Aster DEX Tutorial & Review (2026) – Fees, Safety & How to Use

Decentralized exchanges (DEXs) are becoming increasingly popular as traders look for more control and fewer restrictions. Instead of depositing funds into an exchange account, users trade directly from their own wallet.

As regulations tighten around centralized platforms, many major exchanges are supporting decentralized alternatives. One example is AsterDEX, backed by Binance, which combines self-custody with a professional trading interface.

In this guide, we’ll explain what Aster is, how it works, its fees, safety, and how to start trading step-by-step.

Want to skip the tutorial and start trading right away? Visit AsterDEX and connect your wallet now.

What is Aster?

Aster is a decentralized crypto exchange (DEX) that allows users to trade directly from their own wallet. Unlike centralized platforms, Aster does not hold your funds. You stay in full control of your assets at all times.

The platform offers both spot and perpetual futures trading, with a user interface that feels similar to major centralized exchanges. This makes it beginner-friendly while still offering advanced tools for experienced traders.

Aster is backed by Binance, giving it additional credibility and infrastructure support within the crypto ecosystem.

In short, Aster combines the freedom of decentralized trading with the trading experience of a professional exchange.

Why choose AsterDEX?

Self-custody: You remain in control of your funds on a DEX

Global access: There are no restricted countries for a DEX

Backed by Binance: Backed by a big centralised exchange

Fast withdrawal: Instantly withdraw your funds into your wallet

AsterDEX Features

|

AsterDEX |

Centralised Exchange (e.g. Binance) |

|

Leverage Trading (futures) |

Leverage Trading (futures) |

|

Spot Market (but fewer trading pairs) |

Spot Market (More trading pairs) |

|

Grid Bots |

Grid Bots |

|

External copy trading (EchoSync) |

Copy-trading |

|

Self-custody (Third-party wallet) |

The company holds users' funds |

The gap between centralized and decentralized exchanges is getting smaller. For most traders today, the experience feels almost the same. The main difference is how the system works behind the scenes.

On a decentralized exchange, your wallet is your account. You trade directly through smart contracts, and you always keep control of your funds.

On a centralized exchange, the platform holds your assets and manages everything for you.

So while both can look similar on the surface, using a DEX means more freedom and ownership, but also more responsibility for your security.

Summary: AsterDEX is different because you trade from your own wallet, not from an account controlled by an exchange. But the trading experience is very similar.

Step-By-Step guide on using AsterDEX

1. Creating An Account (Connect Wallet)

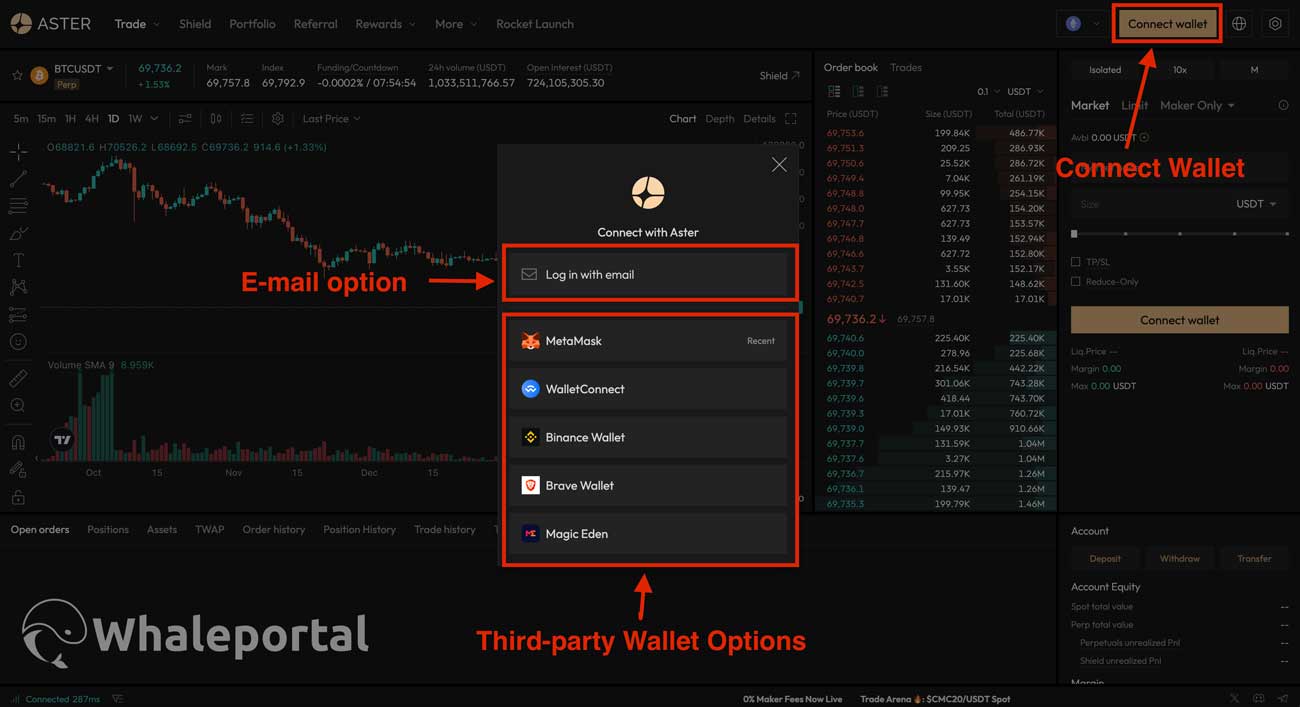

AsterDEX is a DEX and works differently from a centralised exchange. To create an account, you simply need to follow these steps:

- Visit the official AsterDEX website and click on “Connect.”

- Choose your third-party wallet (e.g., Metamask). IF you don’t have a third-party wallet, you can use an email as well. AsterDEX will create a wallet address for you.

2. Depositing Funds

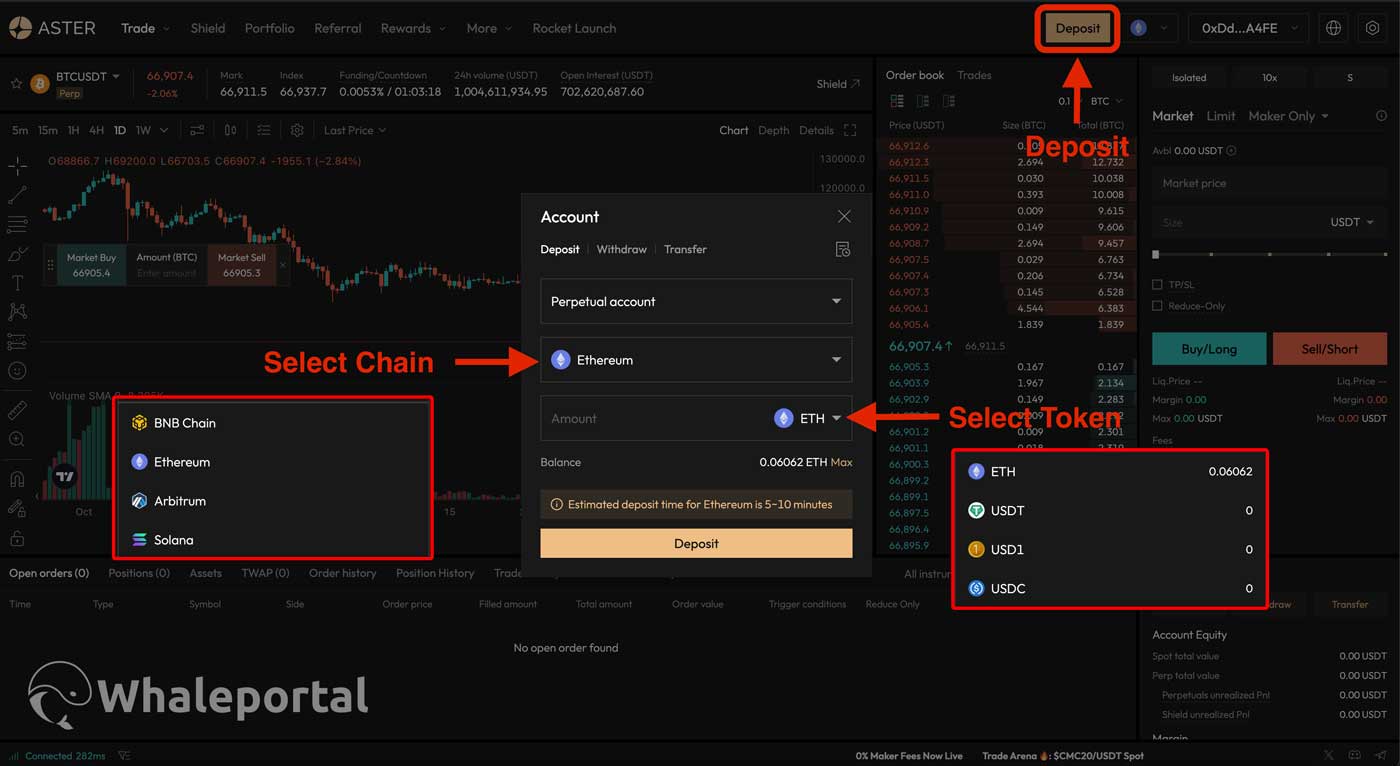

Now we’ll need to deposit funds into your AsterDEX account.

- To deposit ,simply click on “Deposit.”

- Select the account where you want the funds in (Perpetual or spot)

- Select the chain you want to use to deposit (e.g. Ethereum or BNB)

- Select token and amount, then click “Deposit.”

Once the funds are confirmed on the blockchain, you’ll have them in your account, and you can start trading directly.

3. Placing A Trade

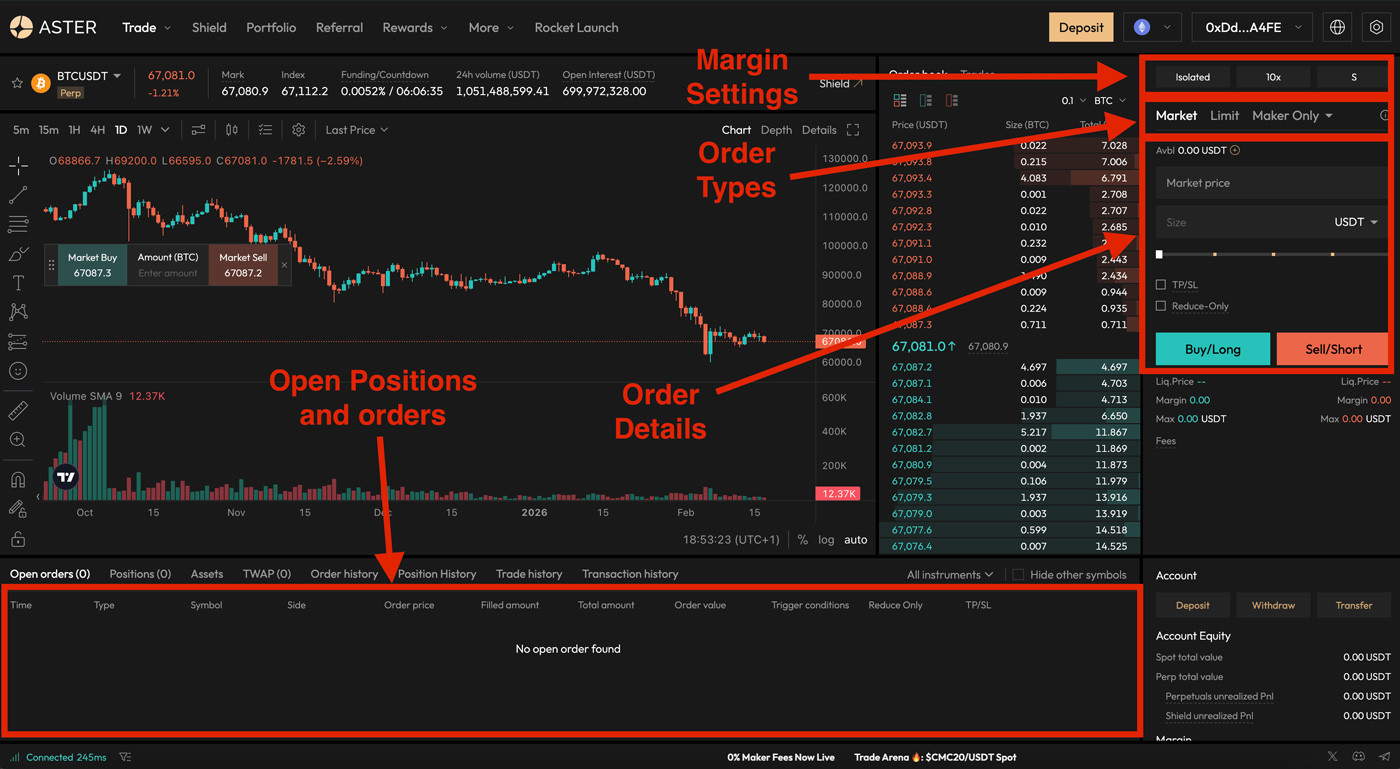

Placing a trade on AsterDEX is pretty straightforward and works similar as other exchanges.

- Navigate to the “Trade” section and select the trading pair

- Set your leverage and select order type (Market, limit or conditional order)

- Select the amount

- Click long (buy) or short (sell)

- The trade will appear in “Open positions.”

4. Withdrawing Funds

Because Aster is decentralized, you remain in control of your funds at all times. You can withdraw directly back to your external wallet (such as MetaMask) whenever you want.

To withdraw your funds:

- Click “Withdraw.”

- Select the chain you want to withdraw on (e.g., Ethereum or BNB)

- Select the amount and click “Withdraw”

AsterDEX Fees Explained

The trading fees on Aster are highly competitive and often lower than those of many centralized exchanges.

- Maker fee: 0.005%

- Taker fee: 0.04%

If you use Aster’s native token to pay your fees, you receive a 5% discount.

When you sign up through our affiliate link, you get an additional 2% fee discount, bringing your total discount to 7%.

While 7% may sound small, active traders know that even minor fee reductions can significantly improve long-term profitability, especially when compounding gains over hundreds of trades.

Is AsterDEX Safe?

AsterDEX operates as a decentralized exchange (DEX), which means you trade directly from your own wallet. Unlike centralized exchanges, Aster does not hold custody of your funds. You remain in control at all times.

Self-Custody Protection

Because your assets stay in your wallet, there is no centralized pool of user funds that can be frozen, mismanaged, or lost due to exchange insolvency.

Smart Contract Infrastructure

Trades are executed through smart contracts. This removes counterparty risk but introduces smart contract risk, like any DeFi protocol, security depends on the code.

Backed by Binance

Aster is backed by Binance, one of the largest crypto exchanges globally. This adds an additional layer of credibility and infrastructure support.

What Are the Risks?

While DEXs remove custody risk, they require more personal responsibility. If you lose access to your wallet or private keys, your funds cannot be recovered. Users are also responsible for protecting themselves against phishing websites and scams.

AsterDEX Promotion & Referral Link

Centralized exchanges often attract users with large deposit bonuses. Decentralized exchanges work differently; instead of temporary promos, they focus on lower trading fees.

Since you keep full custody of your funds, the real advantage is long-term cost efficiency. If you trade regularly, even a small fee reduction can significantly improve your overall profitability.

By signing up through our link, you get a 2% discount on trading fees on Aster.

Aster Compared To Other DEXs

Let’s compare Aster with Binance and Apex Omni. Binance backs Aster, while Apex Omni is a decentralized exchange supported by Bybit.

|

Feature/Metric |

Aster |

Binance |

Apex Omni |

|

Type |

Decentralised Exchange (DEX) |

Centralised Exchange (CEX) |

Decentralised Exchange (DEX) |

|

Custody |

Self-custody |

Binance holds funds |

Self-custody |

|

Fees (Maker/Taker) |

0.005% / 0.04% |

0.02% / 0.024% |

0.02% / 0.05% |

|

Order Types |

Market, limit, advanced |

Market, limit, advanced |

Market, limit, advanced |

|

Geographic Access |

Globally |

Restricted |

Globally |

|

Copy-trading |

Yes with third-party (EchoSync) |

Yes |

Yes |

|

Real-World-Assets markets (RWA) |

Yes |

Yes |

Yes |

|

Liquidity |

High |

Extremely High |

High |

|

Trading Pairs |

300+ Trading Pairs |

1400+ Trading Pairs |

130+ Trading Pairs |

As shown in the comparison table above, the differences in features and trading capabilities are relatively small. In fact, some traders may find a DEX even easier to use, mainly because there are fewer geographic restrictions and no traditional account setup required.

If you’d like a deeper comparison, we’ve also reviewed the top decentralized exchanges in a separate article.

Conclusion: Is AsterDEX Worth It?

AsterDEX combines the benefits of decentralized trading with a professional, easy-to-use interface. You stay in control of your funds, benefit from competitive fees, and trade on a platform backed by Binance.

For traders who want self-custody without sacrificing performance, Aster is a strong choice.

If you’re ready to start trading, sign up through our link and get 2% discount on your trading fees. Lower fees mean you keep more of your profits, and over time, that makes a real difference.

AsterDEX FAQ

What is AsterDEX?

AsterDEX is a decentralized crypto exchange (DEX) that allows users to trade directly from their own wallet. Unlike centralized exchanges, Aster does not hold custody of your funds.

Is AsterDEX safe?

AsterDEX is non-custodial, meaning you remain in control of your assets at all times. There is no centralized storage of user funds. However, like all decentralized platforms, users are responsible for securing their wallet and private keys.

Is AsterDEX backed by Binance?

Yes. AsterDEX is backed by Binance, one of the largest crypto exchanges globally, which adds credibility and infrastructure support to the platform.

What are AsterDEX trading fees?

AsterDEX charges:

- Maker fee: 0.005%

- Taker fee: 0.04%

Users can receive a 5% discount when paying fees with the native token. When signing up through our link, you receive an additional 2% discount.

Does AsterDEX require KYC?

No, AsterDEX does not require traditional KYC verification because it operates as a decentralized exchange. You simply connect your wallet to start trading.

What can I trade on AsterDEX?

AsterDEX offers both spot trading and perpetual futures trading. Traders can use leverage and choose between market, limit, and conditional orders.

How do I withdraw from AsterDEX?

Since AsterDEX is decentralized, withdrawals are made directly back to your connected wallet. Simply click “Withdraw,” select the chain and amount, and confirm the transaction.

Is AsterDEX better than Binance?

AsterDEX and Binance serve different purposes. Binance is a centralized exchange that holds custody of your funds and offers a wide range of products. AsterDEX is decentralized, meaning you trade from your own wallet with lower custody risk and fewer geographic restrictions.

Related Articles:

- Can You Use Binance In Canada?

- How to Avoid Liquidation in Crypto Futures (Survival Guide)

- Apex Omni Tutorial and Guide