Which Crypto Exchange Has the Lowest Fees? VIP & Market Maker Programs Compared

It is no secret that exchanges compete with each other not just when it comes to features and liquidity, but also trading fees, as for active traders, even a tiny fee reduction can translate into substantial savings. Also, to reward high-volume users, many top exchanges offer tiered VIP programs and market-maker incentive schemes, granting lower trading fees and sometimes even fee rebates (for those who meet steep volume or liquidity requirements). But at what point do the fee savings justify the push for higher trading volumes? Let’s find out!

TL;DR

|

What Are VIP Programs? |

Tiered reward systems on exchanges that reduce fees as trading volume increases. |

|

Fee Benefits |

Spot fees can drop from 0.1% to as low as 0.02%; derivatives fees even lower. |

|

Volume Requirements |

Entry starts around $1M monthly; top tiers can demand $50M–$500M+ volume. |

|

Market Maker Perks |

Some platforms (e.g. Bybit, BitMex, ApeX) offer rebates for providing liquidity. |

|

When It’s Worth It |

When fee savings outweigh the cost, risk, or capital needed to reach the tier. |

|

Low-Fee Alternatives |

DeFi exchanges (like Apex Omni) offer very low rates while imposing little to no volume/KYC requirements. |

|

Best for |

Institutional traders, algorithmic firms, high-frequency or API-based strategies. |

Why trading fees matter for high-volume traders

From the outside looking in, trading fees might seem small when analyzing individual trades (often a fraction of a percent); however, these tiny transactions can add up quite quickly and deceptively. For instance, a 0.1% fee on a $100,000 trade is $100, but if an individual trades millions of dollars in volume per month, these figures can eat significantly into their profits (or in some cases even increase their losses).

This is why professional and institutional traders are obsessed with fee rates because, after a certain point, lower fees can offset the need for higher volume, meaning the money saved can compensate for the effort or capital required to reach that volume.

What are VIP programs and what do they entail?

VIP programs are tiered membership levels that exchanges offer to high-rollers. As their 30-day trading volume (or account size) grows, they can ascend VIP levels and accrue various perks (like fee discounts).

Typical features associated with these programs include:

Tiered fee schedule

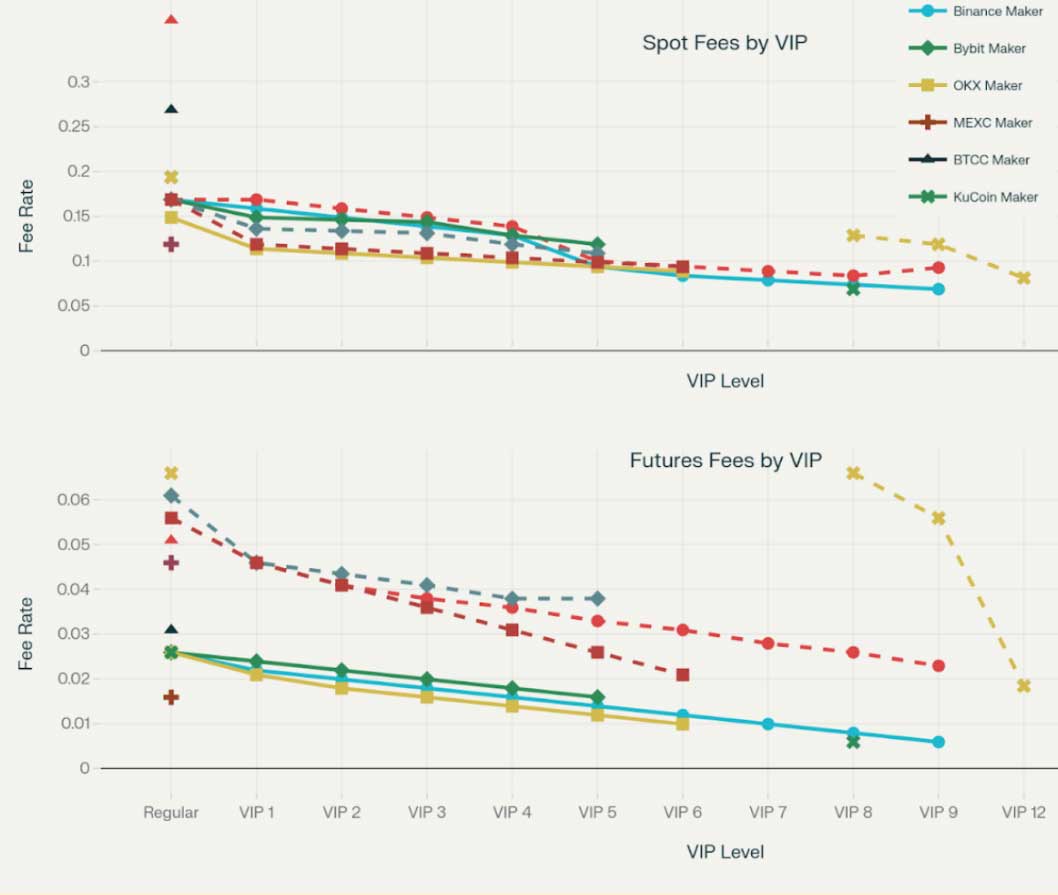

Each level (VIP 1, VIP 2, …) corresponds to lower maker/taker fees than the last. For instance, Bybit’s standard fees for derivatives are 0.06% taker / 0.01% maker at VIP 0, but drop to 0.03% taker / 0.00% maker at the highest “Supreme VIP” level. Binance similarly lowers spot fees from a base 0.1% down to near 0.02% or less at top tiers.

High volume requirements

To qualify, traders must typically meet hefty 30-day volume thresholds (often in the millions or sometimes even billions of USD). For example, Binance VIP1 requires ≥ $1 million monthly volume (plus a holding of 25 BNB) while Bybit’s VIP levels start at $1M spot or $10M derivatives volume for VIP 1, scaling up to $100M+ for the top tier.

Alternate criteria

Some programs allow qualification via account size or holdings. Bybit lets users attain VIP status by holding large asset balances (e.g. ≥ $500k for VIP 3) instead of strictly trading volume. This flexibility recognizes that a trader with significant funds might not trade huge volume monthly but still deserves VIP perks.

Beyond fee reductions, VIPs often get priority support, higher withdrawal limits, exclusive events, and bonuses.

Can I get rebates for providing liquidity?

In addition to the aforementioned VIP tiers, many exchanges offer market maker programs designed specifically to incentivize the adding of liquidity (placing limit orders) to an exchange as it helps tighten spreads and improve market quality.

For instance, Bybit offers qualified liquidity providers up to a 0.005% maker rebate on spot and derivatives trades, meaning that they can get paid 0.005% of their trade volume on relevant orders, instead of paying a fee.

That said, users are still charged the normal taker fee based on their VIP level for any market order. However, the extra maker rebate is a huge advantage for high-volume algo traders.

Other platforms like Crypto.com and Binance (Binance US) have similar programs, which come with requirements like minimum monthly volume and maintaining tight bid-ask spreads.

Fee Rebates in Action

On some derivatives exchanges, top-tier market makers even enjoy negative fees. BitMEX's current standard fee is 0.05% for derivatives alongside competitive rebates and reduced taker fees (plus cash rebates up to $105,000 per month for qualifying participants). Similarly, Bybit's highest "Pro" tiers and market maker levels can bring maker fees down to zero or below.

That said, it’s worth noting these perks usually require invitation or application as they are often limited to institutional trading firms or bots that can sustain large volumes and meet technical requirements (such as quoting on multiple pairs, minimum order sizes, API usage > 20%, etc.).

For example, Bybit’s Pro tiers (Pro 1 to Pro 6) and Market Maker (MM) tiers kick in when API trading volume exceeds 20% and volumes are extremely high (Pro 6 needs > $5 billion 30-day volume) or when makers account for a significant share of total market volume.

VIP Tier comparison between Binance, Bybit, OKX, and Others

Binance VIP

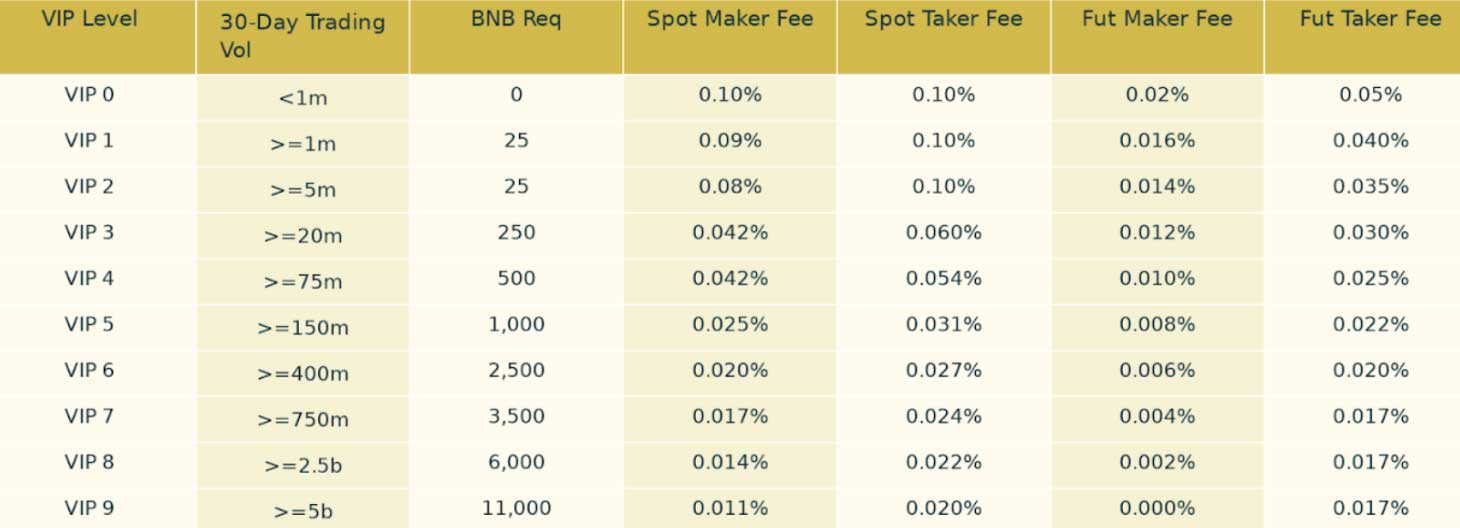

Binance’s VIP program (levels 1–9) requires both a high 30-day trading volume and a minimum BNB coin balance. For example, VIP 1 starts at ≥ $1 million volume and 25 BNB held. Base trading fees for regular users are 0.1% maker/taker on spot (0.075% each if using BNB for fees).

At VIP 1, fees drop slightly to 0.09% maker / 0.10% taker and climbing these tiers yields bigger discounts, e.g. VIP 5 (≥ $150M vol, 1,000 BNB) pays around 0.025% maker / 0.031% taker. At the highest level (VIP 9, meant for volumes above $5 billion), Binance even offers 0% maker and ~0.017% taker on futures.

Bybit VIP

Bybit introduced an expanded VIP program up to “Supreme VIP” and further Pro levels for institutions. Standard (VIP 0) fees on Bybit are 0.10% maker/taker for spot and 0.01% maker / 0.055-0.06% taker on futures whereas VIP tiers 1–5 then step down fees incrementally. Notably, Bybit allows qualification via either 30-day volume or asset balance (or borrowing amount for margin users).

For instance, to reach VIP 3, users need ≥ $10M spot volume or $50M futures volume (or hold $500k assets). Once attained, futures fees shrink to about 0.014% maker / 0.035% taker. Similarly, the Supreme VIP tier requires $100M spot or $500M derivatives volume and confers a 0% maker fee on derivatives and just 0.03% taker fee. Spot fees also drop to 0.03% maker for Supreme VIP.

Beyond this, Bybit’s Pro 1-6 tiers (for API traders) keep taker fees similar but may offer maker rebates as discussed.

Bybit Deposit Program

Bybit’s Deposit Bonus Campaign continues to operate as an always-available promotion for new users, remaining exclusive to first-time registrants who can sign up through an affiliate link.

The tiered ladder starts with a $50 bonus for a $500 deposit plus $5,000 in taker volume and scales through mid-tiers, $350 for a $1,000 deposit/100,000 volume, $800 for $10,000/1 million, $5,000 for $50,000/10 million (up to the flagship $30,000 reward requiring $250,000 deposited and $150 million in taker trades).

All bonuses are credited to the derivatives wallet, and profits realized with bonus funds are immediately withdrawable, while the principal credit remains locked to derivatives positions.

Furthermore, trading fees hinge on taker volume such that non-VIP users pay 0.06% on USDT-perpetual taker orders, but reaching VIP 1 (≥ $10 million 30-day derivatives volume) cuts fees to 0.04% (33.3% reduction), and VIP 3 (≥ $25 million) further lowers them to ~0.035% (41.7% reduction).

For instance, $1 million in taker trades costs $600 at VIP 0 versus $400 at VIP 1 (saving $200) or $350 at VIP 3 (saving $250). Applied to the popular $800 bonus tier (1 million volume), fees drop from $600 to $350, signalling a 41.7% reduction and boosting a user’s net bonus capture by over 50%.

OKX VIP

OKX (formerly OKEx) also has a tiered fee system favoring large traders with regular spot fees starting at 0.08% maker / 0.10% taker for retail. Their VIP 1 kicks in at a relatively attainable ≥ $5 million monthly volume or $100k asset balance, with fees around 0.045% maker / 0.050% taker at that level.

Higher OKX tiers can reduce spot maker fees to 0.02% or lower. Similarly, for futures, OKX matches Binance’s base 0.02%/0.05%, with similar discounts at VIP tiers. OKX’s thresholds are somewhat lower than Binance’s, making mid-level VIP status a bit more reachable for active individuals.

Huobi, KuCoin, Others

Many other exchanges have comparable programs. Huobi and KuCoin, for example, will lower trading fees if you either hold a large amount of their native token (HT or KCS) or hit volume milestones. KuCoin’s highest VIP tier (Level 12) requires 80,000 KCS tokens staked or ≥ 150,000 BTC 30-day volume, but then offers maker rebates and tiny taker fees (as low as 0.0125%).

Exploring decentralized alternatives

The traditional way to enjoy minimal fees has been to become a VIP on a big exchange; however, with the emergence of decentralized exchanges (DEX) it is possible to gain access to low fees without having to meet astronomical volume requirements.

One example is Apex Omni, whose standard fee structure is 0.05% taker and 0.02% maker fees on perpetual futures, plus 0% for all spot trades. Moreover, during certain promotional periods, the exchange has offered rates as low as 0% (maker) and 0.02% (taker).

These promotional rates are significantly cheaper than even what DeFi leaders like dYdX are offering. Current dYdX v4 fee structure shows Tier 1 at 0.05% taker and -0.011% maker (rebate) for users with trading volumes under $1M. And on Apex, these fees are available to any user (no KYC required, since it's a DEX), without needing millions in volume.

Essentially, Apex Omni gives users “VIP-level” fees from day one, something it achieves thanks to it being built on Arbitrum and forgoing centralized profit margins (in lieu of growth).

Another route to reduce fees is trading on smaller or newer centralized exchanges that use low fees to attract users. Many of these exchanges don't have VIP tiers at all; instead, they just set flat fees that undercut bigger rivals. For example, MEXC offers 0.01% maker fees and 0.04% taker fees on futures for users in certain regions (with 50% discounts available for MX token holders holding ≥500 MX) while BTCC charges 0.06% for both makers and takers on futures trading.

Conclusion

When weighing the VIP and Market Maker programs of the aforementioned crypto exchanges, Bybit emerges as the clear, most cost-effective and secure choice for serious traders. And, while some no-KYC platforms like MEXC or dYdX offer tempting fee models, they fall short in terms of institutional-grade security, regulatory compliance, and long-term reliability.

Bybit, on the other hand, offers competitive taker and maker fees, aggressive VIP discounts, and an ongoing $30,000 deposit bonus program which, when paired with VIP tiers, can effectively reduce taker fees by 30% or more, translating into thousands in net savings.

For users in restricted jurisdictions, Apex Omni remains a strong decentralized alternative, offering ultra-low fees without KYC hurdles. But for most global users seeking maximum fee savings, robust security, and a full-featured trading experience, Bybit stands out as the clear winner.

Related Articles:

- Best Crypto Exchange for Companies and Institutional Users

- How to Open a Corporate Account on Bybit

- Best Crypto Exchanges for Passive Income