Apex Omni vs Aster. Which DEX Dominates the DeFi Trading War?

The decentralized exchange (DEXs) landscape has continued to undergo a radical shift, with two platforms in particular, namely Apex Omni and Aster, emerging as the frontrunners for DeFi’s next phase of evolution. For starters, both platforms offer on-chain, non-custodial trading alongside various advanced features traditionally found on centralized exchanges (CEX). In this review, we will compare the two offerings in terms of their technological base, trading experience, liquidity, fees, and much more

Apex Omni - A brief overview

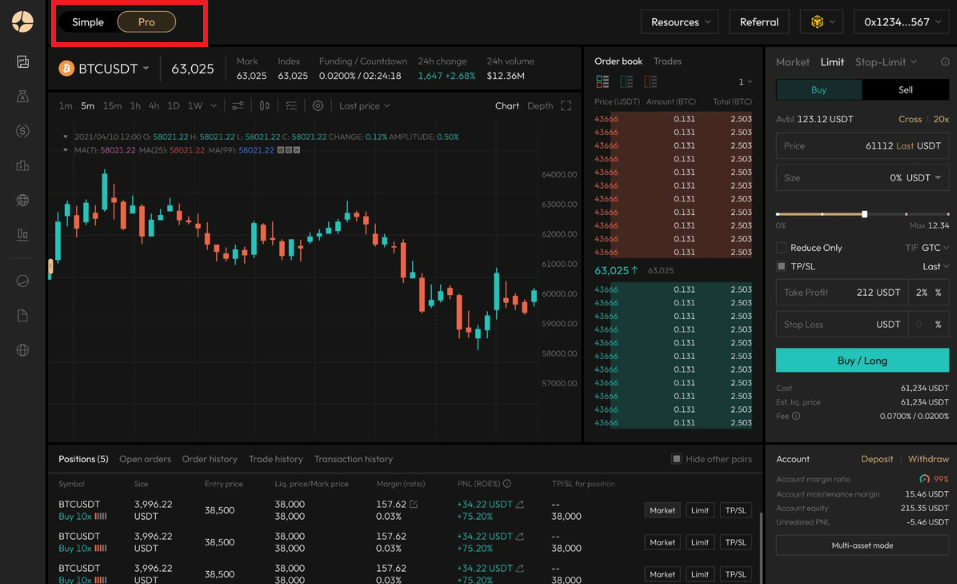

Apex Omni’s trading interface resembles that of Bybit, a popular CEX, featuring a full order book, charting tools, and even a “vault” panel replete with passive yield opportunities (e.g., earning massive APYs from liquidation fees). The platform offers both spot and derivatives trading with up to 100x leverage.

Apex’s interface and overall ease of use enable traders to connect their wallets (such as MetaMask) and access a Bybit-style dashboard, complete with advanced charting, order books, and order types, all without any KYC or custodial risk.

Join Apex Omni Today and receive 5% Discount on your fees.

Moreover, the platform operates on an aggregated multichain liquidity model, using a zkRollup (zkLink) architecture to tap liquidity across Ethereum, BNB Chain, Solana, Base, and more while enforcing security with zero-knowledge proofs.

Key Features

- It supports both spot trading (0% fees) and perpetual futures with up to 100× leverage, covering around 80+ crypto pairs. Moreover, it offers copy-trading and social trading tools where users can become “strategy providers” and allow others to automatically copy their trades, earning a share of followers’ volume, or conversely follow top traders to mirror their strategies

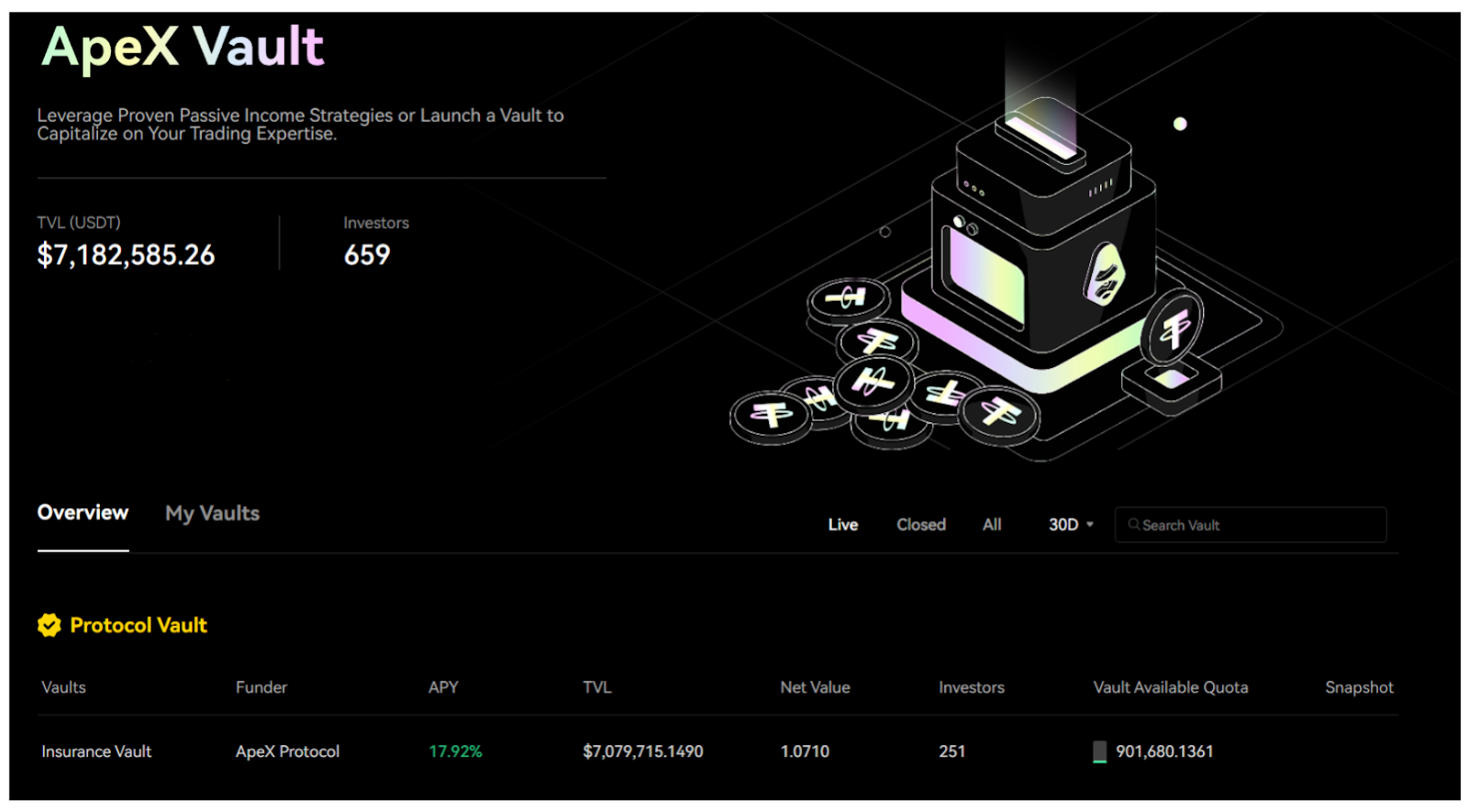

- Apex offers its clients ‘vaults,’ i.e. smart contracts where users stake funds to earn a portion of the exchange’s liquidation fees, with some yielding up to 30%+ APY during favorable market conditions. For more automation and CEX like experience, grid trading bots and advanced conditional orders are also built-in.

- It comes with access to prediction markets, letting users bet on real-world events or crypto outcomes directly on the platform. The ecosystem is powered by the $APEX token (originally from the ApeX Protocol) which is central to Apex Omni’s rewards. In fact, earlier in 2025, the team allocated 25 million APEX tokens from its treasury to reward active users (an airdrop campaign) and introduced staking and VIP tiers for trading fee discounts.

Performance and Growth

Since its debut, Apex Omni has registered steady but solid growth so much so that by Q1/Q2 2025, it had amassed over 545,000 users, $124+ billion cumulative trading volume and $1.3 billion daily trading volume giving it roughly 3–5% of the decentralized perps market (moreover, during special events like its XP reward campaign, volumes spiked even higher).

From a security and tech perspective, one can see that Apex leverages zk-rollups (where transactions are batched and validated via cryptographic proofs on Ethereum) and is non-custodial, meaning that users hold their keys at all times and even withdrawals can be proven on-chain. Last and perhaps very importantly, there are no KYC requirements, yet privacy is maintained without sacrificing performance.

Aster - A brief overview

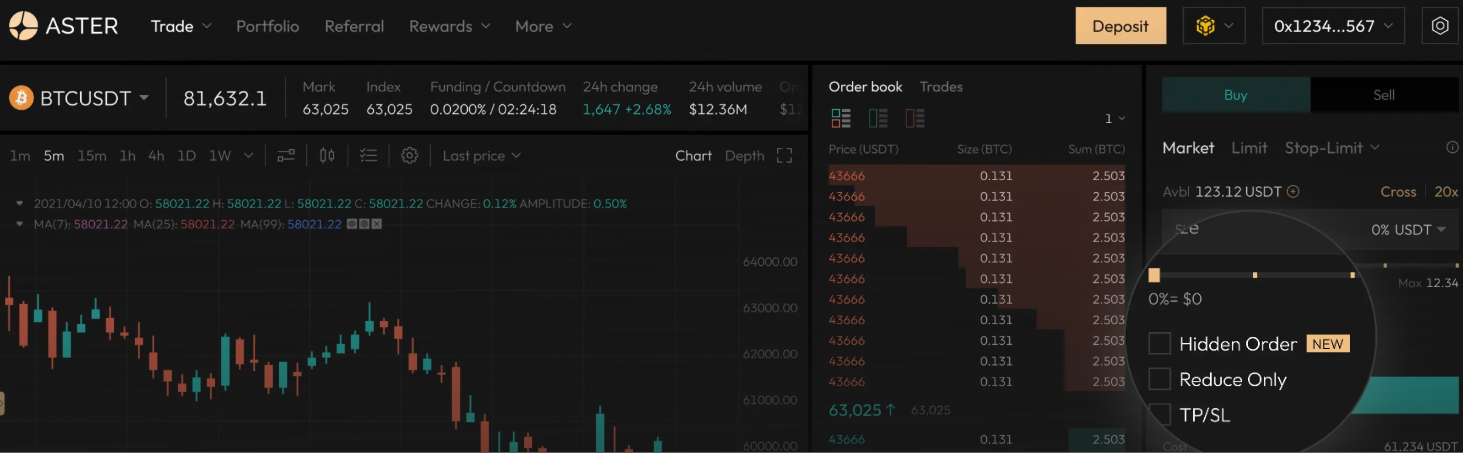

Aster’s Pro trading interface (dark mode shown) provides a professional order book setup with advanced controls. The platform also offers a “simple” mode for quick, on-chain trades, emphasizing speed and high leverage.

Having burst onto the DeFi scene in 2025, the platform emerged as a result of a merger between Astherus (a liquidity protocol) and APX Finance (a perp exchange). It operates across the BNB Chain (primary), Ethereum, Solana, and Arbitrum, allowing traders to choose their preferred chain for execution. That said, Aster mainly positions itself as a “perpetual-native, multi-chain, privacy-aware DEX” (in an effort to target both hardcore traders and those frustrated with traditional exchange limitations).

Key Features

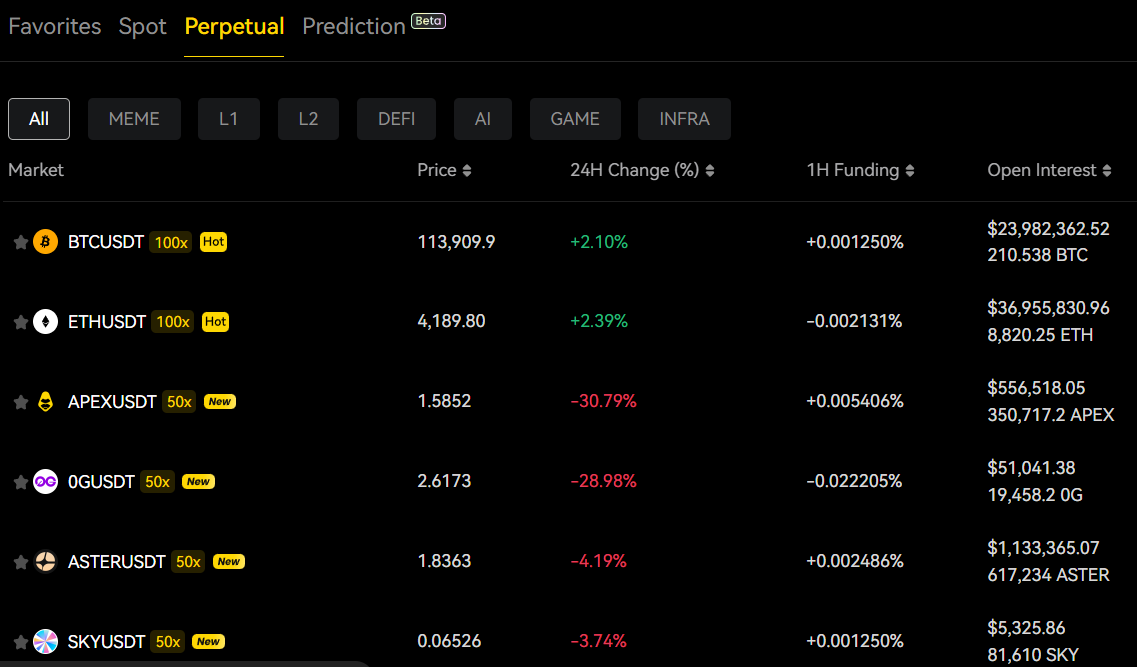

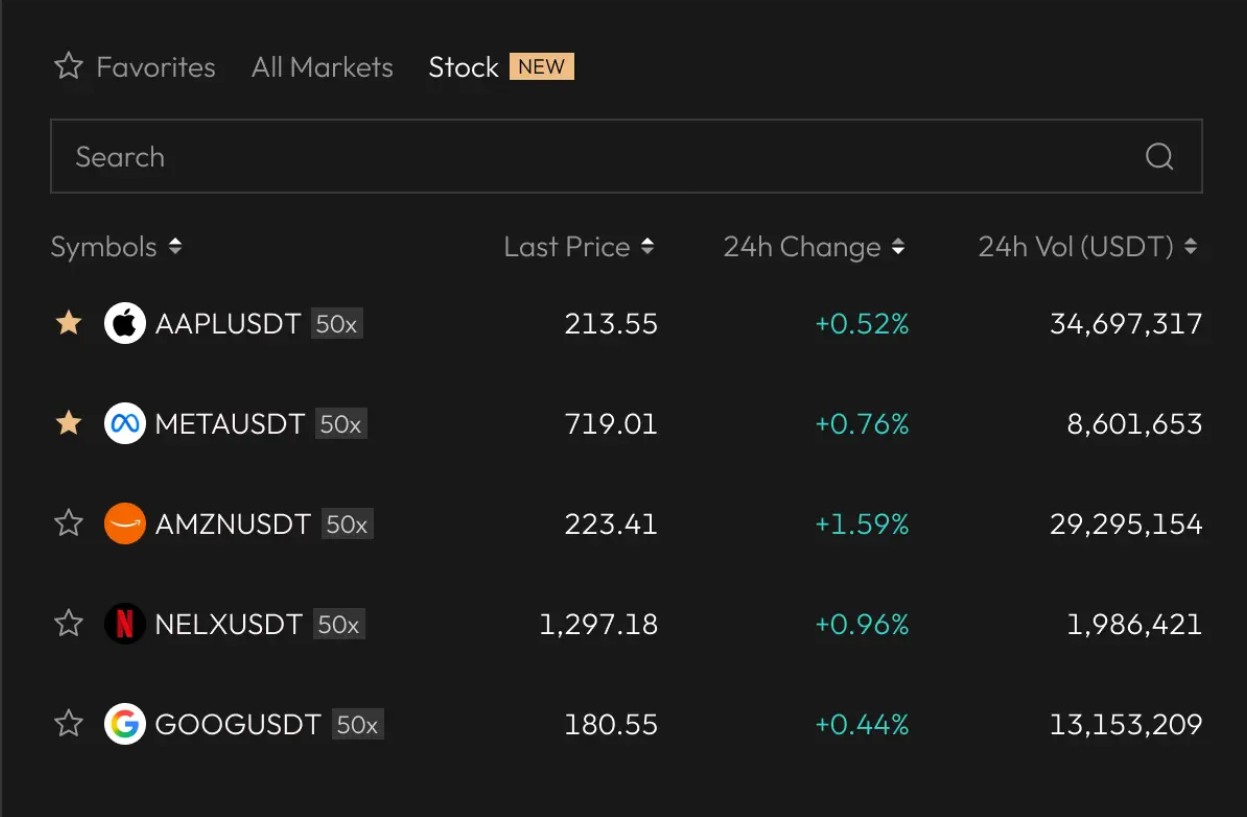

- Aster is laser-focused on perpetual futures trading, including some novel markets. Traders can go long or short on cryptocurrencies and even major U.S. tech stocks (through synthetic stock perpetuals) around the clock.

- It offers two core modes of operation:

- Simple mode: Users are presented with an ultra-streamlined interface where they don’t even deposit funds into the exchange; instead all they have to do is simply connect their wallets and open a position directly, with the system using the wallet’s assets as collateral. This mode supports only select top pairs (like BTC-USD) on BNB and Arbitrum and enables a headline-grabbing maximum leverage of 1001×.

- Pro mode: offers a deep order book exchange with advanced order types (including hidden orders and iceberg orders), bracket orders, take-profit/stop-loss combos, and more. It also allows cross-margin with multi-asset collateral.

- Aster’s most standout feature is probably its privacy framework and MEV-resistance. It introduces ‘Hidden Orders’ on its pro order book, so large orders do not appear publicly until executed, mitigating the risk of front-running and sandwich attacks. Additionally, Aster’s trade matching uses MEV-aware routing to prevent miner-extractable value exploits, aiming to preserve fair pricing for traders.

- On the liquidity side of things, Aster deploys a hybrid setup such that for the on-chain ‘Simple mode’ trades, it uses an ALP (Automated Liquidity Pool) where users can contribute assets to a pool that acts as the counterparty (similar to GMX’s GLP model). Meanwhile, the Pro mode taps liquidity across chains and integrates with major oracles (Pyth, Chainlink, Binance Oracle) for pricing.

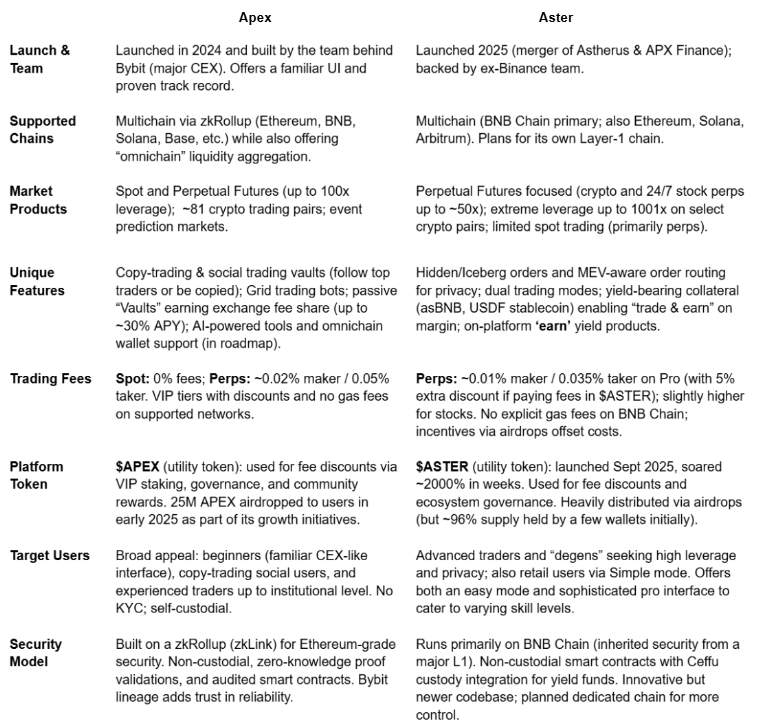

A head-to-head comparison

Apex Omni and Aster take different approaches under the hood to achieve a secure, high-performance DEX experience. Apex, for instance, is built on a zkRollup infrastructure (zkLink X), which means trade execution happens off-chain for speed, but every batch of trades is validated by cryptographic proofs on Ethereum (offering the latter’s security and finality, while keeping trading latency low).

Also, it aggregates liquidity and orders across multiple chains but centralizes the matching in a secure layer, ensuring users can always withdraw assets via the rollup proofs even if the front-end goes down. Since Apex is non-custodial, users remain in control of funds (no deposits are held by an exchange operator; instead, collateral is managed by smart contracts that the user can withdraw through L1 if needed).

Furthermore, Apex Omni invites both decentralized and centralized market makers via open APIs, effectively bridging CeFi and DeFi liquidity. While this improves liquidity, Apex’s matching engine still operates in a decentralized manner through its rollup, balancing speed and trustlessness.

Aster’s technical design, on the other hand, uses a multi-pronged approach. Initially, Aster ran primarily on BNB Chain (a high-throughput blockchain with low fees), thus requiring its security to partially rely on the underlying chains. To mitigate front-running and MEV, Aster employs custom logic.

That said, one key contrast between the two platforms is the tradeoff between privacy vs transparency as Apex Omni, being a rollup, posts validity proofs and some data on Ethereum, ensuring a high degree of transparency (withdrawal proofs are on-chain. Aster, with its hidden orders and private execution, means the ecosystem is a bit more closed.

Trading Features and Products

When it comes to trading capabilities, Apex Omni is all about breadth and familiarity, whereas Aster emphasizes innovation. Some key points in this regard include:

(i) Markets Offered: Apex Omni supports both spot trading and perpetual Futures markets, allowing users to process simple buy/sell of actual crypto assets (spot) or trade derivatives with up to 100x leverage on major coins (perps). Aster is focused almost entirely on perpetuals, including stock-indexed perpetuals (e.g., Tesla, Apple, etc.) so crypto traders can get exposure to equities 24/7.

Apex vs Aster perpetuals offerings

(ii) User Interface & Modes: Apex Omni presents a single, unified interface that’s very similar to the CEX dashboard of platforms like Bybit or Binance, complete with charting tools, order book, trade history, etc., all in one screen. In contrast, Aster offers two modes, ala simple and pro, which are vastly different in terms of their usability.

(iii) Advanced Order Types: Apex Omni provides the typical limit, market, stop orders, etc., and thanks to its CLOB design, all of these transaction types execute quickly. It also supports algorithmic orders through its grid bot feature (which lets you set up automated grid trading to buy low/sell high in a range). Aster’s distinctive offering is the Hidden (Dark) Order on its order book, preventing other traders from seeing large pending orders and potentially moving the price in anticipation. Aster also supports iceberg orders (only a small portion of a large order is displayed at a time).

(iv) Copy Trading & Social Features: Apex Omni clearly outshines Aster in the realm of social trading as the latter does not offer copy trading or leaderboards at this stage (it’s more geared toward individual traders).

Fees and Trading Experience

Any trader knows that the cost of trading and their overall experience are critical factors when it comes to choosing a DEX. Here is a breakdown of what Apex Omni and Aster charge:

(i) Trading Fees: On Apex Omni, spot trades are fee-free (0%), which is great for casual investors swapping tokens. For derivatives, Apex charges a flat 0.02% maker / 0.05% taker fee on par with or lower than many peers. Notably, Apex operates gas-free for users on its supported chains; since trades are done via the rollup, traders aren’t directly paying L1 gas for each order. Aster’s fees on Pro mode start at 0.01% maker / 0.035% taker. However, its stock perps have higher fees (around 0.1%/0.2% maker/taker as listed) due to the added complexity of equity pricing. Also, in Aster’s ‘simple mode,’ there are implicit costs like a slightly larger spread or funding rate adjustments since it’s fully on-chain.

(ii) VIP Discounts and Rebates: Apex Omni has a VIP program whereby staking $APEX tokens or hitting volume milestones, traders can unlock fee tiers with maker rebates or reduced fees. This means even moderate traders can work their way to virtually 0% fees or even earn rebates on maker orders, incentivizing liquidity provision. Aster, on the other hand, too offers a similar VIP program.

(iii) Funding Rates: Since both platforms offer perpetual futures, funding rate costs come into play for holding positions. These aren’t set by the exchange but by market conditions. There isn’t a significant difference here as both Apex and Aster facilitate the periodic payment between long and short traders to keep contract prices aligned with spot indices.

(iv) User Experience: Apex Omni’s UX is often praised for being smooth and familiar with their being a minimal learning curve. However, Aster’s interface is more complex and might feel overwhelming to a beginner.

(v) Speed and Performance: Given Apex Omni uses a zkRollup, order execution is very quick (comparable to layer-2 speeds) with there being minimal delay for most actions. Aster, running on BNB Chain and others, also boasts low latency.

Liquidity and Performance Metrics

A DEX’s success depends on liquidity (tight spreads, deep order books) and the trading volume it can attract.

(i) Trading Volume & Market Share: Apex Omni, despite being relatively new, ramped up to significant volumes, handling around $1.3 - 1.4 billion in daily volume by mid-2025, placing it only below giants like dYdX and Hyperliquid. Aster, in contrast, experienced explosive growth following the weeks of its launch, locking billions in trade volume. In fact, on September 23, 2025, Aster traded about $13.5B in 24 hours.

(ii) Liquidity and Order Books: Apex sources its liquidity from centralized market makers and any user who wants to place orders via API. This has led to very healthy order books on key pairs, with one report highlighting that even a $2 million order on ETH could be filled with no slippage on Apex.

(iii) Slippage and Spreads: For a trader, what matters is that they can enter/exit without moving the market. Both platforms perform well on major pairs with Apex’s integration of professional market makers resulting in CEX-like tight spreads on coins like BTC, ETH, etc. Aster’s ALP pool ensures that even huge orders on Simple mode find a counterparty (the pool) but slippage depends on pool depth and price impact formulas. On Pro mode, Aster also has market makers (possibly some of the same trading firms, incentivized by high volume) providing liquidity.

(iv) Stability and Sustainability: A question mark is how sustainable Aster’s volumes are in the long-term as history (like the Sushiswap vs Uniswap saga) has shown that once token incentives taper, volumes often drop.

(v) Institutional vs Retail Liquidity: Apex Omni’s approach of familiar UI and copy trading suggests it’s courting a broad range of users, including retail traders and even newbies (with its education and AI tools forthcoming). Aster, while having attracted big whales and institutions early, has yet to prove itself in the larger scheme of things.

Primary Income and Yield Opportunities

Beyond active trading, both Apex Omni and Aster provide ways for users to earn yield or passive income, though they approach this in different ways aligned with their platform philosophies.

(i) Apex Omni: A core earning feature on Apex is its ‘vaults’ offering which is like a pooled fund that takes the opposite side of liquidations on the exchange (in simplified terms). When highly leveraged positions get liquidated, a fee is collected. Apex Omni shares those liquidation fees with Vault depositors, yielding sizable returns.

(ii) Aster: The platform’s core USP is its ability to use yield-bearing assets as collateral. For instance, if a user deposits asBNB (a token that represents staked BNB accruing staking rewards) as margin, they can continue earning BNB staking yield while it sits as collateral for your trades. Similarly, USDF, Aster’s native yield-enabled stablecoin, accrues yield from a basket of DeFi strategies even as it’s used as margin.

Then there’s also Aster Earn, the platform’s investment product for those who want to park funds for yield. This is separate from trading where users can choose from various strategies (possibly lending, farming on other chains, etc.) all managed by Aster’s team and partners, including CeDeFi options (CeFi-DeFi hybrids) and things like Ceffu custody for added security.

Conclusion

From the outside looking in, both Apex Omni and Aster seem to highlight the rapid innovation emanating from today’s DEX landscape, all while catering to slightly different audiences and priorities. Apex Omni, for instance, comes across as an all-rounder, thanks to its user-friendly UI and packing of advanced tools. Aster, on the other hand, has sought to push the envelope of DeFi tech with unheard-of 1001x leverage while embracing privacy and liquidity. In other words, it’s the platform for the adventurous trader.

That being said, one can argue that Apex Omni provides a more balanced and arguably more trusted environment for long-term trading. Its feature set encourages learning and earning in a way that’s accessible, and it doesn’t rely solely on incentives to keep one around. Aster offers raw excitement and cutting-edge tools that can be incredibly rewarding but also require a bit more savvy and vigilance to navigate safely.

Join Apex Omni Today and receive 5% Discount on your fees.

Related Articles:

- Best Decentralized Crypto Exchanges in 2025 (Ranked & Compared)

- Apex Omni Vaults Explained: Copy-trading On a Decentralised Exchange

- Apex Omni Tutorial: Trade on Bybit’s Decentralized Exchange (Step-by-Step Guide)