Best Decentralized Crypto Exchanges in 2025 (Ranked & Compared)

Looking for the best decentralized crypto exchanges in 2025? Whether you're a privacy-focused trader, a resident of a restricted country, or someone seeking self-custody and high-yield opportunities, DEXs are becoming more popular. In this guide, we compare the top decentralized exchanges, including Apex Omni, dYdX, and Hyperliquid. Based on features, fees, user experience, copy trading, and more.

TLDR

|

Exchange |

Best for |

Trading Fees (M/T) |

Key Strengths |

|

Apex Omni |

Easy user-interface, all-round traders |

0.02% / 0.05% |

Copy-trading, Grid Bots, Similar to Bybit |

|

dYdX |

Advanced traders |

0.02% / 0.05% |

MegaVault |

|

Hyperliquid |

Institutional Clients |

0.015% / 0.045% |

Deep liquidity, most trading pairs |

Short on time? Start trading on Apex Omni today and receive 5% discount on your fees.

Why Traders Use Decentralized Exchanges

More and more traders are choosing decentralized exchanges over centralized platforms. Let’s take a look at the key reasons behind this shift in 2025.

Crypto Regulations and No-KYC Access

Crypto regulations are changing quickly, creating uncertainty for traders. Centralized exchanges like Bybit have made sudden policy changes due to new rules. For example, European users recently lost access to features like margin trading. In some countries, people can’t even open an account on major centralized platforms because those services are not available in their region.

Decentralized exchanges (DEXs) solve this problem. They are open to users from anywhere in the world and don’t require any KYC (Know Your Customer) process to start trading. This makes them ideal for traders in restricted countries or those who prefer more privacy.

Privacy and Self-Custody of Funds

Privacy is a big deal for many crypto users. The crypto space was built on the values of freedom and anonymity. Decentralized exchanges support these values by allowing users to trade without giving up personal information.

Another key benefit is self-custody. On decentralized platforms, you keep control of your own crypto at all times. This reduces the risk of losing funds due to an exchange collapse, like what happened with FTX. With DEXs, you stay in charge of your assets.

More Features Than Ever Before

Decentralized exchanges have come a long way. Many of them now offer the same tools and features as centralized exchanges. In the past, advanced tools like copy trading, trading bots, and automated strategies were only available on centralized platforms.

Today, DEXs like Apex Omni offer these features too, making it easier for traders to switch without losing functionality. Whether you're a beginner or an advanced trader, decentralized exchanges now provide a full-featured trading experience.

Decentralised Exchanges

In this section, we’ll look at Apex Omni, dYdX, and Hyperliquid, three of the biggest names in decentralized trading. We’ll compare their features, fees, and what makes each platform unique

Apex Omni Overview: Pros, Fees & Features

Apex Omni is a decentralized exchange developed by the same team behind Bybit, which is why many traders find it familiar and easy to use. The platform offers a similar user interface, with features like copy trading, trading bots, and advanced order types, making it feel just like a centralized exchange.

One of the main reasons traders choose Apex Omni is its competitive fee structure. The platform offers 0% spot trading fees, and futures trading with 0.02% maker fees and 0.05% taker fees.

What makes Apex Omni stand out are its unique passive income features. You can become a copy trader and earn rewards based on the trading volume of users following you. Alternatively, you can copy top-performing traders to generate passive income without having to trade yourself.

Apex Omni also offers Vaults, a special feature where users earn a share of the exchange's liquidation fees. This is a low-risk passive income opportunity that can deliver up to 30%+ APY, depending on market conditions.

Apex Omni also offers prediction markets, allowing users to bet on the outcome of specific events, similar to platforms like Polymarket.

Quick Summary of Apex Omni

- Fees: 0.02% Maker / 0.05% Taker

- Trading Pairs: 81

- Highlights: Unique features like copy trading and grid bots

- User Experience: Similar look and feel to centralized exchanges

- Markets Available: Spot and Futures

- Max leverage: 100x

Promo: Get 5% discount on your trading fees with our specific affiliate link.

DYdX Overview: Pros, Fees & Features

DYdX is a decentralised exchange mainly focused on perpetual futures. It is a more advanced decentralised exchange in terms of user-interface. Just like all other decentralised exchanges you can connect your wallet and start trading. You do not need to have any KYC verification.

You can easily connect with a MetaMask wallet, Coinbase wallet, Phantom wallet, and more. DYdX is built on the Cosmos blockchain. It’s a non-custodial exchange which means that you remain always in charge of you’re funds.

Next to trading perpetual, you can as well get passive income on dYdX using their MegaVault. MegaVaults are smart tools (called smart contracts) that let you deposit money, which is then traded automatically to try to make profits for you. It works kind of like copy trading on regular exchanges, but here it’s fully automated and decentralized. Instead of copying a specific trader, you’re trusting the automated strategy created by the dYdX team.

Quick Summary of dYdX

- Fees: 0.02% Maker / 0.05% Taker

- Trading Pairs: 89

- Highlights: MegaVault for passive income

- User experience: Slightly more advanced than Centralized Exchange

- Markets Available: Perpetual Futures

- Max Leverage: 50x

Would love to start trading on dYdX? Connect your wallet today!

HyperLiquid Overview: Pros, Fees & Features

Hyperliquid runs on its own custom Layer 1 and quickly became popular thanks to one unique feature: all trading positions are public. Anyone can see which wallet holds what position, how much profit or loss they have, their order size, and even the liquidation price.

A lot of attention came when a well-known trader named James Wynn started placing massive long and short positions on Bitcoin, some with over $1 billion in size. This sparked curiosity and controversy. Some traders even suggested it was a marketing stunt.

Hyperliquid is also known for its high trading volume and deep liquidity, making it a platform suited for professional traders, high-stakes players, and market makers who need low slippage and fast execution.

It offers more trading pairs than any other perpetual exchange and recently launched its native token, $HYPE, which is already ranked #11 on CoinMarketCap.

While Hyperliquid is non-custodial and fast, governance is still somewhat centralized; the core protocol and infrastructure are controlled by the team. Also, the team remains anonymous, which raises concerns for some users.

Quick Summary of Hyperliquid

- Fees: 0.015% Maker / 0.045% Taker

- Trading Pairs: 171

- Highlights: Deep liquidity

- User Experience: Advanced

- Markets available: Spot and Perpetual futures

- Max Leverage: 40x

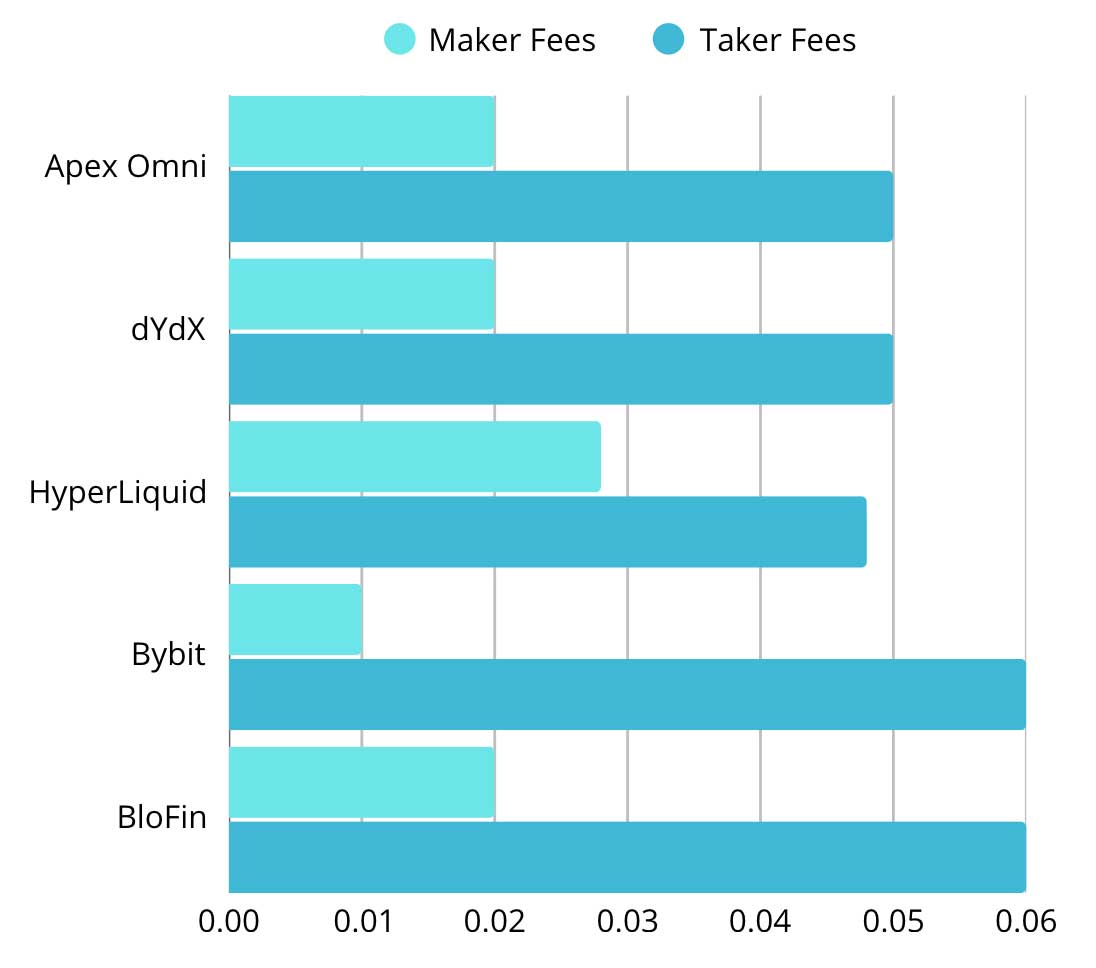

Fees Comparison

Now, we’ve discussed the basic features of the 3 most used DEX’s, let’s compare their fees. When it comes to trading fees, decentralized exchanges are very competitive, and in some cases, even cheaper than centralized exchanges.

One thing that stands out is the difference between maker and taker fees. While some centralized exchanges may offer lower maker fees, decentralized platforms usually offer lower taker fees, which is important for active traders who execute market orders.

If you sign up on Apex Omni using our affiliate link, you’ll get a 5% discount on all trading fees. This discount makes Apex Omni one of the most affordable decentralized exchanges available right now.

Features Compared

When picking a decentralised exchange, some traders might need other features than others. Let’s compare the features that are being offered by these Dex’s.

|

Exchange |

Spot Market |

Futures Market |

CopyTrading |

Passive Income |

Public Positions |

Grid bots |

|

Apex Omni |

X |

X |

X |

X |

|

X |

|

dYdX |

|

X |

|

X |

|

|

|

HyperLiquid |

X |

X |

|

|

X |

|

If you're looking for a decentralized exchange that feels like a centralized one, Apex Omni is a great choice. It offers many of the same features you'd find on a centralized platform, but with the benefits of decentralization. From grid bots to creating your own vaults that let other traders copy your strategy and earn you a share of their profits, Apex Omni makes advanced tools accessible to everyone.

On the other hand, dYdX and Hyperliquid are slightly more suited for advanced users. In particular, Hyperliquid is ideal for traders who need very high trading volume and deep liquidity, such as institutions or high-frequency traders.

DEX Affiliate Programs Compared

Apex Omni, dYdX, and Hyperliquid all offer referral programs, allowing you to become an affiliate and promote the platform. When users sign up using your link, you earn a share of the trading fees they generate, without any downside for them. In fact, users often receive a bonus or fee discount when joining through an affiliate link.

Let’s take a closer look at the affiliate programs of these leading decentralized exchanges.

Apex Omni

Apex Omni offers an affiliate program that lets affiliates earn up to 50% commission, similar to what you’d find on many centralized exchanges. They also run exclusive promotions that are only available through affiliate links. For example, by signing up with our affiliate link, you’ll get a 5% discount on trading fees, a small perk that can add up to big savings over time.

dYdX

dYdX offers a referral program similar to Apex Omni, where affiliates can earn up to 50% of trading fees as commission from users who sign up through their unique link. These commissions are lifetime-based, meaning you’ll continue earning as long as your referrals keep trading.

dYdX also features a public leaderboard, showing which affiliates have earned the most in commissions, adding a competitive edge to the program.

HyperLiquid

Hyperliquid offers a referral program where users can earn a percentage of the trading fees generated by their referrals after completing just $10,000 in trading volume. Referees benefit too, receiving a 4% fee discount on their first $25 million in volume. The program applies to spot and perpetual trading, but not to vaults or sub-accounts.

Affiliates on Hyperliquid earn a 10% commission on the trading fees paid by each referred user. This commission lasts for the lifetime of that user's trading, capped at $1 billion in trading volume per referral. So after the user's trading volume becomes higher than 1 billion, you will not receive any commissions anymore. So, it’s very different than to dYdX or Apex Omni.

Overview of Affiliate Programs

|

Exchange |

Commission |

Promotions |

Lifetime |

|

Apex Omni |

Up to 50% |

In collaboration |

Yes |

|

dYdX |

Up to 50% |

In collaboration |

Yes |

|

HyperLiquid |

Flat 10% |

4% fee discount for the user |

Capped at 1 billion USD in volume per user |

Best DEX for Copy Trading

How common is copy trading on decentralized exchanges?

It’s still quite rare, but there are a few emerging options and creative workarounds.

Apex Omni, for example, offers a native copy trading feature called Vaults. These are smart contracts that allow users to allocate funds to a trader without giving them withdrawal access. In other words, the trader can actively trade with your funds, but cannot move or withdraw them. While this might sound unusual, it's a necessary structure in the decentralized world, where smart contracts replace the need for centralized trust.

dYdX doesn’t offer traditional copy trading, but they do feature a community-approved strategy provider called MegaVault. Users can allocate funds to this provider and earn yield through market-making strategies. The current APY is around 16%, and while not risk-free, the risk is considered relatively low due to the provider’s ties with the dYdX community and its incentive to maintain a strong reputation.

Hyperliquid, on the other hand, does not offer copy trading or direct passive income options. However, since trader positions are public, users can manually track and mimic trades from wallets they trust, without paying any fees. Just be cautious: even large whales sometimes get it wrong, and blindly following them can be risky.

Additionally, Apex Omni offers a unique Apex Vault, operated by the protocol itself. It distributes fees collected from liquidations to participants, providing another form of decentralized, yield-generating exposure.

|

Exchange |

Copy Trading |

Passive Income (e.g. Staking) |

|

Apex Omni |

Yes, Vaults |

Yes |

|

dYdX |

No |

Yes |

|

HyperLiquid |

No, but positions are public |

No |

DEX Metrics

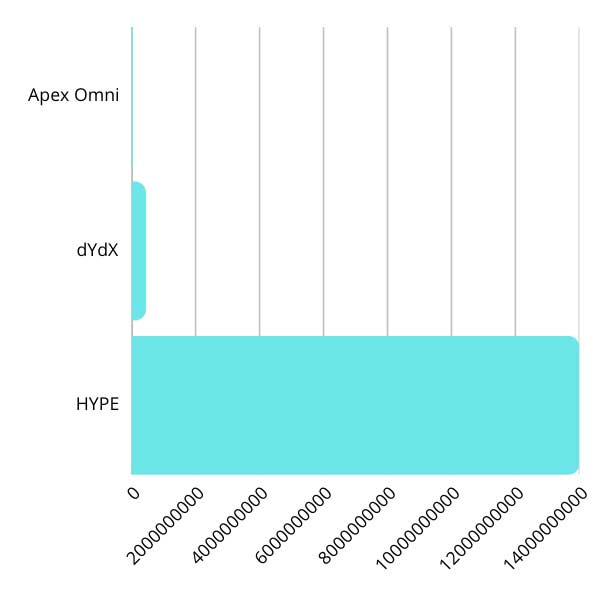

Native Tokens

$APEX

The APEX token is the native utility and governance token of the Apex Protocol. You can stake your APEX on Apex Omni.

$DYDX

DYdX token is the native token of dYdX Exchange. DYDX token holders can actively participate in the governance of the dYdX protocol by voting on proposals that shape the platform’s future as well as using the token to pay the fees or in some cases, get a fee reduction.

$HYPE

HYPE is the native utility token of the Hyperliquid ecosystem, used for governance, staking, and as gas for transactions on the platform. HYPE is in the top 20 on CoinMarketCap, ranking it as the highest decentralised exchange token.

Token Marketcaps

When comparing the market caps of these native tokens, the differences are striking. At the time of writing, HYPE has a market cap of $14 billion, while dYdX sits at $450 million and Apex Omni at just $32 million. This significant gap could present interesting opportunities, especially considering that Apex Omni currently has more users and higher trading volume than dYdX. However, HYPE may carry greater risk due to its already high valuation, leaving more room for potential downside.

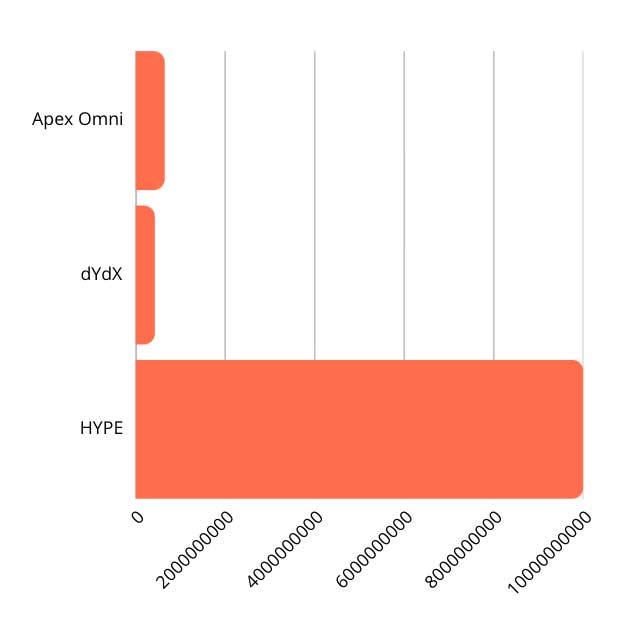

Exchange Volume

Exchange volume favors Hyperliquid over both Apex Omni and dYdX. However, it's important to note that Hyperliquid is not fully decentralized; its validator set is permissioned, and volume data is not fully transparent or verifiable on-chain. In contrast, Apex Omni operates entirely on-chain via Starknet, meaning all trades and volumes are publicly auditable and fully transparent. Interestingly, Apex Omni currently records higher trading volume than dYdX, even though its native token’s market cap is significantly smaller.

DEX Overview (Apex Omni, dYdX, HyperLiquid)

|

|

Apex Omni |

dYdX |

HyperLiquid |

|

Fees (M/T) |

0.02/0.05 |

0.02/0.05 |

0.015/0.045 |

|

Trading Pairs |

81 Pairs |

89 Pairs |

171 Pairs |

|

Spot Market |

Yes |

Yes |

No |

|

Futures Market |

Yes |

Yes |

Yes |

|

Max Leverage |

100x |

50x |

40x |

|

Fully decentralised |

Yes |

Yes |

No |

|

Copy-Trading |

Yes |

No |

No |

|

Passive Income (Eg. Staking) |

Yes |

Yes |

Yes |

|

24h volume |

460m |

400m |

14b |

|

Supported Wallets |

13 Wallets |

8 Wallets |

7 Wallets |

Conclusion

Choosing the right decentralized exchange depends on your individual needs, whether it's liquidity, user experience, passive income tools, or privacy. Each platform has its strengths, but when comparing all the options, Apex Omni stands out as the most well-rounded choice.

It offers a full suite of features similar to centralized exchanges, such as copy trading, vaults, and grid bots, while maintaining the benefits of decentralization. Its smooth user experience, combined with full on-chain transparency and backing by the team behind Bybit, makes it an excellent choice for most traders.

The only potential downside is trading volume. While Hyperliquid offers deeper liquidity, especially for institutions or large-scale traders, Apex Omni provides more than enough volume for the majority of users, and even surpasses dYdX in activity.

👉 Connect your wallet and get started with Apex Omni today. Use our link to receive a 5% discount on all trading fees.

Related Articles:

- Apex Omni Vaults Explained: Copy-trading On a Decentralised Exchange

- How to Trade Anonymously (Legally) in Crypto

- Apex Omni vs dYdX – Which Decentralized Exchange Is Better?