How to Open a Corporate Account on Bybit

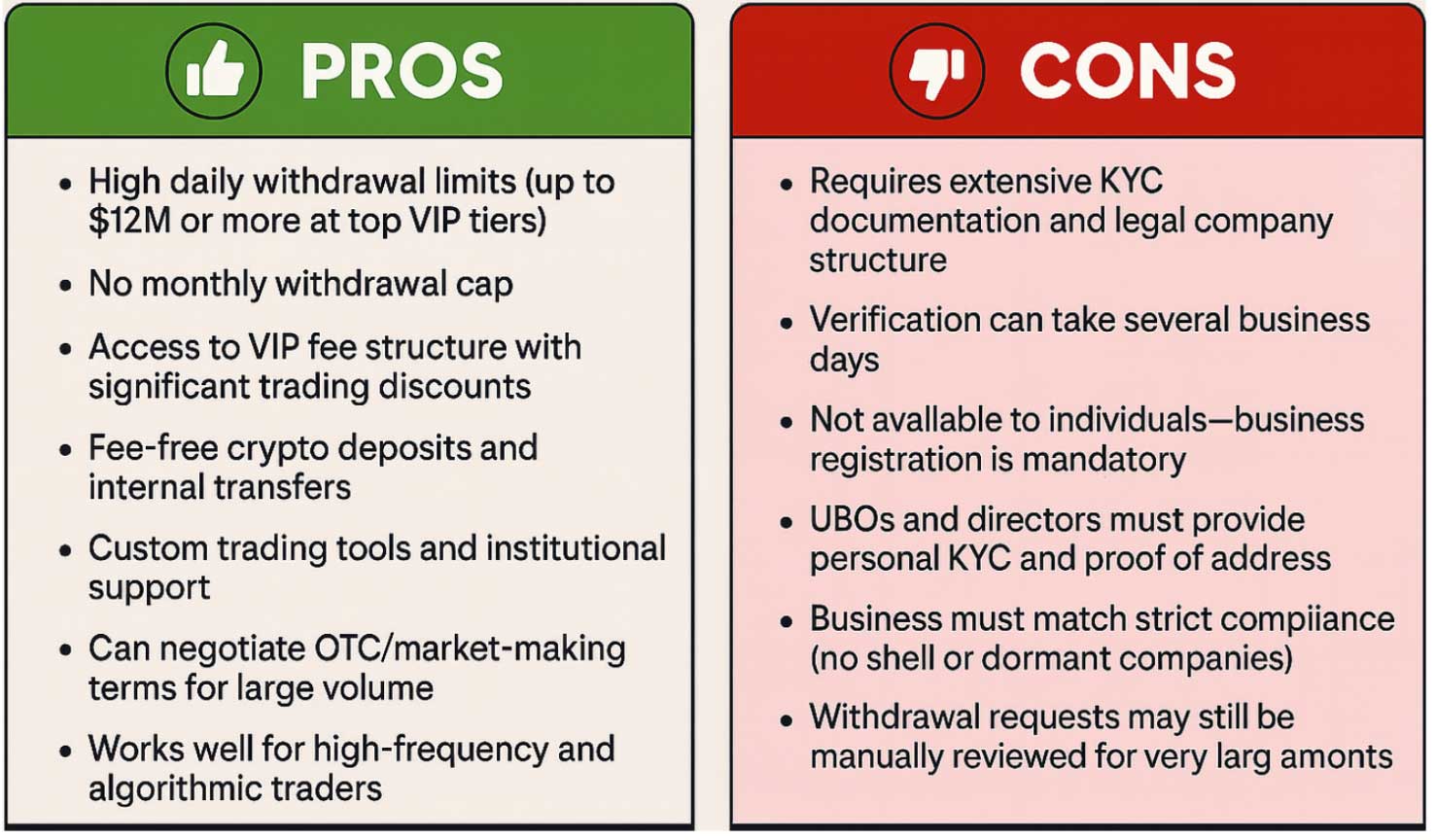

Bybit’s institutional (corporate) portal provides advanced tools and deep liquidity tailored for professional traders. Also, unlike retail sign-ups, corporate accounts have to undergo a dedicated onboarding process with extensive KYC requirements. Official guides on this topic are scarce, so this article fills the gap with a clear, step-by-step walkthrough.

TL;DR

|

What |

Bybit offers a dedicated institutional portal for verified corporate users. |

|

Why Open One |

Unlocks higher withdrawal limits, VIP trading fees, and business-friendly features. |

|

KYC Requirements |

Incorporation docs, shareholder/director registers, UBO verification, IDs, and org chart. |

|

Fee Structure |

No deposit fee; trading fees decrease with higher VIP tiers. |

|

Time to Approve |

Business KYC approval takes 3–5 business days. |

|

Workaround (if no company) |

Consider registering a business in Dubai, Georgia, or other relevant compliant countries. |

Opening a corporate Bybit account unlocks features like unlimited withdrawals (no monthly limit after business KYC), customized fee discounts, and VIP-level pricing. To start, a business must gather certain specified documents and submit them via Bybit’s dedicated Business KYC portal. But before you can apply, you first need to create an account.

Once done, businesses must click the “Verify Now” button to upload all of the relevant documents, an action that triggers a specialized verification process, which may take several days.

After completion, companies enjoy institutional-grade withdrawal limits (initial daily $4M, rising with VIP level up to $12M or more) and no monthly withdrawal cap. Trading fees are also reduced at higher VIP tiers, making this institutional portal valuable for asset managers, trading firms, and crypto hedge funds.

Step-by-Step Tutorial for Opening a Bybit Corporate Account

1. Create a Bybit Account (if needed)

To start with, users need to register for a regular Bybit account (if one does not already exist). After logging in, a representative can proceed to complete the business verification process by clicking on Account & Security → Identity Verification and then selecting the Business or Institutional option. Following this, they need to click on the “Verify Now” button.

2. Prepare and Submit KYC Documents

Bybit requires extensive paperwork for a corporate account, the checklist for which includes:

- Certificate of Incorporation: An official government document proving your company is registered.

- Articles of Association (or equivalent): A company’s constitutional documents (articles, memorandum, or constitution).

- Register of Shareholders/Members: Latest registers showing the personnel holding equity in the firm.

- Register of Directors: A current list of all directors.

- UBO Information: Details of any Ultimate Beneficial Owner holding ≥25% of shares. Bybit will send a verification link to each such UBO’s email.

- IDs and Addresses: Valid passports/IDs and recent proof of address for all directors (if they differ from the UBO), and for the account operator/trader if different from the UBO. Acceptable proof of address includes bank statements or utility bills (issued within 3 months).

- Company Organizational Chart: A chart showing the ownership structure and roles (UBO, directors, managers).

3. Ensure the veracity of each document

Each piece of identification submitted needs to show the photo, name, DOB, ID number, and issue date of the applicant/applicants in question. Once all of the files are uploaded and the form submitted, the portal automatically starts processing the application.

4. Wait for Verification

After submission, the verification is conducted by Bybit’s compliance team. This process takes time, typically longer than personal KYC checks. Generally, expect about 3–5 business days for review. During this period, it is important to not submit duplicate applications as it may interfere with the verification process. Bybit may contact the company or UBOs directly if additional information is needed.

5. Account Activation

Once the KYC process is approved, applicants are notified via email and the account is upgraded to corporate status. Companies can then begin deposits and trading with full institutional privileges; however, before making any big moves, they should verify that their account shows the updated business status. At this point, the account should have no monthly withdrawal limit (only daily limits), and trading fees should follow Bybit’s VIP program (see above).

6. Deposit Funds and Start Trading

Crypto deposits on Bybit are fee-free, and internal transfers within Bybit incur no charges. Similarly, withdrawal fees depend on the blockchain network and are fixed per transaction (as noted on the withdrawal screen). After funding, trading can begin with corporate accounts tracking their 30-day volume to reach higher VIP tiers (see VIP breakdown below).

Lastly, if any issues arise during the KYC, Bybit advises contacting their live chat or emailing compliance@bybit.com before resubmitting. It is imperative that the company’s details name, and bank accounts match to avoid rejection.

Bybit Corporate Fees, VIP Tiers, and Costs

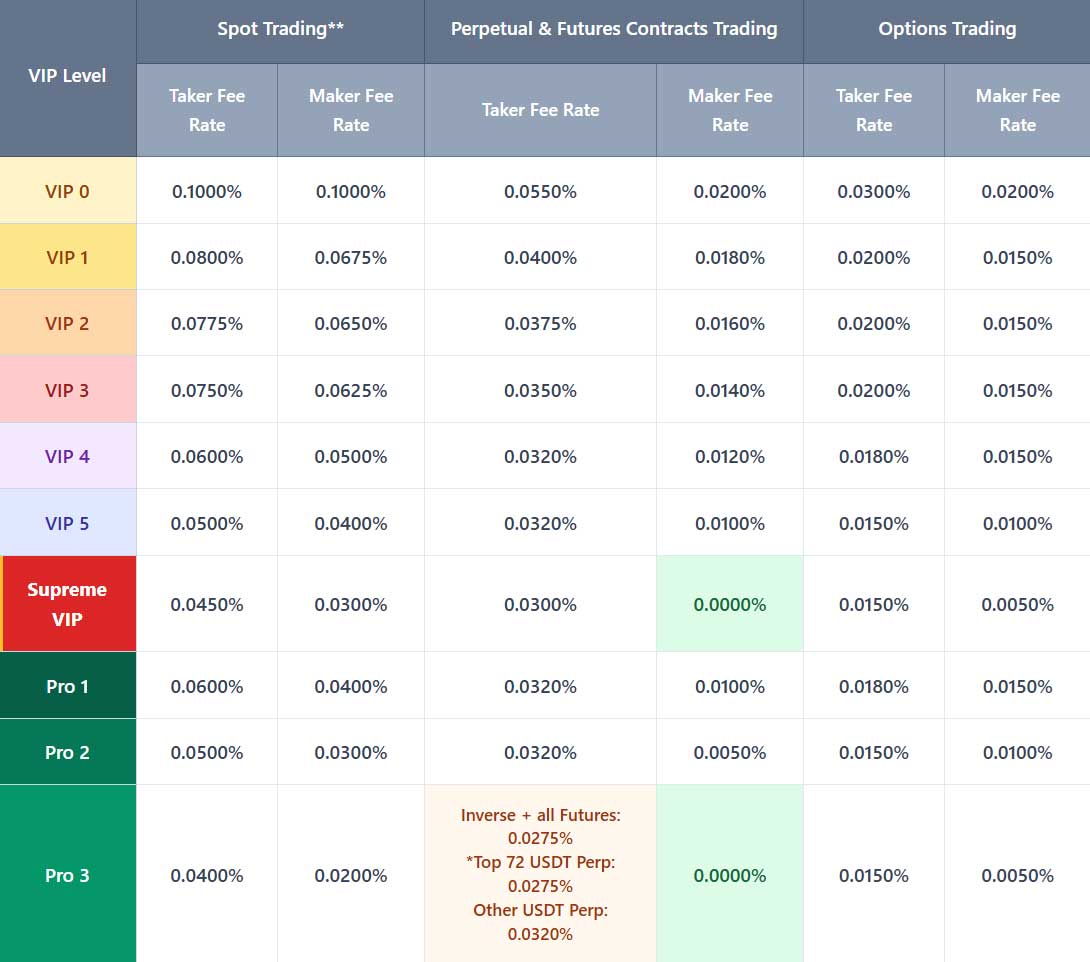

Bybit’s trading fees depend on the participating firm’s VIP status, offering a tiered fee schedule where higher volumes are rewarded with discounts. Thus, ideally, institutional clients should aim for top VIP levels to minimize their financial overheads.

- Spot Trading Fees: At the VIP 0 level (below $100K 30d volume) the taker fee is 0.1% (maker 0.1%). As shown on Bybit’s fee table, a VIP4 account pays 0.06% taker / 0.05% maker, VIP5 pays 0.05%/0.04%, and a Supreme VIP pays just 0.045%/0.03%. (Even lower rates apply at Pro levels for extremely high volume.)

- Futures/Derivatives Fees: VIP discounts similarly apply to perpetual futures and inverse contracts, with top-tier taker fees below 0.05%. Institutional accounts often also negotiate customized OTC or market-making fees if volume is very large.

- Fiat Fees: Bybit supports credit/debit and bank deposits via partners, but these channels usually have a small processing fee (e.g., a 1% merchant fee) and can vary by region.

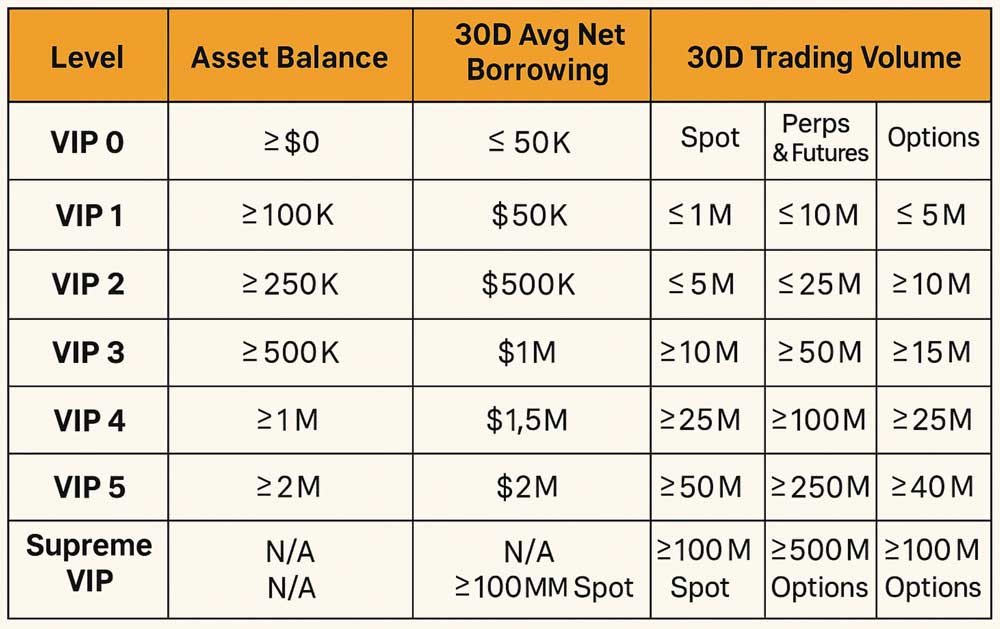

VIP Volume Requirements

Bybit’s VIP program is structured around a 30-day rolling trading volume or asset balance, with seven ascending levels, each unlocking progressively lower fees across spot, derivatives, and options trading.

For spot trading, the initial maker and taker fee for VIP 0 is 0.10% each. Upon reaching VIP 4, the rate drops significantly to 0.05% maker and 0.06% taker fees, and at Supreme VIP (requiring ≥ $100 M monthly volume), fees fall further to 0.03% maker and 0.045% taker.

Volume thresholds are clearly defined for the various progressions as well. To attain VIP 1, a trader must execute ≥ $1 M in 30-day spot volume or hold ≥ $100K in assets; VIP 2 requires ≥ $5 M; VIP 3 ≥ $10 M; VIP 4 ≥ $25 M; VIP 5 ≥ $50 M; and Supreme VIP demands ≥ $100 M .

From a cost-saving perspective, this tiered structure stands to deliver substantial benefits at scale. Consider a trader executing $100 M per month in spot volume. At VIP 0, the combined fees (maker + taker) come to around $100,000. At VIP 4, assuming a balanced trading mix, the same volume garners a blended rate near 0.055%, totaling approximately $55,000, a ~$45,000 monthly savings. Extrapolated over a year, that’s over half a million dollars in fee reductions, not to mention additional savings from discounted derivatives and options fees .

Moreover, VIP status renewal is managed daily at 7 AM UTC, with a 14-day grace period if volume dips below the threshold, thus allowing a buffer to maintain benefits. Derivatives and options fees reflect similar tiered discounts, with VIP 4 futures/taker fees at 0.032% and maker fees at 0.012%, compared to VIP 0 rates of 0.055% and 0.020% respectively.

In sum, scaling to VIP 4 or higher enables corporate accounts to potentially halve their spot trading costs. Lastly, advanced users can also consider using Bybit’s frequent promotions and their deposit bonus program for extra savings.

Registering a Company in Crypto-Friendly Jurisdictions

Companies unable to meet Bybit’s corporate KYC requirements (for whatever reason) can consider forming an entity in a compliant jurisdiction and then apply under that corporate identity.

Dubai (UAE)

Bybit’s status & licensing

Bybit has received a provisional VASP license from Dubai’s VARA in September 2024, and a second in‑principle crypto exchange license from the UAE's Securities and Commodities Authority (SCA) in February 2025, marking progress toward full operational status for both retail and institutional services.

How to set up:

(i) Form a UAE-based company (e.g., Free Zone or LLC).

(ii) Apply for the VARA/SCA virtual asset license.

(iii) Open a UAE corporate bank account (compliant with crypto).

(iv) Submit business KYC to Bybit using that entity.

Ideal for high-volume traders

Dubai offers robust regulatory clarity and global credibility, making it ideal for high-volume traders and firms seeking large-scale institutional credibility. In fact, the Middle East now generates ~7.5% of global crypto volume, with a growing share institutional due to its aforementioned VARA regulation.

Georgia

Bybit’s status & licensing

Bybit obtained a Virtual Asset Service Provider (VASP) license from the National Bank of Georgia on November 5, 2024, and launched a localized Bybit Georgia platform in mid-2025

How to set up:

(i) Register a Georgian company by completing the relevant registration under Georgian corporate law (online or via a local agent).

(ii) Obtain VASP licensing by submitting an application with the National Bank (providing relevant crypto-friendly infrastructure (GBR) documentation.

(iii) Open a bank account with a provider that supports VASP operations.

(iv) Complete Bybit Business KYC and use Georgian entity documents to apply.

Best for SMBs/Regional Operators

Georgia offers a straightforward licensing process and Bybit presence, making it an ideal choice for small to medium businesses seeking compliant fiat integration and regional market access.

Kazakhstan

Bybit’s status & licensing

Bybit Kazakhstan received a full license from the Astana Financial Services Authority (AFSA) in September 2024, enabling it to offer trading, custody, margin, derivatives, and loan services through a regulated digital asset trading facility. It also partnered with Bank CenterCredit in June 2025 to enable direct local fiat trading.

How to set up

(i) Register a company in the Astana International Financial Centre under AIFC regulations.

(ii) Prepare a license application by forming a legible business plan, compliance policies, board resumes, and office lease (within 2–3 weeks of submitting papers).

(iii) Apply for the crypto license (can take ~6–9 months; includes compliance staff).

(iv) Open a local corporate bank account that supports digital asset operations.

(v) Provide licensed AIFC entity documentation to Bybit and register.

Best for long-term regional presence

Kazakhstan offers a fully regulated financial center and local custody services. While licensing takes longer, it supports firms planning long-term operations in Central Asia, with regulated frameworks and regional fiat access.

Is Bybit Corporate an option worth considering?

Bybit’s institutional portal fills a unique niche for professional crypto trading, but its setup process can be a little tedious. The keys are to prepare all required documents in advance, use the official Business KYC portal, and be patient during the verification wait (3–5 business days). Once approved, users can access high withdrawal limits (up to 12M–30M USDT daily, depending on VIP level) and very low trading fees.

Ready to upgrade your crypto trading with institutional-grade benefits?

Start your Bybit Corporate application today and unlock high withdrawal limits, exclusive VIP support, and ultra-low fees.

Frequently Asked Questions (FAQs)

Q. What is a Bybit corporate (institutional) account?

A. It’s an account designated for companies or funds. It has the same trading functions as a regular account but requires Business KYC and enjoys higher limits (and often dedicated support). After approval, it has much higher withdrawal limits and can achieve lower fees through VIP status.

Q. What documents are required for Business KYC?

A. Required documents include the incorporation certificate, company constitution (articles), registers of members and directors, and details/verification of the UBO (25%+ shareholder). Also needed are passports/IDs and proof-of-address for all directors and the designated account operator (if not the UBO), plus an organizational chart.

Q. How long does corporate KYC take?

A. Typically about 3–5 business days after submitting a complete application. In complex cases it may take a bit longer, especially if extra verification is needed.

Q. Are there hidden fees for corporate accounts?

A. No one-time setup fee is charged. Bybit does not charge deposit fees, and internal transfers are free. Network fees apply on withdrawals (these are fixed by the blockchain operators themselves). Trading fees are set by VIP level (see table above). Note that making very large withdrawals may trigger manual review as part of anti-fraud procedures.

Q. Can I open a corporate account without all documents?

A. No; Bybit explicitly requires the full Business KYC checklist. If a company cannot provide these they can consider forming an entity in a crypto-friendly jurisdiction (see above) or using an alternative exchange that allows less stringent KYC.

Q. What are some alternatives if Bybit KYC fails?

A. Alternatives include decentralized exchanges (e.g. Apex Pro) or other non-KYC-friendly centralized exchanges. WhalePortal has a guide on trading without KYC, and a step-by-step guide to Bybit’s KYC process, which may help complete verification.

Related Articles

- Can You Trade on Bybit Without KYC?

- Bybit KYC Verification 2025: Step-by-Step Guide & Alternatives

- Bybit Deposit Bonus and Referral Guide