DyDx

DyDx

Visit DyDxdYdX is a decentralized derivatives trading platform that offers advanced tools for trading perpetual contracts on assets like Bitcoin, Ethereum, and other major cryptocurrencies. Built on a non-custodial framework, it allows users to trade directly from their wallets without needing to complete KYC.

Rating

68Location

U.S.Contract types

USDMaker fee

0.02 %Taker fee

0.05 %Max leverage

50xUS allowed

YesDeposit methods

CryptoAverage funding fee (BTC)

-Table of contents

- DyDX Review 2025: Is This the Best Decentralized Perpetuals Exchange?

DyDX Review 2025: Is This the Best Decentralized Perpetuals Exchange?

dYdX is a decentralized derivatives trading platform that offers advanced tools for trading perpetual contracts on assets like Bitcoin, Ethereum, and other major cryptocurrencies. Built on a non-custodial framework, it allows users to trade directly from their wallets without completing KYC.

Decentralized exchanges are gaining popularity as regulations tighten around the world. With just a wallet connection, you can deposit and trade. So no need to verify documents, prove your citizenship, or worry about regulatory obstacles or exchange insolvency. One standout option is dYdX, a U.S.-based decentralized exchange that's a solid choice for active traders.

🎯 Short on time? Start trading on DyDX and enjoy full self-custody with no KYC requirements.

TL;DR

|

Feature |

Summary |

|

Best for |

Intermediate traders |

|

Available in |

Worldwide |

|

Trading pairs |

80+ pairs |

|

Markets |

Perpetuals, MegaVaults (Copy-trading) |

|

Fees |

0.01% Maker, 0.05% Taker |

|

KYC |

No |

|

Sign-up bonus |

Discount on fees (With affiliate link) |

What is dYdX?

In short: dYdX is a decentralized exchange built on the Cosmos blockchain.

DyDX is a decentralized exchange (DEX) offering perpetual futures trading. Unlike centralized exchanges like Bybit or Bitunix, DyDX is non-custodial. You trade directly from your wallet, without handing over your funds to a third party.

DyDX was first built on Ethereum, but now it runs on its own custom network called Cosmos. This makes the platform faster, smoother, and more independent.

It’s mainly designed for experienced traders who want a trading experience similar to big platforms like Bybit, with deep liquidity, easy-to-use dashboard, and leverage, but without needing to do KYC or give up control of their crypto.

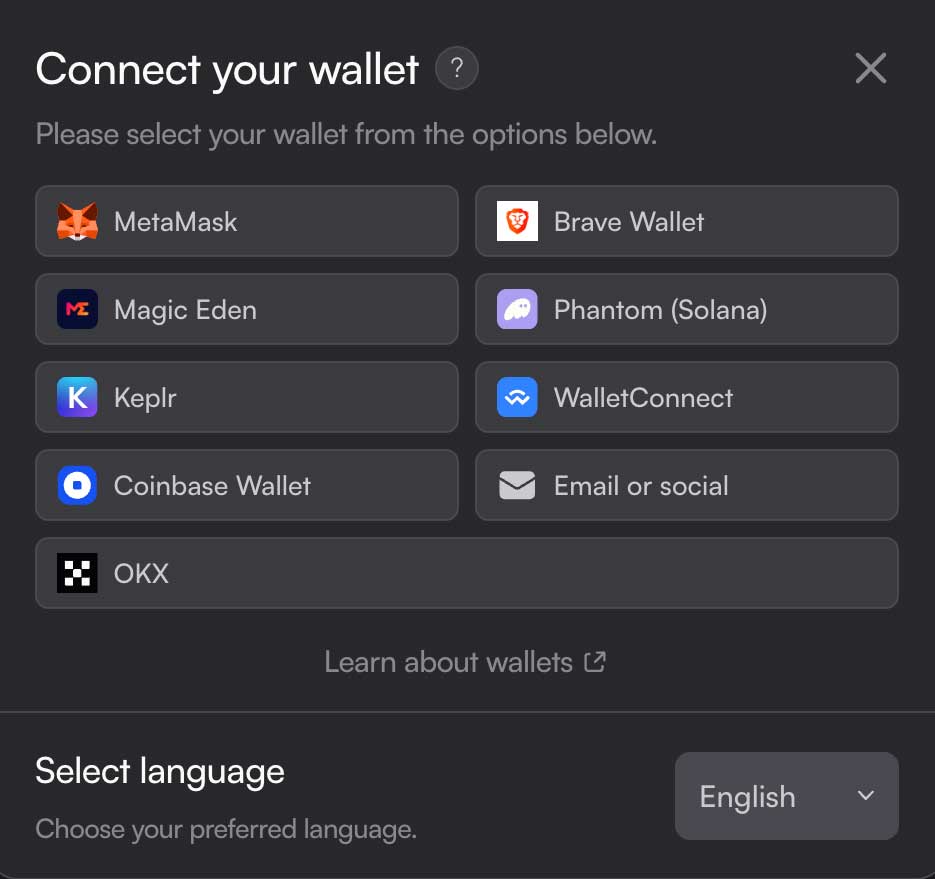

How to use dYdX?

Since dYdX is a decentralized exchange, getting started is simple, just connect your crypto wallet, such as MetaMask or Phantom. There's no KYC process, meaning you don't need to submit any personal documents. If you don't already have an external wallet, dYdX also offers the option to create an account using your email. In that case, a dYdX wallet will be automatically generated for you, allowing you to deposit funds and start trading right away.

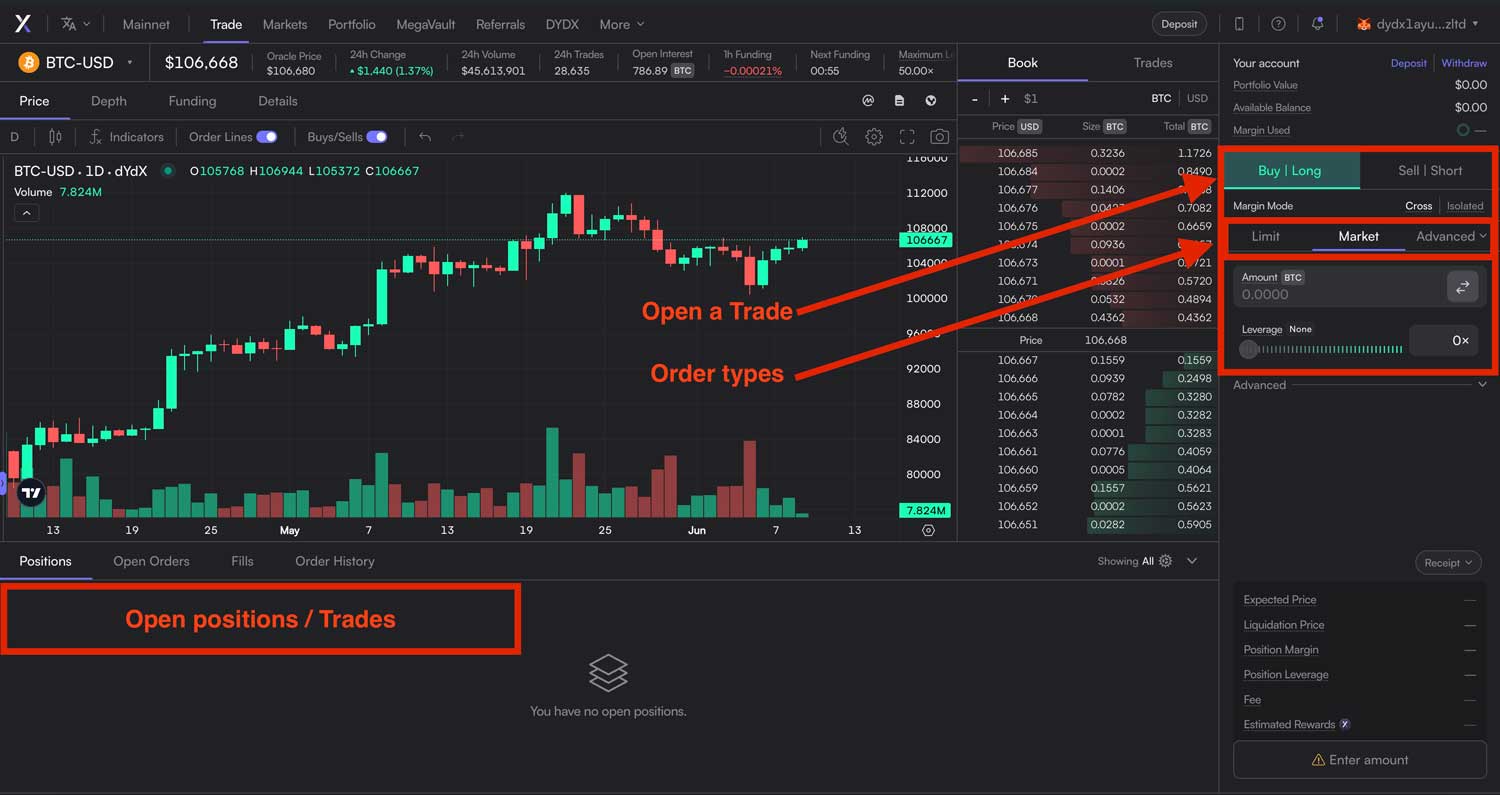

To open a trade simply:

- Connect your waller or Create an account

- Deposit funds

- Click on “Trade”

- Select order type & Order size

- Confirm order

If you're already familiar with centralized exchanges and using external wallets like MetaMask, you'll find it very easy to use a decentralized exchange like dYdX.

Is dYdX Safe and legit?

dYdX is considered one of the safer options for trading, especially for users concerned about centralized exchange risks. Since it’s a decentralized exchange (DEX), there’s no need for KYC verification, which means you won’t face issues like account bans or rejected documents. You also avoid the risk of exchange insolvency, as you remain in control of your own funds through your wallet. However, decentralized platforms come with their own set of risks, mainly technical ones, such as smart contract vulnerabilities or bugs. While dYdX is a well-audited and battle-tested platform, no smart contract system is completely risk-free.

$dYdX Native token

DYDX was an ERC-20 token on the Ethereum network. DYDX has moved to its own blockchain called the dYdX Chain, which is built on Cosmos. It now exists as a native token on the Cosmos-based dYdX Chain. The DYDX token is the main token used in the dYdX trading platform. It allows users to vote on important decisions, such as changes to the system or new features. Users can also stake (lock up) their DYDX tokens to help secure the network and earn rewards in return. Additionally, holding DYDX can give users discounts on trading fees and extra benefits during reward programs. In short, DYDX is used for governance, security, and rewards within the dYdX ecosystem.

dYdX Fees

The fee structure on dYdX is quite competitive. Maker fees are just 0.01%, and taker fees are 0.05%. This is slightly cheaper than platforms like Apex Omni, where maker fees start at 0.02% with the same 0.05% for takers. If you trade larger volumes, you can unlock even lower fees through dYdX’s VIP tiers. Plus, by signing up with our affiliate link, you’ll receive an extra discount on your trading fees. Now, let’s see how dYdX compares to some other decentralized exchanges.

dYdX vs. Apex Omni

Both dYdX and Apex Omni are decentralised exchanges, let’s have a look at their main differences:

|

Feature |

dYdX |

Apex Omni |

|

Fees |

0.01% / 0.05% |

0.02% / 0.05% |

|

Trading pairs |

89 Pairs |

81 Pairs |

|

Volume |

88 million (24 hour) |

221 million (24 hour) |

|

Max leverage |

50x |

100x |

At first glance, Apex Omni and dYdX appear quite similar. However, there are a few key differences that matter to active traders. One of the most important is trading volume, higher volume means better liquidity, which results in less slippage and a smoother trading experience. Apex Omni generally offers higher leverage options, which may appeal to more advanced or high-risk traders. You can check out our full Apex Omni tutorial for a step-by-step guide on how to use it. On the other hand, dYdX has slightly lower fees, making it more attractive for intermediate traders who prioritize lower fees. In short, Apex Omni may be better suited for larger, high-leverage traders, while dYdX is a great choice for those looking to keep trading costs low.

dYdX vs. Hyperliquid

Let’s have a look at dYdX vs. Hyperliquid, another big player when it comes to decentralised exchanges.

|

Feature |

dYdX |

Hyperliquid |

|

Fees |

0.02% / 0.05% |

0.015% / 0.045% |

|

Trading pairs |

89 Pairs |

168 Pairs |

|

Volume |

88 Million (24 hour) |

3 Billion (24 Hour) |

|

Max Leverage |

50x |

50x |

When comparing dYdX to Hyperliquid, there are some notable differences in trading volume and available pairs. However, dYdX charges slightly higher fees. As with most platforms, the choice depends on your priorities. Traders who deal with large order sizes and need deep liquidity may prefer higher-volume exchanges like Hyperliquid. On the other hand, if keeping things simple is your main focus, dYdX remains one of the most effective options.

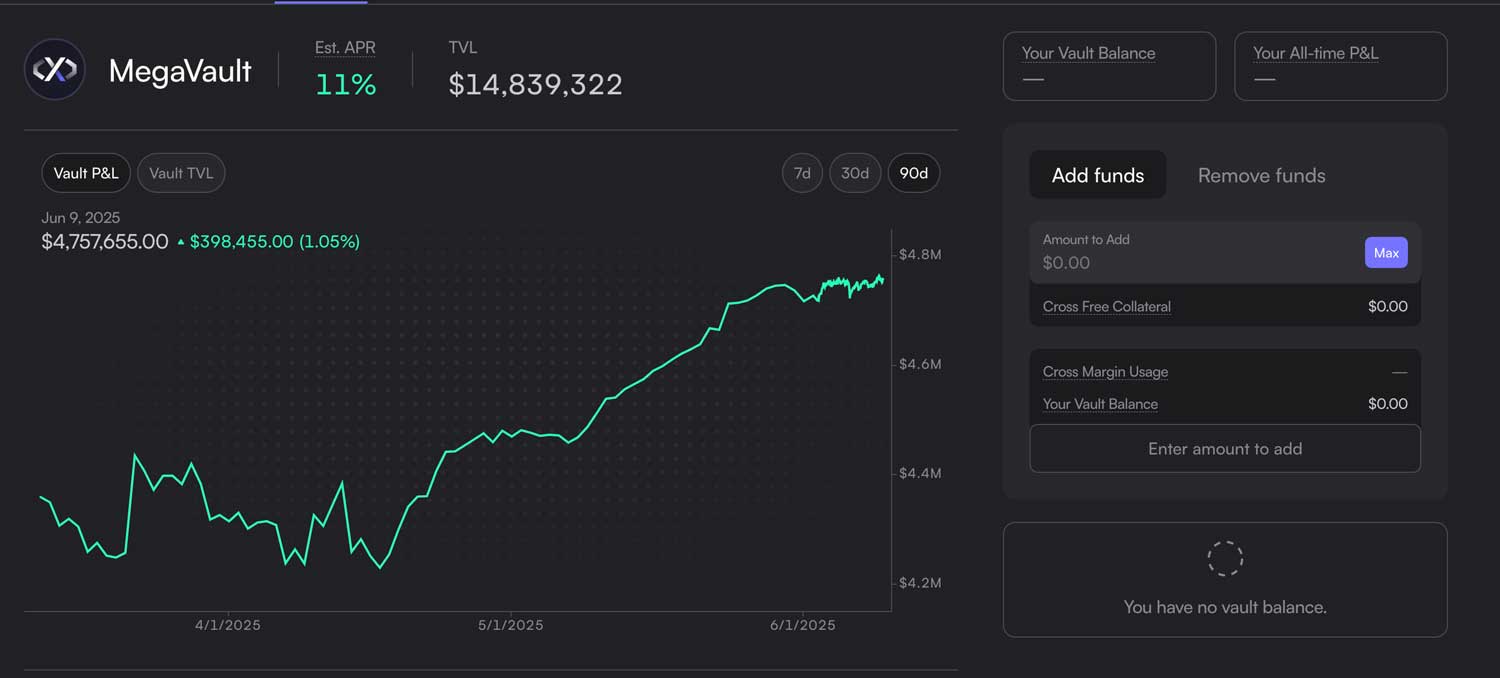

MegaVaults

MegaVaults are smart contracts that function like vaults, allowing investors to deposit funds that are then actively traded to generate yield. It’s similar to copy trading on centralized exchanges, but in the decentralized world, it's referred to as a “vault” due to the smart contract structure. The dYdX Vault automatically trades across dYdX markets and earns a portion of the platform’s fee revenue. It aims to maintain a market-neutral strategy by quoting both sides of the order book. However, performance depends on market conditions, and there's a risk of losing some or all of the USDC deposited. So, instead of copying a specific trader, you’re following an automated trading strategy developed by the dYdX team. If you’re looking into creating your own vault, then check out Apex Omni Vaults.

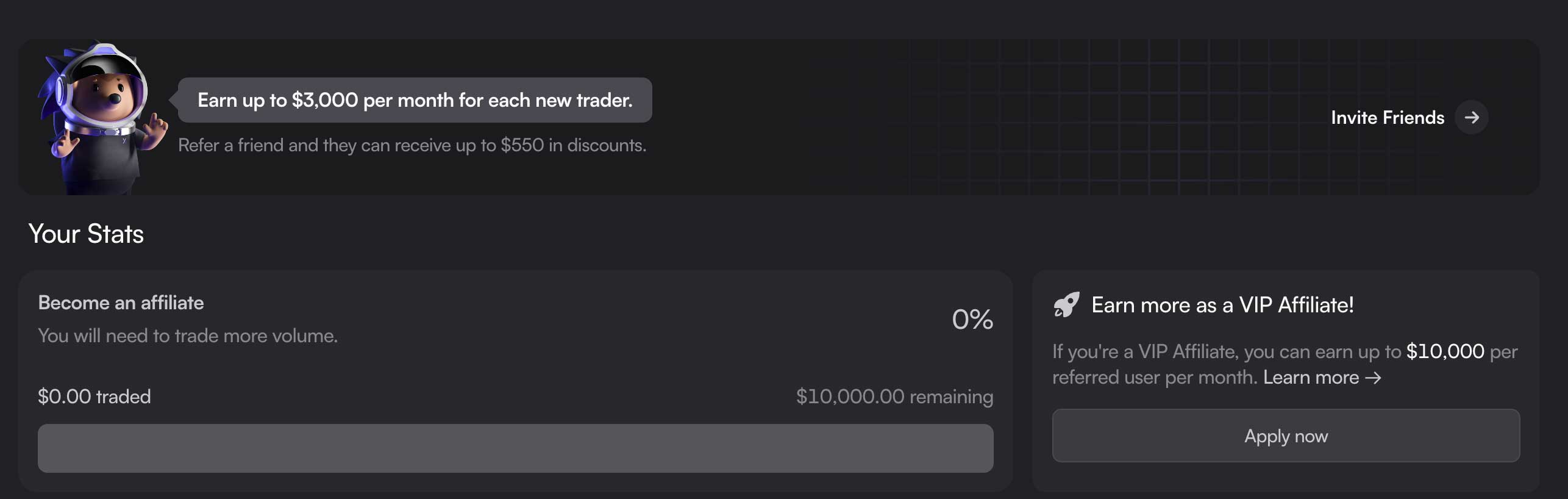

Referral Program

dYdX also offers a referral program that allows you to earn commissions based on the trading fees paid by users you refer. Through the standard referral program, you can earn up to $3,000 per month for each referred trader, with a 15% commission on their trading fees. If you have a larger audience or established platform, you can apply for the VIP Affiliate Program, which offers up to 50% commission, a significant increase compared to the standard tier.

dYdX Surge

The dYdX Surge Program is a nine-month trading competition offering up to $20 million in $DYDX rewards. Each season lasts one month, with traders competing for a share of up to $2.2 million based on their leaderboard rankings. Points can be earned by executing taker trades on dYdX, using official interfaces, staking $DYDX to a validator, and trading in boosted markets. Additional boosts apply for consistent trading days. The leaderboard, powered by Chaos Labs, updates in near real-time and ensures fair play with wash trading detection. Rewards are distributed at the end of each season based on your total points.

Pro’s and Con’s

|

Pro’s |

Con’s |

|

Decentralised (no KYC) |

Lower volume |

|

Low fees |

No deposit bonus |

|

Easy-to-use |

|

|

Passive Income (MegaVaults) |

|

Final Thoughts: Is dYdX the Best Decentralized Perpetuals Exchange?

dYdX stands out as one of the most robust and user-friendly decentralized exchanges for perpetual trading. It combines the functionality of a professional trading platform with the benefits of decentralization, no KYC, self-custody of funds, and low fees. With its migration to the Cosmos-based dYdX Chain, the platform has gained speed, flexibility, and independence from Ethereum’s limitations.

While other platforms like Apex Omni and Hyperliquid may offer higher leverage or more trading pairs, dYdX offers a low fee structure, and overall smooth user experience. It’s a great choice for intermediate to advanced traders who want full control over their assets with privacy while still being able to trade crypto.

Whether you're attracted to the low fees, the Surge rewards program, or the safety of non-custodial trading, dYdX provides a well-rounded solution for decentralized derivatives trading. If you're ready to trade without limits or verification hassles, dYdX is definitely worth considering in 2025 and beyond.

FAQ

What is dYdX?

dYdX is a decentralized exchange (DEX) that allows users to trade perpetual contracts on crypto assets like Bitcoin and Ethereum. It operates on the Cosmos blockchain and is non-custodial, meaning users trade directly from their own wallets without giving up control of their funds.

Do I need to verify my identity (KYC) to use dYdX?

No. One of the key benefits of dYdX is that it does not require KYC. You can trade directly by connecting your wallet, with no need to upload documents or verify your identity.

Is dYdX safe to use?

dYdX is considered one of the safer decentralized trading platforms. Since it’s non-custodial, your funds remain in your wallet. However, like all DEXs, it still carries some risk, mainly from smart contract vulnerabilities, although such risks are minimized through audits and security measures.

What are the trading fees on dYdX?

Trading fees on dYdX are competitive. Maker fees start at 0.02%, and taker fees are 0.05%. High-volume traders can unlock even lower fees through VIP tiers. Additional discounts are available if you sign up using a referral link.

What is the DYDX token used for?

The DYDX token is used for:

- Governance (voting on protocol upgrades)

- Staking to secure the network

- Fee discounts and reward incentives

It originally launched as an ERC-20 token but now exists as a native token on the dYdX Chain (Cosmos-based).

What is a MegaVault?

A MegaVault is a smart contract-based vault where users can deposit funds. The vault trades automatically using a market-neutral strategy and shares fee revenue with depositors. While it offers yield potential, there is still risk based on market conditions and performance.

How does dYdX compare to Apex Omni or Hyperliquid?

-

dYdX vs Apex Omni: dYdX has lower fees, but Apex Omni offers higher leverage and sometimes more trading volume.

-

dYdX vs Hyperliquid: Hyperliquid may have deeper liquidity, but dYdX is more cost-effective for users focused on fee efficiency and security.