Litecoin's Comeback: Why It’s Set to Crush Other Cryptos in 2025

Most seasoned crypto investors are familiar with Litecoin. However, for newcomers, this might be their first time hearing about it. Litecoin is one of the oldest cryptocurrencies, created shortly after Bitcoin as one of the first altcoins.

In this article, we’ll explore why Litecoin could be the sleeping giant of 2025, backed by strong charts and promising indicators.

The Story of Litecoin

Litecoin, created by Charlie Lee in 2011, has long been considered the "silver to Bitcoin’s gold." It gained significant popularity during the 2017 bull market, positioning itself as one of the most important cryptocurrencies of that era. Designed for faster transactions, Litecoin has remained a key player in the crypto space, often serving as a testing ground for innovations like SegWit and the Lightning Network.

Dino Tokens

"Dino tokens" refer to older, well-established cryptocurrencies that have been around for many years but may have lost some of their hype compared to newer projects. "Dino" is short for dinosaur, implying that these tokens are survivors from early crypto cycles but are not that interesting for new investors as new tokens are created every single day and narratives shift to other corners like DeFi or Memetokens. Some examples of Dino tokens are: Litecoin (LTC), Dash (DASH), Ethereum Classic (ETC).

But here’s the catch, could these Dino tokens, especially Litecoin, be on the verge of a massive comeback? Has Litecoin been quietly consolidating since 2017, building momentum for an even bigger breakout? With growing institutional interest, could its next move surprise the market? Let’s dive into the charts and find out!

Is XRP the front-runner?

XRP is also a Dino token, and the structure of XRP looks very similar as to that of Litecoin due to the following reasons:

- XRP has been a star in 2017, gaining massive interest and returns

- It did not make a new all-time high in the 2021 bull market

- It’s been consolidating since 2017 and broke out in 2024.

- In 2017, XRP was also one of the first tokens to see a massive surge in price

Let’s have a look at Litecoin (LTC)

- Litecoin (LTC) has been consolidating since 2017

- No new all-time high was broken (double top)

- 2017 Litecoin gained massive popularity and significant returns similar to XRP

The big question is, can Litecoin break out of this formation in 2025, following the price structure we have seen with XRP?

Institutional Interest & Litecoin Spot ETF’s

Institutional interest in Litecoin has been gaining momentum, particularly with the recent filings for Litecoin-focused exchange-traded funds (ETFs). In October 2024, Canary Capital submitted an S-1 registration to the U.S. Securities and Exchange Commission (SEC) for a spot Litecoin ETF, aiming to provide investors with direct exposure to Litecoin.

Following this, in January 2025, CoinShares filed for both Litecoin and XRP spot ETFs, further indicating growing institutional interest in these digital assets.

Analysts anticipate that initial responses to these Litecoin ETF applications could arrive by March 2025, with final rulings expected by September 2025.

The approval of a Litecoin spot ETF would mark a significant milestone, potentially attracting substantial institutional investment and enhancing Litecoin's presence in the financial markets.

The increasing number of ETF filings and the evolving regulatory environment suggest that 2025 could be a pivotal year for Litecoin's integration into traditional financial products.

The potential growth for Litecoin

When comparing Litecoin’s fundamentals to Bitcoin and Ethereum, it’s clear that Litecoin has significant room for growth. First, its market cap sits at just $5 billion, while Bitcoin has already surpassed $1 trillion. But that’s not the full story, Litecoin processes nearly 50% of Bitcoin’s daily transactions, yet its price remains far lower.

Additionally, Litecoin’s transaction fees are significantly cheaper than those of Bitcoin or Ethereum, making it a more efficient network for everyday use. This combination of high network activity and a low market cap means Litecoin requires far less liquidity to experience substantial price gains. Fundamentally, Litecoin remains strong, yet its valuation appears to lag behind its true utility, highlighting a clear divergence between price and value.

Litecoin Network Value

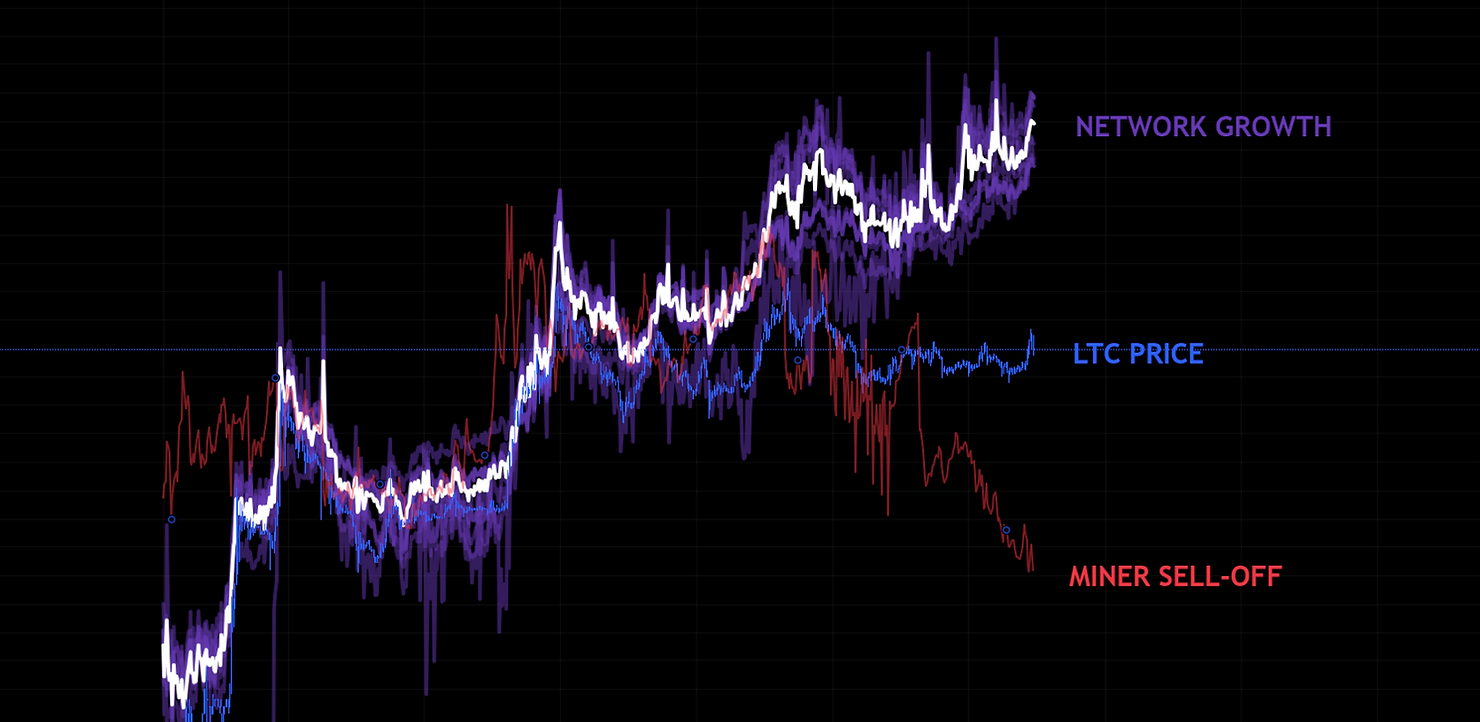

Litecoin's network is showing impressive growth, even though its price hasn’t changed much. One key metric to look at is the hashrate, which measures the total computing power used to secure the network. Recently, Litecoin’s hashrate reached an all-time high, indicating that more miners are joining in and supporting the network.

Additionally, Litecoin has seen an increase in transaction volume, meaning more people are using it for everyday transactions. This is important because it shows that while the network is becoming stronger and more valuable, the price of Litecoin hasn’t yet reflected this growth. In simple terms, Litecoin's network value is increasing, but its price is still catching up. We can see it in the Litecoin’s network value chart form Lookintolitecoin.com.

Another notable aspect of this chart is that Litecoin miners currently hold record-low amounts of the cryptocurrency. This suggests that they have sold off a significant portion of their holdings, which could lead to reduced selling pressure on Litecoin in the market.

Litecoin/Bitcoin Chart (LTC/BTC)

When we have a look at Litecoins valuation against Bitcoin, we can see that this chart is at a crucial support level. While at the support level, the momentum indicator is already showing upward movement indicating momentum building up in the background of the price. This is a sign, that Litecoin could potentially outperform Bitcoin in 2025. Another positive sign for Litecoin's price in 2025.

Summary

Litecoin could be poised to emerge as one of the next Dino tokens to take off in 2025, following a prolonged period of consolidation since the 2017 bull market.

This article has explored several key factors supporting this potential comeback, including its price structure, growing institutional interest, solid fundamentals, price divergence, and the record low holdings among miners.

Interested in buying Litecoin? Buy this token on Bybit.