How to Avoid Liquidation in Crypto Futures (Survival Guide)

TL;DR

Liquidation happens when your exchange closes your leveraged position because your margin isn’t enough to cover losses. It usually comes from using too much leverage, sizing too big, and not using a stop loss.

To avoid it, keep leverage low, risk only a small % per trade, and place a stop loss before your liquidation level. Tools like liquidation calculators and liquidation heatmaps can help you plan safer entries and avoid crowded liquidation zones.

Introduction to Liquidations

Even the most confident leveraged traders feel the shock when a perfect-looking trade suddenly turns against them, and their account takes a heavy hit. This moment is called liquidation, and it is one of the main reasons traders fail in futures markets.

Many beginners believe losses happen because they misread the direction. In reality, trades often fail even when the analysis is right. The real mistake is not giving the position enough room to survive normal market volatility.

One liquidation can erase weeks or even months of progress. After that, emotions take over, and traders start making worse decisions. Some call it bad luck, but most liquidations come from predictable risk-management errors.

The good news? With the right preparation and structure, liquidation can usually be avoided. Smart traders focus not only on finding good entries, but on protecting their capital and staying in control.

What Is Liquidation in Crypto Trading?

Liquidation happens when an exchange automatically closes your leveraged position because your collateral is no longer enough to support the trade.

When you trade futures, you are not using only your own money. You borrow additional funds from the exchange to control a larger position. Your own funds act as collateral, also known as margin.

The exchange must protect the money it lends. If the market moves too far against you, your collateral can no longer cover the potential loss. At that moment, the exchange closes the position automatically.

That forced closure is liquidation.

Liquidation is the exchange’s safety mechanism. It guarantees the borrowed funds are never in danger.

From a trader’s perspective, it can feel sudden and brutal.

From the exchange’s perspective, it is simply risk control.

Understanding how crypto liquidation works helps remove the emotion from the event. It is not a punishment. It is a built-in system designed to prevent debt.

Margin Call vs Liquidation

Many traders come into crypto futures with expectations from traditional finance. This creates a dangerous belief: there will always be a warning before liquidation happens.

In older financial markets, brokers may issue a margin call. This is a request to add more funds or reduce the position.

Crypto markets work differently.

They trade 24/7 and move extremely fast. There is rarely time for manual intervention. Some exchanges show margin warnings, but they usually appear very close to the liquidation price. By the time you react, it may already be too late.

This is why preparation must happen before entering the trade.

Prevention is always more powerful than reaction.

If you want a stronger safety buffer before trading with leverage, see our guide to the best crypto deposit bonuses and find out where you can receive extra margin and trading rewards.

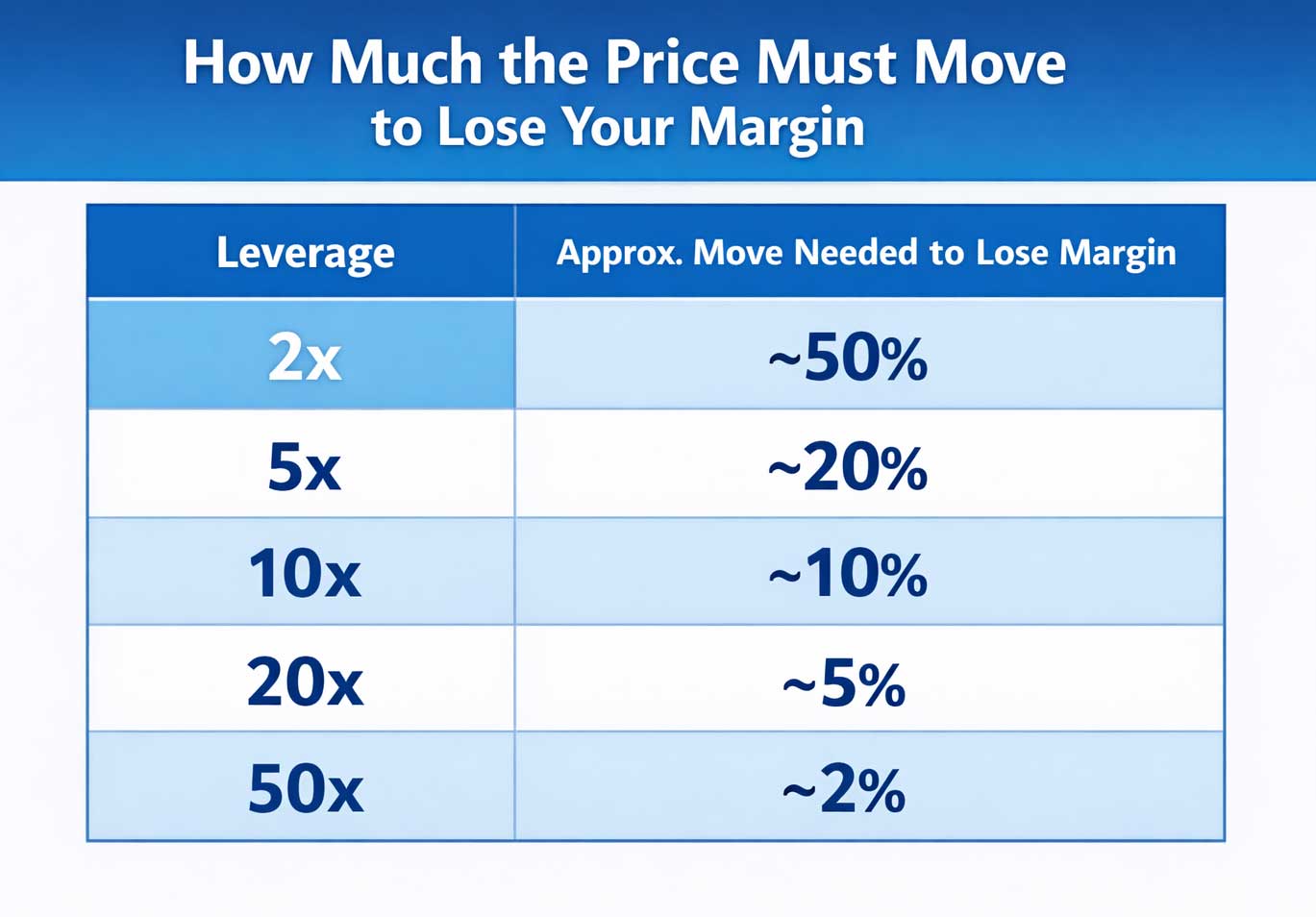

Why Leverage Makes Liquidation Faster

The obvious question is: why can liquidation happen so quickly?

The answer is simple — leverage.

Leverage allows you to control a large position with a small amount of capital. This increases potential profits, but it increases risk in the exact same proportion.

The higher the leverage, the smaller the distance between your entry price and your liquidation level. As a result, the trade has less room to survive normal market movement.

And crypto markets are volatile by nature.

Prices regularly swing several percent in a single day. This is normal behavior, not a market crash.

If your position cannot survive normal volatility, liquidation becomes a matter of when, not if.

Experienced traders understand this. They treat leverage as a risk tool, not a shortcut to profit.

Beginners often do the opposite — and the market teaches them through liquidation.

Recognizing the relationship between leverage and volatility is one of the biggest steps toward long-term survival.

The Real Reasons Traders Get Liquidated

Many traders believe liquidation happens because they picked the wrong direction.

That is only part of the story.

In most cases, liquidation happens because the trade was built on a weak structure from the beginning.

The most common problem is position size.

When too much capital is committed to a single idea, even small price movements become dangerous.

The second major cause is excessive leverage.

Higher leverage shrinks the safety buffer and brings the liquidation level closer to the entry price.

Another frequent mistake is trading without a stop loss.

Traders try to avoid small losses and hope the market will turn around. Unfortunately, markets rarely reverse just because someone is waiting.

Emotions also play a big role.

After a loss, many traders increase their leverage to recover faster. In reality, this usually accelerates the path toward another liquidation.

Finally, some traders ignore volatility and major news events. Sudden spikes in price can wipe out overleveraged positions within minutes.

Once you recognize these patterns, liquidation stops being a mystery. It becomes a risk that can be measured, planned, and controlled.

Before trusting any platform with leveraged trading, it’s also important to know how safe it is. Read our guide How to Check if a Crypto Exchange Is Legit (DEX & CEX Safety Checklist) to learn how professionals evaluate exchanges and protect their funds.

How to Avoid Liquidation in Crypto

There is no magic trick that guarantees safety in leveraged trading.

But there are rules professional traders follow to dramatically reduce the chance of getting liquidated.

Let’s go through the most important ones.

Use Low Leverage

A common myth in crypto is that leverage creates profit.

It doesn’t.

Leverage mainly determines how fast you can lose.

Yes, higher leverage can magnify gains. But it also reduces how much market movement your trade can survive.

Crypto is naturally volatile. Bitcoin and altcoins regularly move several percent within hours. This is normal behavior, not a crash.

If you trade with very high leverage, your position sits inside this everyday noise.

The market does not need to collapse to liquidate you. Normal movement is enough.

Experienced traders understand this. They use leverage carefully and give trades breathing room.

Beginners often chase big returns with 50x or 100x.

Most of them learn the same lesson the expensive way.

Risk a Small Percentage per Trade

Once leverage is understood, the next question becomes:

How much of the account should be risked on one idea?

This is where many traders unknowingly build liquidation risk.

New traders focus on how much they can win.

Professionals focus on how much they can lose.

A widely respected rule is risking only 1 to 2 percent of the total account per trade.

At first this may feel slow. But during losing streaks, and they always happen, this approach keeps you alive.

Small risk has another advantage, emotional stability.

Losses feel manageable, which makes it easier to stick to the strategy instead of revenge trading.

This discipline prevents position sizes from becoming dangerously large.

Always Use a Stop Loss

Before entering any trade, every trader must answer one question:

Where am I wrong?

Many people skip this step and assume they can exit manually.

But markets often move faster than human reaction time.

A stop loss is a predefined exit that protects you before liquidation happens.

Before opening a position, three numbers must be known:

-

Entry price

-

Stop loss

-

Liquidation level

If you do not know them, you are trading on hope.

A good stop loss turns a disaster into a manageable loss.

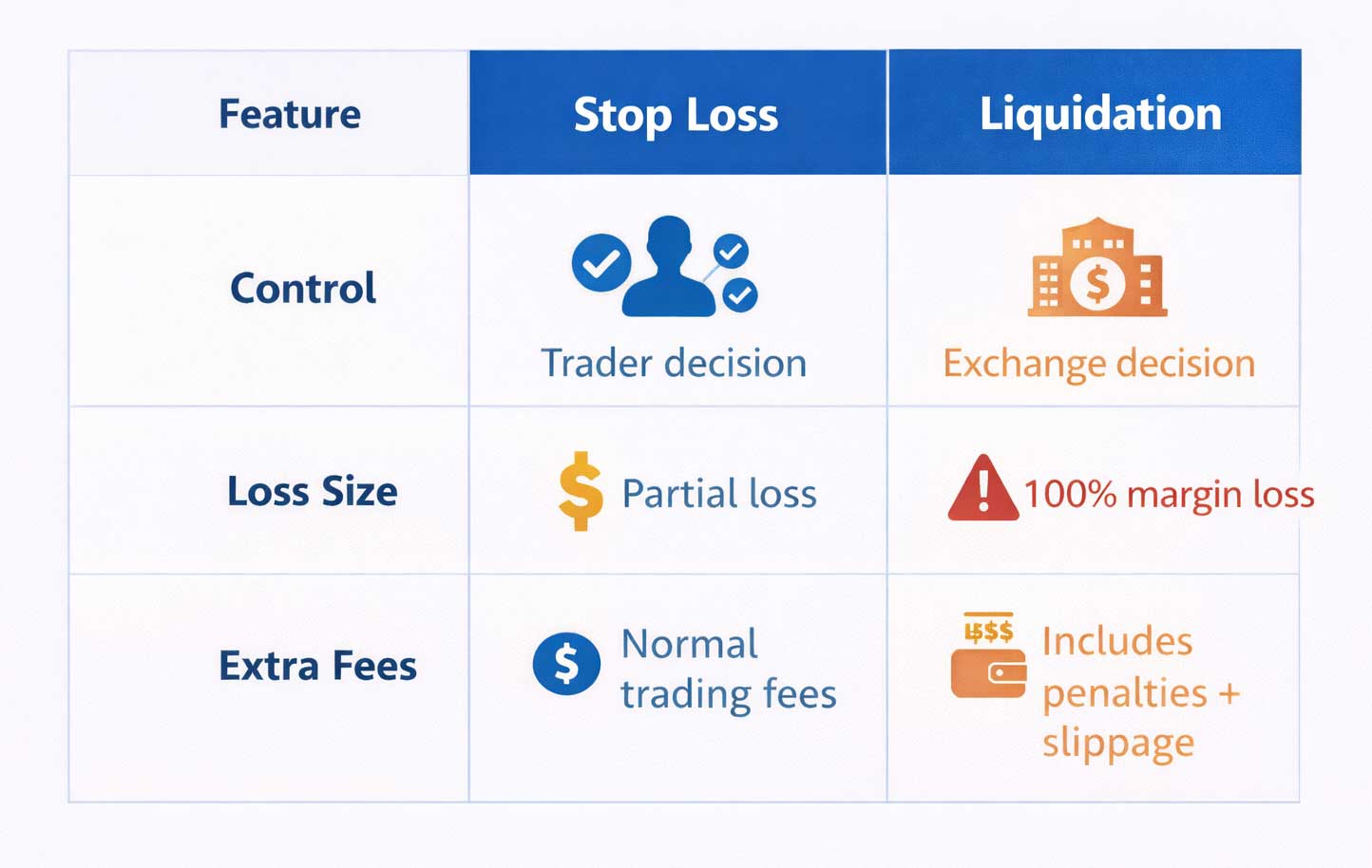

Stop Loss vs Liquidation

The difference is enormous, both financially and psychologically.

A stop loss means you stay in control.

Liquidation feels forced and often leads to emotional decisions.

Liquidation may also include extra fees, making the damage worse.

The mission of risk management is simple.

Choose your loss before the market chooses it for you.

Where to Place Stop Losses

Stop losses are not random numbers.

They are placed at the point where your trade idea becomes invalid.

Common examples:

-

Below support for long positions

-

Above resistance for short positions

-

Beyond recent swing highs or lows

If price reaches those levels, the market structure has changed.

It makes sense to exit and protect capital.

Three Stop Loss Styles

Stop loss well before liquidation

You exit early, save most of your margin, and live to trade the next setup.

Stop loss near liquidation

You risk most of your capital. This is usually used by experienced scalpers.

No stop loss

This works until it does not. When it fails, it usually ends in liquidation.

Example Trade Structure

BTC long

Entry: $38,000

Margin: $1,000

Leverage: 10x

Position size: $10,000

Even with planning, risk never disappears.

The goal is control, not perfection.

Factor in Funding Fees

Funding is one of the silent killers of margin.

Perpetual futures require payments between longs and shorts. Over time, these payments slowly reduce your available collateral.

A trader can be liquidated even if price barely moves.

Example:

Position: $10,000

Margin: $1,000

Funding: 0.01 percent every 8 hours

Holding for days means margin keeps shrinking

As margin falls, the liquidation level moves closer.

Smart traders monitor this and use liquidation calculators to stay aware of the risk.

Understand Exchange Rules

Liquidation is not determined by price alone.

It also depends on how the exchange manages risk.

Different platforms use different systems.

Liquidation on CEXs

On centralized exchanges like Bybit, liquidation is usually based on a mark price rather than the last traded price. Fees may go to an insurance fund, and during extreme volatility Auto Deleveraging can reduce profitable positions.

Liquidation on DEXs

Decentralized platforms such as Apex Protocol often rely on oracle pricing and may perform partial liquidations instead of closing the entire trade at once. Larger positions typically require higher maintenance margin.

Understanding these mechanics helps you anticipate risk instead of being surprised by it.

Practical Protection Checklist

-

Use isolated margin instead of cross

-

Place stops using mark price

-

Monitor margin ratio

-

Pay attention to ADL signals

Small adjustments can make a major difference in survival.

Watch Liquidation Heatmaps

Markets often move toward areas where many traders are vulnerable.

Liquidation Heatmaps help identify these clusters.

If you see heavy liquidations below your entry, placing your stop somewhere else can reduce the chance of getting caught in the cascade.

These tools improve planning, but they never replace discipline.

Avoid Common Mistakes

Why do traders still get liquidated after learning all this?

Because knowledge is easier than behavior.

Typical self-destructive actions include:

-

increasing leverage after a loss

-

moving the stop further away

-

adding to losing positions

-

ignoring funding costs

-

trading during major news without protection

Each decision slowly weakens the structure of the trade until normal volatility becomes fatal.

Avoiding liquidation is therefore not only technical. It is psychological.

The Simple Checklist to Avoid Liquidation

Before entering any trade, experienced traders run through a quick safety check.

Ask yourself:

-

Is the leverage low enough for the position to survive normal volatility?

-

Is the position size small relative to the account?

-

Is the stop loss placed well before the liquidation level?

-

Can the account survive several consecutive losses?

If the answer to these questions is yes, the trade is structurally healthy.

If not, something must be reduced or adjusted before entering.

Small corrections before the trade are much easier than dealing with liquidation afterward.

Who Should Pay the Most Attention to Liquidation?

This guide is especially important for:

-

beginners using leverage for the first time

-

traders who have been liquidated before

-

traders with small accounts

-

active futures traders

At some point, everyone learns the same lesson.

Prediction alone is not enough.

Markets do not reward the trader who is right the most.

They reward the trader who survives the longest.

And survival comes from managing risk and avoiding liquidation.

FAQs

How do you avoid liquidation in crypto?

Use lower leverage, control your position size, and always place a stop loss before the liquidation level.

How can I avoid forced liquidation?

Monitor your margin ratio and exit losing trades early with predefined stop losses.

What is liquidation in crypto?

Liquidation occurs when an exchange closes your leveraged position because your collateral can no longer cover the losses.

Why does my crypto balance show zero?

Your margin may have been fully used or your position might have been liquidated.

How do I use a stop loss in crypto trading?

A stop loss automatically closes your trade at a chosen price to prevent larger losses.

Can my crypto account go negative?

Usually not. Most exchanges close positions before losses exceed your available margin.

Is it normal to lose money in crypto trading?

Yes. Losses are part of trading, which is why risk management is essential.

Why is my wallet empty after a trade?

Funds may have been spent, withdrawn, or lost through liquidation in leveraged positions.

What happens when a position is liquidated?

Your margin is lost, fees are applied, and the exchange closes the trade automatically.

What is a good stop loss percentage?

Many traders risk around 1 to 2 percent of their total account on a single trade.

How can I stop losing money in crypto?

Reduce leverage, follow strict risk management, and avoid emotional trading decisions.

What does a 5 percent stop loss mean?

It means your position will close automatically if price moves 5 percent against you.