Crypto Vaults Explained (2025): How Apex Omni & dYdX Help You Earn Passive Income

Crypto vaults are automated smart contracts that let users earn passive income by deploying crypto into trading strategies. In this guide, we’ll explain how crypto vaults work, compare Apex Omni and dYdX Vaults, and help you decide which strategy fits your goals.

What Are Crypto Vaults?

A crypto vault is a smart contract that allows users to deposit crypto and earn a return. It runs a trading strategy on your behalf. Think of it like putting your money into a digital investment fund that runs automatically. Once you deposit, the vault manages everything on your behalf. Each vault runs a unique trading strategy. We’ll walk you through the most common ones and how they work.

Vaults appeal to users who want to earn from their crypto without actively managing trades. Some vaults are low-risk and provide steady returns, while others may aim for higher profits through more aggressive strategies. So it’s a way to get exposure to passive income. The risk varies per vault as every vault is using its own specific trading strategy.

Types of Crypto Vaults

Crypto vaults generally fall into two categories:

User-Created Vaults: These let individuals or traders set up their own strategies. Other users can deposit funds into these vaults and follow the creator’s trades, much like copy trading.

Exchange Vaults: These are official vaults built and managed by the decentralised exchange itself. They’re typically lower risk and designed to generate a stable yield. DYdX calls it the “MegaVault” and Apex Omni calls theirs the ‘Apex Protocol Vault.

Let’s explore how Apex Omni and dYdX use both models.

Apex Omni Vaults: Copy Top Traders or Create Your Own

Apex Omni allows anyone to create a trading vault. If you’re a skilled trader, you can launch your own vault and let others follow your trades. If you’re an investor, you can browse a variety of vaults and choose one that fits your goals and risk appetite.

This system benefits both traders and followers. Traders get rewarded (10%) based on their performance, and investors can earn (90%) without actively trading. It’s basically the same concept as copy-trading but then on a decentralised platform. Apex Omni is currently the only decentralized exchange that allows anyone to create copy-trading vaults.

For a step-by-step guide, check our Apex Omni Vaults Explained.

Apex Protocol Vaults: Safe Passive Income from Real Fees

Protocol Vaults on Apex Omni are different. These are official products developed by the ApeX team, offering predictable, stable returns with minimal risk.

Highlights:

- Yield Source: Funded by liquidation fees from Apex’s Perpetual trading platform

- Stable Returns: Designed to avoid negative yield and provide consistent passive income

- Daily Updates: Earnings reflected via Net Asset Value (NAV) updated every 24 hours

- No Lock-Up: Users can deposit or redeem anytime

Terms:

- Initial Vault Cap: 2,000,000 USDT

- Per User Cap: 200,000 USDT

- Minimum Deposit: 10 USDT

How Does the Apex Protocol Vault Work

When someone on Apex Omni makes a risky trade using leverage and loses, the system has to close their position before they lose everything. This is called a liquidation. When that happens, a small fee is collected from that trader.

The Protocol Vault collects all these small liquidation fees and shares them with people who have deposited their USDT in the vault. So if the market is very active and traders are getting liquidated, more fees are collected, which means more profit for the vault users. You don’t need to trade or take risks yourself. You just let others trade, and you earn a piece of the fees from their mistakes.

Here's how it works:

- Traders on Apex use leverage

When traders open large positions with leverage, they risk being liquidated if the market moves against them. - When liquidations happen, Apex charges a fee

This fee is collected in USDT and is part of the trading engine’s core mechanics, it's real money earned from trader losses. - The Protocol Vault receives those liquidation fees

Apex has programmed its official vault to receive a portion of these liquidation fees as a reward for vault participants. - Your deposit is your ticket

When you deposit USDT into the vault, you’re not lending it or putting it at risk — instead, it acts like a ticket that entitles you to a proportional share of the daily liquidation fees collected. - NAV increases with revenue, not speculation

Each day, Apex calculates how much was earned from liquidations, updates the Net Asset Value (NAV), and your vault shares increase in value. That’s how you earn passively.

Your funds in the Apex Protocol Vault aren’t traded or lent out. They simply sit in the vault and grow as the protocol adds liquidation fees to the vault daily. It’s a passive income mechanism, not an investment into risky strategies.

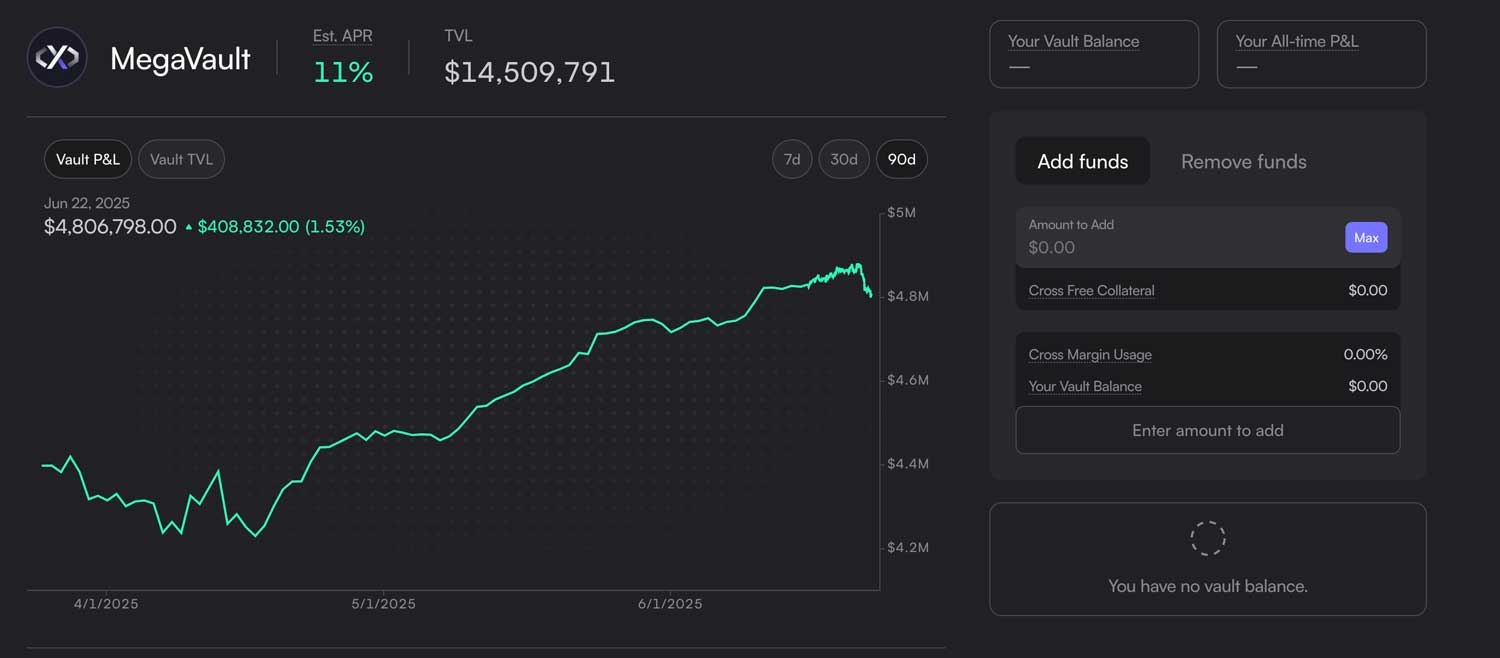

dYdX MegaVault: A Higher Risk Option for Protocol Support

The MegaVault on dYdX offers a different approach. There is an entity that is selected by the community through votes that manages the capital inside the vault. So in simple terms, a trading company uses the capital in the vault for their trading strategy and aims to generate modest returns through low-risk strategies. So the yield is not as high as Apex Omni, but they strive to be stable and secure.

How It Works:

- Funds are used for automated trading strategies across illiquid and volatile markets

- Returns come from a mix of positive PnL, fees, funding payments, and community rewards

- Estimated APR is based on past performance and may fluctuate greatly

Key Risks:

- Negative PnL: Vault may lose money on trades

- Dilution: New users reduce your share of rewards

- Slippage Fees: Withdrawals may incur high slippage depending on leverage

MegaVault is non-custodial and you control your funds via your wallet. However, it’s best for users who understand the risks and are comfortable with volatility.

Want to learn more about dYdX Exchange? Read our dYdX Review.

Quick Comparison Table

|

Feature |

Apex Protocol Vault |

Apex Omni Vaults |

DYdX MegaVault |

|

Strategy/Manager |

Apex (Official) |

Any User |

Community chosen entity |

|

Risk level |

Low |

Medium-High |

Medium |

|

Yield Source |

Liquidation fees |

Copy-trading |

Automated Trading Strategy |

|

Guaranteed positive returns |

Yes |

No |

No |

|

Withdraw slippage |

No |

No |

Yes |

|

Lock-up period |

No |

No |

No (unless opening new market, 30 days) |

Are Crypto Vaults Worth It in 2025? Here's What You Should Know

Crypto vaults can be a great tool, depending on your goals:

- Use Apex Protocol Vaults if you want passive income with low risk

- Try user-created vaults if you want to follow or monetize trading strategies

- Consider dYdX MegaVault only if you're comfortable with trading risk and want to support the protocol

Always do your research before depositing funds and understand how the vault earns yield.

Which vaults carry the most risk?

|

Exchange |

Risk |

Reason |

|

Apex Protocol Vault |

Low |

Distribution of liquidation fees |

|

DYdX MegaVault |

Medium |

Low-risk automated trading stagey |

|

Apex Omni Vaults (Copy-Trading) |

Medium-High |

This varies on the copy-trader that you’re copying and the strategy that is applied. |

Are Crypto Vaults a Good Investment in 2025?

Crypto vaults are still in their early stages, but they’re quickly gaining momentum as decentralized exchanges grow in popularity. As more users shift away from centralized platforms, vaults are becoming an essential tool in DeFi yield strategies, offering accessible ways to earn passive income without actively trading.

Whether you're looking for passive income in crypto in 2025 through low-risk vaults that collect liquidation fees, prefer to follow simple automated trading strategies, or want to diversify across multiple vaults to spread your risk, there's likely a vault that fits your style. For traders, the ability to create and monetize their own vault strategy adds another layer of opportunity.

With adoption increasing and liquidity steadily flowing into decentralized exchanges, the best DeFi vaults are well-positioned to become core components of crypto investing in 2025 and beyond.

Frequently Asked Questions (FAQ)

What is a crypto vault?

A crypto vault is a smart contract that manages your crypto assets to generate yield. It automates strategies so users can earn without trading manually.

Are crypto vaults safe?

Vaults can vary in risk. Protocol vaults like those from Apex offer stable returns with minimal risk. Others, like dYdX MegaVault, carry more risk due to market exposure.

How do crypto vaults make money?

They earn from trading profits, liquidation fees, funding payments, or protocol rewards depending on the platform and vault type.

Can I lose money in a crypto vault?

Yes, especially in vaults like dYdX MegaVault. Protocol vaults like those on Apex Omni are designed to avoid negative returns, but smart contract and market risks always exist. If you copy a trader through a vault, the trader can always lose money. Profits are not guaranteed.

What’s the difference between a user vault and a protocol vault?

User vaults are created by individuals and often used for copy trading. Protocol vaults are official platform products, designed for consistent yield often carrying lower risks.

Do vaults require KYC?

No, because vaults are offered by decentralised exchanges. They do not require any KYC verification.

Are there fees for joining or leaving a vault?

Most user and protocol vaults do not charge fees on entry/exit, but dYdX MegaVault can apply slippage fees when withdrawing based on leverage and liquidity. With Apex Omni Vaults, created by users, you pay 10% of your profits to the trader.

Final Thoughts

Crypto vaults are becoming a core part of DeFi and automated income strategies. Whether you prefer the low-risk returns of Apex Protocol Vaults or are exploring higher-risk tools like dYdX MegaVault, understanding how vaults work is essential before investing.

Ready to earn passively? Try Apex Protocol Vaults today.

Related Articles:

- Copy Trading on Decentralized Exchanges

- Best Crypto Deposit Bonuses for 2025

- Apex Omni Tutorial