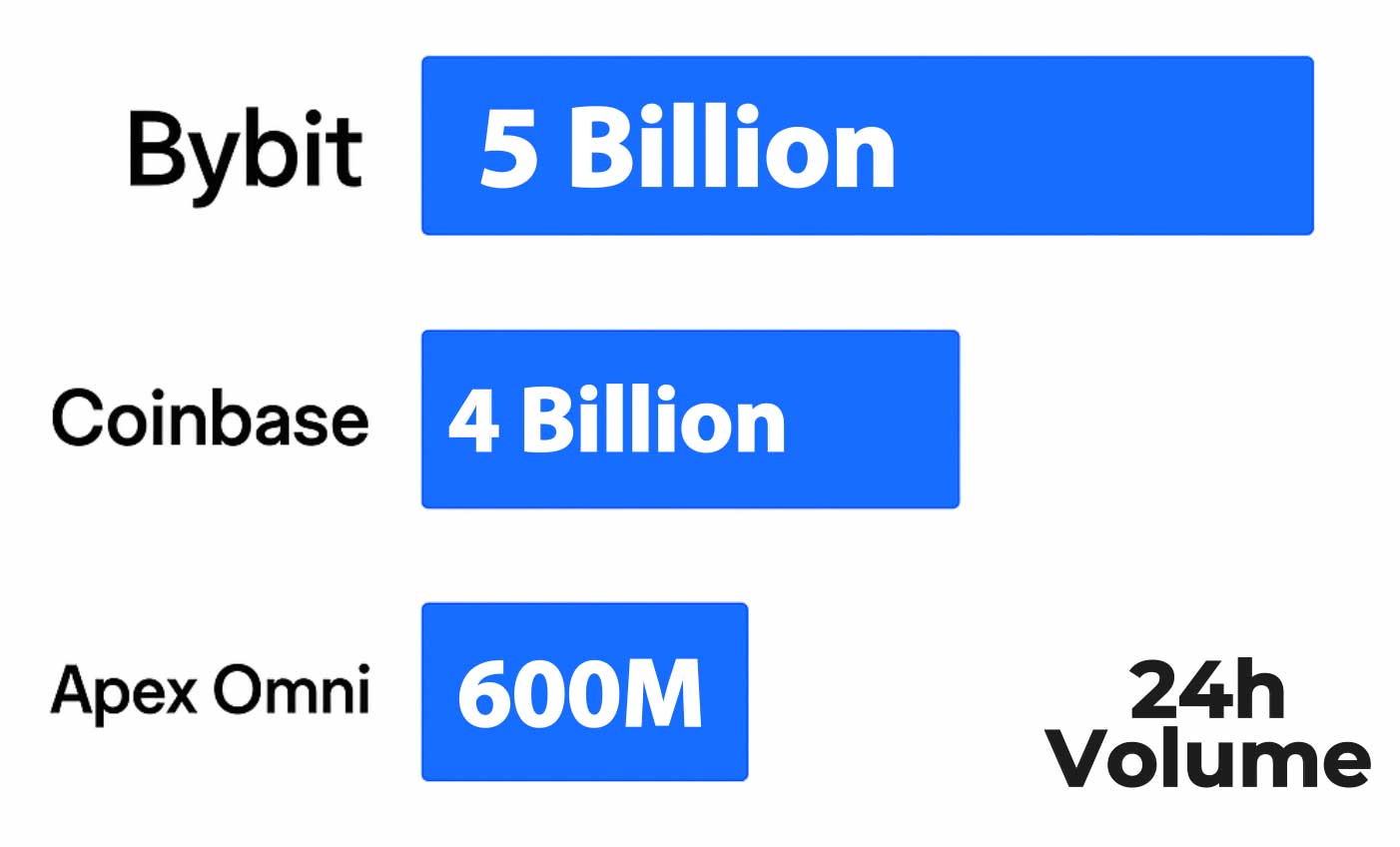

To avoid slippage and ensure smooth execution, it’s important to use an exchange with high liquidity. For large trades, consider platforms that offer deep order books or access to OTC (over-the-counter) services; both Coinbase and Bybit provide these options. Bybit currently has a higher amount of volume than Coinbase, especially on the derivatives markets.

Trading Software

Most institutional traders and companies don’t trade directly through exchange websites. Instead, they use professional trading software that connects to platforms like Coinbase and Bybit through APIs. Some of the most widely used tools include Fireblocks for secure custody and automated transfers, Talos for order routing and execution, and Copper for instant settlement without needing to deposit assets on exchanges. These platforms help companies manage risk, automate trades, and stay compliant with internal controls and external regulations. For firms that build their own tools, both Coinbase and Bybit also offer institutional-grade API access. Apex Omni also offers some integrations, especially custom-built. Though it lacks centralized compliance tools, Apex Omni gives institutional users flexibility to integrate advanced automation while controlling custody directly.

Dedicated Support

When a company trades large volumes on an exchange, it often receives a dedicated account manager to provide priority support and handle specific requests. This can include faster onboarding, custom fee structures, and help with technical or compliance needs. Both Coinbase and Bybit are well known for offering excellent support to high-value institutional clients, making them strong choices for companies that need a more hands-on relationship with their exchange.

What’s the Best Institutional Crypto Exchange?

|

Category |

Top Pick |

Why? |

|

U.S. Based Firms |

Regulated and trusted, with strong compliance and institutional-grade offerings. |

|

|

Outside U.S. |

Broadest range of supported countries, coins, and features, ideal for global operations. |

|

|

API Tools |

Offers advanced APIs and developer-friendly features for automated trading setups. |

|

|

Custody only |

Industry-leading custody, secure wallet infrastructure, and institutional integrations. |

|

|

Decentralised Option |

Decentralised exchange, self-custody, and low fees |

Conclusion

The best crypto exchange for your company depends on your jurisdiction, goals, and risk profile. Whether you're managing a fund, trading actively, or simply allocating part of your treasury to crypto, your exchange must meet the highest standards of security, regulatory clarity, liquidity, and infrastructure.

- If compliance and custody are your top priorities, Coinbase Institutional or Fireblocks may be the right fit.

- If you want greater flexibility, more trading pairs, or derivatives access, especially outside the U.S., Bybit Institutional is a powerful alternative.

- For full on-chain control and automation, Apex Omni offers a decentralized route with strong trading tools.

🔗 Want to start? Create your Bybit Institutional account here

Frequently Asked Questions (FAQ)

Can a company legally trade crypto?

Yes, in most jurisdictions, companies can legally trade cryptocurrencies, either as a primary business activity or as part of treasury management. However, local laws vary. You may need to register your company with financial authorities or comply with AML/KYC rules, especially if you handle client funds or offer crypto-related services.

Do institutional exchanges offer better security?

Generally, yes. Institutional-grade exchanges and custody platforms (like Fireblocks, Coinbase Prime or Bybit Institutional) invest heavily in advanced security infrastructure, such as MPC wallets, multi-user controls, and insurance-backed custodianship. These are designed to meet the higher risk standards of funds, banks, and enterprises.

What’s the difference between retail and institutional accounts?

Retail accounts are made for individual users and have lower trading limits, simplified features, and fewer compliance checks.

Institutional accounts, on the other hand, offer:

- Higher withdrawal/trading limits

- Access to OTC desks and API trading

- Dedicated account managers

- Team-based controls and reporting tools

- Faster fiat on/off-ramps and better banking access

Platforms like Bybit Institutional or Coinbase Prime deliver specifically to business needs.

How do taxes work for crypto companies?

Crypto taxes for businesses depend on your country’s laws, but typically:

- Trading profits are taxed as corporate income.

- Crypto held as assets may be subject to capital gains tax when sold.

- Received payments in crypto (e.g., from clients) are taxed as business revenue.

- Proper bookkeeping is essential, including fair market value at the time of transaction, conversion rates, and gains/losses tracking.

We recommend working with a crypto-aware accountant in your jurisdiction to stay compliant.

Related Articles:

- How to Create Bybit Corporate Account

- Can You Trade on Bybit Without KYC?

- Best Crypto Exchanges for Passive Income