Altcoin Season Index Explained: How to Use This Indicator to Profit from Alt-Season

Introduction

The crypto market moves in predictable cycles, and by recognizing these patterns, you can identify the most profitable coins to invest in at the right time. The key question is whether you want to hold Bitcoin or altcoins. Money often rotates between a Bitcoin-focused market and a speculation-driven altcoin market. But how can you tell when it’s time to shift your focus from Bitcoin to altcoins?

Short answer: The Altcoin Season Index.

In this guide, we’ll explain exactly how the Altcoin Season Index works, why it matters, and how you can combine it with other tools to maximize trading opportunities while managing your risk.

What Is the Altcoin Season Index?

The Altcoin Season Index is a market tool that helps traders determine if we’re currently in a phase where altcoins outperform Bitcoin, also known as “Altseason”. Outperforming Bitcoin means that the altcoin’s price increases more in USD than Bitcoin’s during the same period. Both can rise in value, but the altcoin shows stronger relative growth.

The Altcoin Season Index is a market tool that helps traders determine if we’re currently in a phase where altcoins outperform Bitcoin, also known as “Altseason”. Outperforming Bitcoin means that the altcoin’s price increases more in USD than Bitcoin’s during the same period. Both can rise in value, but the altcoin shows stronger relative growth.

How is the Altcoin Season Index Calculated?

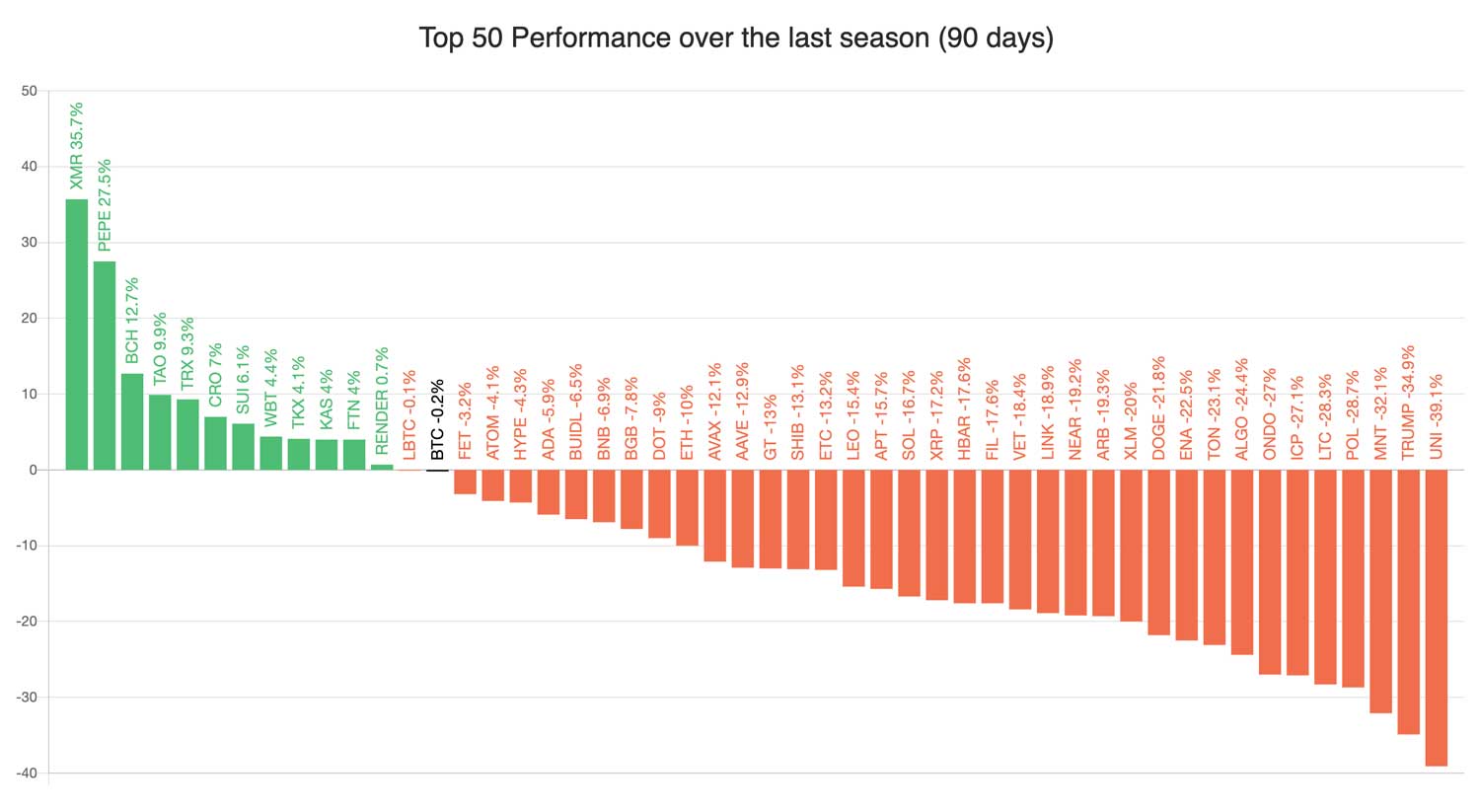

The Altcoin Season Index is calculated based on three metrics:

- The index evaluates the top 50 altcoins by market capitalization, excluding stablecoins and asset-backed tokens such as wBTC and PAXG (Gold).

- It looks at each altcoin’s performance over the last 90 days.

- If 75% or more of these altcoins have outperformed Bitcoin during this period, the market is officially in Altcoin Season.

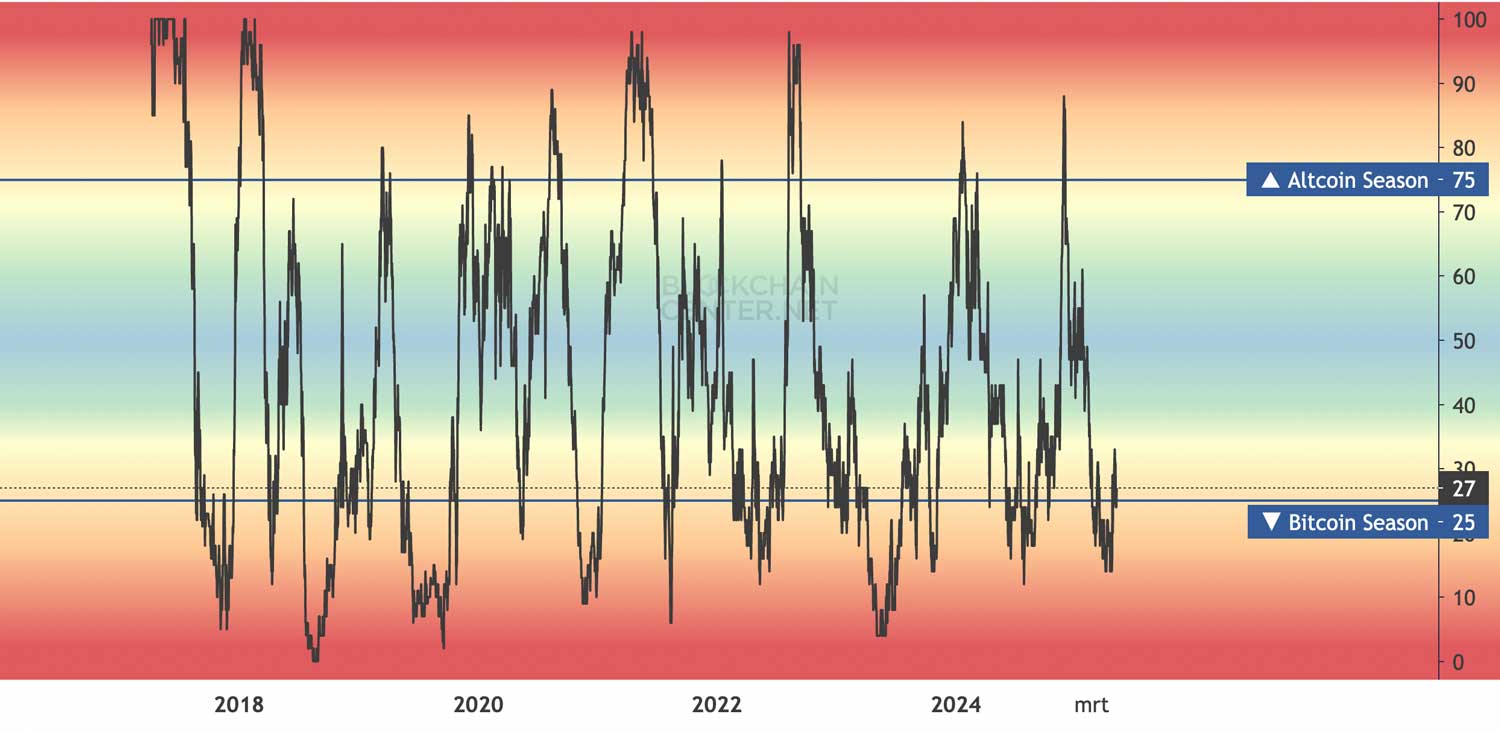

How to Read the Altcoin Season Index

Let’s divide the market in three different stages, Bitcoin season, Neutral, and Altcoin season.

- 0–25: Bitcoin Season: BTC outperforms most altcoins.

- 26–74: Neutral Market: No clear dominance.

- 75–100: Altcoin Season: Altcoins are leading the market.

Is the Altcoin Season Index a Lagging Indicator?

While the index is based on historical 90-day performance, it’s highly effective for identifying current market conditions. Think of it as a confirmation tool rather than a predictive one. It tells you whether the altcoin market is currently strong, which helps traders adjust their strategies accordingly.

How to Combine the Altcoin Season Index with Other Indicators for Safer Trading

1. Watch Bitcoin Dominance (BTC.D)

A falling Bitcoin dominance chart combined with a rising Altcoin Season Index signals a strong rotation into altcoins. So doing technical analysis on the Bitcoin Dominance chart can help you predict or foresee an altcoin season before it’s already in full swing.

2. Use Liquidation Heatmaps for Better Timing

Altcoin seasons bring increased leverage and speculative behavior. By analyzing liquidation heatmaps, you can pinpoint where large liquidations might trigger sudden price spikes or drops. This helps improve your trade timing and avoid getting caught in sudden market reversals.

3. Manage Risk Effectively

Altcoin rallies don’t last forever. Keep an eye on the index to recognize when the market is overheated. Consider rotating profits back into Bitcoin or stablecoins before a potential correction. Altseasons generally don’t last very long, so it’s best to time your positions accordingly.

Which Altcoin Season is it?

When the Altcoin Season Index rises, signaling an altcoin season, it means liquidity is flowing into altcoins. But not all altcoins move equally, some sectors often outperform others. Liquidity tends to rotate between sectors, rather than flooding the entire altcoin market at once.

For example, during an altcoin season, DeFi tokens might lead the rally. After that, liquidity could shift to meme coins, gaming tokens, or even ISO 20022-compliant assets like XRP and XLM. These sector-based moves often happen in waves, with groups of tokens pumping together.

Because of this rotating behavior, several sector-specific indexes have been created. These tools allow you to track the relative strength of different altcoin sectors and spot where liquidity is flowing next.

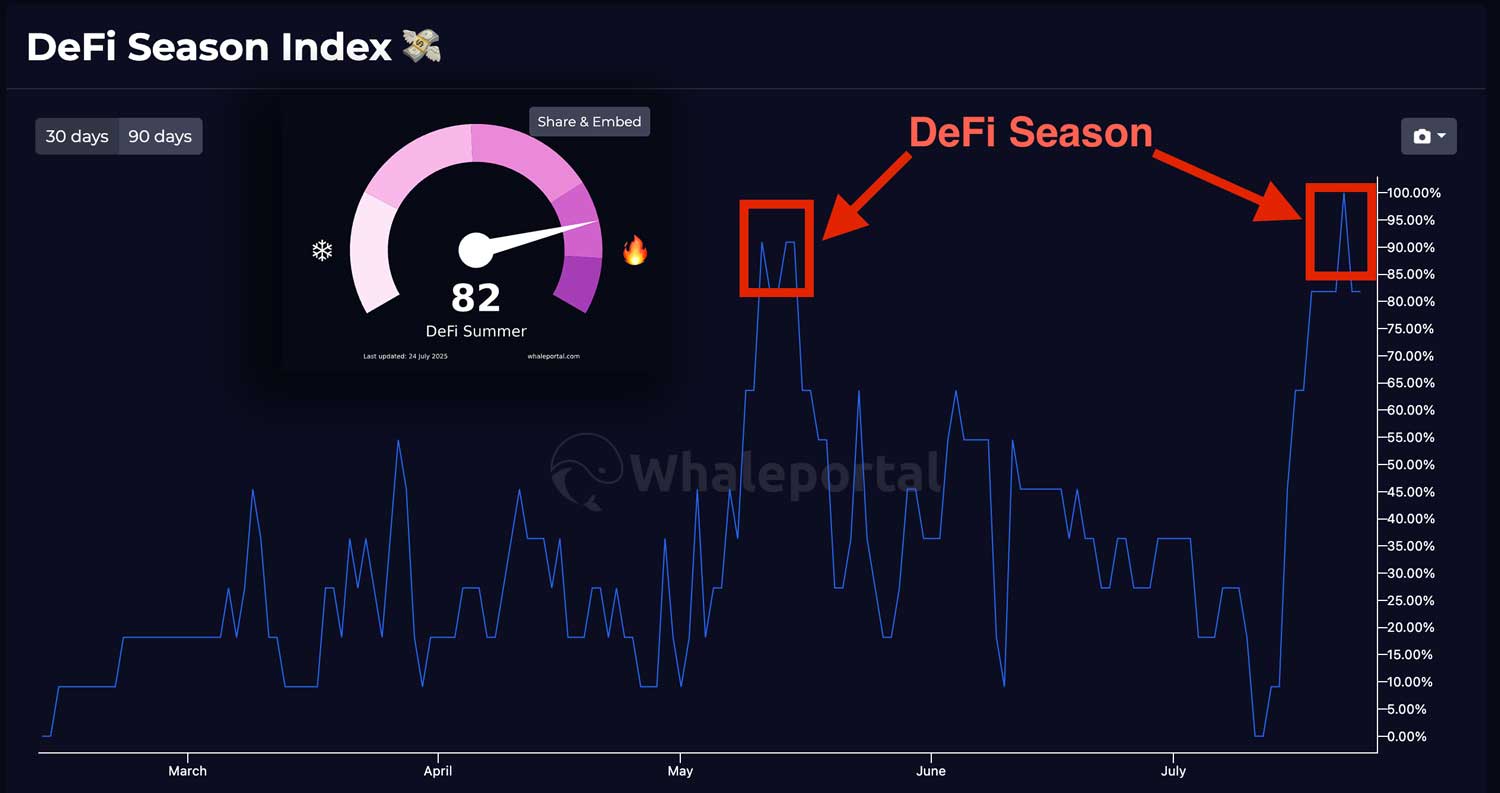

DeFi Season Index

The DeFi Season Index tracks the performance of DeFi tokens relative to Bitcoin over a 30- or 90-day period. When this index is at a high level, it not only confirms that we’re in an altcoin season, but also shows that most of the liquidity within altcoins is flowing into DeFi projects. In other words, DeFi is catching the hype.

Meme Season Index, Gaming and ISO20022

Other seasonal indexes include the Meme Season Index, the Gaming Season Index, and the ISO 20022 Season Index. In the example above, the strongest performance is seen in the ISO 20022 sector, with tokens like XRP, HBAR, and XLM leading the way. These tokens are compliant with the ISO 20022 messaging standard, and their collective strength adds an extra layer of insight. By using these sector-specific indexes, you can fine-tune your strategy within an altcoin season and identify which sectors are currently the most attractive.

Other seasonal indexes include the Meme Season Index, the Gaming Season Index, and the ISO 20022 Season Index. In the example above, the strongest performance is seen in the ISO 20022 sector, with tokens like XRP, HBAR, and XLM leading the way. These tokens are compliant with the ISO 20022 messaging standard, and their collective strength adds an extra layer of insight. By using these sector-specific indexes, you can fine-tune your strategy within an altcoin season and identify which sectors are currently the most attractive.

Finding the Right Exchanges for Altcoin Trading

To take advantage of altcoin seasons, you’ll need access to platforms with:

- Amount of Altcoins offered (availability)

- High liquidity on altcoin pairs (to prevent slippage)

Explore our crypto exchange comparison list to find the best platforms for altcoin trading.

Prefer to trade more anonymously? Check out our no-KYC exchange list for exchanges that let you trade quickly without identity verification.

Conclusion

Altcoin season is one of the best opportunities for traders to make profits. Therefore it’s important to know exactly when there is strength in altcoins. The Altcoin Season index is a perfect tool to determine when alt season is active and opportunities are high. If you're looking for specific alt-coins like meme tokens, have a look at the Meme Season Index.

Related Articles:

- Best Decentralized Crypto Exchanges in 2025 (Ranked & Compared)

- Bitcoin 60-day Cycle Explained

- Wealth Transfer and Crypto Prophecies