Apex Omni vs AsterDEX (2026): Best DEX Compared

Decentralized exchanges are gradually becoming the backbone of crypto trading, with many offering robust trading models, enhanced liquidity, and even eliminating or reducing gas fees. Today, decentralized exchanges offer a centralized-like trading experience while retaining key features such as no KYC verification and self-custody.

Whether you are a new or professional crypto trader, choosing one of the best decentralized exchanges in 2026 requires a good level of research. In this article, we provide a detailed overview of two leading DEXs: Apex Omni and AsterDEX, offering clear insight into how they work and what you should consider before trading on them.

Apex Omni vs AsterDEX: Key Differences

|

Features |

Apex Omni |

AsterDEX |

|

Blockchain |

Arbitrum |

BNB Chain |

|

Backers |

Bybit's Team |

Ex-Binance's Team (Yzi Lab) |

|

Trading fee |

0.02% - Maker Fee / 0.05% - Taker Fee |

0.01% - Maker Fee / 0.035% - Taker Fee |

|

Leverage |

Up to 100x |

Up to 1001x |

|

KYC |

Not required |

Not required |

|

Trading type |

Spot, Perpetual, Grid, and RWA |

Spot and perpetual |

|

Gas fee |

Zero all chains |

Zero only on BNB Chain |

|

Order types |

Market, limit, conditional orders |

Market, limit, stop limit |

Ready to start trading?

Open an Apex Omni account to receive a 5% trading fee discount, or access AsterDEX to unlock up to 4% off your trading fees.

What Is Apex Omni?

Previously known as Apex Pro, Apex Omni is a multi-chain decentralized exchange built on a modular architecture to provide a smooth and efficient spot and perpetual trading experience. It features deep-liquidity and cross-chain functionalities that ensure that users can complete high-volume trades without impacting asset price and move assets between the 4 supported blockchains.

Check our Apex Omni tutorial for a complete guide on how to trade on Apex Omni.

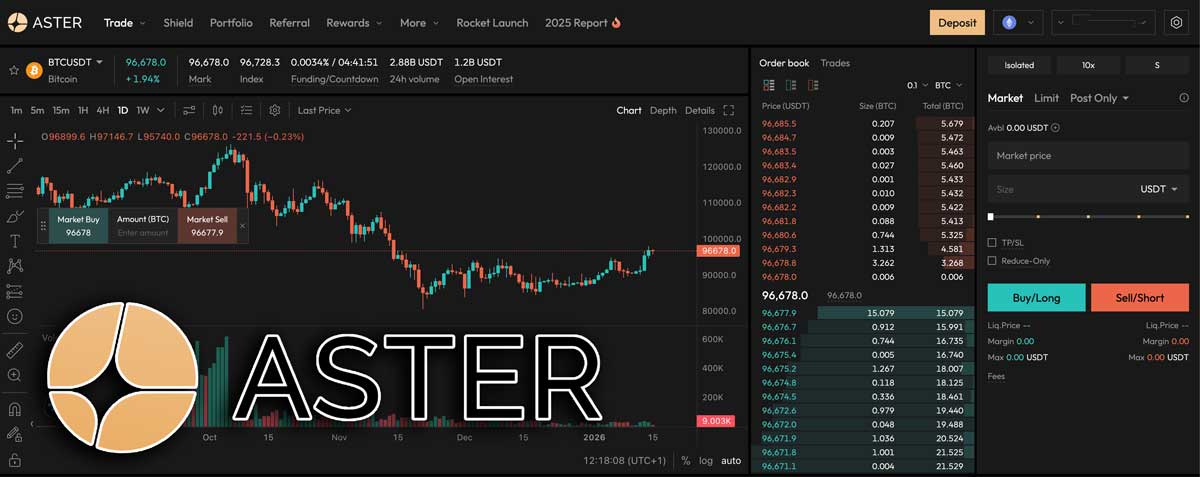

What Is AsterDEX?

Ranking top two on CoinMarketCap, AsterDEX is a decentralized exchange introduced in September 2025 for spot and perpetual trading. Aside from its popular 1001x leverage, AsterDEX is also a multi-chain wallet with deep liquidity and low trading fees.

Check our AsterDEX tutorial for a complete guide on how to trade on AsterDEX.

Blockchain Infrastructure: Arbitrum vs BNB Chain

Apex Omni is built on Arbitrum, a Layer 2 blockchain with a 0.25-second block time. This means it benefits greatly from Arbitrum speed and low transaction fees. Therefore, trading on Apex Omni is fast and cheap, but because Arbitrum relies on optimistic rollup technology, withdrawals may be slow.

In addition, Apex Omni uses zkLink X technology for enhanced privacy, ensuring optimal transparency while keeping transactions secured. A key part of Apex Omni's enhanced blockchain infrastructure is that it eliminates gas fees for in-exchange activities across all blockchains. However, you pay a gas fee for deposits or withdrawals from another wallet.

AsterDEX is built on BNB Chain, a leading Layer 1 blockchain with 0.45-second block times; however, it will be moved to its own distinct blockchain, the Aster chain. The testnet was completed and launched in February 2026.

This Layer 1 blockchain is explicitly designed for fast spot and perpetual trading with a 10-millisecond execution time and a 50-millisecond block time. Relying on it makes AsterDEX a more secure decentralized exchange, free from third-party security breaches.

While the Aster blockchain is expected to be faster than Arbitrum, it is impossible to confirm the accuracy, as the mainnet has yet to be launched.

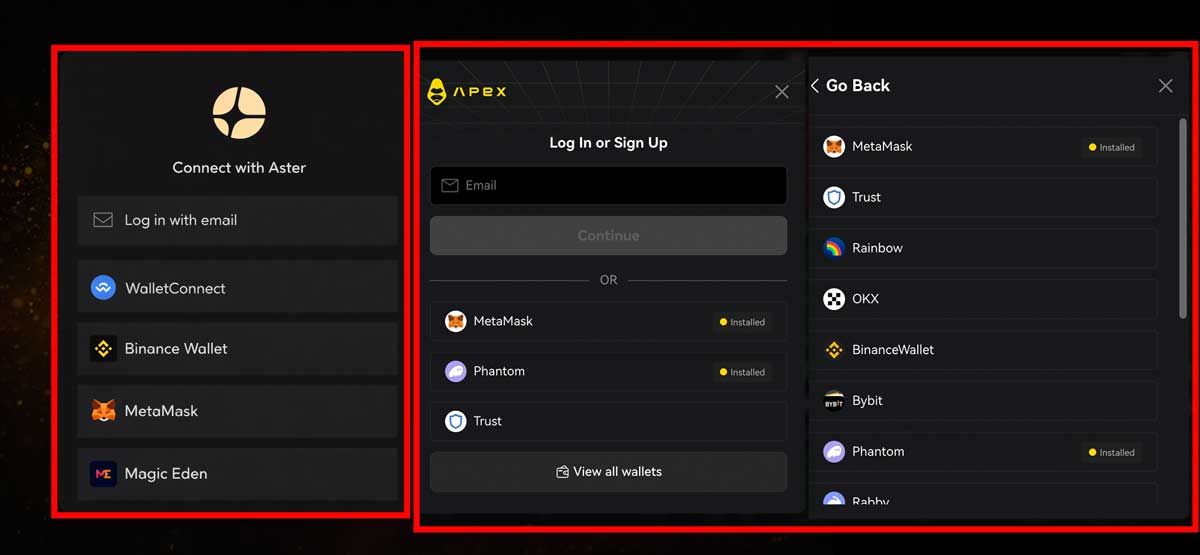

Wallet Connection

You can connect to any of these exchanges using decentralized wallets like MetaMask. Since the exchanges do not require KYC verification, your unique wallet address serves as your on-chain identity for depositing and withdrawing funds.

Also, Apex Omni works seamlessly with the Bybit Web3 wallet, and you can connect AsterDEX to the Binance Web Wallet, which allows navigating between these centralized and decentralized exchanges if you are an existing Bybit and Binance user.

Apex Omni is a clear winner in this category, though, because it offers way more wallet connections than Aster. In the image above, you can see the 4 wallet connections that are available with Aster and the many options Apex Omni is offering.

An alternative to using a wallet is to sign in with your email address. Apex Omni and AsterDEX support this. To get started, input your email address and enter the verification code sent to you. No password required. Once this is complete, the exchange will generate a unique wallet address for you to send the crypto asset to.

Quick Note: Since you will not be setting a password, the exchange sends a verification code to your email each time you attempt to log in. Therefore, you need to have access to the email address each time you want to use it.

Security and Privacy

Apex Omni and AsterDEX feature a built-in MEV protection that prevents malicious bots from frontrunning or backrunning trades.

zkLink Privacy (Apex Omni)

Apex Omni relies on zkLink rollup for privacy. This technology ensures transactions are recorded on-chain for transparency but only sender and receiver have access to full transaction details. Hence, details like amount sent, wallet balance, sender and recipient wallet addresses may not be available.

Hidden Orders & Whale Protection (AsterDEX)

AsterDEX takes security a further step by introducing Hidden Order for pro trading. With this, high-volume traders do not appear in the orderbook until they are executed. Whales can benefit significantly from this feature, since it protects against unnecessary price fluctuations and ensures that traders can complete trades with minimal slippage.

Trading Fees: Maker, Taker and VIP Discounts

Generally, trading on decentralized exchanges is cheaper and faster than on centralized exchanges. However, trading fees vary depending on the DEX and the type of order placed.

Apex Omni Fee Structure

On Apex Omni, traders pay:

-

0.02% maker fee (limit orders that add liquidity)

-

0.05% taker fee (market orders that remove liquidity)

These fees apply to perpetual trading, while spot trading follows a similar competitive structure. The maker/taker model rewards traders who provide liquidity to the order book.

AsterDEX Fee Structure

AsterDEX also uses a maker/taker model across its trading pairs:

-

0.01% maker fee

-

0.035% taker fee

This makes AsterDEX slightly cheaper at the base level, especially for active traders placing high volumes of market orders.

How to Reduce Trading Fees on Apex Omni and AsterDEX

Both exchanges offer VIP programs that can reduce trading fees by up to 50%, depending on your trading volume.

On AsterDEX, traders can receive an additional 5% fee discount when paying trading fees in $ASTER. This can further reduce overall trading costs for active users.

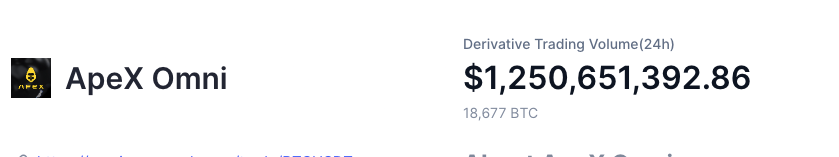

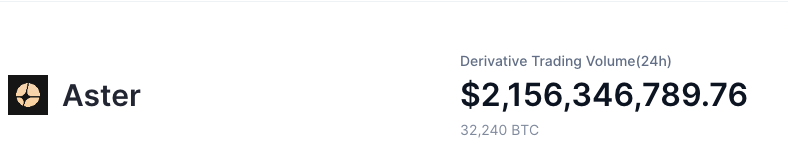

Liquidity and Order Book Depth

Liquidity is important because it directly affects execution speed, price stability, and slippage. As a trader, you should always choose an exchange with deep and consistent liquidity.

Apex Omni aggregates liquidity across its supported blockchains. Thanks to its cross-chain infrastructure, traders can move assets between chains without traditional bridging, improving capital efficiency and helping maintain stable order book depth across markets.

AsterDEX, on the other hand, benefits from BNB Chain’s broad ecosystem adoption and uses an aggregated order book structure to support high-volume trades with minimal slippage.

Both exchanges rely on a central limit order book (CLOB) model rather than an automated market maker (AMM). This provides a more precise price-matching mechanism and gives traders a centralized-like experience while maintaining full self-custody.

In addition, strong order book depth on both platforms helps reduce price impact during large trades, which is especially important for high-leverage or whale-sized positions.

Features and Users’ Experience

Interface:

AsterDEX offers an easy-to-use interface suitable for both new and experienced traders. Users can switch between trading and portfolio with a single click. On the dashboard, you can see the deposit, withdraw, and transfer menus.

The portfolio page provides a good overview of asset balance, trading history, ongoing trades, margin, and even total trading volume and total profit and loss over 7 days.

Apex Omni offers a similar interface with additional functionalities. It features deposit, withdraw, transfer, convert, and spot swap options. Aside from PnL history, you can view your win rate to get an overview of your trading performance for up to 3 months.

Deposit and Withdrawal: On both exchanges deposit takes 15 seconds to 1 minute, depending on the blockchain. However, while AsterDEX offers fast withdrawals, normal withdrawals on Apex Omni may take up to 4 hours.

Trading Models: Apex Omni offers spot, perpetual, grid, and RWA trading; AsterDEX offers only spot and perpetual trading.

Trading pairs: Apex Omni has 130, while AsterDEX has 100+.

Supported chains: Apex Omni supports 4 blockchains (Arbitrum, Ethereum, Mantle Network, and Base), and AsterDEX supports 4 blockchains (Arbitrum, Ethereum, BNB Chain, and Solana).

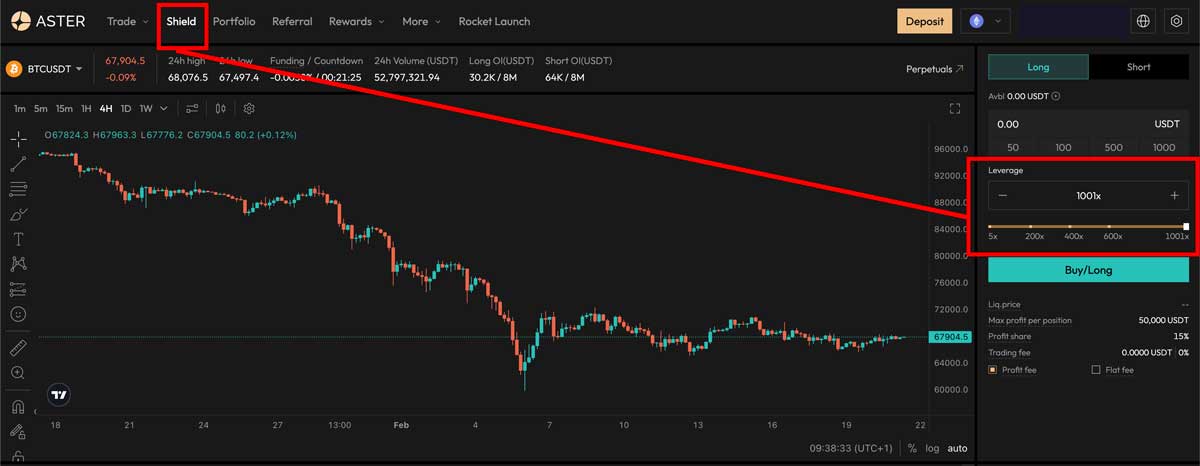

Leverage: Apex offers up to 100x while AsterDEX offers up to 1001x.

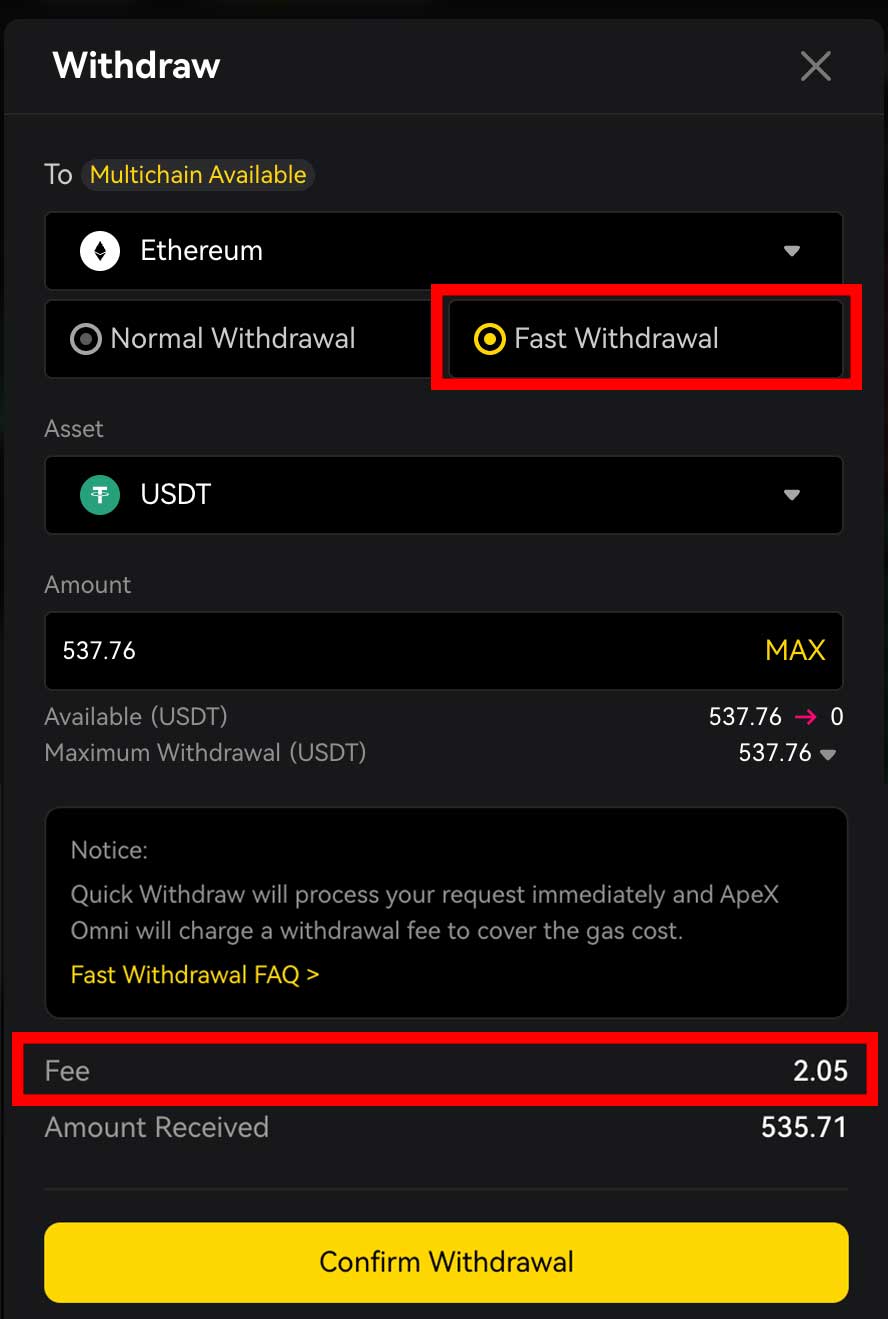

What Is Apex Omni Fast Withdrawal?

Because Apex Omni operates on rollup-based infrastructure, standard withdrawals may take longer due to network settlement mechanisms.

To improve user experience, Apex Omni introduced a Fast Withdrawal option. This allows liquidity providers to process withdrawal requests on your behalf, significantly reducing waiting time.

With Fast Withdrawal, transactions are typically processed within minutes. However, a handling fee applies in addition to the standard gas fee.

On most supported chains, the total withdrawal cost (handling fee + gas fee) is generally low, often around a few dollars. On Ethereum, however, the final withdrawal fee may vary depending on network congestion, gas limit, and the price of $ETH.

Is The AsterDEX 1001x Leverage A Good Deal For Me?

AsterDEX outperforms Apex Omni here, but using the 1001x leverage on AsterDEX is designed to offer traders lower returns and higher risk. With it, you get between 300% - 500% ROI in profit and bear 1000% in losses.

Example: If you open a trade with $200 and 1000x leverage, that is a $200,000 trade. A 2% winning rate gives you a maximum of $2,000 instead of $4,000 while a 0.1% dip in asset price liquidates your trade.

Additionally, AsterDEX charges a standard 0.08% trading fee on open and close trades. This means you are paying a total of 0.16% per trade, which is up to 10x higher fee.

Summary: For fast trading with good liquidity, a simple interface, and a smooth deposit and withdrawal process, use any of the two. However, Apex Omni offers more trading models for advanced traders and high-volume traders can consider using AsterDEX for its leverage.

How To Earn Passive Income on Apex Pro and AsterDEX

Apex Omni and AsterDEX offer passive income starting with referral rewards, airdrops, and ongoing trading challenges, but the best deal is in using Apex Vault for copytrading or earning income on yield-bearing assets on AsterDEX.

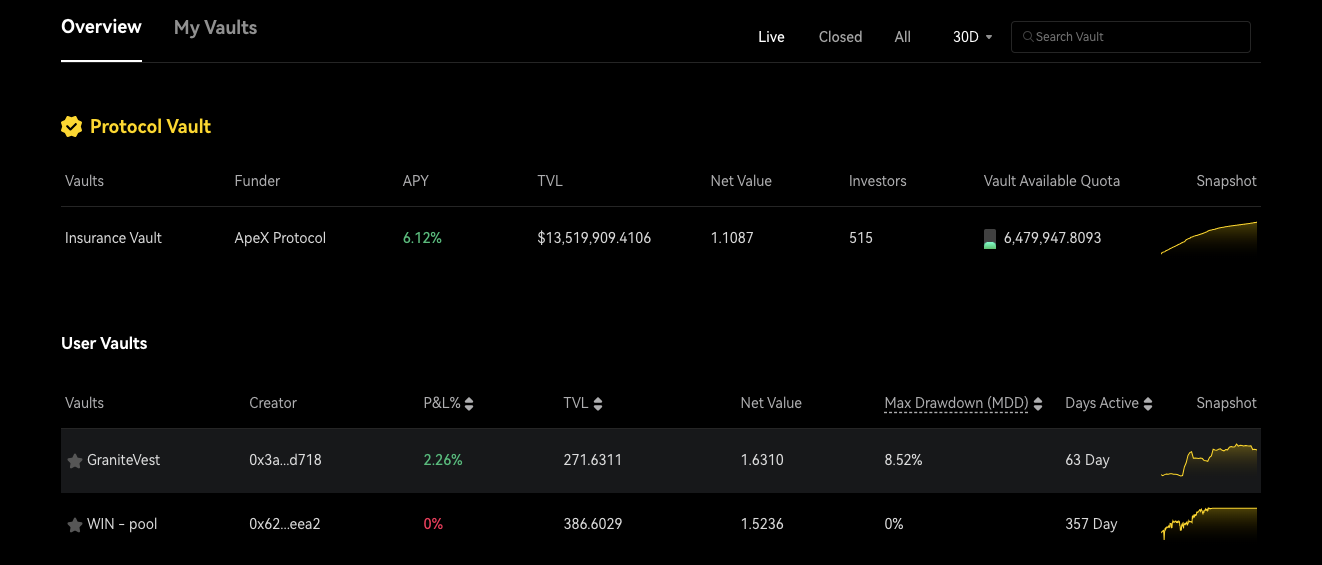

How The Apex Vault Works

- Traders add funds to the protocol vault (for 6.12% yield) or users' vault (for 90% trading profit).

- Users’ vaults are decentralized copytrading where the lead traders execute trades with the fund, and investors share part of the trade profit or loss.

In this article, you can access exhaustive information on how the Apex Omni Vault works.

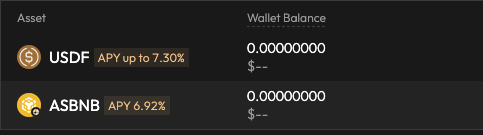

How Earn Passive Income on AsterDEX

- Traders hold USDF and asBNB to earn 9% and 6.2% yield respectively, while using the asset for trading.

- USDT and asBNB represent USDT and BNB. AsterDEX uses these underlying assets to maintain delta-neutral positions, like providing liquidity or funding rates and reward traders for that.

Note: Asset is not locked like you have under traditional staking,hence traders can still use it to open trading positions. Also, USDF is convertible to USDT at a 1:1 basis while asBNB is convertible to $BNB.

Two things to consider here:

- AsterDEX offers high and stable yield rewards, and it is suitable if you are an experienced trader who can execute trades for more profits.

- Apex Omni has multiple type of vaults. Trading vaults by traders which works similarly to copy trading, and the Apex Omni Protocol Vault where you can earn more stable yield on liquidation fees that are distributed to Vault investors.

Apex Omni and Aster DEX Referral and Promotions

Apex Omni and Aster DEX offer referral and promotion bonuses. To use, sign up on any of the two exchanges and navigate to the referral program to generate a referral link or code that you can share with other traders.

|

Referral Reward |

Apex Omni |

Aster DEX |

|

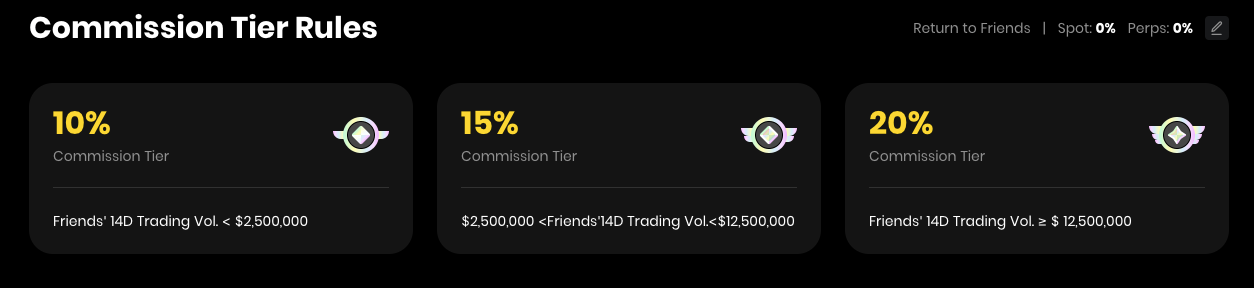

Referrer’s Commission |

Up to 20% on all trades |

10% on all trades |

|

Invitee’s Fee discount |

5% fee discount |

Set by referrer |

Note that on Apex Omni, commission is also divided into tiers; the exchange used the invited trader’s trading volume within a certain period to determine this.

Apex Omni has an ongoing promotion that requires traders to use AI (claws) to complete high-volume trades. With this, participants can get up to $100,000 in rewards. Start trading on Apex Omni to join

Also, you can join the Aster stage 4 airdrop for a share of 120,000,000 ASTER tokens. Create your Aster DEX account or connectyour wallet to check eligibility

Pros and Cons of Apex Omni

Pros

- Offers 130+ trading pairs, low trading fees, deep liquidity

- No KYC verification

- Grid trading, RWA, spot swap and other advanced trading options

- A smooth and easy-to-use interface all traders

- Decentralized copytrading and staking for passive income

- High referral commission and fee discount

- Zero gas fees on all supported blockchains

- Up to 100x leverage

Cons

- No special protection for high-volume orders

- No discount when traders use $Apex to pay trading fee

Pros and Cons of AsterDEX

Pros

- Advanced privacy and MEV protection for whales

- 100+ trading pairs, deep liquidity, lower trading fees

- 5% fee discount when you pay the trading fee using $Aster

- No KYC verification

- Zero gas fees on BNB chain only

- Up to 1001x leverage on specific mode

Cons

- Lower referral commission and no specific fee discount

- Few trading models.

- Traders pay gas fee on supported blockchains (except BNB Chain)

Apex Omni vs AsterDEX: Which One Should You Choose

Apex Omni and AsterDEX check all the boxes when it comes choosing the best decentralized exchange for spot and derivative trading. However, they are more suited for different traders based on the available features.

Apex Omni is ideal for traders looking for a fully-optimized non-custodial exchange with advanced trading options, broad passive income, and high trading bonus. However, if you like to take the risk up by 900%, you should definitely check out the AsterDEX 1001x leverage.

Finally, if you like what trading feels like on Bybit but cannot access it due to your current location, using Apex Omni gives you a similar experience without asking you for any verification.

Let’s do a quick recap of everything.

|

Features |

Apex Omni |

AsterDEX |

|

Exchange tokens |

$APEX |

$ASTER |

|

Liquidity |

Medium-high |

Medium-high |

|

Passive income |

Apex Omni vault & staking |

Yield-bearing assets |

|

Wallet connection |

Decentralized wallet and Bybit web3 wallet |

Decentralized wallet and Binance web3 wallet |

|

Interface |

Suitable for beginners and pros |

More suitable for beginners |

|

Multi-chain support |

Yes |

Yes |

Start trading on Apex Omni with our link to get 5% off trading fee, or use AsterDEX for 2% discount on trading fee.

Frequently Asked Questions

Is Apex Omni or AsterDEX better in 2026?

Both exchanges offer strong perpetual trading infrastructure, low fees, and non-custodial access. Apex Omni is better suited for traders looking for multiple trading models, cross-chain functionality, and structured passive income options.

AsterDEX may appeal more to high-risk traders seeking ultra-high leverage and slightly lower base trading fees.

The best choice ultimately depends on your trading style, experience level, and risk tolerance.

Can I use Apex Omni and AsterDEX in the United States?

Both platforms operate as decentralized exchanges and do not require mandatory KYC for basic access.

However, users are responsible for complying with their local regulations before trading. Availability may depend on regional restrictions and evolving regulatory policies.

Why does Apex Omni charge a handling fee for fast withdrawals?

Apex Omni’s fast withdrawal feature allows liquidity providers to process withdrawal requests on behalf of the network.

In return, these providers receive a small handling fee. This fee compensates them for supplying instant liquidity and significantly reduces withdrawal waiting times.

What are the best decentralized exchanges in 2026 besides Apex Omni and AsterDEX?

Several decentralized exchanges now compete in the perpetual trading space, offering deep liquidity, advanced order books, and competitive fees.

Platforms such as Hyperliquid and dYdX are strong alternatives depending on your trading preferences.

For a complete comparison of the top platforms, read our guide on the Best Decentralized Exchanges in 2026.