Using Social Sentiment to Trade Crypto

Most traders might not realise this but sentiment is one of the most important short-term and long term indicators a trader can use into their trading strategy. In this article we’ll dive into the specifics of using the social sentiment as a key indicator for your trading strategy.

What is the sentiment?

The sentiment is the dominant emotional state of the traders and investors in the markets. When the dominant emotional state is panic, there is a negative sentiment, when the dominant emotions that are experienced by market participants is FOMO (Fear of missing out) the sentiment is positive, as investors expect the price to continue going up.

Sentiment cycles

The market moves in cycles between buyers and sellers. When more buyers then sellers are present the price goes up, when more sellers than buyers are present the price goes down, simple isn’t it? Well, not quite yet! The reason why it’s difficult for most traders to use the sentiment is because they are caught in the sentiment. This is the exact reason why 90% of the traders make sooner or later the wrong decisions which will be fatal to their portfolio.

To illustrate this with a simple example, Let’s say, we have more buyers than sellers in the market. The price goes up, and when the trader goes to his favourite influencer or analyst on Twitter, he/she will probably sit on the side where the majority of the market participants are, which is the buy side. This is simple statistics. If 80% are buyers, then there is roughly 80% chance that the content you consume is from this side of the market. What people fail to see here is that when 80% are buyers, they already bought. Which leaves the market with less buyers. So the higher this ratio is, the more likely the price goes down as eventually these buyers can potentially become sellers.

The reason why most people fail to see this in the exact moment is because it is an emotional state of the trader or investor. Emotional states are one of the highest influences of decision making. So when a trader feels FOMO (Fear of missing out), because he/she reads online a lot of positive price predictions, he is more likely to fall into this trap of the sentiment.

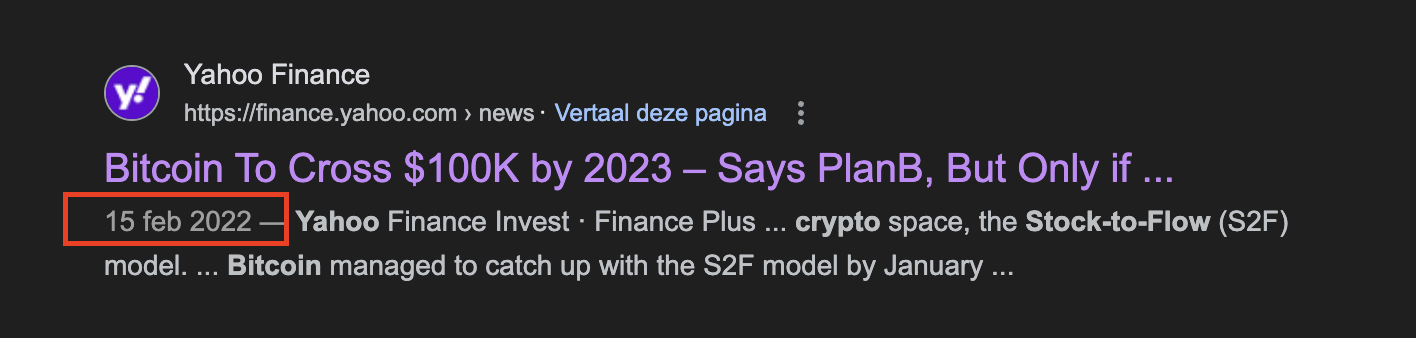

These market movements between buyers and sellers are happening in shorter-term timeframes but also in the longer time frames. One of the best examples was the top in the 2021 bull market.

The bull market narrative was clear, Bitcoin is going to at least a 100’000 USD because of the stock to flow model. Once this narrative reached the mainstream media, most possible market participants where aware of this prediction model and have already bought into the hype. You can see that the publication date of this model in the mainstream media marked the Bitcoin top of the 2021 bull market at +- 70’000 USD.

How to analyse the sentiment?

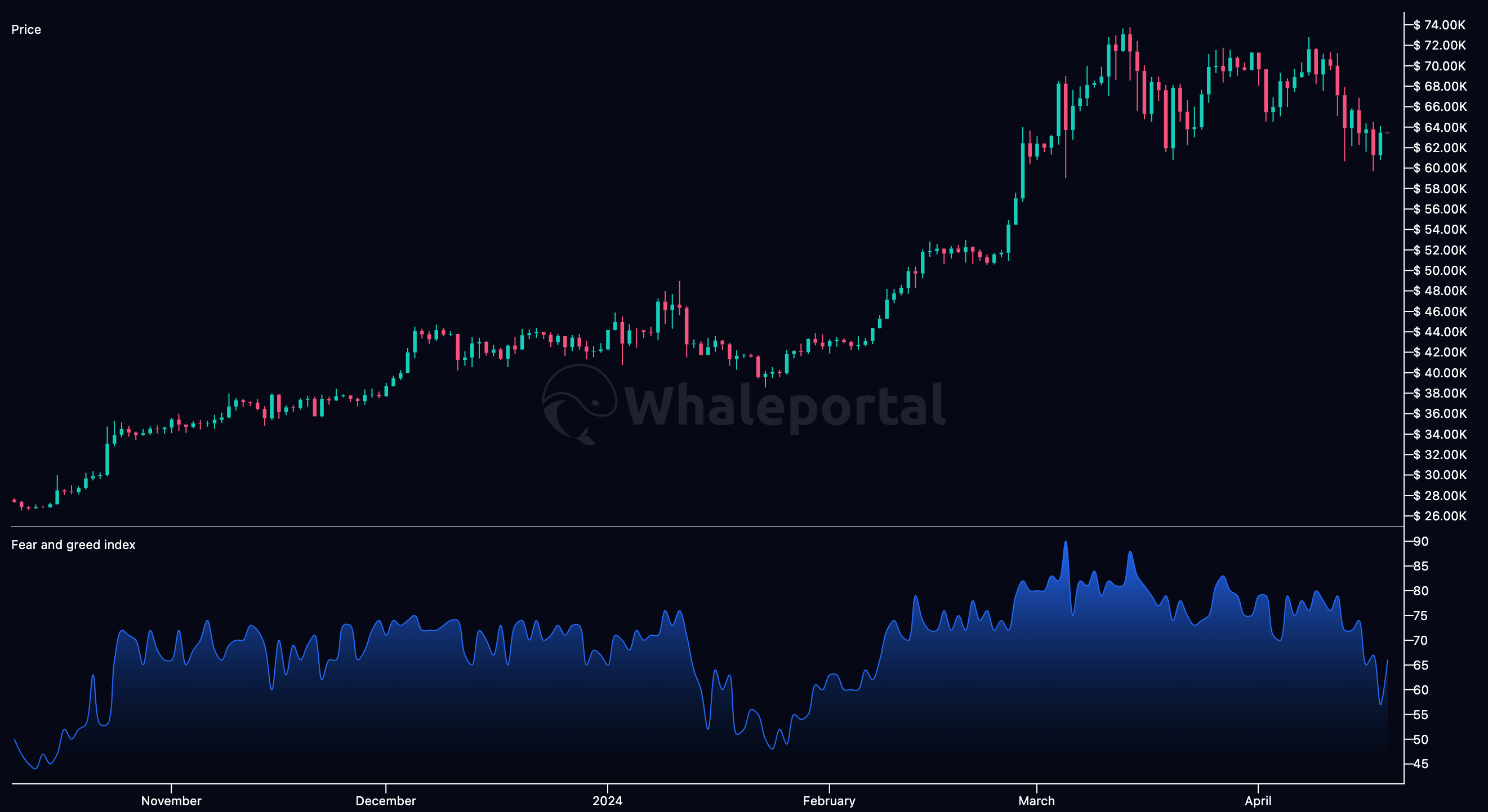

Crypto fear and greed

One of the most popular metrics traders use to determine sentiment is the Crypto fear and Greed index. This metric looks at volatility, trends, social media and the bitcoin dominance to determine the sentiment. It’s mostly used for macro-analysis. When the metric shows “extreme greed” it might be a good time to sell, and when there is “extreme fear” it might be a good time to buy. You can analyse this metric in the Whaleportal Pro Charts together with the Bitcoin price. You can see that when prices rise, the sentiment becomes more positive or "greedy" and when prices are more low, the senitment tends to be more negative or "fearful".

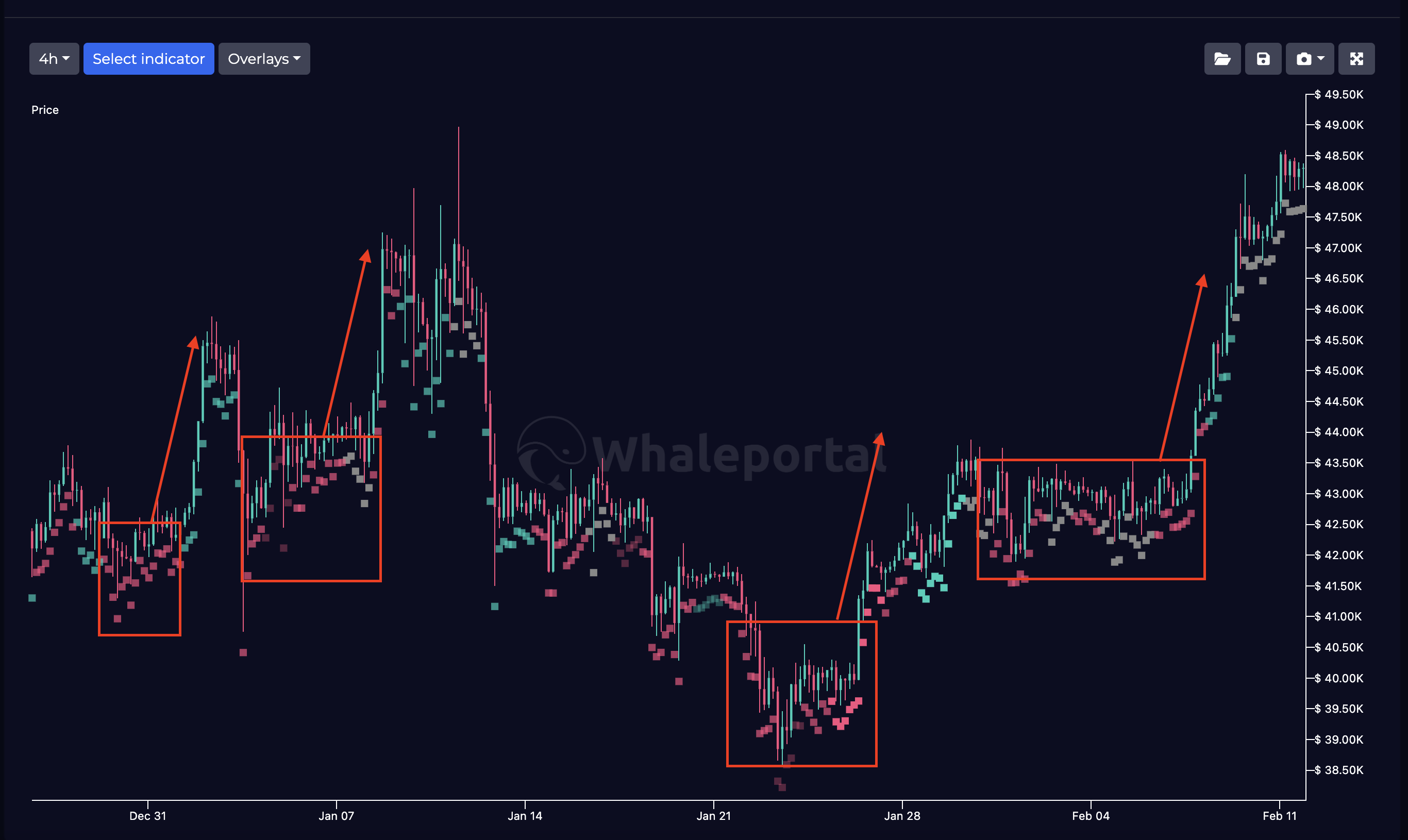

Sentiment heatmaps

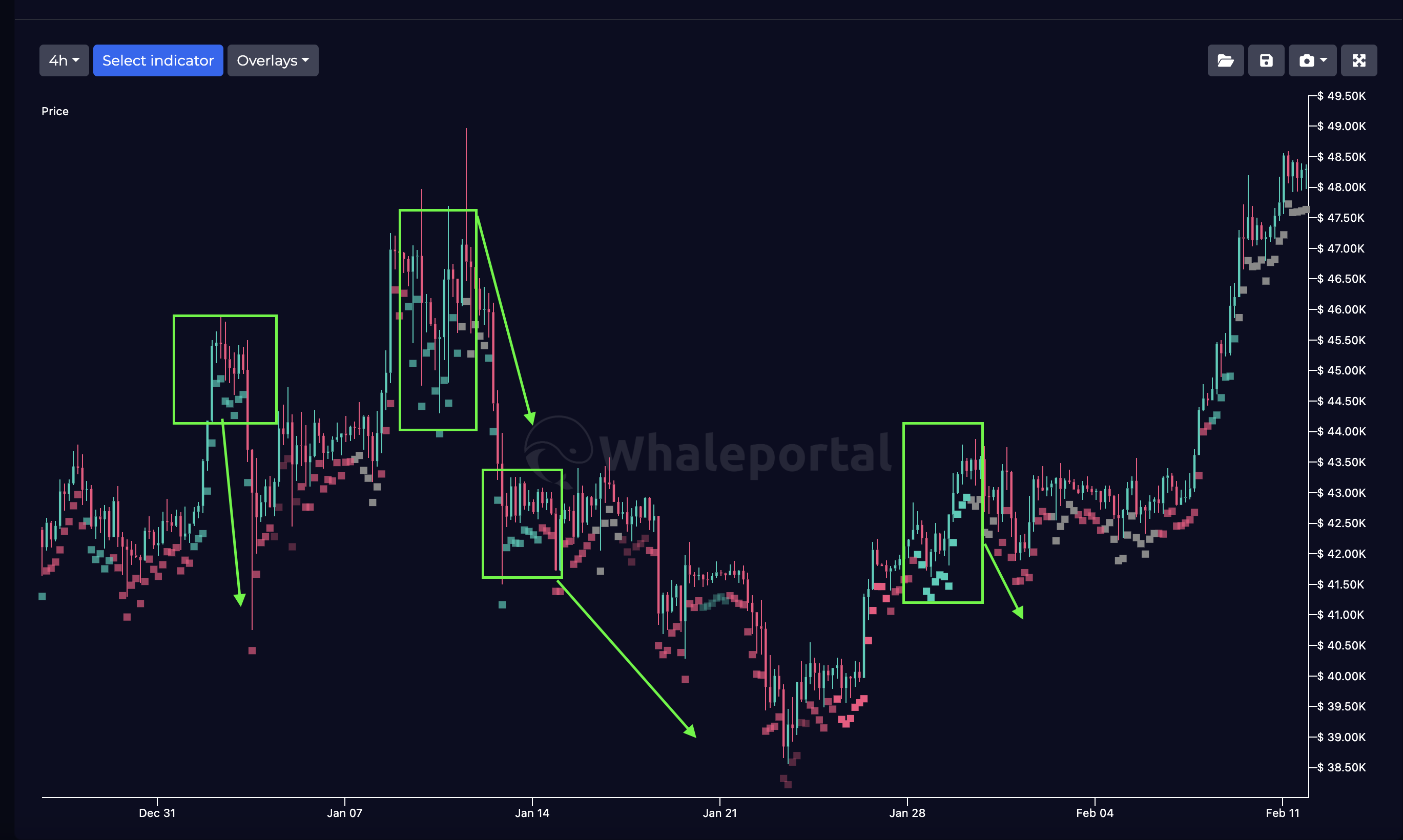

The Crypto fear and greed index works very good for macro-traders, but for short-term traders,. this metric is less useful. Fortunately, there is something called “Sentiment Heatmaps”. Sentiment heat maps are daily readings of the current sentiment in the cryptocurrency markets. Every single day the sentiment is analysed from various content creators and Influencers and based on their predictions a sentiment read is plotted on the chart. The ratio can vary between “extremely bearish” to “extremely bullish”.

Generally, when the sentiment is bearish, it is more likely that the price will go up in the short-term, as you can see in the example below. Whenever there are red dots, it means that the sentiment is “negative” or “bearish”. Whenever there is a green dot the sentiment reading is “positive” or “bullish”. There are different intensities of red and green.

And below you can see the positive sentiment highlighted.

Sentiment Summary

Overall, as a profitable crypto trader you can’t really afford not to use the sentiment as it’s one of the biggest factors of why most traders losing money. In short the sentiment reading can help the trader:

- Not getting caught in the sentiment himself

- Recognise the emotional state of the markets

- Increase his profitability by being able to counter trade the sentiment

Also, with any already working trading strategy, you can increase the profitability ratio when you include the sentiment as an extra indicator to either confirm or invalidate trades. The sentiment is one of the most underrated indicators as it helps the individual to avoid mistakes and give the trader unique emotional market insights which helps with more profitable decision-making.

If you’d like to dive deeper into how you can use this into an unique trading strategy, there is a complete course on how to trade Bitcoin using the best indicators available.