Best Crypto Exchanges for Passive Income in 2025

Not everyone has time to trade crypto actively. The good news? You don’t have to. In 2025, there are several ways to earn passive income from crypto, whether you prefer low-risk staking or higher-reward copy trading.

In this guide, we’ll explore:

- The top centralized and decentralized exchanges for passive income

- The difference between staking, copy trading, and vaults

- The best platforms and traders to follow

Just want the best option without reading the full guide?

|

Exchange |

Method |

Risk |

Important |

|

Copy-trading |

Medium-high |

Need KYC verification |

|

|

Apex Protocol Vault |

Low |

Decentralised (no KYC) |

ApeX Omni Vaults are available worldwide and offer some of the lowest-risk, highest-return opportunities right now.

Different Types of Passive Income

Passive income in crypto refers to earning rewards without actively managing trades. There are three main methods:

1. Staking

- You lock your crypto to support a network (or lend it) and earn interest

- Often very low-risk, especially with assets like ETH or stablecoins

- But returns are usually low (2–6% APY)

- Biggest risk? The exchange (or platform) you use might go insolvent, as seen with FTX or Celsius in 2022.

2. Copy Trading

- Automatically mirror the trades of professional traders

- Can offer much higher rewards than staking

- Performance depends on who you follow and market conditions

3. Crypto Vaults

- Very similar to copy-trading but managed by an exchange

- Usually lower risks than copying regular traders

- More oversight but decentralised

Crypto vaults are very similar to copy trading, but in a decentralised structure.

Staking

In crypto, staking means committing your tokens to a blockchain network to help support its security and operations. In return for supporting the system, you earn cryptocurrency, usually more of the same token. It’s a popular way to earn passive income without actively trading. The rewards usually range from 1%-9% per year.

In short: Staking is when you lock up your crypto to help run and secure a blockchain, and you get rewarded with more crypto in return.

Staking options

You can stake your crypto in two main ways: through a centralized exchange or using a decentralized protocol. Each comes with its own risks. Generally, staking offers relatively low rewards, but the risks are also fairly low, depending on where and how you stake.

With centralized exchanges, the main risk is the platform becoming insolvent or freezing withdrawals. With decentralized staking, the biggest risk usually comes from smart contract vulnerabilities or hacks.

Without diving too deep, here are two of the best and easiest staking options:

Stake on Bybit

Bybit is one of the most reliable and well-established centralized exchanges. While no platform is 100% risk-free, the chance of insolvency is much lower compared to smaller, less-regulated exchanges. Staking on Bybit is simple, user-friendly, and suitable for beginners.

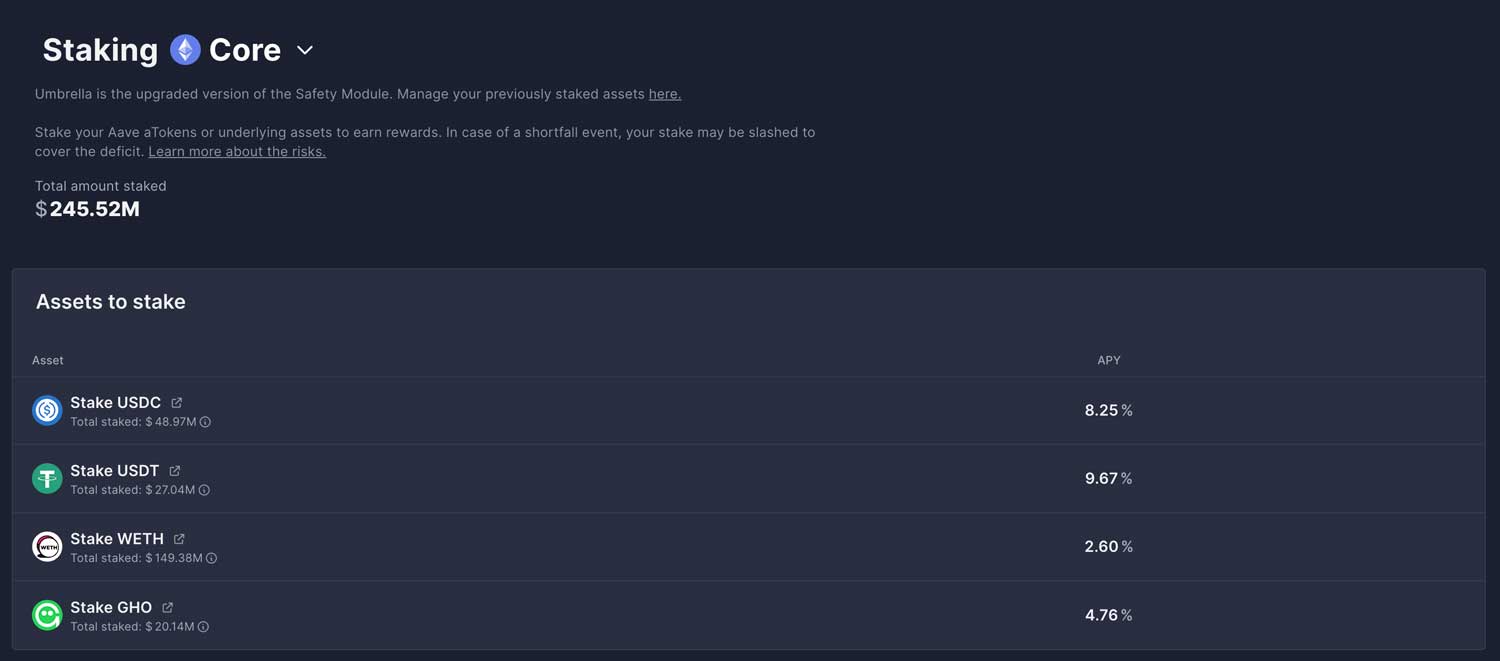

Stake on Aave

Aave is a decentralized lending and borrowing protocol. Instead of staking in the traditional sense, you deposit your crypto into Aave’s smart contract pools. These funds are then lent out to other users, and you earn interest in return, essentially passive income. Aave is non-custodial, meaning you stay in control of your funds. You can even connect a hardware wallet like Ledger for extra security.

Many other platforms offer staking, but these two options stand out for their reliability and long track record, they’ve been tested over time and proven to be trustworthy.

Staking Summarised

|

Feature |

Bybit (Centralised) |

Aave (Decentralised) |

|

Staking Method |

Lock tokens in Bybit Earn |

Lock tokens in Liquidity Pools |

|

Custody |

Funds held by the Exchange |

Self-custody |

|

Risk |

Exchange insolvency or withdrawal freeze |

Smart contract vulnerability or protocol hack |

|

Rewards |

2%-6% APY |

2%-9% APY |

|

Who it’s for |

More beginner friendly |

Users comfortable with DeFi and self-custody |

|

Lock-up period |

Fixed/Flexible |

Fixed/Flexible |

Copy-Trading

Copy trading, at its core, means automatically replicating the trades of another trader, simple as that. Most centralized exchanges now offer this feature, as it’s gaining popularity among two groups: casual traders looking to earn extra income and investors seeking passive returns.

However, it’s important to understand that copy trading comes with risks. The reality is that most traders lose money, and just because someone is labeled a “professional” doesn’t guarantee they’re consistently profitable. Success in copy trading isn’t as straightforward as it seems.

That’s why doing your own research is essential. Look for traders with a proven track record, transparent performance, and ideally a strong community around them. A trader with a reputation to uphold is more likely to act responsibly because their name is on the line.

What Makes a Good Passive Income Exchange?

Not all crypto exchanges are created equal, especially when it comes to earning passive income. Choosing the right platform is crucial for both your profitability and peace of mind. Below are the key factors to consider when selecting an exchange or platform for staking, copy trading, or vault investing:

1. Security and Reputation

Before anything else, make sure the platform has a strong reputation and track record. In crypto, history matters. Avoid newer platforms with limited transparency or unclear legal structures. Look for:

- Publicly visible team or governance

- A long-standing track record without major hacks or insolvencies

Examples: Bybit (centralized), & ApeX (decentralized exchange from Bybit)

2. Transparency

For any passive income product, you should know:

- Where your funds are stored/managed

- How rewards are generated

- Who manages the strategies (especially for copy trading and vaults)

You want to understand where the funds are stored and how they’re managed, as well as who has access to them, typically, only you do. Traders can use your funds solely to execute trades on your behalf. It's also important to know how the rewards are generated, as this directly reflects the level of risk involved.

3. Returns vs. Risk

A good exchange should offer a healthy balance of returns and risk. If something offers extremely high APY without a clear explanation, that’s a red flag. The best platforms clearly show:

- Historic ROI (with charts or logs)

- Volatility or drawdowns

- Strategy description

Avoid platforms promising “guaranteed profits”; there’s no such thing in crypto.

4. User Control

Especially for copy trading and vaults, look for platforms that give you flexibility:

- Can you close trades manually?

- Can you adjust risk settings? (e.g., Set max drawdown)

- Can you withdraw anytime?

The more control you have, the safer your capital is, especially in volatile markets.

5. KYC and Global Access

Some users prefer KYC-compliant platforms for legal clarity, while others look for no-KYC options due to privacy concerns or regional restrictions. A good exchange should match your needs:

- KYC platforms like Bybit are ideal for regulated access and strong compliance.

- No-KYC platforms like ApeX Omni and Aave are better for users in restricted regions or those who prioritize decentralization.

A centralized non-KYC exchange can change its policy at any time and start requiring KYC, forcing you to quickly find an alternative platform. In contrast, decentralized exchanges don’t carry that risk, as they operate without centralized control.

6. Fees

Passive income can be eaten up by hidden fees. Always check:

- Management or performance fees (vaults)

- Withdrawal fees

- Copy-trading commissions or profit-sharing terms

Lower fees = better net returns.

These are key factors to consider when choosing a platform for passive income. While no single option may tick every box perfectly, it's important to weigh each element based on your risk tolerance and personal goals. The better informed you are, the safer and more rewarding your passive income journey will be.

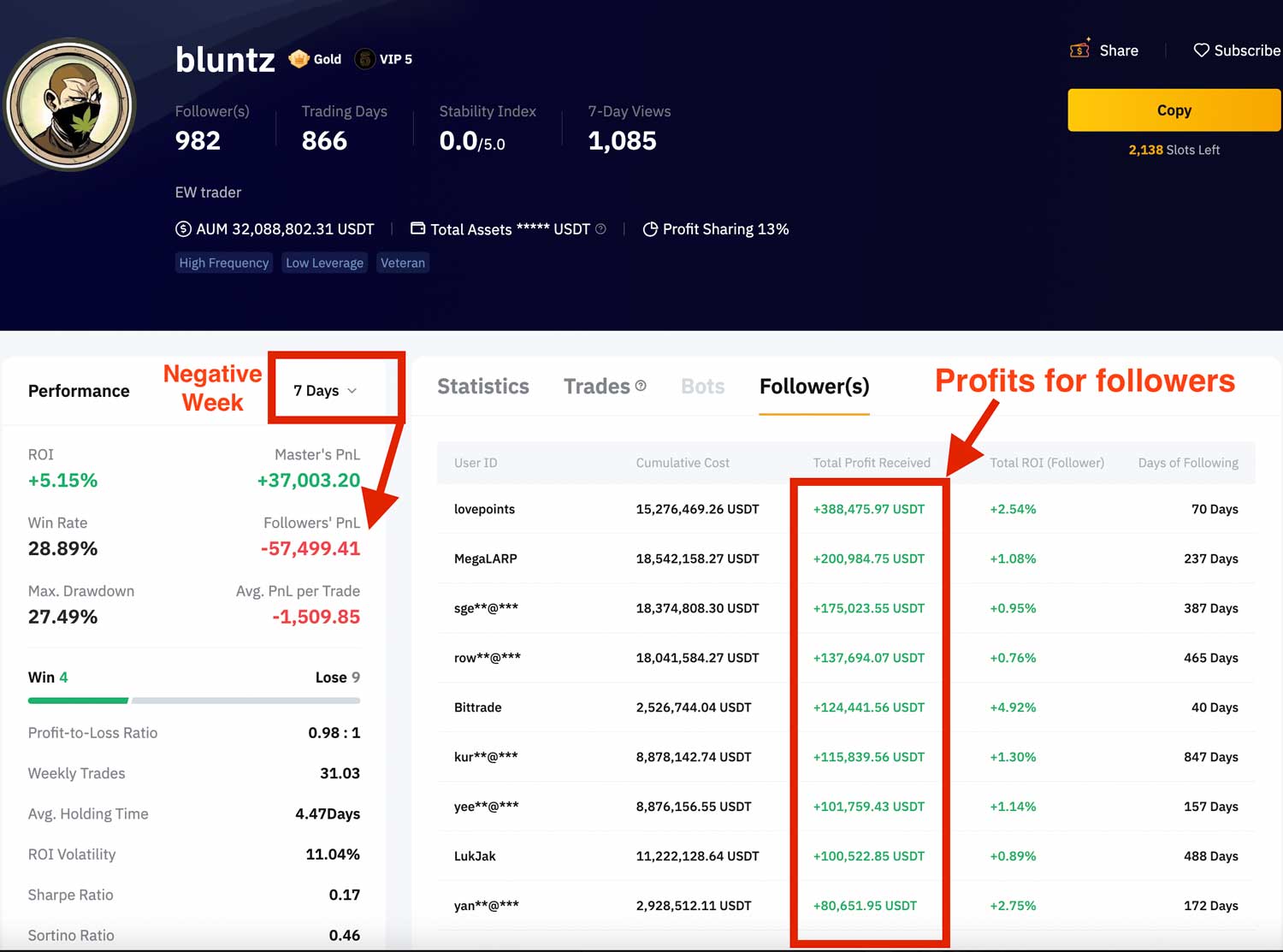

A Case Study in Successful Copy Trading

A strong example of a successful copy trader is Bluntz, with a well-established presence on social media, known for consistently sharing high-quality technical analysis. This trader has been active as a Master Trader on Bybit for an extended period, generating significant returns for their followers. What sets him apart is a sense of responsibility and a strong reputation to uphold, especially within his community. That said, even the most skilled traders experience periods of negative returns, sometimes lasting weeks or even months. This is part of trading. The key is not perfection, but consistency over time. When choosing a trader to follow, look for a long-term track record, a clear sense of accountability, strong community engagement, and someone whose approach and personality resonate with you.

Which Copy Trading Platforms Are Safe?

Bybit is one of the best platforms for copy trading because it holds Master Traders to higher standards than most other exchanges. Traders must apply through a dedicated subaccount, meet performance requirements like low drawdown and solid ROI, and complete onboarding steps before being listed. As an investor, you also get full control, position details are completely transparent, and you can set your own risk settings. If a trader opens a position you’re not comfortable with, you can simply close it on your end. While that makes copy trading less passive, it gives you more control over your funds.

Many exchanges offer copy trading, but most have fewer requirements to become a master trader, which can lead to lower-quality traders. Bybit stands out with its stricter criteria, but it also comes with a downside: users in certain restricted countries can’t sign up. This creates a challenge for investors in restricted countries seeking passive income through copy trading. Fortunately, a new solution is emerging: decentralized copy trading, which removes regional restrictions and opens up more opportunities for global users.

|

Exchange |

Pro |

Con |

|

Best copy traders, high requirements |

Need KYC verification |

|

|

No verification needed |

Low requirements for master traders |

|

|

No verification needed |

Low requirements for master traders |

Crypto Vaults

Crypto vaults refer to a form of copy trading on decentralized exchanges. They are smart contracts where funds are securely stored and managed under predefined conditions. Each vault is linked to a trading strategy, which can be either automated or controlled by a master trader.

Importantly, the master trader never has direct access to the investor’s funds, they can only execute trades through the vault. This setup enhances security while allowing investors to benefit from expert strategies. Investors also retain full control and can withdraw their funds at any time.

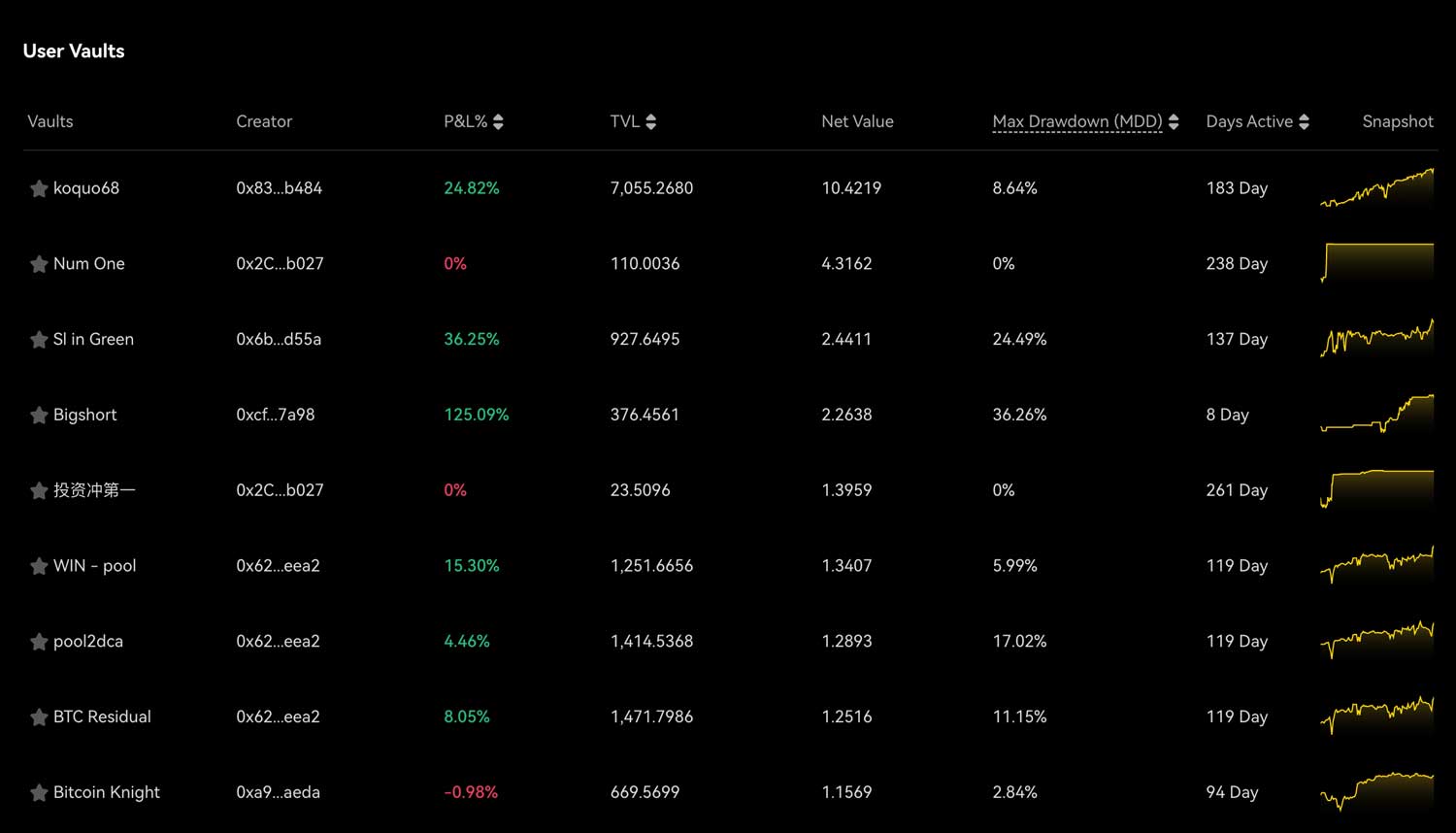

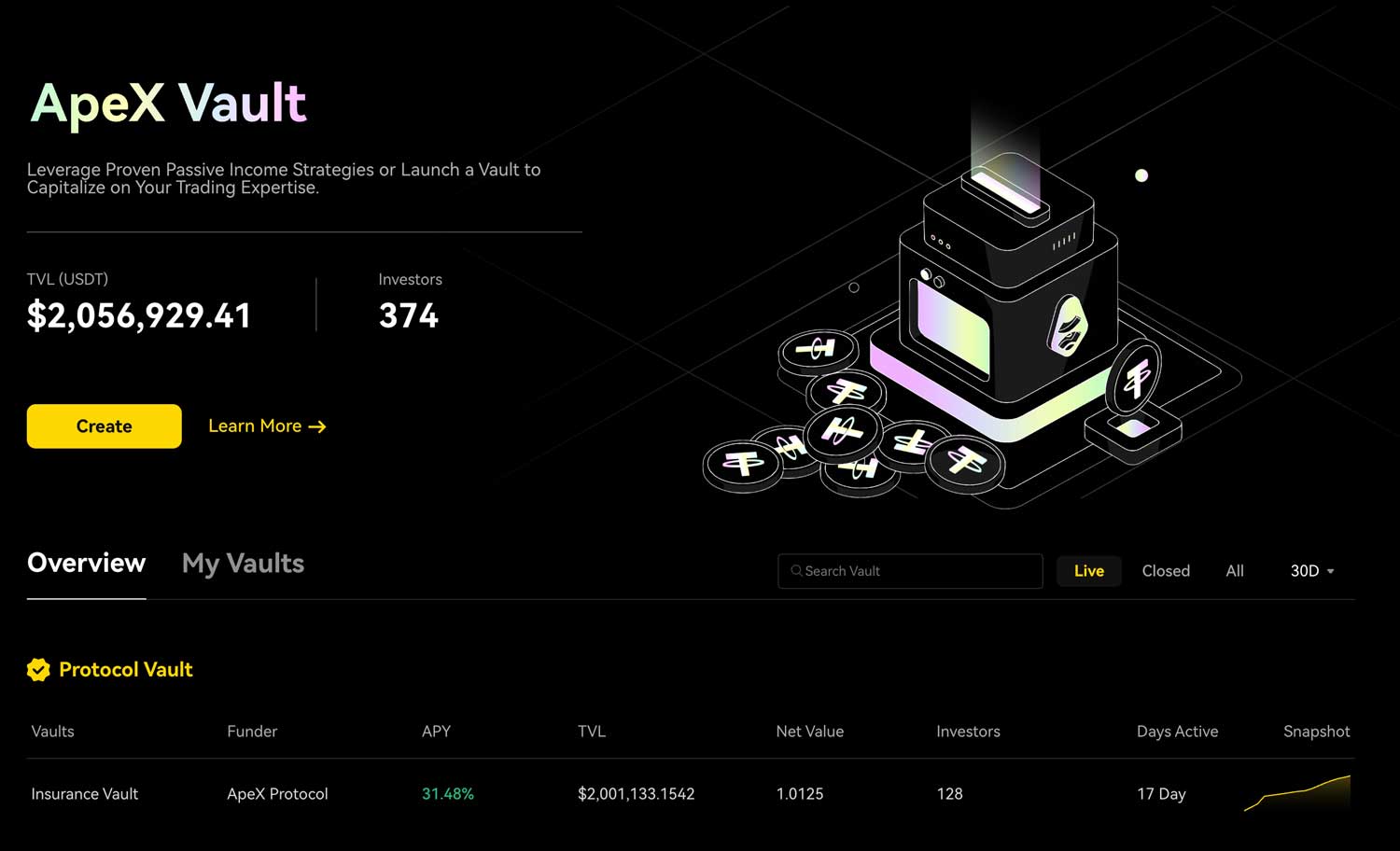

Apex Omni Vaults

Apex Omni Vaults are likely the closest you’ll get to copy trading on a decentralized exchange. Anyone can create a vault, which acts as a bridge between traders and investors. Each vault is linked to a trading strategy, and its performance is publicly visible on the leaderboard, showing key stats like ROI and drawdowns.

Investors can choose to allocate funds to a vault they trust. The trader then manages those funds through the vault, without ever having direct access to them. When profits are made, 90% goes to the investor, and 10% is rewarded to the trader. It’s a system that closely mirrors copy trading on centralized exchanges, but with the transparency and security of DeFi.

Exchange Managed Vaults

For a safer approach to earning passive income while staying within the decentralized ecosystem, consider exchange-managed vaults. Some decentralized exchanges, like Apex and dYdX, offer vaults that are managed either by the exchange itself or by a trusted community. These vaults typically carry lower risk and offer more stability, as the exchange has a vested interest in maintaining performance and protecting its reputation. Since the platform is directly involved, these vaults often come with higher standards of oversight and accountability.

Apex Protocol Vault

The Apex Protocol Vault allows users to earn passive income by receiving a share of liquidation fees collected on the Apex exchange. When traders are liquidated, part of the fees they pay is redistributed to vault investors. The APY fluctuates based on market activity and currently stands at 34%, making it an attractive, hands-off way to earn yield without actively trading or taking directional risk.

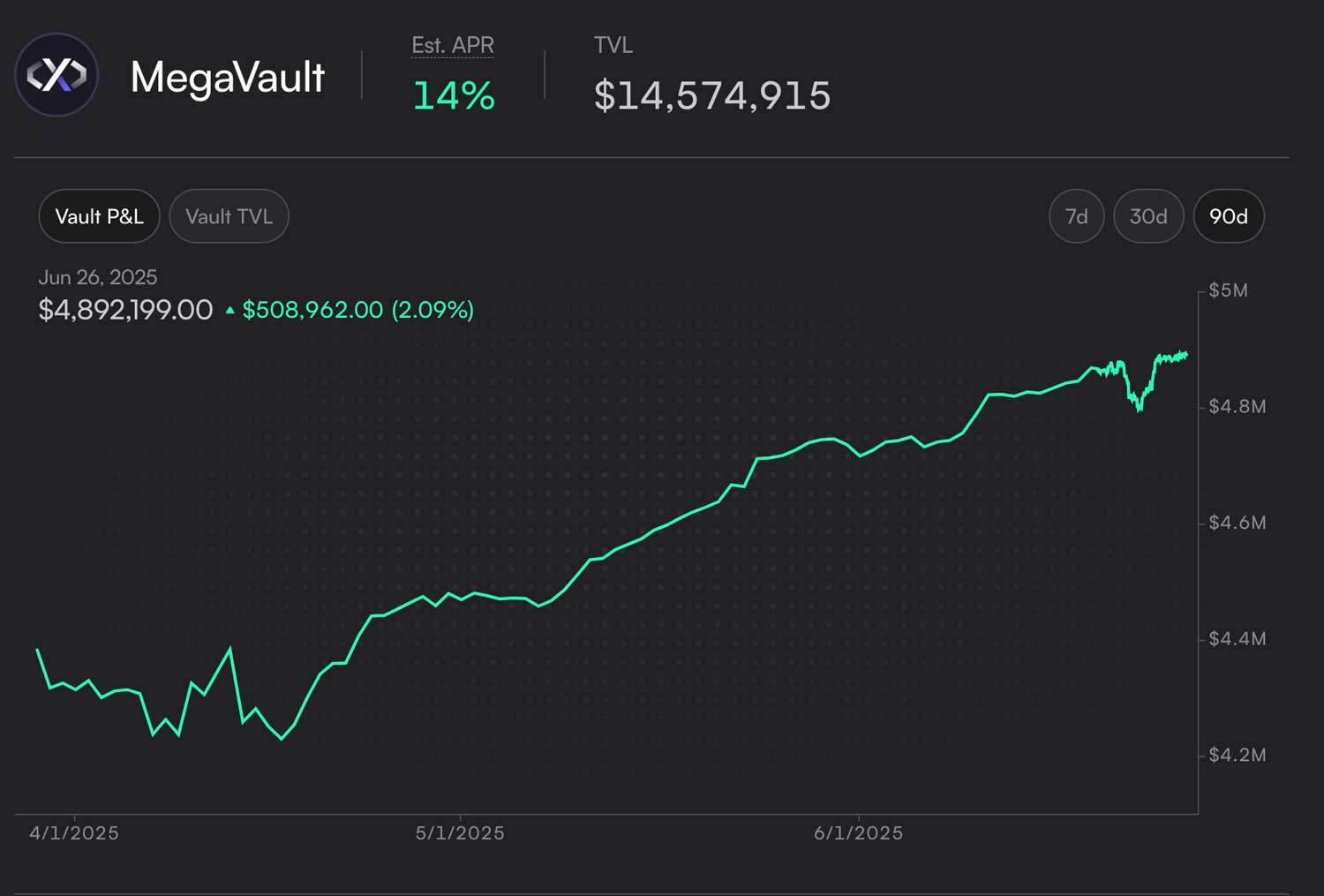

DYdX MegaVault

dYdX also offers a vault, but it works a bit differently. Instead of copying a trader, the vault is managed by a community-approved team that runs an automated trading strategy. The current APY is around 14%, and the goal is to deliver low-risk, stable returns.

The strategy is market-neutral, meaning it places trades on both sides of the market to reduce exposure to big price swings. The vault earns a share of dYdX's trading fees, but returns can still go up or down depending on market conditions. Keep in mind: while it’s designed to be low-risk, there’s still a chance of losing some or all of the USDC you deposit.

This setup helps dYdX increase liquidity on its platform, while giving investors a way to earn passive income from that activity.

Risks of Passive Income in Crypto

Earning passive income in crypto always comes with risks; there's no such thing as a reward without risk. Whether you're using centralized or decentralized platforms, it's important to understand the potential downsides and choose options that align with your risk tolerance. Here are some key risks to be aware of:

Platform Insolvency (Centralized Risk)

This is a major concern for centralized exchanges. Since a single entity controls the platform, poor decisions, hacks, regulatory issues, or outright fraud can lead to insolvency. We've seen this happen with high-profile collapses like FTX and Celsius, especially during bear markets when platforms are under more pressure.

Even reputable exchanges carry some level of risk. While the likelihood may be low, it’s never zero. Always do your research and avoid putting all your funds on a single platform.

Smart Contract Bugs (Decentralized Risk)

For decentralized platforms, the biggest risk comes from smart contract vulnerabilities. Since these platforms are code-based and self-executing, there’s no centralized authority that can intervene if something goes wrong.

While smart contracts are often audited and tested, bugs or exploits can still occur. The risk may be lower on battle-tested platforms, but it’s not completely eliminated.

3. Trader Performance (Copy Trading Risk)

When you're copying a trader, whether on a centralized platform or using DeFi vaults, you're exposed to human error and market unpredictability. Even experienced traders like Bluntz can go through unprofitable periods.

To manage this risk, consider:

- Monitoring performance regularly

- Setting loss limits or alerts

- Pausing investments if a trader hits a losing streak

Remember, past performance is not a guarantee of future results.

Overexposure to a Single Strategy or Trade

Putting all your funds into one strategy or copying a single trader creates a single point of failure. If that strategy fails, you could lose a large portion of your capital.

The best approach? Diversify. Spread your investments across multiple traders, vaults, or strategies to reduce overall risk and improve long-term stability.

Final Thoughts

In 2025, there are more options than ever for earning passive income in crypto, and there’s something to suit every type of investor. Whether you prioritize privacy, prefer low-risk and stable returns, want to diversify your strategy, or choose between custodial vs. non-custodial solutions, the flexibility is there.

You can opt for trusted centralized platforms, explore decentralized vaults, or even combine multiple approaches to manage risk and boost potential returns.

Here’s a quick overview of the main options:

|

Method |

Risk-level |

APY range |

Platforms |

|

Staking |

Low |

2-6% |

Bybit, Aave |

|

Copy-Trading |

Medium |

Varies |

Bybit, Apex Omni |

|

Vaults |

Medium |

10-34% |

Apex, dYdX |

The best option depends on your personal goals, but based on our research, Bybit Copy Trading and Apex Protocol Vaults stand out as two of the most exciting ways to earn passively.

👉 Ready to start? Join Bybit and explore copy trading here

🚀 Prefer a decentralized approach? Get started with Apex Omni Vaults here

FAQ: Passive Income from Crypto in 2025

What is the best way to earn passive income with crypto in 2025?

The best methods are copy trading and using crypto vaults. If you prefer decentralized options, Apex Omni Vaults offer a secure and transparent way to earn yield. For centralized copy trading, Bybit is a top choice due to its strict trader requirements and full user control.

What is the difference between staking, copy trading, and vaults?

- Staking: Lock up your crypto to earn interest (low risk, low reward)

- Copy Trading: Automatically mirror pro traders (higher risk, potentially higher reward)

- Vaults: Decentralized or exchange-managed strategies that mimic copy trading with more transparency and lower custodial risk

Which crypto exchanges are safest for passive income?

Top platforms include:

- Bybit: Known for strict standards, great copy trading tools, and reliability

- Apex Protocol: Offers decentralized vaults with full transparency

- dYdX: Provides market-neutral strategies with audited vaults

What is the average return for crypto staking?

Returns vary by asset and platform but typically range from 2% to 9% APY. Stablecoins often offer lower yields, while riskier assets may offer more.

Can I lose money in crypto copy trading?

Yes. Copy trading carries market risk and depends heavily on the trader’s performance. Even top traders have losing streaks, so it’s essential to monitor results and diversify.

How do crypto vaults work?

Vaults are smart contracts that allow users to earn from a predefined trading strategy. Funds are managed without giving traders direct access. Returns depend on strategy performance, and users can withdraw at any time.

What is the current APY of Apex Protocol Vaults?

The Apex Protocol Vault currently offers around 34% APY, depending on market activity and liquidation fees collected from traders.

Can I earn passive income from crypto without KYC?

Yes, platforms like Apex Omni and Aave offer no-KYC options for earning yield. These decentralized platforms are ideal for privacy-focused users or those in restricted regions.

Related Articles:

- Best Crypto Deposit Bonuses of 2025

- Copy Trading on Decentralized Exchanges

- Apex Omni Tutorial: Trade on Bybit’s Decentralized Exchange