Coincatch

Coincatch

Visit CoincatchTrading volume (24h)

$9,280,011,466.528Open interest

$3,173,449,407.993Founded in 2022 and registered in the British Virgin Islands, CoinCatch has quickly become a key player in crypto derivatives trading. With strong security measures, Proof of Reserves, leverage trading, and a user-friendly interface.

Rating

65Location

British Virgen IslandContract types

USDTMaker fee

0.02 %Taker fee

0.06 %Max leverage

200xUS allowed

NoDeposit methods

CryptoAverage funding fee (BTC)

0.0043%Table of contents

CoinCatch Review

Founded in 2022, CoinCatch has quickly positioned itself as a leading crypto exchange for derivatives trading. Registered in the British Virgin Islands and operated by Linkbase Technology Limited, the platform aims to provide a secure, professional, and user-friendly trading environment for both individual and professional traders. Listed below are some of the platform’s core features

Security and Regulation

CoinCatch prioritizes user asset security, implementing institutional-grade hot and cold wallet solutions with robust access controls. The platform is registered as a Money Service Business (MSB) under both FINTRAC in Canada and FinCEN in the United States, lending credibility to its operations.

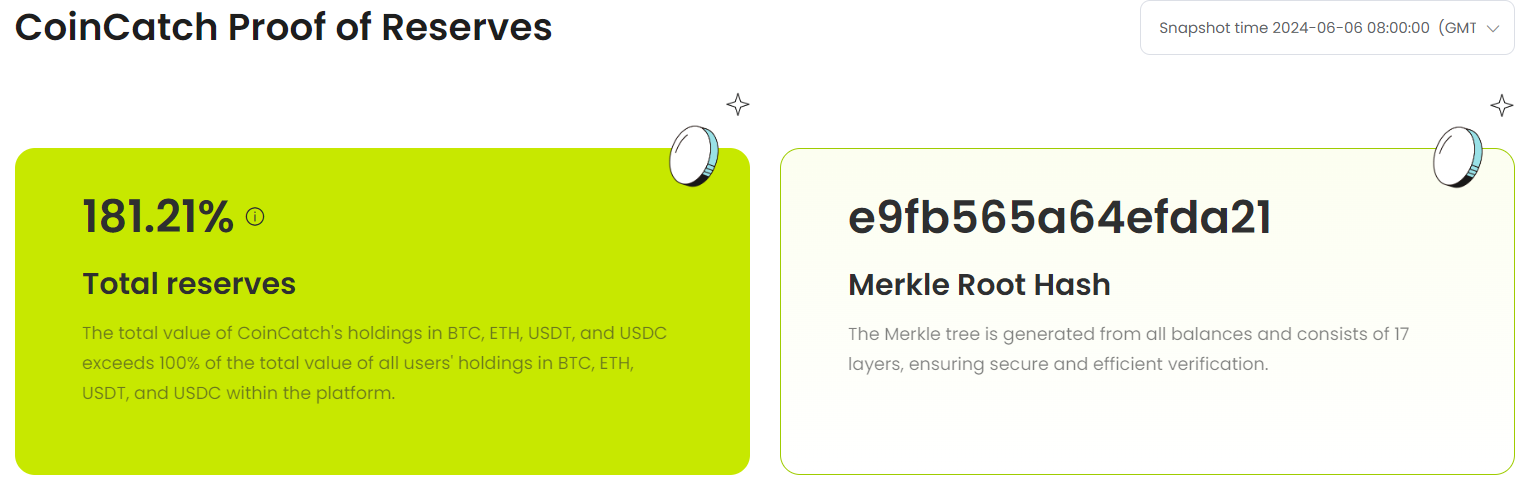

Proof of Reserves

CoinCatch implements a Proof of Reserves (PoR) system to demonstrate the security of user funds. This system uses Merkle tree technology to provide cryptographic proof of the platform's reserves. Users can verify the inclusion of their funds in the asset Merkle tree, ensuring that the platform holds sufficient assets to cover all user balances. As per recent data, CoinCatch possesses a total reserve ratio of 181.21%, with individual ratios for major currencies like BTC (161.86%), USDT (191.3%), ETH (147.65%), and USDC (194.01%).

Trading Features and Performance

The exchange boasts an impressive trading infrastructure, claiming to handle millions of trades per second through its Derivatives Trading System 3.0. This high-performance system, coupled with its “Nasdaq-class liquidity,” aims to provide seamless trading without any apparent downtime. Traders can also benefit from advanced features like trailing stop orders and cross-margin mode.

Lastly, CoinCatch offers both a web platform and a mobile app, allowing users to trade on the go. The user interface is designed with futures trading in mind, promising an intuitive and smooth experience for derivatives traders.

User Experience and Support

The platform emphasizes a user-first approach, offering 24/7 customer support as well as newbie bonuses (of up to 5,125 USDT). The onboarding process is straightforward, i.e. create an account, deposit or buy crypto, and start trading. The project also offers a mobile app for Android as well as iOS that has been downloaded over 10,000 times.

Additionally, to keep its growing user base engaged, CryptoCatch regularly organizes various events and competitions, including deposit and trading rewards, quizzes, and check-in events.

Affiliate Program

The exchange offers an attractive affiliate program with commission rates claimed to be 10% higher than market standards. Features include daily settlements, a multi-layer sub-affiliate structure, and a real-time performance monitoring module.

Market Position

While CoinCatch presents impressive statistics - $300B in total trading volume, operations in 100+ countries, 1,000+ global affiliates, and 150+ perpetual contracts - it's important to note that as a relatively new platform, these figures should be viewed cautiously and verified independently.

Verdict

CoinCatch appears to be an ambitious new entrant in the crypto derivatives trading space, offering a mix of high-performance technology, user-friendly features, and attractive incentives. Its focus on security and transparency, evidenced by its proof of reserves system, is commendable.

However, as with any new crypto platform, potential users should cautiously approach their investments. While the features and benefits sound appealing, conducting thorough due diligence is crucial, starting with small amounts, and being aware of the risks associated with crypto derivatives trading.

Start trading crypto on Coincatch today by creating an account here.