Apex Omni vs dYdX – Which Decentralized Exchange Is Better?

Decentralized exchanges (DEXs) are rapidly gaining traction, not only due to increasing regulatory pressure on centralized platforms but also because of the tremendous improvements in user experience, performance, and features. Today, trading on a DEX can feel nearly identical to trading on a centralized exchange like Bybit, while offering additional benefits such as self-custody and access from restricted regions.

In this article, we compare two of the most advanced DEXs currently available: Apex Omni, a decentralized exchange built by Bybit, and dYdX, one of the most established players in the space. We’ll look at everything from supported technology and trading features to fees, wallet connections, copy trading options, and more. This article explains exactly whether Apex Omni or dYdX would suit your needs as a trader or investor better.

TL:DR

|

Feature |

Apex Omni |

dYdX |

|

Chain |

Arbitrum |

Cosmos |

|

Wallets |

13+ (MetaMask, Truts, Phantom etc.) |

8+ (MetaMask, Phantom, Keplr etc.) |

|

Fees |

0% (Maker) / 0.025% (Taker) |

0.01% (Maker) / 0.05% (Taker) |

|

KYC |

No |

No |

|

Leverage |

100x |

50x |

Don't have time to read the full article? Join Apex Omni today and receive 5% discount on your fees.

Blockchain Technology (What It’s Built On)

Apex Omni is built on Arbitrum, a Layer 2 blockchain on top of Ethereum. The reason for this choice is performance: Arbitrum is much faster and cheaper than Ethereum itself, which allows Apex to offer gasless trading. Being on Arbitrum also means Apex stays close to the wider Ethereum DeFi ecosystem, making future integrations and compatibility easier.

dYdX, on the other hand, chose to build its own custom blockchain using the Cosmos SDK. This gives them full control over the network and allows them to create a trading-optimized chain with high speed and zero gas fees. It’s a more independent setup, designed to scale the platform to professional levels.

In Simple Terms:

- dYdX is like building a private highway just for traders: ultra-fast, smooth, and with no traffic.

- Apex Omni is like using a high-speed lane on Ethereum’s highway: fast and efficient, but still connected to the rest of the Ethereum world.

What This Means for You, the Trader

Even though these exchanges are built on different blockchains, you don’t need to worry about that when connecting your wallet.

Both platforms support easy wallet connections, and you don’t have to manually use Arbitrum or Cosmos to deposit or withdraw.

Wallet Connections

To start trading on a decentralized exchange, you'll first need to connect a crypto wallet. Let’s take a look at which wallets are supported by Apex Omni and dYdX.

|

Wallets |

Apex Omni |

DYdX |

|

MetaMask |

Yes |

Yes |

|

Trust |

Yes |

|

|

Phantom |

Yes |

Yes |

|

Rabby Wallet |

Yes |

Yes |

|

Keplr |

|

Yes |

|

Wallet Connect |

Yes |

Yes |

|

Coinbase Wallet |

Yes |

Yes |

|

Bybit Wallet |

Yes |

|

|

Rainbow |

Yes |

|

|

OKX |

Yes |

Yes |

|

Email or social media |

Yes |

Yes |

Both platforms support major external wallets like MetaMask, but Apex Omni offers broader wallet compatibility. Since it’s built by Bybit, it also integrates seamlessly with the Bybit Web3 Wallet, making it especially convenient for existing Bybit users. Both platforms offer to create an account using an email or social media, and they will then generate a wallet and link that to your account through a third-party.

Fees

The fee structure between Apex Omni and dYdX is quite different. Currently, Apex Omni is significantly cheaper and also offers a spot market in addition to futures trading, unlike dYdX.

Withdrawal fees from Apex Omni to an external wallet depend on the blockchain used and its current congestion. For most fast withdrawals, fees are typically around $2. On dYdX, the withdrawal fee needs to be paid in the native token (e.g., Ethereum).

|

|

Apex Omni |

dYdX |

|

Futures Fees |

0% (Maker) / 0.02% (Taker) |

0.01% (Maker) / 0.05% (Taker) |

|

Spot Market Fees |

0% (Maker & Taker) |

|

|

Withdrawal Fee |

$2 |

Variable, paid in native gas token |

Liquidity

Liquidity is one of the most important metrics for traders when choosing an exchange. It reflects how many traders are actively participating and committing capital.

High liquidity means lower slippage, better price execution, greater stability, and the ability to trade larger amounts with confidence.

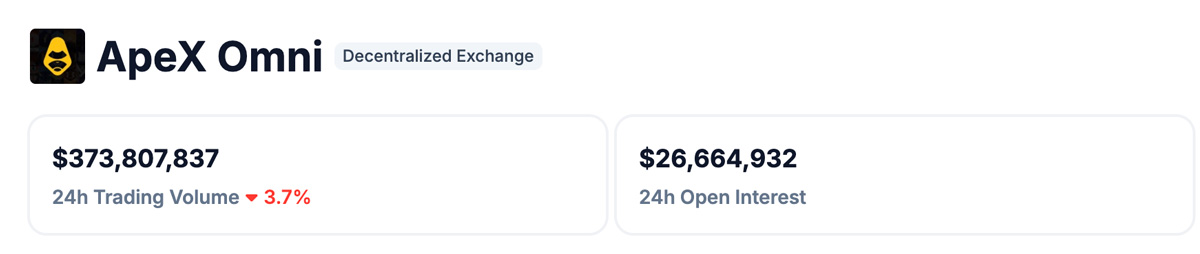

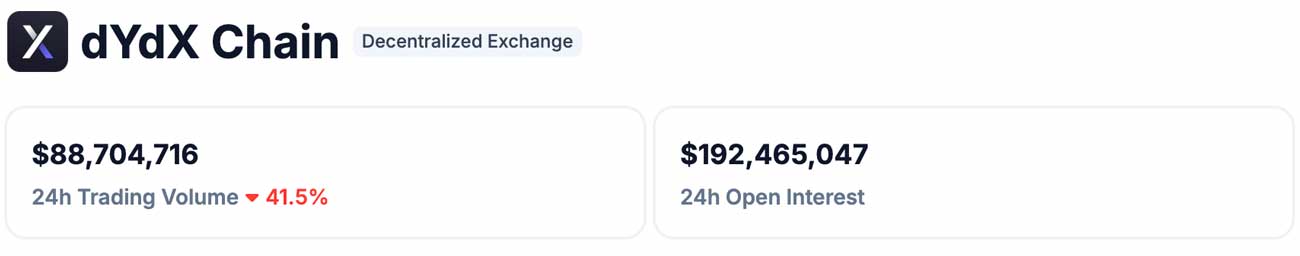

Let’s take a look at the 24-hour trading volume of ApeX Omni and dYdX to compare their liquidity.

This metric favors ApeX Omni, which currently has nearly four times the trading volume of dYdX.

That said, dYdX still maintains sufficient liquidity for a solid trading experience. However, when it comes to raw volume and depth, ApeX Omni has the edge.

Trading Pairs and Markets

ApeX Omni

ApeX Omni offers both a spot market and a futures market.

- Spot Market:

The spot market features 50+ trading pairs, with a strong focus on meme tokens on the Solana blockchain. However, it also includes more established assets like PEPE and others.

(Note: All spot trades are settled in USDT.) - Futures Market:

ApeX Omni supports 81 perpetual trading pairs, including major cryptocurrencies like BTC, ETH, XRP, SOL, PEPE, AVAX, ONDO, and many more.

dYdX

dYdX offers only perpetual futures and supports 89 trading pairs, slightly more than ApeX Omni.

It includes all major tokens and is well-suited for traders focused exclusively on derivatives.

|

Trading Pairs |

Apex Omni |

dYdX |

|

|

Perpetual Futures |

81 |

89 |

|

|

Spot Market |

50 |

- |

|

In this category, you could argue that dYdX offers more in terms of the number of trading pairs.

However, the absence of a spot market is a clear drawback, and that’s where ApeX Omni has the advantage.

Features and User Experience

ApeX Omni

- Exchange layout: The trading dashboard echoes the familiar Bybit look-and-feel, making it easy for CEX users to settle in quickly. Offering spot and futures trading.

- Automated trading: A native Grid-Bot lets you run fully customisable grids on any USDT-perp, even paying a negative maker fee of -0.002 % during promos.

- Trade-to-Earn XP & Airdrops: Every filled order earns XP points that count toward a rolling 25 M APEX token airdrop and other retroactive rewards.

- Affiliate program: Tiered affiliate structure pays up to 50% of referrals' trading fees.

- Copy-trading & passive income:

- Vaults – follow top traders or deposit into Protocol Vaults that are fed by liquidation fees for low-risk USDT yields.

Takeaway: Apex Omni feels really similar to a centralised exchange. They even provide similar features like Grid Trading Bots and Copy-Trading. They also organize events for traders to earn their native token $APEX by using the platform.

dYdX

- Minimalistic dashboard: The Cosmos-based v4 front-end is fast and easy to use; traders can see order book depth and funding in the dashboard as well. Regular and advanced orders are possible.

- dYdX Surge: A trading-rewards competition distributing up to $2.2 M in DYDX every month, points accrue automatically as you trade.

- SocialFi – Yapper Leaderboard: Post insightful content about dYdX on Crypto-Twitter and compete for a $50 k USDC prize pool each month.

- MegaVault: MegaVault pools USDC to supply perpetual-market liquidity and pays depositors passive yield.

- Affiliate program: Lifetime commissions of up to 50 %, paid instantly in USDC, plus VIP perks for high performers.

Takeaway: dYdX is derivatives-only, organises many events for the users (whether you are an influencer or trader), Surge for traders, Yapper for influencers, MegaVault for liquidity providers, alongside a simple, easy-to-use UI.

Copy Trading and Vaults

We touched on this earlier, but it's worth diving deeper, because passive income is one of the features for modern crypto investors. In fact, copy trading has become so popular on centralized exchanges that nearly every platform offers some version of it. And now, both ApeX Omni and dYdX are bringing passive income opportunities to the decentralized world.

Let’s have a look at how each platform approaches it:

ApeX Omni Vaults

ApeX Omni offers a copy-trading experience through its Vault system, which operates via smart contracts.

- How it works:

Traders create their own Vaults, and investors can choose to deposit USDT into one or more of them.

The profits are split 90/10, with 90% going to the investor and 10% to the trader as a performance fee.

- Why it’s attractive:

It’s familiar to those who’ve used copy trading on centralized platforms, but with on-chain transparency and custody.

ApeX Protocol Vault

For investors who prefer lower risk and don’t want to follow individual traders, ApeX offers the Protocol Vault.

- This vault collects liquidation fees from leveraged traders across the platform and distributes them to depositors.

- With a current APY of 32%, it provides a passive, platform-driven yield that doesn’t rely on trader performance.

- And because it’s owned and operated by ApeX itself, it carries an added layer of trust and security.

dYdX MegaVault

dYdX offers its own version of passive income through the MegaVault, which takes a slightly different approach:

- The MegaVault is managed by a community-selected market-making entity.

- It uses the pooled capital to provide liquidity on the dYdX order book, earning trading fees and rebates.

- The APY currently hovers around 16%, and while it fluctuates, it’s backed by a structured, algorithmic strategy.

- Why it's reliable:

The MegaVault isn’t tied to the risk of individual traders; it’s a part of the official dYdX ecosystem.

Final Thoughts: ApeX Omni or dYdX?

Let’s recap the key points from this comparison:

|

Feature |

Apex Omni |

dYdX |

|

Wallet Connections |

X |

|

|

Liquidity |

X |

|

|

Trading Pairs / Markets |

X (Has spot market) |

X (Has more trading pairs) |

|

User-interface |

X |

|

|

Passive Income |

X (Vaults and Exchange Vault) |

X (Exchange Vault) |

|

Tech |

Arbitrum |

Cosmos |

|

Trading Fees |

X |

|

While both platforms are well-established DEXs, ApeX Omni stands out as the more complete decentralized exchange. Its edge comes from a combination of higher liquidity, a user interface that feels like using Bybit, and the unique ability to trade both spot and futures markets, something that’s not possible on dYdX.

With tools like grid bots, copy-trading vaults, and XP-based airdrop rewards, ApeX Omni delivers the familiar ease of a centralized exchange, but with the security and transparency of a DEX.

This isn’t to discredit dYdX, it’s a great decentralised exchange with a strong reputation, and we would still recommend it to many traders, especially those focused on derivatives. However, ApeX Omni currently feels more complete and established, scoring higher across the key points covered in this article.

If you're looking for a DEX that’s powerful, user-friendly, and packed with incentives, ApeX Omni is hard to beat.

Ready to Start Trading?

Create an account on Apex Omni and receive 5% discount on your fees.

Or want to try dYdX? Connect your wallet and start trading!

Frequently Asked Questions (FAQ)

What is the main difference between ApeX Omni and dYdX?

The main difference is that ApeX Omni offers both spot and perpetual trading, while dYdX only supports perpetual futures. ApeX Omni is built on Arbitrum (Ethereum Layer 2), while dYdX uses its own custom blockchain built with the Cosmos SDK. This affects performance, fees, and network integration.

Which platform has lower trading fees?

ApeX Omni currently has lower trading fees and even offers gasless trading. dYdX is also gasless due to its custom chain, but withdrawal fees are paid in native tokens like ETH, while ApeX Omni bundles these into USDT for user convenience.

Does ApeX Omni have a spot market?

Yes, ApeX Omni includes a spot market with over 50 trading pairs, many of which are meme tokens on Solana, along with popular assets like PEPE. All spot trades are settled in USDT. dYdX does not offer spot trading.

Which platform has better liquidity?

At the time of writing, ApeX Omni has nearly 4x the 24-hour trading volume of dYdX, giving it better liquidity. This translates to lower slippage and better execution, especially for larger orders.

Can I earn passive income on these platforms?

Yes, both platforms offer passive income features:

- ApeX Omni has copy-trading Vaults and a Protocol Vault that pays yields from liquidation fees (up to 32% APY).

- dYdX offers the MegaVault, which is managed by a market-making entity and yields around 16% APY.

Is copy trading available on ApeX Omni or dYdX?

Only ApeX Omni supports direct copy trading through user-created Vaults. Traders create a Vault, and investors can deposit funds to automatically follow their strategy. dYdX does not offer traditional copy trading.

What wallets can I use to connect?

Both platforms support major wallets like MetaMask. ApeX Omni also integrates with the Bybit Web3 Wallet, which is especially convenient for existing Bybit users.

Which is better for beginners?

ApeX Omni is better suited for beginners due to its Bybit-style user interface, integrated spot market, and intuitive vault system. It feels similar to using a centralized exchange while offering decentralized benefits.