Apex Omni Vaults Explained: Copy-trading On a Decentralised Exchange

Decentralized exchanges are growing in popularity due to benefits such as no KYC requirements and self-custody of assets. In addition, many services previously limited to centralized platforms like Bybit, such as copy-trading, are now becoming available on decentralized exchanges. Apex Omni introduces its version of copy-trading, called “Apex Omni Vaults,” which creates value for both traders looking to enhance returns with their strategies and investors seeking passive income by investing in those strategies. If you're looking to explore regular trading, have a look at our Apex Omni Tutorial.

Want to start directly? Become a copy-trader or investor on Apex Omni today.

What Are Apex Omni Vaults?

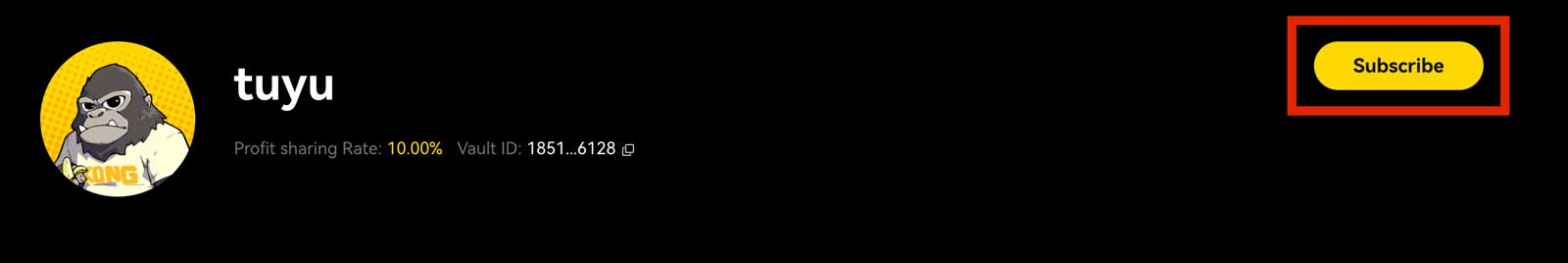

Apex Omni Vaults are smart contracts that enable copy-trading directly on a decentralized exchange. Each vault is linked to a trader’s account, allowing investors to allocate funds into the vault. When the trader generates profits, 90% of those profits are distributed to the investor, while the remaining 10% goes to the trader.

This is copy-trading without middlemen or centralized control. It’s secure and transparent, thanks to smart contracts that handle everything on-chain. There are no lock-in periods for withdrawals, and the system is fully permissionless. Anyone can create a vault, and anyone can invest.

Unlike centralized exchanges like Bybit, where traders must go through verification and approval before offering copy-trading, Apex Omni simplifies the process. No gatekeepers, no delays, just decentralized, trustless copy-trading for everyone.

How Do Apex Omni Vaults Work for Traders?

If you’re an experienced trader with a consistent strategy, you can open a vault and trade using both your capital and capital deposited by others.

Key benefits:

- Low barrier to entry: Start with only 100 USDT.

- Profit sharing: Keep 10% of the profits generated by investor capital.

- Scalability: Run up to 5 vaults simultaneously per account.

- API Access: Automate your strategy using the API for seamless integration.

This opens the door for algorithmic traders or anyone with a working strategy to turn it into recurring income.

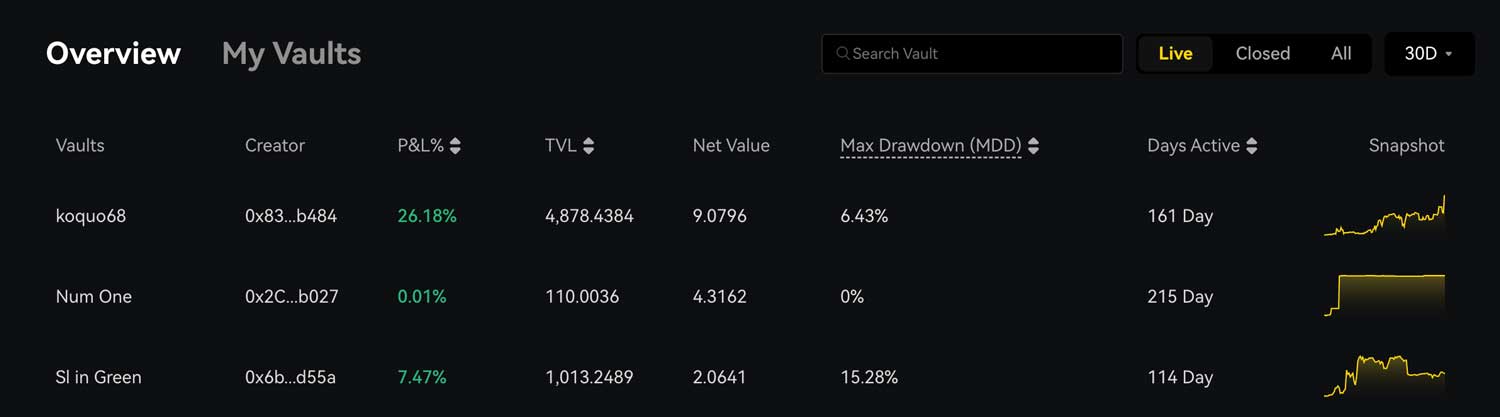

The performance of your strategy is displayed on the leaderboard, making it visible to potential investors seeking passive income opportunities. Strategies with consistent returns and minimal drawdowns are more likely to attract attention. In this way, your results serve as your marketing by demonstrating your value and helping to attract capital into your vault.

How It Works for Investors

You don’t need to be a trader to benefit. By depositing funds into a vault of your choice, you let experienced traders do the work for you.

Why it works for investors:

- 90% profit share: You’ll get 90% of the profits made with your investment.

- Full control: Withdraw anytime; lock-up time is mostly only 1 day.

- Insights: See past performance, risk profile, strategy descriptions, and more before you commit.

There’s no need to guess, you can analyze historical stats and follow vaults that match your risk appetite and you can withdraw at any time your funds out of the smart contract.

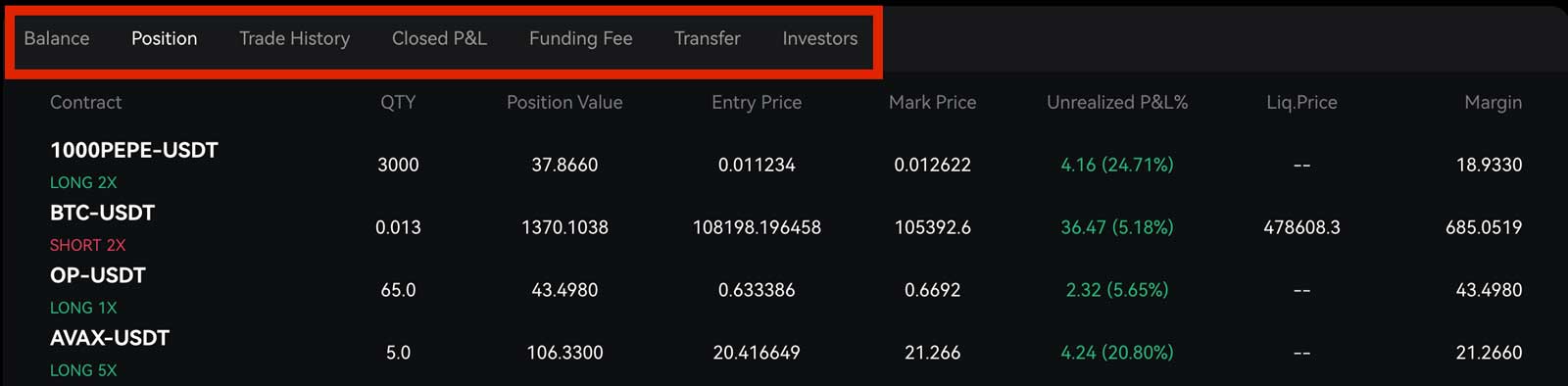

Apex Omni Vaults are very transparent. You can even see current open positions, the closed PNL, which investors follow the trader and for how long, as well as the trade history. So you can basically see everything before, during, and after copying a specific trader which presents an honest view of who you are going to copy.

How to Follow a Vault

Here’s a quick walkthrough:

- Connect your wallet to the ApeX Omni Exchange interface.

- Browse available vaults: Select looking at the P&L, Max Drawdown etc.

- Click into a vault to see details, past trades and performance.

- Click "Subscribe" and confirm the amount you want to put in the vault, then click “confirm”.

Everything is handled via smart contracts, no one has custody of your funds. It’s transparent and trustless.

How to Create Your Vault on Apex Omni

If you’re an active trader and want to create a vault, you need to connect your wallet with Apex Omni or create an account using an email and have at least 100 USDT which needs to be put into the vault. It’s a very easy process just simply:

- Connect your wallet (or create an account) and go to “Vaults"

- Click “Create”

- Choose a Vault name & description

- Select the Amount of funds you want to deposit.

- Start trading and create a good performance for the leaderboard.

Risks of Apex Omni Vaults

Every opportunity that generates yield involves some level of risk, and Apex Omni Vaults are no exception—for both traders and investors.

Starting with the risks for the trader: although the Apex system is well-developed, it relies on smart contracts, which are never entirely free from vulnerabilities. There is always a small chance of a smart contract being exploited, as happened with Ethereum in 2016. While the likelihood is low, it is not zero. Still, this does not necessarily make it more dangerous than copy trading on a centralized exchange, which can also be exposed to hacks.

The risks may be more relevant for investors. Traders cannot directly access investor funds, but they can execute trades with them. If a trader makes poor decisions, it could lead to losses of the capital the investor deposited into the vault. This risk is not unique to Apex Omni; it is also present when using centralized platforms that offer copy trading.

One advantage of a decentralized exchange (DEX) like Apex Omni is that investors always remain in control of their funds. On centralized exchanges, users sometimes face issues withdrawing their assets due to required identity verifications, long waiting times, or manual payment approvals. These are risks you don’t typically encounter on a DEX.

Final Thoughts

Apex Omni Vaults really offers a unique opportunity for the freedom-seeking cyberpunks out there who either want to dip their toes into generating passive income or the profitable traders who are looking for extra rewards for their strategy. Apex Omni offers many advantages when it comes to its copy-trading platform that you simply do not have on a centralised exchange.

Interested in Using Apex Omni Vaults? Connect your wallet and start trading today!

Related Articles:

- Apex Omni Tutorial Step-by-Step

- Best no-KYC Exchanges of 2025

- Bybit Deposit Bonus Guide