Copy Trading on Decentralized Exchanges: Apex Omni and dYdX Vaults Explained

Copy trading has become an essential feature on centralized exchanges, benefiting investors seeking passive income and traders looking to monetize their strategies. But how does copy trading work in a decentralized environment? Do decentralized exchanges (DEXs) offer this feature? And if so, how different is it from the centralized version?

In this article, we’ll answer all these questions and explore how decentralized copy trading works through an innovation called “Vaults.”

What is Copy-Trading and how does it work?

In short: copy trading allows investors to allocate funds to a trader, who then trades on their behalf. The profits (or losses) are shared—typically with a percentage of the profits going to the trader as a commission.

It’s a feature that connects two groups:

- Traders with a profitable strategy but limited capital.

- Investors who have funds but lack the time, experience, or desire to trade themselves.

For traders, copy trading is an opportunity to scale their strategy by managing other people’s funds and earning commission on performance. For investors, it offers a chance to earn passive income by mirroring the trades of proven professionals.

Which platforms offer copy-trading?

Copy trading was first introduced by centralized exchanges like Bybit and Bitget. Today, it has become so popular that most centralized platforms offer it as a standard feature. It’s almost unthinkable for an exchange not to. But as decentralized exchanges (DEXs) continue to gain traction, a natural question arises: Can you also access copy trading on a decentralized exchange? And if so, how does it work in a decentralized environment?

Introducing “Vaults”

Copy trading has recently made its way to decentralized exchanges, but it goes by a different name due to slight differences in how the service is structured. Two well-established DEXs—Apex Omni and dYdX—now offer a form of copy trading known as “Vaults.” While both platforms use the same term, the way Vaults work on each exchange is quite different. Let’s take a closer look at each one individually.

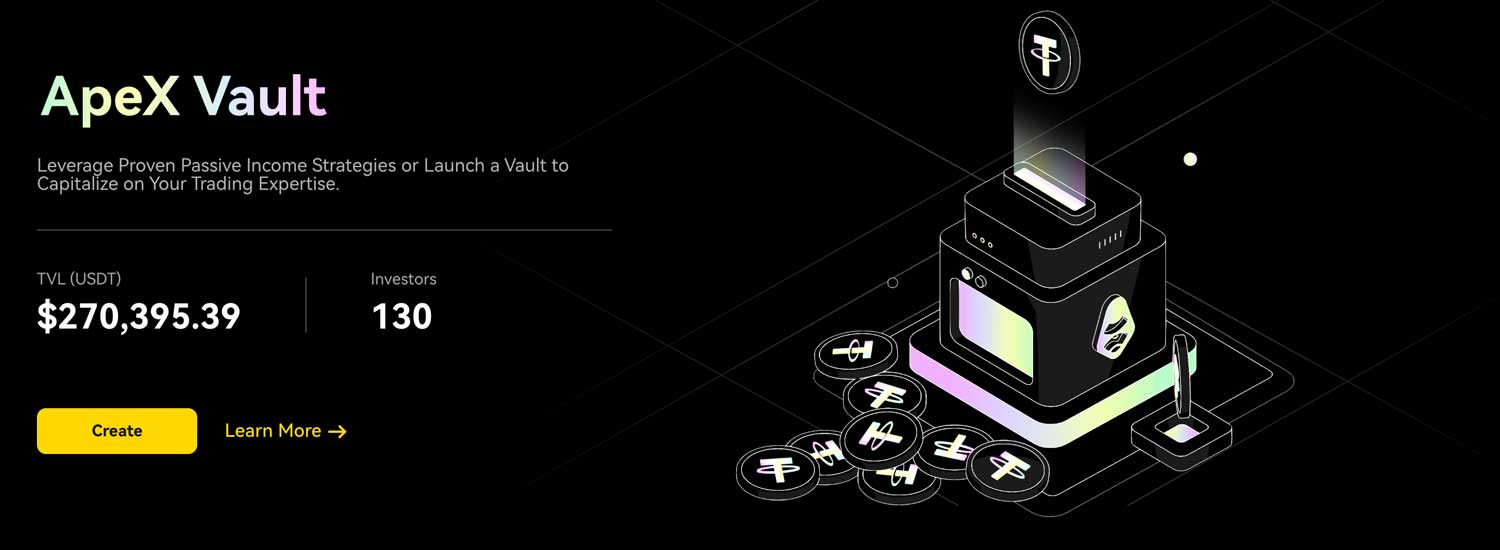

Apex Omni Vaults

Apex Omni Vaults offer one of the closest experiences to traditional copy trading but on a decentralized exchange. The core idea is the same: investors can follow a trader and automatically mirror their trades. The key difference lies in the underlying technology. Instead of relying on a centralized system, Apex uses smart contracts to handle everything transparently and securely.

You can browse through available traders, view their performance stats, total assets under management, past results, and even their open positions, making the system highly transparent. The term "Vault" refers to the smart contract where funds are temporarily locked. This ensures that the trader cannot withdraw or misuse your funds; they can only execute trades within the parameters of the strategy.

As a trader, you can launch your own Vault with as little as $100 of your own capital. Once your Vault is live, other users can invest in it, increasing your trading capital. In return, you’ll receive a share of the profits as a commission. On Apex Omni, the standard profit split is 10% for the trader and 90% for the investor.

For example, an investor deposited $1,000 into a high-performing Apex Omni Vault run by a trader with consistent 20% monthly returns. After a month, the investor earned $180 in profit after the 10% trader fee, without making a single trade.

Want to start copy-trading on Apex Omni? Connect your wallet or create an account now!

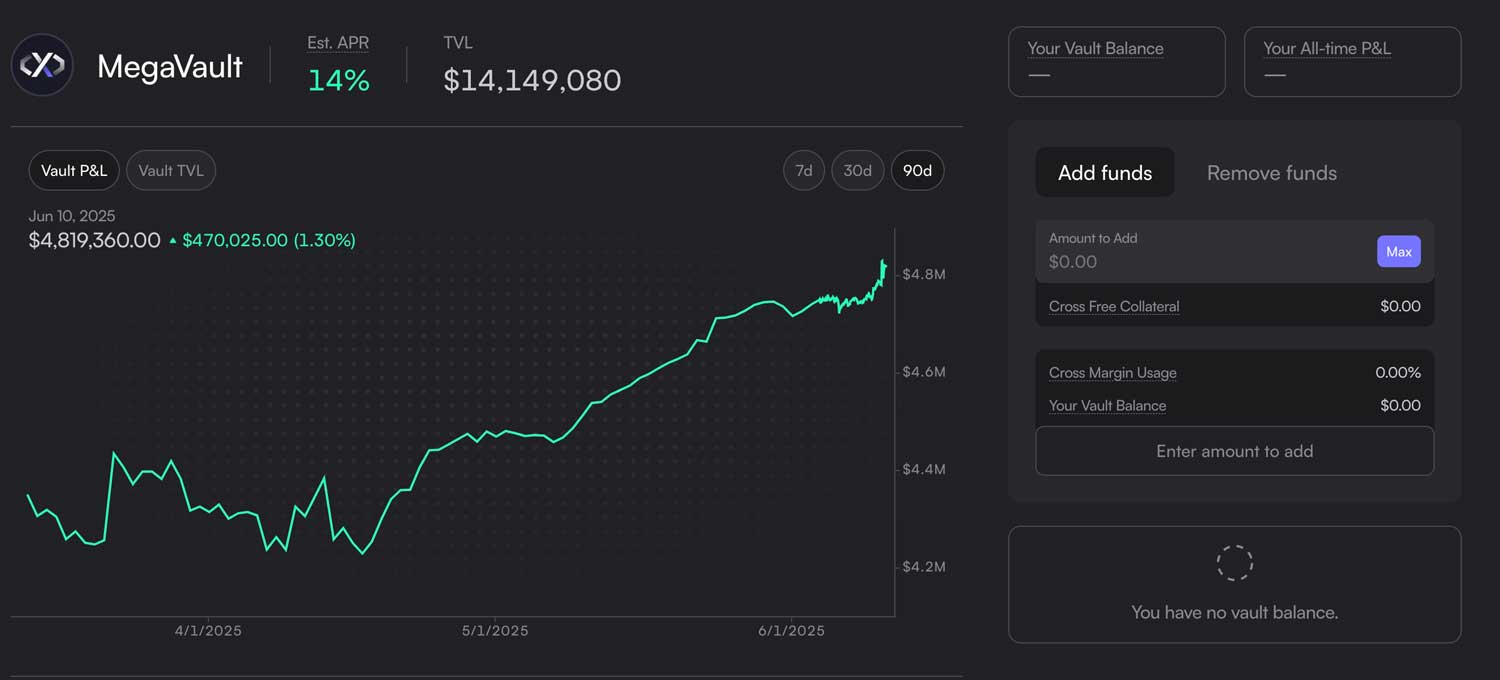

dYdX MegaVault

dYdX offers a feature called the MegaVault—a unique way for investors to earn passive income by depositing funds into a single, community-managed vault. The MegaVault currently offers an estimated 14% APY and is designed to be low-risk.

Unlike Apex Omni, dYdX does not allow individual traders to create their own vaults. Instead, there is only one MegaVault, which is operated by Greave Cayman Limited, a company selected and approved by the dYdX community.

While it’s not traditional copy trading, the benefit of this model is that it’s likely to be more regulated and carefully audited, given the community vetting process behind the vault operator.

Vaults Summarised

|

Feature |

Apex Omni Vaults |

DYdX MegaVault |

|

Copy-trading availability |

Yes, with individual trader Vaults |

No direct copy-trading; single managed vault |

|

Who manages the Vault? |

Independent traders |

Greave Cayman Limited (community selected) |

|

Transparency |

Full stats, open positions, trader history |

Limited to overall vault performance |

|

Investor Control |

Choose specific traders to follow |

One shared pool for all investors |

|

Trader Requirements |

Anyone can start a Vault with $100+ capital |

No option to start a Vault as a trader |

|

Profit Distribution |

90% investor / 10% trader |

Estimated APY (~14%) |

|

Risk-level |

Varies by trader strategy |

Designed to be low-risk |

Pros and Cons of Decentralized Copy Trading

Just like with any financial tool, decentralized copy trading comes with its own set of advantages and limitations. Here's a quick overview:

Pros

- Non-Custodial: Your funds remain in a smart contract, not with the trader or platform, reducing counterparty risk.

- Transparency: Platforms like Apex Omni provide full visibility into trader performance, open positions, and AUM.

- Passive Income Potential: Investors can earn profits without actively trading.

- Accessible for Traders: Traders can launch their own Vaults with low capital requirements and scale their strategies.

- Decentralized Governance: In the case of dYdX, the community selects and oversees the vault operator.

Cons

- Limited Platform Options: Only a few DEXs currently support copy-trading-like features.

- Smart Contract Risk: Bugs or exploits in the contract code can still pose risks to your funds.

- Lower Adoption: Fewer users and traders compared to centralized platforms, which can mean less liquidity and fewer vault choices.

- Less Flexibility (on some platforms): For example, dYdX only offers a single vault managed by a third party, giving investors fewer options.

Conclusion: Is Decentralized Copy Trading Worth It?

Decentralized copy trading is still in its early stages, but it’s evolving quickly. Platforms like Apex Omni are pushing the boundaries by offering a truly non-custodial, transparent experience that closely mimics centralized copy trading. Meanwhile, dYdX takes a more conservative, community-driven approach with its MegaVault, offering simplicity and potentially lower risk.

Whether you’re a trader looking to scale your strategy or an investor searching for passive income opportunities, decentralized vaults are a promising new tool worth exploring—especially if you value control, transparency, and decentralization.

FAQ: Decentralized Copy Trading and Vaults

What is a Vault in crypto trading?

A Vault is a smart contract-based investment product that allows users to allocate funds to a trading strategy managed by a trader or platform. In the context of Apex Omni and dYdX, Vaults act like decentralized copy-trading tools—letting investors earn passive income while traders execute strategies on their behalf.

Is decentralized copy trading safe?

Decentralized copy trading is generally considered safer than centralized alternatives because your funds are never held by a third party. Instead, they're stored in a smart contract. However, risks still exist, including smart contract bugs, poor trader performance, or extreme market volatility.

Can I lose money in a Vault?

Yes. Just like any trading strategy, there are risks involved. If the trader’s strategy performs poorly, you may experience losses. Always review a Vault’s track record, risk profile, and performance metrics before investing.

What is the difference between Apex Omni Vaults and the dYdX MegaVault?

- Apex Omni allows individual traders to create their own Vaults. Investors can choose who to follow based on transparency, performance, and strategy.

- dYdX, on the other hand, offers a single MegaVault managed by a third-party operator chosen by the community. It’s more passive, with fixed APY, but less flexible for traders.

Do I need KYC to use Vaults on Apex or dYdX?

No. Both Apex Omni and dYdX are decentralized platforms, meaning you typically do not need to complete KYC (Know Your Customer) procedures to use Vaults or trade.

How much can I earn from a Vault?

Earnings vary. On dYdX, the MegaVault offers a fixed ~14% APY (subject to change). On Apex Omni, earnings depend on the performance of the trader you're following. Some traders show high monthly returns, but profits aren't guaranteed.

Can I withdraw my funds at any time?

On Apex Omni, most Vaults allow you to withdraw your funds at any time, although doing so during active trades might affect timing. The dYdX MegaVault may have withdrawal windows or cooldown periods—always check the platform’s terms.

Want to try Vaults? Create an account on Apex Omni or dYdX decentralised exchange