How and Where to Set Up a Crypto Company. Here’s What You Need to Know

Attempting to run trades through a personal account or an informal setup may seem convenient at first, but it can quickly lead to a blurring of lines, especially when it comes to personal and business assets, regulatory exposure, and unpredictable tax outcomes.

By comparison, incorporating a dedicated legal entity (in a regulated country) can offer a clear structure for accounting, liability protection, and, depending on the jurisdiction, considerable tax efficiency.

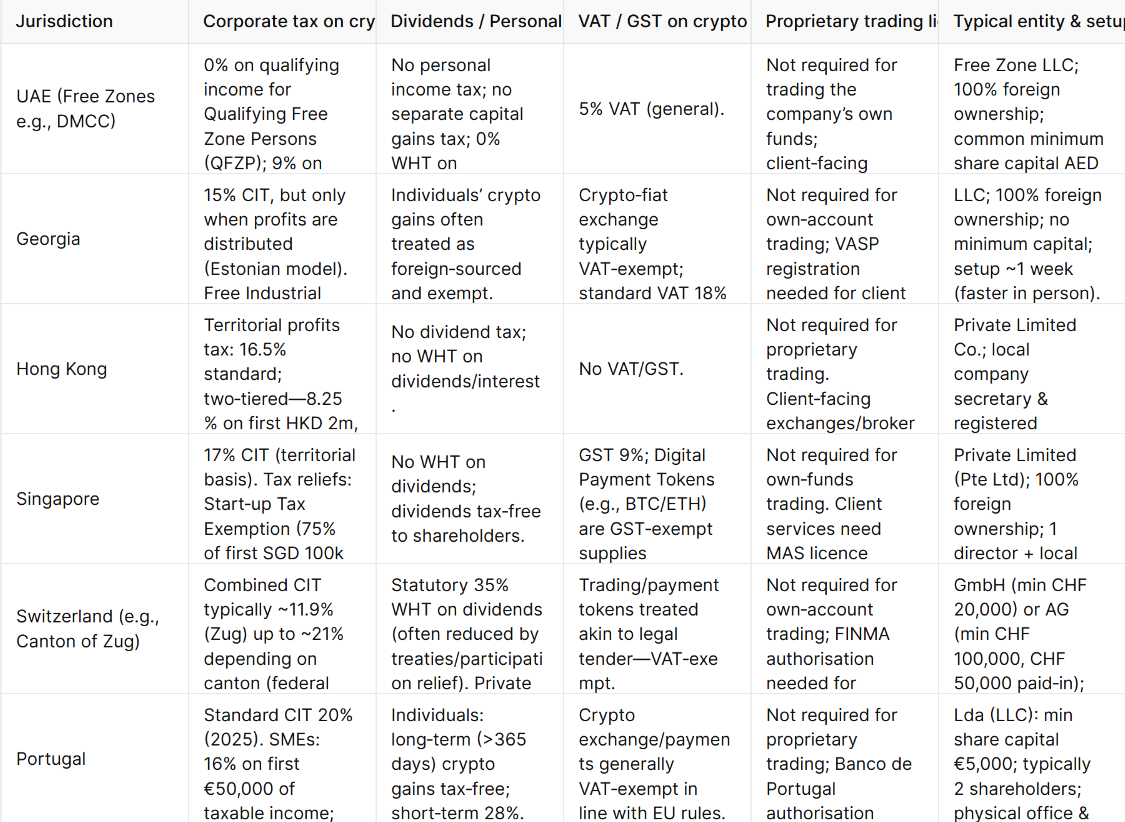

That said, not all jurisdictions are equal in how they monitor or tax crypto-related activities, given that some governments have taken a proactive stance toward creating frameworks that encourage innovation while maintaining regulatory oversight. Listed below are some of the most attractive destinations for companies to set up their crypto ventures.

United Arab Emirates (UAE) – Free Zone Companies and Offers a 0% Tax Environment

The UAE (particularly Dubai) has emerged as a global crypto hub, attracting companies with its business-friendly policies. In 2023, the UAE introduced a 9% federal corporate tax, but free zone companies can still enjoy 0% tax on qualifying income. Moreover, crypto trading profits have been explicitly confirmed as qualifying income for 0% in many cases. Here’s how a company can leverage the UAE for its crypto operations:

Free Zone LLC Formation

Foreigners can establish a wholly-owned LLC in one of the UAE’s many free trade zones. Notably, the DMCC (Dubai Multi Commodities Centre) Free Zone is a popular choice for crypto businesses, even hosting a dedicated Crypto Centre. Benefits of DMCC (and similar zones) include 100% foreign ownership (no local sponsor required) and a guaranteed zero corporate and personal income tax for 50 years.

Free zone companies also have no currency restrictions and full profit repatriation, so your crypto profits can be freely moved out in crypto or converted to fiat without local barriers.

Tax Treatment

Under the UAE’s new tax law, a “Qualifying Free Zone Person” that earns only free-zone sourced income pays 0% corporate tax. The Federal Tax Authority clarified in May 2024 that crypto assets held by free zone companies are eligible for 0% tax as qualifying income. In practice, this means if a Dubai free zone company trades crypto (and doesn’t, say, service UAE mainland clients), it can operate tax-free on those trading profits.

There’s also no capital gains or dividend tax in the UAE, and no personal income tax for residents. If a free zone company were to stray from the qualifying criteria, e.g., doing business with UAE mainland customers, then profits could be taxed at 9%. But a proprietary trading firm typically can avoid this.

Licensing

Simply trading or investing the company’s own funds in crypto generally does not require a special license in the UAE. However, if the company offers crypto services (exchange, brokerage, etc.) to customers, then approval from regulators like VARA (Virtual Assets Regulatory Authority in Dubai) would be needed.

For a pure trading firm, one can choose a broad business activity (like “proprietary investment” or “crypto proprietary trading”) when setting up the company. DMCC, for example, has specific crypto asset business license categories. The process involves submitting passport copies, a business plan, KYC on shareholders, and meeting the minimum share capital (often around AED 50,000, USD $13.6k approx., which can just be kept as working capital). The formation process is relatively quick, with DMCC estimating around 10 working days if documentation is in order.

One challenge can be banking, as UAE banks are conservative and may not readily offer accounts to crypto-related companies unless they have proper licenses and a convincing compliance setup. That said, the UAE is launching initiatives (like digital banks and partnerships) to support the sector, and using an Emirati free zone entity lends credibility. Also, if the company’s owners want to live in Dubai, the free zone company can sponsor residency visas, making it practical to physically operate there.

Georgia – Low Taxes, Territorial Treatment, and Fast Setup

Georgia is sometimes called a “crypto tax haven” because of its favorable laws offering a mix of territorial taxation and special regimes that benefit both individuals and companies engaged in crypto activities.

Tax on Crypto Trading

Individual residents in Georgia pay no tax on crypto trading profits as the law treats crypto gains as foreign-sourced income (since crypto is not issued by Georgia), thus exempt for Georgian individuals. For companies, Georgia has a 15% corporate income tax, but uniquely, this tax is applied only when profits are distributed (the Estonian model of corporate taxation).

In other words, if a Georgian LLC trades crypto and makes profits, it doesn’t owe the 15% until it pays out dividends or other profit distributions. Additionally, if the firm keeps reinvesting or holding the profits, tax is deferred indefinitely. And when a distribution is carried out, there’s a 5% dividend withholding tax. Effectively, if a company eventually takes out all its profits, the total tax is about 19.25% (because 0.85 * 0.95 yields that net), but there’s control over timing.

Free Zone Option (0% Tax)

For an even more appealing setup, Georgia has Free Industrial Zones (FIZ), like the Tbilisi Free Zone, where companies can register to get 0% corporate tax, 0% VAT, and no tax on exports. According to legal advisors, a crypto business in a Georgian FIZ pays no corporate income tax at all, with the only tax being the 5% on any distributed dividends.

There are minimal reporting requirements as FIZ companies aren’t subject to the usual monthly or quarterly filings that normal companies are. That said, to be a FIZ company, one usually needs to rent space or a desk in the zone (fulfilling a physical presence), though some service providers handle this virtually.

Company Formation

Setting up a Georgian LLC is straightforward and low-cost, with foreigners being able to own 100% of the company with no required minimum capital. The registration can be done in a matter of days, roughly 1 week to register the LLC (even faster if you visit in person). Basic steps include choosing a unique company name, providing passports for shareholders, a local address (often provided by business service firms), and filing with the National Agency of Public Registry.

If pursuing a crypto exchange or financial service, one might need to obtain a VASP license from the National Bank of Georgia, but if the company is only trading its own assets, no special license is needed. In case a license is desired (for more official status or expanding services), Georgia has introduced a Virtual Asset Service Provider (VASP) license, but interestingly, many crypto entrepreneurs skip the full license by operating under the FIZ regime, which is lighter and still legitimate for proprietary trading.

Other Benefits

Georgia has no capital gains tax generally on long-term assets and no wealth tax. It also does not tax crypto-to-fiat conversions for companies (no VAT on crypto trades for companies either). If the owners spend time in Georgia, they can benefit from one of the lowest personal income tax regimes as well.

Hong Kong – A World-Class Financial Hub Offering Evolving Crypto Incentives

Hong Kong has long been a favored place for base trading firms due to its forward-looking legal system, low taxes, and status as a finance hub. For crypto, Hong Kong’s approach is “open but regulated,” encouraging businesses to set up while still implementing well-planned licensing regimes for exchanges alongside clear tax rules:

Taxation structure

Hong Kong taxes businesses on a territorial basis, with its headline profit tax rate being 16.5% for corporations (but only on profits sourced in Hong Kong). There is no capital gains tax in HK and no tax on dividends or bank interest. In practice, if a company is actively trading crypto in Hong Kong, the Inland Revenue Department has indicated that such profits are likely considered trading income (not passive capital gains) and thus taxable.

However, if the company can argue its crypto investments are long-term capital holdings or the trades are executed outside Hong Kong, some portion might be treated as non-taxable. This can get complex because, for instance, if the trading decisions and management are in HK, the profits will be seen as locally derived and taxed.

Many funds and proprietary traders live by paying the 16.5% profit tax on their net trading gains, which is still moderate by global standards. Importantly, no additional tax on dividends means that once the company pays 16.5%, it can distribute profits to the owners with 0% withholding, and individuals don’t pay tax on receiving those dividends. Additionally, Hong Kong has a two-tiered profit tax where the first HKD 2 million (USD $255k) of profits are taxed at a half rate (8.25%), which can benefit smaller companies.

Crypto-Specific Incentives

As of late 2024, Hong Kong’s government has proposed new tax exemptions for crypto investment income for certain classes of investors. Specifically, there is a plan to waive taxes on investment gains from cryptocurrencies for hedge funds, PE funds, and family offices that are privately managed. If implemented, it means a Hong Kong domiciled fund or family office vehicle trading crypto could be fully exempt from profit tax on those trades.

Company Formation and Regulations

Setting up a Hong Kong company (usually a Private Limited Company) is straightforward with a local corporate service provider. It requires at least one director (can be foreign), one shareholder, and a local company secretary (this is a service one hires), as well as a local registered address.

Incorporation can be done in 1-2 weeks, as Hong Kong now has a licensing regime for any business providing crypto trading to the public (the VATP license via the Securities and Futures Commission). But if a company is only trading its own assets, it does not need this license.

Lastly, HK’s banking sector is high-quality but can be strict with compliance, meaning that a new crypto trading company might need to show strong documentation to open a bank account. However, Hong Kong is actively positioning itself as a crypto-friendly hub in Asia, so banks and regulators are becoming more accommodating to bona fide crypto businesses.

Benefits of HK for Crypto Companies

Companies get a stable legal environment, a common law system, and a reputation (which helps when dealing with partners or investors). There’s also a massive talent pool in finance and tech. Hong Kong also does not restrict capital flows, allowing entities to freely convert and move money, which pairs well with crypto liquidity needs.

Moreover, if the company’s operations involve trading on both centralized and decentralized exchanges, Hong Kong’s time zone and network can be useful (lots of crypto exchanges and funds have a presence there, enabling good connections and API latency, etc.).

Singapore – Asia's Premier Crypto Hub

Singapore couples well-established regulation with a strong pro-innovation agenda, making it one of the top countries in the world for structured crypto operations.

Taxation Structure

Singapore operates on a territorial tax system with a competitive corporate income tax rate of 17% on profits derived from activities conducted in Singapore. However, a key advantage for crypto trading companies is the country’s absence of capital gains tax, meaning profits from trading activities may not be subject to additional taxation beyond the standard corporate rate.

For crypto-specific activities, Singapore offers several tax advantages. As an example, Digital Payment Tokens (DPTs) like Bitcoin and Ethereum are exempt from the 8% Goods and Services Tax (GST), with this exemption also applying to the exchange, transfer, and use of recognized cryptocurrencies (though some token types may still be subject to GST).

Moreover, the Inland Revenue Authority of Singapore (IRAS) has indicated that crypto trading profits by companies are generally treated as business income rather than capital gains, meaning they're subject to the 17% corporate tax rate. However, if a company can demonstrate that crypto holdings are long-term investments rather than active trading positions, some portion of the funds might qualify for more favorable treatment.

Lastly, Singapore offers a two-tiered profit tax system where the first SGD 300,000 (approximately USD 220,000) of profits are taxed at only 8.5%, providing significant savings for smaller trading operations. Additionally, there's no withholding tax on dividends paid to shareholders, allowing clean profit distribution once corporate taxes are paid.

Company Formation and Licensing

Setting up a Private Limited Company (Pte Ltd) in Singapore is straightforward, requiring only one director, one shareholder, and a local company secretary (with incorporation typically taking 1–2 weeks, alongside the provision that it can be 100% foreign-owned).

For firms trading only their own assets, no special license is required, but companies offering exchange, custody, or payment services must obtain a Payment Institution License under the Monetary Authority of Singapore (MAS). Depending on the scale, firms may apply for either a Standard Payment Institution (SPI) license or a Major Payment Institution (MPI) license, each with escalating requirements for compliance and capital adequacy.

Practical Advantages

From the outside looking in, Singapore offers world-class financial infrastructure, a predictable legal system, strong talent availability, and unrestricted movement of profits. For firms with global teams, relocation is practical through Employment Passes and investor residency schemes, making Singapore one of the strongest options in Asia.

Switzerland – The Original “Crypto Valley” with Tax Optimization

Switzerland, more specifically the Canton of Zug (often referred to as “Crypto Valley”), has long been a go-to destination for crypto firms seeking regulatory certainty and competitive tax treatment (thanks, in large part, to its innovation-friendly policies and a globally respected legal framework).

Tax Treatment

Private investors in Switzerland can often trade cryptocurrencies tax-free under the country’s “safe haven” rules, provided they meet certain conditions, such as:

- Holding assets for at least six months

- Trading turnover less than 5x portfolio value at the year start

- Capital gains are less than 50% of the total annual income

- No debt financing for investments

- Derivatives are used only for hedging

Also, for companies, corporate tax rates can vary significantly by canton, ranging from 11.9% to 21%. Zug, for instance, offers one of the lowest rates across Europe (at approximately 11.9%). Lastly, the federal corporate tax rate is also just 8.5%, with cantonal and municipal taxes adding the remainder.

Payment tokens like Bitcoin and Ethereum are exempt from VAT, and dividends can often be distributed to non-resident shareholders without withholding tax. The country’s extensive double taxation treaty network further strengthens its appeal for international businesses.

Company Formation and Licensing

Most crypto businesses in Switzerland operate as either a GmbH (LLC) or an AG (joint-stock company). A GmbH requires a minimum share capital of CHF 20,000, while an AG requires CHF 100,000, of which CHF 50,000 must be paid in. At least one Swiss-resident director is mandatory, and incorporation generally takes three to four weeks.

For firms trading only their own assets, no special license is required; however, companies offering services to third parties fall under the supervision of FINMA. The regulatory entity recognizes the following license categories:

- Fintech License: For limited banking activities

- VASP License: For Virtual Asset Service Providers

- Investment Fund License: For collective investment schemes

- Banking License: For full banking services

Business Environment

There’s no denying that Switzerland’s political stability, strong banking infrastructure, and concentration of blockchain expertise in Zug have helped create an ecosystem for crypto entities to thrive in. Also, the local governments’ willingness to accept tax payments in Bitcoin, has reinforced the country’s practical openness to crypto.

Portugal – Europe’s Emerging Crypto Haven

Portugal has quickly carved out a niche as one of the most favorable nations for crypto investors and companies in the European Union. Known for its progressive taxation of digital assets, Portugal combines EU market access with business-friendly reforms.

Taxation Framework

Since 2023, Portugal has made a clear distinction between long-term and short-term crypto holdings. For individuals, digital assets held for more than a year are exempt from capital gains tax, while shorter-term gains are taxed at 28%. Furthermore, crypto-to-crypto swaps are not taxed immediately, allowing portfolio optimization without triggering tax events.

Similarly, for companies, the corporate tax rate is 21%, though small businesses pay a reduced 17% on the first €50,000 of profits, with even lower rates in Madeira and the Azores. Dividends are subject to a 25% withholding tax, but VAT exemptions apply to crypto transactions in line with EU standards.

Company Formation and Regulation

Businesses are usually incorporated as an LDA (Limited Liability Company) with a minimum share capital of €5,000 and at least two shareholders, with formation typically taking three to four weeks. Not only that, but a physical office space in Portugal and hiring a local director is also mandatory.

Other required documentation includes:

- Apostilled and translated passport copies of all shareholders and directors

- Proof of address for all parties (utility bills within 3 months)

- Tax residency certificates and numbers

- Criminal record certificates for all beneficial owners

- Comprehensive AML documentation

The Banco de Portugal oversees licensing for firms offering third-party services, though proprietary trading firms using only their own funds often face fewer requirements. Licensing applications cost about €475 and usually take 5–7 months.

Strategic Advantages

As an EU member, Portugal provides passporting rights under the upcoming MiCA regulation, enabling firms to operate across the entire European Union from a single base. Coupled with low operating costs, a skilled workforce, and attractive residency options (through its Golden Visa program), Portugal has become one of Europe’s most promising crypto hubs.

Conclusion & Key Takeaways

Choosing where to incorporate a crypto trading or investment company can have a huge impact on taxation, legal protection, and long-term sustainability. While operating informally or through a personal account may feel convenient, it often leads to blurred lines between personal and business assets, regulatory risks, and unpredictable tax exposure.

By contrast, setting up a proper legal entity in a crypto-friendly jurisdiction can provide structure, credibility, liability protection, and in many cases, significant tax advantages. The most attractive destinations today include:

-

UAE (Dubai Free Zones): 0% tax on qualifying crypto income, world-class infrastructure, and residency opportunities.

-

Georgia: Territorial tax, deferred taxation on corporate profits, and Free Industrial Zones offering near-total tax exemptions.

-

Hong Kong: Reputable global finance hub with evolving crypto tax incentives, moderate 16.5% profit tax, and strong banking access.

-

Singapore: Stable regulation, no capital gains tax, and competitive corporate rates with favorable treatment of crypto assets.

-

Switzerland: Zug’s “Crypto Valley” combines low canton taxes, regulatory clarity, and a strong financial ecosystem.

-

Portugal: EU market access, long-term capital gains exemptions for individuals, and growing recognition as a European crypto hub.

Each country offers its own mix of opportunities and challenges — from licensing requirements and minimum capital contributions to banking access and compliance obligations.

Ultimately, the best jurisdiction depends on your goals (proprietary trading, exchange services, fund management, or residency benefits).

Always do your own research (DYOR) and consult with qualified legal and tax advisors before making a decision, as regulations evolve quickly and every situation is unique.

Related Articles:

- How to Use a Decentralized Exchange (DEX) Within a Company Setup

- Best Crypto Exchange for Companies and Institutional Users (2025 Guide)

- How to Open a Corporate Account on Bybit