Sentiment Heatmap Explained

Most traders are losing themselves in the emotional state of the market and therefor making the wrong trading decisions. This is one of the hardest aspects of a trader, to recognise the sentiment of the markets and to not get caught in the emotional state.

What if their would be a tool that would show you exactly what the general sentiment is for that specific day? You could see how the majority is viewing the market and also recognise if you got caught up in the sentiment.

Sentiment Heatmap

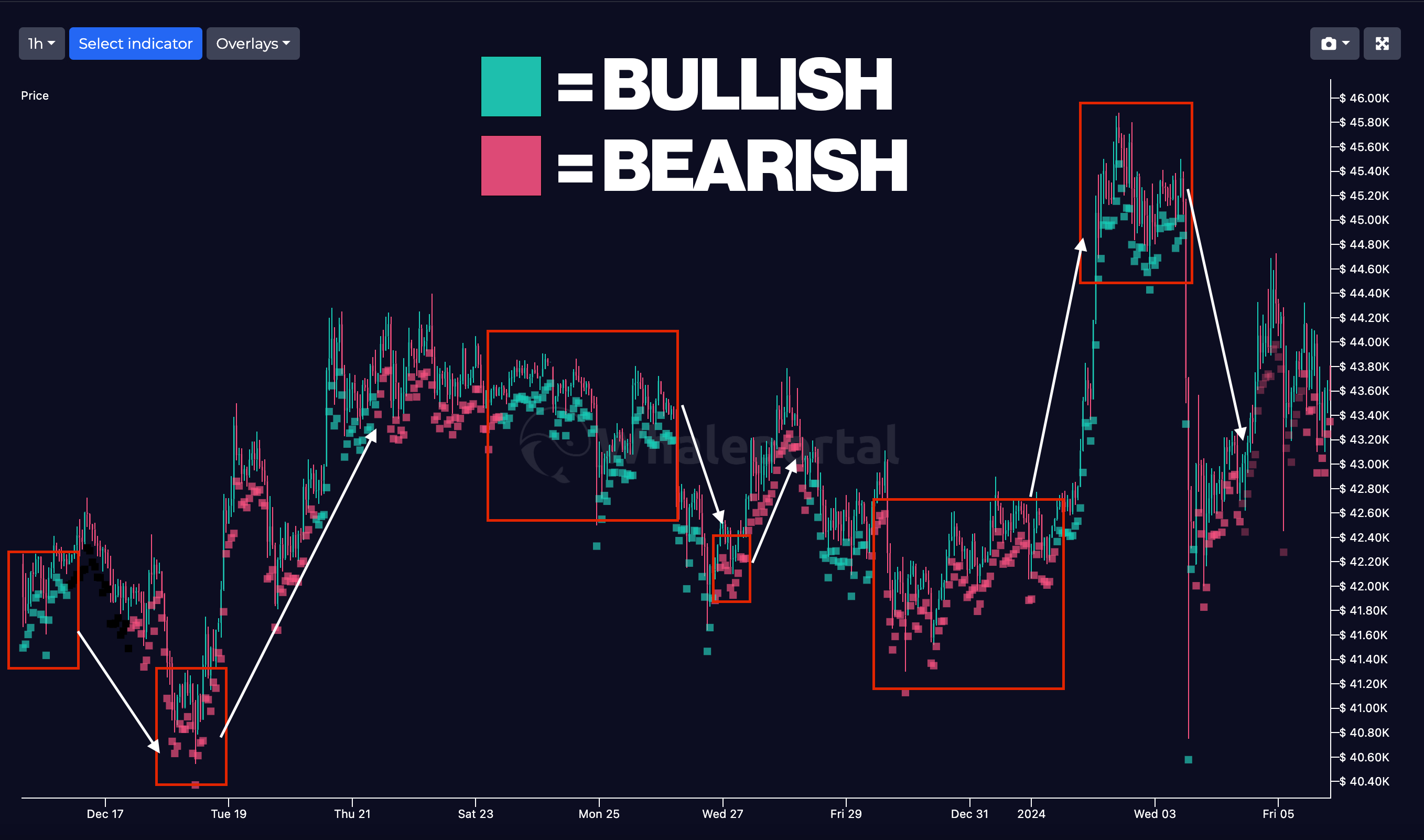

Let me introduce you to our sentiment heatmap. We are scanning through the internet and look what people have to say about Bitcoin and crypto every single day. Based on their opinion we are plotting the sentiment in certain colours on the chart. This gives the trader an overview about the dominant sentiment.

How to add the sentiment to your charts

You can open the “Pro charts” on Whaleportal and click the overlays dropdown and select Sentiment. If you combine this with the heatmap you should make to know which colours are for the sentiment and which ons for the regular heatmap. Sentiment colours are always below the candle.

Why sentiment is so important?

The market is always divided between buyers and sellers, and when the market sentiment is bullish, the percentage of buyers is higher than the percentage of sellers. The emotional state is positive and traders are buying bitcoin, this can be misleading as when more people are buying Bitcoin, they already belong to the buyer side and can only become potential sellers. Therefor, often when the sentiment is very bullish, there is a bigger possibility of the price going down due to buyers that are selling.

Imagine, if everybody who wants to sell Bitcoin, sold Bitcoin. That leaves the market with a low Bitcoin price but also only with buyers, because all seller have sold. Those same sellers can become buyers again when the price reverses to the upside. It might sound confusing but it’s actually very logical and can be illustrated with the sentiment heamtap,

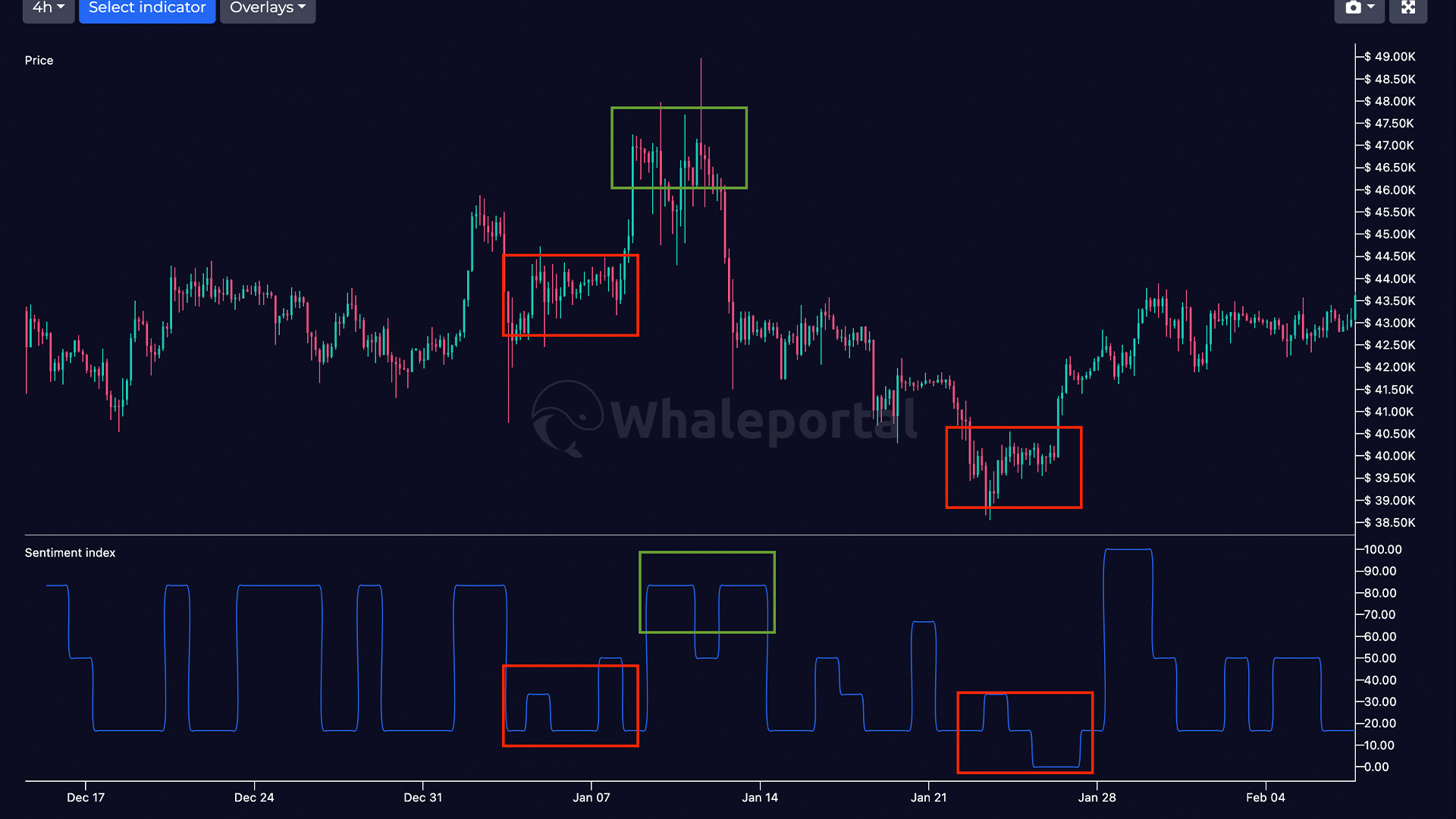

In the example above, you can see clearly, that when the sentiment is bearish or negative (red), the price tends to go up, until the sentiment shifts to a more positive state, where eventually the price comes down again. It may not always be a 100% accurate, but speaking in general terms, when most people are bearish, there is a higher likelihood for the price to go up than when everyone is bullish, and vice versa.

Sentiment as an oscillator

You can also add the sentiment data as an oscilator below the chart. This mgith make it easier to analyse it with the heatmaps as the sentiment heatmap visualizes as colours on the chart.

Sentiment as grip

Another important reason to know what the sentiment in the markets is, is to not get trapped yourself into the sentiment. If you are scrolling on Twitter or watching YouTube videos, whether you like it or not, your opinion will be influenced in some way. If you, let’s say, want to buy Bitcoin because you think it will go up that day or that week, you can always look at the sentiment and check whether you are in the camp of the majority. Whether you have the same perspective as the herd so to say. If so, you might want to think twice, of course this depends as well on your time horizon. If you buy Bitcoin to hold for multiple years, the sentiment right now does not really matter, then you should look more to the macro picture, but for short and mid-term traders, this information is very important.

Sentiment as confirmation

You can also use the sentiment as a confirmation for your perspective. Let’s say, you’e looking to sell Bitcoin because you think the price will decline based on multiple indicators. If you then check the sentiment and it’s very positive, it can be an extra confirmation on your main trading idea. By using this information you may increase your profitability ratio of your trades and give you more clarity of the stance of the markets.

In short you can use the sentiment in multiple ways for your analysis. Overall it’s a great indicator that many traders don’t really pay attention too and therefor often make unnecessary mistakes. This can give you a unique edge in the markets against other traders and help you develop your own emotional insights too. An indicator to not underestimate!