Bybit

Bybit

Visit BybitTrading volume (24h)

$7,638,968,353.903Open interest

$3,159,386,810.58Bybit is a cryptocurrency derivatives trading platform that provides advanced trading tools, including leverage trading and perpetual contracts, for a variety of digital assets such as Bitcoin, Ethereum, and others. Moreover, the platform offers a user-friendly interface, multiple charting options, and a variety of order types to facilitate trading for both novice and experienced traders.

Rating

92Location

United Arab EmiratesContract types

USDT, USDC and Coin MarginedMaker fee

0.01 %Taker fee

0.06 %Max leverage

100xUS allowed

NoDeposit methods

Credit card, Wire transfer, CryptoAverage funding fee (BTC)

-0.0056%Table of contents

- Bybit Review: A Comprehensive Analysis of the Cryptocurrency Exchange

- An Overview of Bybit

- Why Choose Bybit?

- Detailed Breakdown of Bybit’s Features

- Bybit’s Intuitive User Interface

- Utility Laden Smartphone Application

- Support for Web3 and NFT-related Applications

- Quality Customer Support

- Bybit’s Various Contract Offerings

- Inverse and USDT/USDC Perpetual Contracts

- Bybit's Perpetual Futures Contract and Dual Price Mechanism Explained

- What Order Types Does Bybit Support?

- Advanced Order Options Available on Bybit

- Additional Features and Comparisons With Other Exchanges

- Is it Easy to Open an Account on Bybit?

- How Do Deposits/Withdrawals Work on Bybit? Is the Exchange Safe?

- What Does Bybit’s Native Fee Structure Look Like?

- How Airtight is Bybit’s KYC Framework?

- What Data Analytics Tools and Options Is Bybit Offering?

- Other Key Aspects of Bybit Worth Noting

- Bybit’s Exchange Testnet: A User-Friendly Way to Try Trading Without Real Funds

- Bybit Trading Competitions: Battle it Out for Massive Prize Pools

- Bybit Calculator and Bot Support: Making Trading Easy

- Bybit’s Referral Program: Earn Commissions and Discounts

- Bybit’s Copy Trading Module: An Easy Way for New Traders to Learn

- An Overview of Bybit’s Automated Trading Bot

- Final: Is Bybit Worth Considering for Your Crypto Trading Needs?

- FAQs

Bybit Review: A Comprehensive Analysis of the Cryptocurrency Exchange

In the world of cryptocurrency trading, exchanges play a crucial role in facilitating the buying and selling of digital assets. Bybit is one of the leading players in this space, offering traders a range of features and tools to help them manage their portfolios and make informed trading decisions. In this review, we will take a closer look at Bybit, examining its features, security measures, and overall reliability.

An Overview of Bybit

Bybit is a cryptocurrency derivatives exchange that was founded in March 2018. The platform is based in Dubai and is available to traders across 100+ countries worldwide. Bybit primarily offers trading in perpetual contracts ( for cryptocurrencies such as Bitcoin, Ethereum, and XRP) but is not limited to the same.

One of Bybit’s most distinguishing features is its user-friendly interface, which is designed to make trading easy and accessible for both novice and experienced traders. The platform comes replete with a range of trading tools, including charting tools, order types, and risk management features, to help traders make informed trading decisions.

Lastly, Bybit offers a mobile app for iOS and Android devices, making it easy for traders to monitor their positions and execute trades on the go.

Why Choose Bybit?

Bybit is a cryptocurrency exchange that prides itself on offering a highly advanced, secure, and user-friendly platform. Designed to cater to the needs of both retail and institutional traders, Bybit is equipped with the capacity to handle an impressive number of transactions per second (TPS) — 135,000 — thereby surpassing the capabilities of many of its competitors quite handily. This high TPS rate ensures that trades are executed quickly and efficiently, enabling traders to take advantage of real-time market opportunities. Additionally, Bybit's commitment to security measures, such as two-factor authentication and cold storage, provides traders with added peace of mind when it comes to protecting their funds. Bybit deposit bonuses are also available for new traders, providing them with extra trading funds as a welcome reward. This makes Bybit an attractive choice for traders looking to maximize their initial capital and explore the platform with additional funds.

The platform has a reliable system that has never experienced an operational overload, making it extremely trustworthy This uptime reputation has been crucial for the exchange as it has helped build trust with its users. In fact, Bybit's continued innovation and growth have helped attract more users to the platform, positioning it to take a bigger market share by 2023.

Lastly, Bybit is accessible to almost all traders worldwide, with English, Chinese, Korean, Japanese, and Russian translations available, among several others. The Dubai-based exchange is aggressively expanding its reach and bringing more regions under its control. Other key aspects of the exchange include:

- Support for several assets: Bybit is an inclusive platform that accepts up to 55 fiat currencies and 547 payment methods (including credit and debit cards) to facilitate seamless transactions.

- Wide range of trading options: Bybit currently supports a number of trading options, including spot trading, which includes over 371 trading pairs and 60 listed tokens, with a daily trading volume of $3.4 billion. Additionally, Bybit supports futures trading for Inverse Perpetual, USDT Perpetual, and Inverse Futures, providing traders with more opportunities to profit from their trades.

- Advanced options trading platform: Bybit boasts up to 5 professional options market makers as exchange partners. This feature makes Bybit one of the best options trading platforms in the crypto industry.

- Crypto loans: This feature enables traders to use their funds across the platform's ecosystem for spot, margin, and futures trading, all at low-interest rates of just 0.0002%. This feature provides added flexibility and convenience for traders looking to maximize their profits.

- Zero-trading fee campaign: This is one of the industry's biggest and most generous fee campaigns, offering traders the chance to save on transaction fees and boost their earnings.

- Experienced backing team: Bybit was established in 2018 by its owner and CEO, Ben Zhou, who brings years of experience from the forex market to the table, having successfully run a forex exchange for eight years. The Bybit team comprises highly experienced professionals from some of the most reputable companies in the industry, such as Morgan Stanley and Tencent, among others.

Detailed Breakdown of Bybit’s Features

Bybit’s Intuitive User Interface

Bybit’s interface is designed to be intuitive and easy to use, making it stand out from its competitors. To elaborate, the UI can be easily switched between dark and normal mode as well as customized as per the users’ needs and preferences. Moreover, the advanced order forms available on the main exchange are not common on other platforms, making it an excellent feature for traders requiring quick access.

Utility Laden Smartphone Application

As mentioned earlier, the Bybit mobile application is available for iOS and Android users, providing them with the same functionality as its desktop iteration. Traders can also set price levels to receive push notifications on their phones. As of 2023, the app has tens of thousands of installations, with an overwhelming majority of reviews appearing to be positive. And although the web and PC-based trading versions of the exchange offer better visual real estate, the mobile application is a welcome tool for monitoring positions while on the go

Support for Web3 and NFT-related Applications

Bybit added an NFT market to its platform in 2022, which has already garnered over one million registered users and is ranked among the top five NFT marketplaces based on monthly active users. Bybit's Web 3 wallet is easy to access and offers a robust security framework to keep user assets safe. It also supports quick swap functions.

Quality Customer Support

Bybit offers 24/7 customer support, which is one of its most convincing reasons to trade on the exchange. Customer service agents respond quickly and appear to do everything they can to help customers. Bybit's customer support is arguably better than its competitors, such as BitMEX, which provides slow responses and unsatisfactory solutions to problems. Traders can communicate with the Bybit team through the chat box in the interface's bottom right corner.

Bybit’s Various Contract Offerings

Bybit provides its 10+ million client-base seamless access to a crypto Spot/Derivatives/Options market on its platform. This section will explore these offerings as well as talk about available pairs.

(i) The Bybit Spot Market: It is one of the largest in the industry, with a daily trading volume exceeding $3.4 billion. This liquid market offers more than 371 crypto pairs for trading, and about 60 tokens are listed on its platform, providing the opportunity to invest in lesser-known projects.

(ii) The Bybit Options Market: This new addition to the platform was introduced to meet the increasing demand for crypto option products. The exchange has collaborated with industry experts to provide its users with the most liquid options. Once a person has registered with Bybit, they can find option calls for popular crypto assets almost immediately.

(iii) The Bybit Futures Market: The exchange's most popular crypto offering, with daily trading volume exceeding $10 billion. Bybit’s perpetual swap model allows you to trade Bitcoin with up to 100x leverage without a settlement date where the position is closed. Bybit offers three types of perpetual contracts, including Inverse Perpetual and Inverse Futures, USDT Perpetual, and BTC/USDC perpetual. In all, the exchange offers over 228 pairs for trading.

Lastly, it should be pointed out that Bybit's perpetual swap model enables long and short trades on Bitcoin with up to 100x leverage. You can keep your position open until you decide to close it.

Inverse and USDT/USDC Perpetual Contracts

Bybit offers a variety of trading options to suit the needs of its users. One such option is Inverse Perpetual Contracts, which are quoted in USD but traded based on the underlying cryptocurrency. The advantage of this type of contract is that traders don't need to purchase stablecoins like USDT/USDC for margin purposes.

However, they do need to hold the underlying crypto as margin and hedge their position accordingly. Pairings supported via Inverse Perpetuals on Bybit include BTCUSD, ETHUSD, EOSUSD, and XRPUSD. These contracts have no specified delivery date and can be held indefinitely without the need to roll over contracts ahead of an expiration date.

Another popular trading option on Bybit is USDT Perpetuals, which are traded based on USDT/USDC, eliminating the need for traders to hedge their positions and mitigate risks associated with holding crypto as margin. However, traders do need to purchase stablecoins for margin, which is the main disadvantage of this type of contract.

Bybit offers the largest range of pairings by way of USDT/USDC perpetuals. Like inverse perpetual contracts, USDT/USDC perpetual contracts also have no expiration date and can be held indefinitely.

Finally, Bybit offers ‘Inverse Futures,’ which are margined and settled in crypto. These contracts are similar to inverse perpetual contracts in terms of advantages and disadvantages, and trade pairs available via inverse futures contracts include BTCUSD and ETHUSD. Unlike perpetual contracts, inverse futures have a pre-specified delivery date.

Overall, Bybit provides a wide range of trading options for cryptocurrency traders, whether they prefer perpetual or futures contracts and whether they want to hold their positions indefinitely or for a set delivery date.

Bybit's Perpetual Futures Contract and Dual Price Mechanism Explained

Bybit offers a perpetual futures contract — i.e. a derivative that never expires — providing traders with increased opportunities for profit. Bybit also plans to introduce quarterly futures contracts and subaccounts when it integrates with the MetaTrader 4 foreign exchange platform.

Moreover, Bybit’s ‘Dual Price Mechanism’ is designed to protect traders from price manipulation and resulting steep losses. It prevents the liquidation of positions due to margin shortages or requirements at prevailing market prices. Bybit's ‘Mark to Market Price’ is established once every eight hours through ‘Funding’, which helps match the spot price and derivative exchange price by making the last asset traded price the market price.

Bybit Exchange offers up to 100x leverage on perpetual futures products, allowing experienced traders to enter sizable positions and match the maintenance margin requirement. In highly volatile markets, a leveraged long or short position may be liquidated if the price drops below the bankruptcy price. Bybit Insurance Fund helps cover the deficits of liquidated traders due to losses, providing additional protection.

What Order Types Does Bybit Support?

Bybit offers its users various trading order types to choose from, depending on their trading strategy and preferences. In this section, we'll break down the different order types available on the platform and explain how they work.

- Market Order: It is an order placed at the current market price, which means the order is executed at the "bid price" if it's a sell order or the "ask price" if it's a buy order.

- Limit Order: It's an order placed at a level selected by the trader, which may differ from the current market price. This order is open and waiting to be "filled" by a buyer or seller who agrees to match that price. Limit Orders are the most recommended way to trade

- Conditional Order: A Conditional Order executes as a Market Order or a Limit Order as soon as a certain price level is reached. When placing this trade, users are required to define the trigger price, direction, quantity, and leverage. This order is typically used when technically significant levels are reached.

- Stop Loss: When using leveraged trading, Stop Loss is a crucial feature that could make or break a trading account. Bybit offers several ways to set up a stop-loss, and traders should familiarize themselves with these functions to optimize their trading experience.

Advanced Order Options Available on Bybit

In addition to all the market orders mentioned above, Bybit offers clients several additional order options designed for intermediate/advanced users. These include:

(i) Good-Till-Cancelled (GTC): As the name suggests, this order remains open until an investor manually closes the open order.

(ii) Immediate-or-Cancel (IOC): This order is designed to be filled instantly and at the best price. If any part of the order remains unfilled, the remaining amount id canceled. This order type allows for partial order execution.

(iii) Fill or Kill (FOK): This order is designed to be filled entirely and at the best price or not at all. This is very similar to the IOC order, except that it doesn't allow partial orders to be executed.

Moreover, traders can choose how these orders are executed. For instance, with Limit and Conditional orders, traders can choose the "Post Only" option. This ensures that the order is executed as a "market maker," and they benefit from the maker fee.

Traders can also make their Limit order a "Reduce Only" order. This means that the order will only execute if it reduces their position. If the order position were to increase due to the market, it would be amended down or canceled entirely.

Another useful tool offered by Bybit is the leverage calculator. This tool lets traders calculate their crypto Profit/Loss (P/L) and return on investment (ROI) target levels. It can also be used to determine their liquidation levels.

In conclusion, Bybit's various order types and trading tools provide users with amazing options to optimize their trading experience. Understanding these features is essential to make informed trading decisions and maximize profits while minimizing risks.

Additional Features and Comparisons With Other Exchanges

Bybit sets itself apart from other exchanges by always displaying the value of its users’ position in USD, sparing them the inconvenience of calculating the conversion yourself. Clients’ position profits are shown in terms of BTC and USD, making it easier for them to track their profits.

Furthermore, as mentioned earlier, Bybit is currently running a zero-trading fee campaign, one of the largest in the crypto industry. During this campaign, users can enjoy zero fees when placing a trade or closing a position on the platform, saving you high trading fees that can impact your profits. The current zero-fee campaign may not last indefinitely, so taking advantage of it while it's still available is recommended.

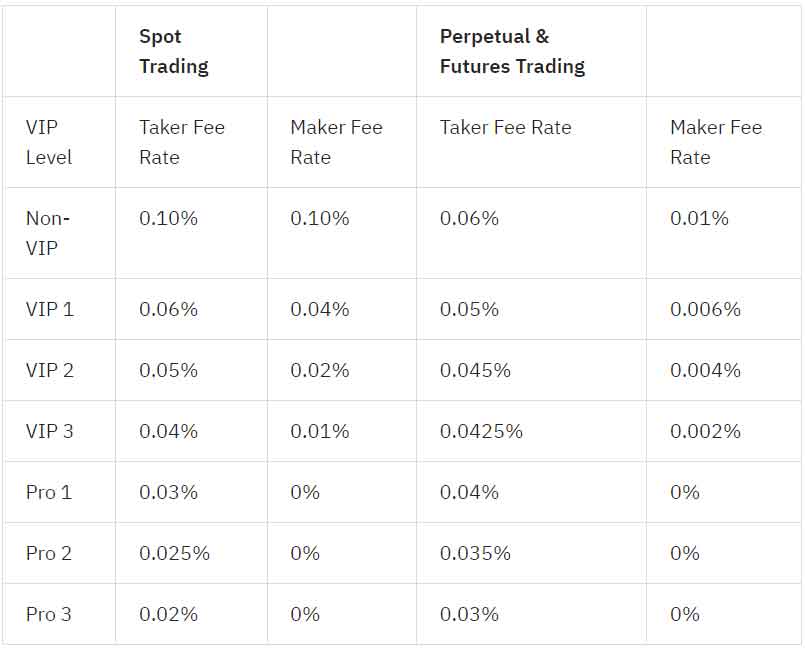

Once this campaign ends, Bybit fees are expected to revert to their usual levels. Bybit's fee structure is similar to BitMEX, with a lower withdrawal fee of 0.0005 BTC, 41% lower than the average on other exchanges. Bybit offers a rebate instead of a fee for limit orders, meaning you are paid for submitting limit orders into the order book. Bybit's market order fee is 0.075%, and the maker fee for limit orders is -0.025%. The funding rate is 0.02%/-0.02%.

Bybit's perpetual contract trading fees are the same as BitMEX, with a maker fee rate of -0.025% and a taker fee rate of 0.075%, accruing a net fee of 0.05%. By comparison, Kraken's net fee is 0.055%, Binance's is 0.06%, Huobi's is 0.07%, and OKEx's is 0.07%. In terms of spot trading, Binance's net fee is 0.2%, OKEx's is 0.25%, Huobi's is 0.4%, Kraken's is 0.42%, Gemini's is 0.6%, Coinbase's is 1%, and Bitstamp's is 1%.

Bybit's contracts are futures contracts, and there is a funding rate to ensure that the futures price equals the spot price. This funding rate is settled directly between buyers and sellers and not to Bybit. If there are more sellers than buyers, sellers will pay the buyers a funding rate of 0.02%, and vice versa. The funding rate is charged every 8 hours at 16:00 UTC, 00:00 UTC, and 08:00 UTC. Traders can earn money through rebates by trading against the majority using limit orders, reducing fees, and earning money for holding their positions.

Is it Easy to Open an Account on Bybit?

In order to open a trading account on Bybit, new users are required to complete a relatively straightforward registration process. This can be done through the website by visiting the registration page, filling in the required details, reading and agreeing to the terms & conditions, and clicking on the 'Sign Up' button. Bybit offers various sign-up bonuses to new users.

Alternatively, users can download the Bybit app and register by selecting the 'Assets' tab on the bottom right corner. Following this, they need to click on the 'Login' option and then the 'Register' key on the top right corner of their screens. At this point, new signees must provide their email addresses or mobile numbers.

After this, users can click on the 'Sign Up' tab to complete the registration process. It is important to note that users from countries restricted under FATCA are not eligible to register with the Bybit app.

How Do Deposits/Withdrawals Work on Bybit? Is the Exchange Safe?

Bybit initially operated as a crypto-to-crypto exchange, limiting deposits to cryptocurrencies only. However, the platform has since evolved to accept more than 55 fiat currencies and 20 coins, including popular options like Bitcoin, Ethereum, XRP, and EOS. Additionally, Bybit supports over 547 payment methods, including credit card transactions, ensuring seamless utilization of the exchange. The platform operates in collaboration with Banxa, Xanpool, MoonPay, and Mercury to support payments through fiat currency.

For those wondering about the platform’s fund safety mechanisms, it's worth noting that the exchange has never been hacked. However, depositing Bitcoin on Bybit requires trust in the platform's security measures, as with any exchange. Bybit stores all funds securely in cold storage, and in the event of a hack, the platform promises full compensation to customers for any losses.

Bybit has also taken the extra step of providing Proof of Reserve for funds under its control, bolstering its reputation in the crypto industry. Bybit allows customers to withdraw funds up to three times per day at specific times, unlike competitors like BitMEX, which only permits one withdrawal per day. Withdrawals are pending until confirmed by Bybit, with confirmation times occurring every eight hours and a maximum withdrawal time of eight hours. Note that withdrawals submitted after 07:30 UTC are not confirmed until 16:00 UTC.

A Closer Look at the Safety Side of Things

Bybit places a significant emphasis on platform security, spending 20% of its annual budget to ensure the protection of its users' funds and information. This is above the industry average of 15%. To enhance security, the exchange has adopted cold wallets with robust security management features instead of hot wallets, which are typically used by other exchanges. All deposit addresses are cold wallet addresses, and offline signatures are utilized for underlying asset transfers and withdrawals.

Withdrawal requests on the platform undergo three levels of verifications and manual reviews per day to manage risk, and traders are permitted to withdraw once every eight hours. Bybit maintains strict crypto-asset consolidation policies encompassing system security, physical environment security, operation authentication, encryption techniques, monitoring, and regular audits. The platform also prioritizes protecting user data and personal information, which aligns with its privacy policy.

Bybit ensures that its employees undergo thorough training, scrutiny, and assessment for internal security control. Two-factor authentication is mandatory for all users, and a six-digit 2FA code is generated randomly inside the Google Authenticator App after scanning any relevant QR code. Storing one’s ‘Recovery Key Phrase’ securely on a cloud server with full SSL encryption is also recommended.

What Does Bybit’s Native Fee Structure Look Like?

Bybit has a fee structure that differentiates between Makers and Takers. Market Makers are traders who provide liquidity and market depth by placing limit orders, whereas Takers are those individuals who place market orders and take liquidity from the order book. To incentivize market makers to supply additional liquidity to the ecosystem, Bybit offers a maker fee rebate of 0.025%, while Takers are charged a fee of 0.075%. The net cost incurred by the platform is 0.05%.

Withdrawals can be made up to 10 BTC per day by entering the wallet address and clicking the withdrawal button up to three times a day, with a withdrawal fee. Bybit also imposes daily withdrawal limits of 0.0005 BTC. Lastly, Bybit has a Funding Fee or Funding Rate of 0.02%/ -0.02%.

How Airtight is Bybit’s KYC Framework?

While KYC submissions are not mandatory for trading on Bybit, customers who wish to increase their daily withdrawal limit to 50 or 100 BTC must complete a verification process. Bybit offers two levels in this regard, with Level 1 requiring a document issued by the country of origin and facial recognition screening, and Level 2 requiring proof of residential address in addition to the Level 1 requirements.

To complete one’s KYC verification on Bybit, users need to go to "Account & Security" in the upper right-hand corner of their screens, select "Verify Now" under "Identity Verification" in the "Account Information" column, and follow the prompts according to the level of verification desired. There are various non-KYC exchange options if you're from a restricted country, one of them being Apex Omni, the decentralized exchange of Bybit.

What Data Analytics Tools and Options Is Bybit Offering?

Bitcoin derivatives exchanges are increasingly offering advanced data analysis tools to their traders, and Bybit is no exception. The 'Advanced Data' section provides traders with graphics and charts that can help inform their trading strategies. As a Bybit trader, it's essential to conduct market analysis. Users can do this by simply pulling up various charts and downloading data in different formats, such as images, vector files, or CSVs.

For instance, the ‘Rolling Volatility chart’ is an excellent example of the data analysis tools available on Bybit. Other tools of a similar nature that users can deploy include:

- Price Moving Average Module: This tool displays Bitcoin's price alongside various moving average indicators for different time frames.

- Monthly Price Range: This section highlights the monthly highs and lows of the asset's price, allowing you to observe the range of the traded asset.

- Rolling Volatility: This tool displays the realized volatility of the asset over the past 30 days compared to the average for the period, providing traders with an idea of how much its price has varied within a given period.

- BTC Daily Realised Volatility: This tool shows the ‘actual volatility’ of the asset over a specified period.

Bybit's tech team offers many other indicators, metrics, and data points that traders can access, including information on the specific index price, funding data, and the insurance fund. These tools allow traders to gain valuable insights into the market and make informed trading decisions.

Other Key Aspects of Bybit Worth Noting

Bybit’s Exchange Testnet: A User-Friendly Way to Try Trading Without Real Funds

For those new to trading Bitcoin or who want to explore Bybit before investing real funds in the platform, the project offers a user-friendly testnet that allows users to experiment without risking their money. Once investors are comfortable with the testnet, they can deposit real assets and apply their personalized strategies to real trading.

Bybit Trading Competitions: Battle it Out for Massive Prize Pools

As a bonus to its clients’ trading experience, Bybit hosts trading competitions where traders compete for massive prize pools. For example, the World Series Of Trading (WSOT) competition, held during the summer of 2022, had a total prize pool of 150 BTC and nearly $300,000 USDT. During these events, traders can join teams, start their own contingents, or even enter individually.

In addition to these competitions being exciting, they also encourage more trading volumes on the platform, leading to higher revenues via fees. Traders participating in these tournaments are advised to closely monitor funding rates.

Bybit Calculator and Bot Support: Making Trading Easy

Bybit offers a powerful calculator that allows traders to monitor their position value and size closely as well as ascertain important trading parameters related to their profit/loss and risk management metrics. With the Bybit Calculator, users can determine their initial margin or deposit, profit/loss, profit/loss percentage, and ROI.

Additionally, traders can calculate the initial margin required to open a position, target price, trigger price, or the best price to achieve a predetermined ROI, liquidation price, account balance, funding rate/funding fees, price difference, and underlying margin.

However, for those individuals who prefer automated trading, Bybit supports various cryptocurrency trading bots such as TradingView, 3Commas, Alertaton, Autoview, Cornix, FMZ, GoodCrypto, Haasonline Hydor, Mudrex, Profit Trading, ProfitTrailer, Profitview, Sirius Trader, Stacked, TokenBot, Tycoon, Wunderbit, and WBCCLUB. These bots allow traders to trade automatically based on pre-set conditions created by experienced traders.

Bybit’s Referral Program: Earn Commissions and Discounts

Bybit's referral program has contributed significantly to it's explosive growth in recent years. For starters, users can earn a 30% commission on all trading fees from other individuals who sign up under their referral link and 10% off the sub-affiliates who sign up under their direct affiliates.

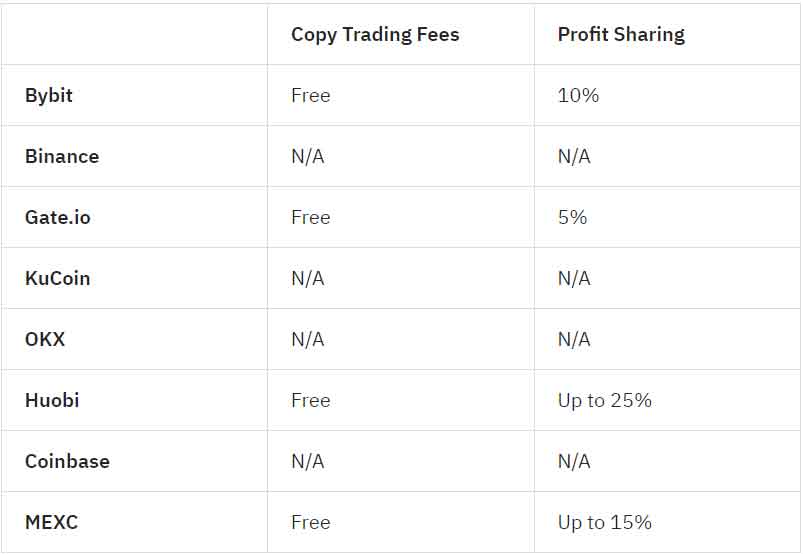

Bybit’s Copy Trading Module: An Easy Way for New Traders to Learn

Bybit's copy trading feature makes crypto trading easier, fun, and hassle-free for users, particularly those traders lacking real financial experience. To elaborate, the module allows traders to choose an expert trader and subsequently copy/paste their daily transactions. That being said, users must share 10% of their net profit with the trader they are aping to avail of this opportunity.

An Overview of Bybit’s Automated Trading Bot

Bybit's trading bot is a powerful feature that can help investors automate their day-to-day/long-term trade strategies as well as improve their overall profit prospects. Some key aspects of the offering include:

- Customizable Trading Strategies: Bybit's trading bot allows users to create custom trading strategies using various indicators and parameters. This enables traders to tailor their strategies to their individual trading styles and risk tolerance levels.

- User-Friendly Interface: The trading bot utilizes a user-friendly interface that makes it easy for traders to set up and manage their trade strategies.

- Backtesting Ability: Before executing a trading strategy using the Bybit trading bot, investors can test their strategies using historical market data to see how they would have performed in different market conditions.

- Risk Management: Bybit's trading bot offers a range of risk management tools, including a stop-loss and take-profit module. This can help traders manage their risk exposure levels and protect their capital efficiently.

Thanks to its customizable trading strategies, user-friendly interface, backtesting capabilities, and risk management tools, Bybit’s trading bot is a valuable feature for individuals looking to optimize their trading performance.

Final: Is Bybit Worth Considering for Your Crypto Trading Needs?

Bybit is a dynamic and feature-rich cryptocurrency trading platform that has rapidly emerged as one of the leading exchanges worldwide, with over 10 million active users. The platform offers leverage trading, cold wallets, low fees, and robust customer support.

Choosing the right crypto exchange that caters to all of one’s trading needs is essential. In this regard, Bybit has several attractive features, making it an excellent option for crypto traders. The exchange's user-friendly interface and ease of use make it accessible to both beginner and experienced traders. Bybit also provides promotions and bonuses, making day/long-term trading extremely rewarding for its customers.

In summary, Bybit is a versatile crypto trading platform that provides traders with various features to improve their overall crypto experience. Its secure and reliable platform and excellent customer support make it an attractive choice for any digital currency enthusiast looking to kickstart their crypto journey.

FAQs

Is Bybit safe to use?

After careful consideration and research, you can say that Bybit is a very safe and secure trading platform that offers trading services to millions of users globally.

Is Bybit legal in the US?

No, US citizens are not allowed to use Bybit. US citizens may have a look at no KYC exchange options.

Is Bybit regulated?

Yes, Bybit is regulated in various jurisdictions across the globe and recently even acquired a MiCA license in Austria.

How to create an account on Bybit?

You can easily create an account on Bybit using only an email and a password.