How to Use a Decentralized Exchange (DEX) Within a Company Setup

As things stand, businesses are increasingly exploring decentralized exchanges (DEXs) as part of their trading and treasury operations, as they offer greater control over assets and potentially lower fees (all while introducing new considerations around security, administration, and legal structure). This article provides a comprehensive look at how a company can integrate DEX trading into its operations, covering security best practices, comparing the market’s top DEXs, and detailing how to set up a crypto-focused LLC in crypto-friendly jurisdictions like the UAE, Georgia, and Hong Kong.

TLDR

1. Why Use a DEX for Company Crypto Trading?

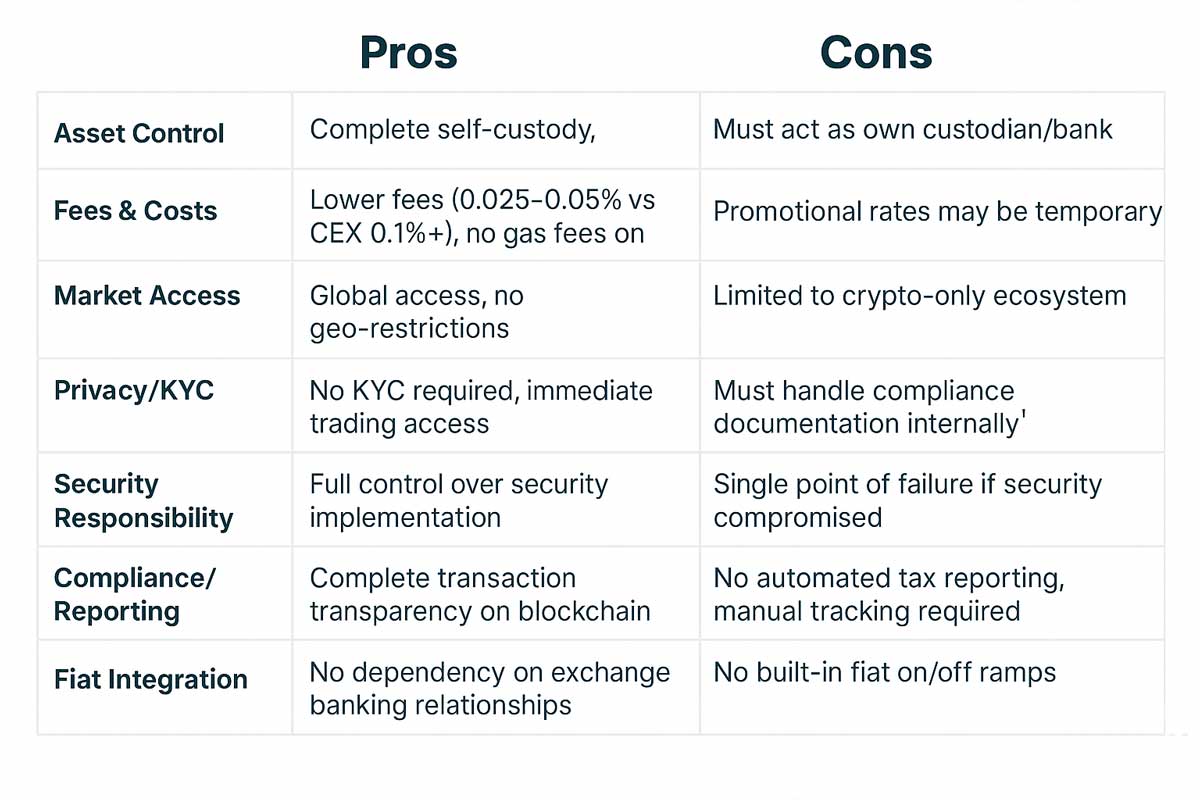

Using a decentralized exchange as a company offers several advantages over traditional centralized exchanges (CEXs). These include:

- (i) Self-Custody of Funds: DEXs allow companies to retain control of their assets at all times, thus eliminating any counterparty risks emanating from exchange custody.

- (ii) No KYC and Global Access: Many DEXs enable trading operations without extensive KYC onboarding. What this means is that a company operating in a jurisdiction where certain CEXs are restricted can still access global crypto markets.

- (iii) Lower Fees and Slippage: DEXs offer highly competitive fees and deep liquidity. Apex Omni, for instance, has taker fees as low as 0.025% and maker fees near zero, with high throughput that keeps slippage minimal. Not only that, it can process up to ~10 trades per second and 1,000 orders/sec with zero gas fees, rivaling many centralized platforms in this regard.

- (iv) Advanced Trading Features: Modern DEXs come with highly sophisticated tools like leverage, derivatives, and automation alongside automated strategy vaults or copy-trading functions.

Trade-Offs

Of course, these benefits come with their limitations. For starters, DEXs generally lack fiat on-ramps, meaning all activity must remain within their respective ecosystems. Moreover, companies using such setups must handle compliance, reporting, and security internally, taking on responsibilities that centralized exchanges would typically have to manage, such as tracking trades for tax purposes and ensuring adherence to regulatory requirements without automated support systems.

Simply put, the absence of account managers and automatic tax reporting means companies bear full responsibility for maintaining comprehensive transaction records.

2. Security and Administration Considerations for Corporate DEX Use

When integrating a DEX into a company setup, security and proper administration of crypto assets are paramount because, unlike personal trading, company crypto trading involves multiple stakeholders and larger sums, so stronger controls are needed:

Role-Based Access Control for Corporate DEX Trading

One of the most critical operational challenges for companies using DEXs involves implementing role-based access controls that allow traders or quantitative analysts to execute strategies without withdrawal permissions. Unlike centralized exchanges that offer built-in role-based access control systems, most DEXs require creative solutions due to their decentralized architecture.

The most viable current solution involves utilizing copy trading vault systems, wherein a skilled trader can create a strategy vault that the institution automatically follows (effectively separating trading execution from fund custody).

While this approach requires sharing approximately 10% of profits with the strategy creator, it allows companies to maintain full control over their capital while benefiting from professional trading strategies without granting direct wallet access. The institutional entity preserves the non-custodial benefits of DEX trading while enabling algorithmic strategies that run autonomously on-chain.

Alternative approaches include multi-signature wallet architectures where trading operations require fewer signatures than withdrawals (e.g., 2-of-3 for trades, 3-of-3 for withdrawals), and emerging API-level solutions that some platforms are developing to provide more granular permission structures. However, these remain limited across most DEX platforms due to technical complexities.

That said, as the institutional adoption of DEXs grows, platforms are investing in enhanced access control features, though companies currently planning DEX integration should expect to work within existing copy trading frameworks or implement sophisticated multi-signature setups to achieve proper role separation.

Hardware Wallets and Key Management

All private keys (or key shares in a multi-sig) should be stored on hardware wallets or secure custody devices, kept offline except when signing. Moreover, companies should implement strict key management policies, including secure backups (in sealed envelopes or hardware backups stored offsite) and procedures for key holder turnover (when an employee with key access leaves, etc.).

In other words, no single individual should ever hold all keys to a multi-sig, especially in larger firms where keys should be distributed among several executives or even a trusted third-party custodian for added safety.

Internal Controls and Audits

Treating a company’s crypto treasury with the same rigor as fiat finances is a must and implies dual-control processes, wherein regular internal audits of crypto balances and real-time monitoring of transactions is done.

This entails every trade being logged in an internal accounting record (with fiat values at time of trade noted for later tax calculations) since DEXs don't issue monthly statements. For this, finance teams might have to use blockchain explorers or portfolio tracking software alongside on-chain trading services (to help generate P&L and tax reports).

Risk Management

Using a DEX doesn’t remove trading risk, and therefore, companies should set clear policies on what types of trades are allowed, position size limits, leverage limits, and stop-loss protocols. For instance, if engaging in leveraged perpetuals, a risk manager should monitor margin levels and ensure the company isn’t overexposed.

Essentially, the company must act as its own bank, setting up all the safekeeping and oversight that a bank or exchange would normally provide.

3. Top Decentralized Exchanges Suitable for Companies

Not all DEXs are created equal, especially when it comes to serving the needs of a company. In that sense, key factors to consider include liquidity, fee structure, security, available trading pairs (especially for derivatives or high-cap assets), and the ability to integrate via API or trading software.

Apex Omni

Apex Omni is a next-generation DEX built by the team behind Bybit, offering an experience very close to a centralized exchange but in a non-custodial way. It uses an order book model for trading perpetual futures and is deployed on Layer-2 (utilizing StarkWare’s StarkEx for scalability). For a company, Apex Omni hits several key needs, including:

Deep Liquidity and Low Fees

Backed by Bybit’s ecosystem and liquidity providers, Apex Omni boasts deep liquidity on major pairs (BTC, ETH, etc.), meaning a company can execute large trades with minimal slippage. Fees are extremely low (standard taker fee ~0.05% or less, often with rebates for makers and even 0% maker promos), and there are no gas fees for trades as transactions are aggregated via an L2. This is ideal for high-frequency or high-volume corporate trading, keeping costs predictable.

Advanced Trading Features

It offers 20x-100x leverage on perpetual contracts and cross-margining, enabling more capital-efficient trading. Companies can deploy algorithmic strategies through Apex’s Vaults, meaning a firm could potentially set up an algorithm to trade continuously without relinquishing custody of funds. The interface and API are similar to Bybit, making it easy for trading teams to adopt without a steep learning curve.

Privacy and No KYC

Apex Omni does not require KYC, allowing a company to start trading immediately without disclosure of corporate details, thus preserving privacy (though the company should still internally document activity for compliance). Furthermore, the platform uses StarkEx validity proofs to ensure the security of funds in addition to its smart contract being audited regularly.

Create an account on Apex Omni and receive 5% discount on your fees with our unique affiliate link.

dYdX

dYdX is another leading DEX focused on perpetual futures. It pioneered the use of order-book style L2 trading on Ethereum (also using StarkWare technology) and by 2025 has moved to its own blockchain for greater throughput. For companies, their core incentives include:

Liquidity and Market Access

dYdX has been one of the largest DEXs for BTC and ETH perpetual swaps, offering up to 20x leverage and a wide user base. Liquidity is generally strong, although liquidity mining rewards have fluctuated as token incentives change. When it comes to fee structures, dYdX uses a tiered fee model based on volume, which can be attractive to high-volume traders (fees can drop to 0% maker and very low taker fees for top tiers). There are no gas fees for trading on its L2 or app chain, which is a plus.

Institutional Features

dYdX provides an API and has been integrated into many trading terminals. However, one caveat is that in late 2023, it had to enforce some KYC/region restrictions (e.g. U.S. users were geo-blocked), which indicates it may not be entirely “permissionless” for all users. Basically, a non-U.S. company wouldn’t face those restrictions, but it’s something to note in terms of compliance.

Hyperliquid

Hyperliquid operates on its own custom L1 and has gained attention for its unique transparency features (such as all trading positions being publicly visible). This includes wallet holdings, profit/loss status, order sizes, and liquidation prices. Additionally, the platform offers exceptional trading volume and deep liquidity, making it suitable for professional traders and market makers requiring minimal slippage.

Lastly, it supports more trading pairs than most perpetual exchanges, even launching its native $HYPE token recently. However, governance remains somewhat centralized with the core team controlling protocol infrastructure, and the anonymous team structure may concern some institutional users.

4. Legal and Tax Considerations for Setting Up a Crypto Trading Company

Using a DEX for company funds works best when the company is properly structured and located in a favorable jurisdiction. Running trades through a personal account or an informal setup can lead to mixing of personal and business assets, regulatory headaches, and tax complications.

Instead, establishing a dedicated legal entity (e.g., an LLC or equivalent) for crypto trading can provide liability protection, clearer accounting, and often significant tax advantages if done in the right country.

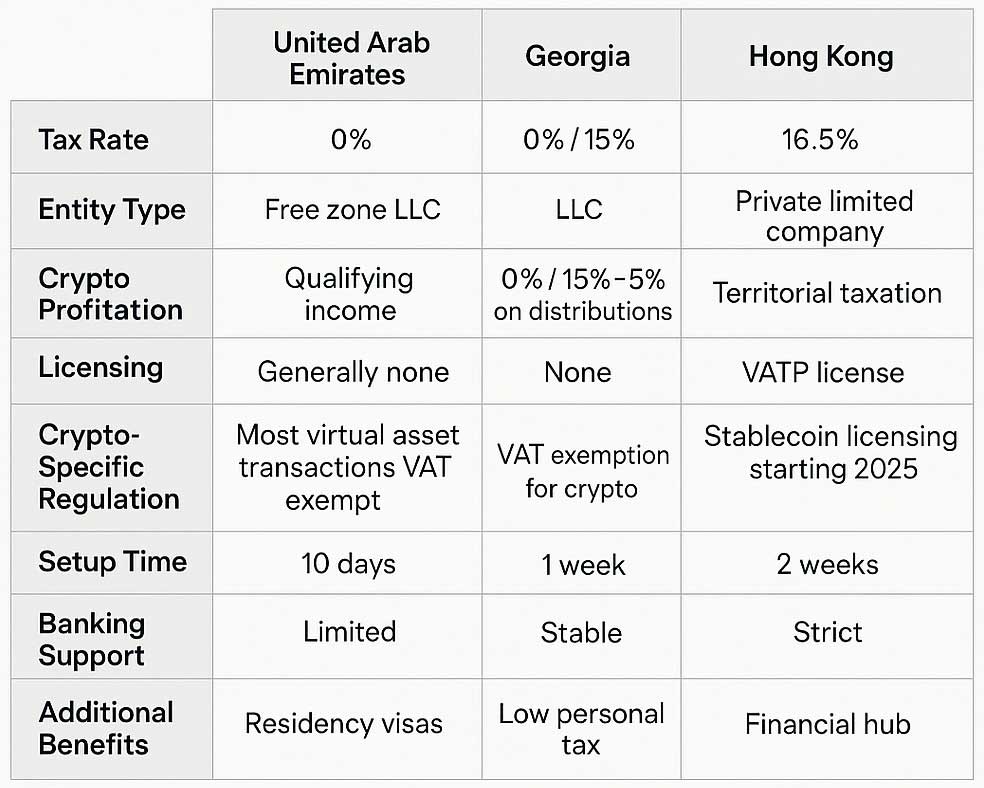

Listed below are some of the most favorable crypto jurisdictions in the world and the regulatory benefits they offer:

United Arab Emirates (UAE) – Free Zone Companies and Offers a 0% Tax Environment

The UAE (particularly Dubai) has emerged as a global crypto hub, attracting companies with its business-friendly policies. In 2023, the UAE introduced a 9% federal corporate tax, but free zone companies can still enjoy 0% tax on qualifying income. Moreover, crypto trading profits have been explicitly confirmed as qualifying income for 0% in many cases. Here’s how a company can leverage the UAE for its crypto operations:

Free Zone LLC Formation

Foreigners can establish a wholly-owned LLC in one of the UAE’s many free trade zones. Notably, the DMCC (Dubai Multi Commodities Centre) Free Zone is a popular choice for crypto businesses, even hosting a dedicated Crypto Centre. Benefits of DMCC (and similar zones) include 100% foreign ownership (no local sponsor required) and a guaranteed zero corporate and personal income tax for 50 years.

Free zone companies also have no currency restrictions and full profit repatriation, so your crypto profits can be freely moved out in crypto or converted to fiat without local barriers.

Tax Treatment

Under the UAE’s new tax law, a “Qualifying Free Zone Person” that earns only free-zone sourced income pays 0% corporate tax. The Federal Tax Authority clarified in May 2024 that crypto assets held by free zone companies are eligible for 0% tax as qualifying income. In practice, this means if a Dubai free zone company trades crypto (and doesn’t, say, service UAE mainland clients), it can operate tax-free on those trading profits.

There’s also no capital gains or dividend tax in the UAE, and no personal income tax for residents. If a free zone company were to stray from the qualifying criteria, e.g., doing business with UAE mainland customers, then profits could be taxed at 9%. But a proprietary trading firm typically can avoid this.

Licensing

Simply trading or investing the company’s own funds in crypto generally does not require a special license in the UAE. However, if the company offers crypto services (exchange, brokerage, etc.) to customers, then approval from regulators like VARA (Virtual Assets Regulatory Authority) in Dubai would be needed.

For a pure trading firm, one can choose a broad business activity (like “proprietary investment” or “crypto proprietary trading”) when setting up the company. DMCC, for example, has specific crypto asset business license categories. The process involves submitting passport copies, a business plan, KYC on shareholders, and meeting the minimum share capital (often around AED 50,000, USD $13.6k approx., which can just be kept as working capital). The formation process is relatively quick with DMCC estimating around 10 working days if documentation is in order.

One challenge can be banking, as UAE banks are conservative and may not readily offer accounts to crypto-related companies unless they have proper licenses and a convincing compliance setup. That said, the UAE is launching initiatives (like digital banks and partnerships) to support the sector, and using an Emirati free zone entity lends credibility. Also, if the company’s owners want to live in Dubai, the free zone company can sponsor residency visas, making it practical to physically operate there.

Georgia – Low Taxes, Territorial Treatment, and Fast Setup

Georgia is sometimes called a “crypto tax haven” because of its favorable laws offering a mix of territorial taxation and special regimes that benefit both individuals and companies engaged in crypto activities.

Tax on Crypto Trading

Individual residents in Georgia pay no tax on crypto trading profits as the law treats crypto gains as foreign-sourced income (since crypto is not issued by Georgia), thus exempting Georgian individuals. For companies, Georgia has a 15% corporate income tax, but uniquely, this tax is applied only when profits are distributed (the Estonian model of corporate taxation).

In other words, if a Georgian LLC trades crypto and makes profits, it doesn’t owe the 15% until such time as it pays out dividends or other profit distributions. Additionally, if the firm keeps reinvesting or holding the profits, the tax is deferred indefinitely. And when a distribution is carried out, there’s a 5% dividend withholding tax. Effectively, if a company eventually takes out all its profits, the total tax is about 19.25% (because 0.85 * 0.95 yields that net), but there’s control over timing.

Free Zone Option (0% Tax)

For an even more appealing setup, Georgia has Free Industrial Zones (FIZ), like the Tbilisi Free Zone, where companies can register to get 0% corporate tax, 0% VAT, and no tax on exports. According to legal advisors, a crypto business in a Georgian FIZ pays no corporate income tax at all, with the only tax being the 5% on any distributed dividends.

There are minimal reporting requirements as FIZ companies aren’t subject to the usual monthly or quarterly filings that normal companies are. That said, to be a FIZ company, one usually needs to rent space or a desk in the zone (fulfilling a physical presence), though some service providers handle this virtually.

Company Formation

Setting up a Georgian LLC is straightforward and low-cost, with foreigners being able to own 100% of the company with no required minimum capital. The registration can be done in a matter of days, roughly 1 week to register the LLC (even faster if you visit in person). Basic steps include choosing a unique company name, providing passports for shareholders, a local address (often provided by business service firms), and filing with the National Agency of Public Registry.

If pursuing a crypto exchange or financial service, one might need to obtain a VASP license from the National Bank of Georgia, but if the company is only trading its own assets, no special license is needed. In case a license is desired (for more official status or expanding services), Georgia has introduced a Virtual Asset Service Provider (VASP) license, but interestingly many crypto entrepreneurs skip the full license by operating under the FIZ regime, which is lighter and still legitimate for proprietary trading.

Other Benefits

Georgia has no capital gains tax generally on long-term assets and no wealth tax. It also does not tax crypto-to-fiat conversions for companies (no VAT on crypto trades for companies either). If the owners spend time in Georgia, they can benefit from one of the lowest personal income tax regimes as well.

Hong Kong – A World-Class Financial Hub Offering Evolving Crypto Incentives

Hong Kong has long been a favored place for base trading firms due to its forward-looking legal system, low taxes, and status as a finance hub. For crypto, Hong Kong’s approach is “open but regulated,” encouraging businesses to set up while still implementing well-planned licensing regimes for exchanges alongside clear tax rules:

Taxation structure

Hong Kong taxes businesses on a territorial basis, with its headline profit tax rate being 16.5% for corporations (but only on profits sourced in Hong Kong). There is no capital gains tax in HK and no tax on dividends or bank interest. In practice, if a company is actively trading crypto in Hong Kong, the Inland Revenue Department has indicated that such profits are likely considered trading income (not passive capital gains) and thus taxable.

However, if the company can argue its crypto investments are long-term capital holdings or the trades are executed outside Hong Kong, some portion might be treated as non-taxable. This can get complex because, for instance, if the trading decisions and management are in HK, the profits will be seen as locally derived and taxed.

Many funds and proprietary traders live by paying the 16.5% profit tax on their net trading gains, which is still moderate by global standards. Importantly, no additional tax on dividends means once the company pays 16.5%, it can distribute profits to the owners with 0% withholding, and individuals don’t pay tax on receiving those dividends. Additionally, Hong Kong has a two-tiered profit tax where the first HKD 2 million (USD $255k) of profits are taxed at half rate (8.25%), which can benefit smaller companies.

Crypto-Specific Incentives

As of late 2024, Hong Kong’s government has proposed new tax exemptions for crypto investment income for certain classes of investors. Specifically, there is a plan to waive taxes on investment gains from cryptocurrencies for hedge funds, PE funds, and family offices that are privately managed. If implemented, it means a Hong Kong-domiciled fund or family office vehicle trading crypto could be fully exempt from profit tax on those trades.

Company Formation and Regulations

Setting up a Hong Kong company (usually a Private Limited Company) is straightforward with a local corporate service provider. It requires at least one director (can be foreign), one shareholder, and a local company secretary (this is a service one hires) as well as a local registered address.

Incorporation can be done in 1-2 weeks, as Hong Kong now has a licensing regime for any business providing crypto trading to the public (the VATP license via the Securities and Futures Commission). But if a company is only trading its own assets, it does not need this license.

Lastly, HK’s banking sector is high-quality but can be strict with compliance, meaning that a new crypto trading company might need to show strong documentation to open a bank account. However, Hong Kong is actively positioning itself as a crypto-friendly hub in Asia, so banks and regulators are becoming more accommodating to bona fide crypto businesses.

Benefits of HK for Crypto Companies

Companies get a stable legal environment, a common law system, and a reputation (which helps if dealing with partners or investors). There’s also a massive talent pool in finance and tech. Hong Kong also does not restrict capital flows, allowing entities to freely convert and move money, which pairs well with crypto liquidity needs.

Moreover, if the company’s operations involve trading on both centralized and decentralized exchanges, Hong Kong’s time zone and network can be useful (lots of crypto exchanges and funds have a presence there, enabling good connections and API latency, etc.).

Other Jurisdictions and Final Tips

The above three locations are among the top choices for crypto business formation; however, there are others worth considering as well. These include:

- Singapore: 0% capital gains, ~17% corporate tax, strong regulatory environment

- Malta: Various tax schemes to reduce effective tax to 5% or less for holding companies.

- BVI/Cayman Islands: Zero tax offshore entities, though opening bank accounts or fiat gateways for those can be trickier.

- El Salvador: No tax on tech innovations, including crypto, and more. The right choice depends on the company’s needs for reputation, investors, physical presence, and banking.

5. Conclusion - Which DEX is Best for Company Operations?

Integrating a decentralized exchange into a company’s structure can be a highly rewarding strategy and among the available DEXs today, Apex Omni stands out as a premier choice for any company ready to dive into decentralized trading because it uniquely delivers the perfect combination of secure, private, and high-performance trading (coupled with deep liquidity, low fees, and a non-custodial design).

Furthermore, by setting up a solid corporate structure (say, a tax-efficient LLC in Dubai, Tbilisi, or Hong Kong ) and adopting Apex Omni as a primary trading platform, a business can unlock new levels of efficiency and growth within its day-to-day crypto operations.

If you'd like to explore the Apex Omni DEX, sign up using our affiliate link to receive 5% discount on your fees.

Related Articles:

- Best Decentralized Crypto Exchanges in 2025 (Ranked & Compared)

- Which Crypto Exchange Has the Lowest Fees? VIP & Market Maker Programs Compared

- Best Crypto Exchange for Companies and Institutional Users (2025 Guide)