Best No-KYC Crypto Exchanges with Low Fees (2025 Guide)

Looking to trade crypto without revealing your identity and without paying high fees? In this guide, we’ll explore the top no-KYC crypto exchanges of 2025, including their fees, features, and why they’re perfect for privacy-focused traders.

What Is a No-KYC Crypto Exchange?

A no-KYC crypto exchange lets you trade cryptocurrencies without identity verification. These platforms are ideal for anonymous trading and quick account access without uploading documents and waiting for verification. In this article, we’ll compare the trading fees of popular no-KYC exchanges, including a decentralized option, to help you find the most cost-effective and private way to trade crypto.

Quick Overview

Before we dive into the specifics let me share a quick overview of the best No-KYC exchanges and their fees and withdrawal limits.

|

Exchange |

Type |

Trading Fees M/T |

Withdraw Limit (Unverified) |

KYC required |

|

Bitunix |

CEX |

0.02% /0.06% |

$10,000 per day |

No |

|

BTCC |

CEX |

0.025%/0.045% |

$10,000 per day |

No |

|

Apex Omni |

DEX |

0.00%/0.05% |

Unlimited |

No |

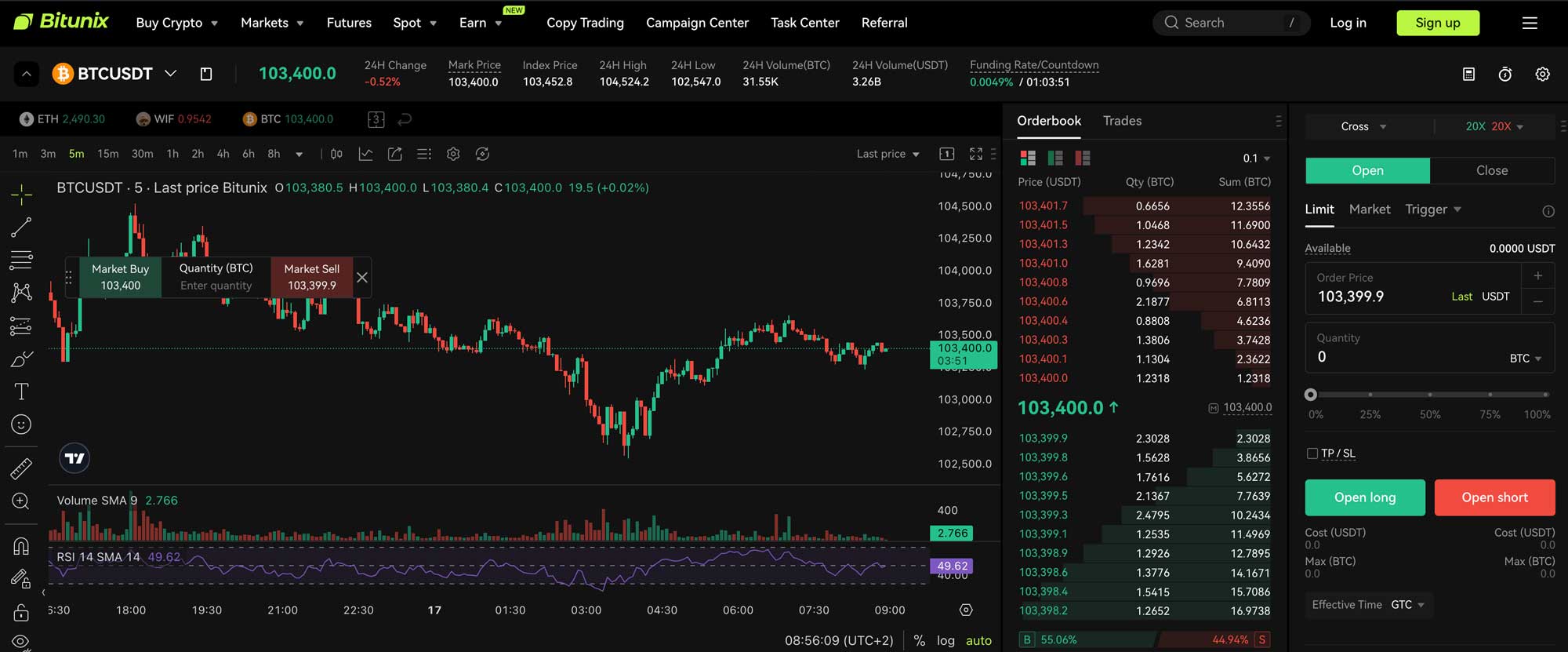

Bitunix - A Trusted No-KYC Centralized Exchange

Bitunix is one of the most popular no-kyc centralized crypto exchange known for its deep liquidity, ensuring a smooth and efficient trading experience even during volatile market conditions. So no scam wicks or liquidation hunting. It’s a great choice for traders who value fast order execution and reliable platform performance.

One thing people really like about Bitunix is that you don’t have to verify your identity if you don’t want to. You can still withdraw up to $10,000 per day without KYC. And if you ever need higher limits, just complete the verification and unlock up to $1 million per day. Perfect whether you’re trading small or going big.

In terms of fees, Bitunix offers slightly cheaper maker fees compared to BTCC, making it attractive for users who provide liquidity. However, taker fees are a bit higher, so it’s something to consider based on your trading style. Bitunix also offers unique deposit bonuses to new users.

🎁 Exclusive Bonus: Start trading on Bitunix today and claim up to 8,000 USDT in deposit bonuses when you register through our special link!

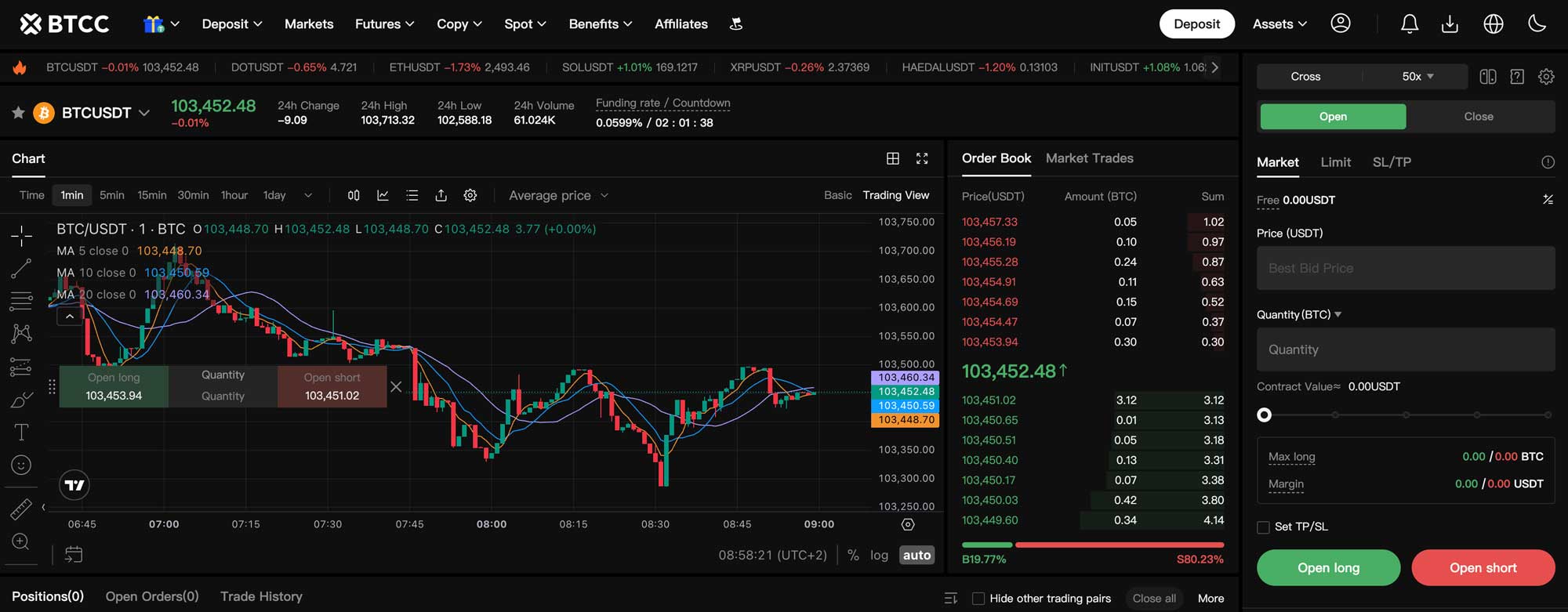

BTCC - Trade Crypto and Commodities Without KYC

BTCC is a well-known centralized crypto exchange that not only offers a wide range of cryptocurrencies but also lets you trade tokenized commodities and stocks directly with USDT. This makes it a great option if you’re looking to diversify your trades beyond just crypto.

When it comes to withdrawals, the limits are the same as Bitunix, up to $10,000 per day without KYC, and if you verify your account, that jumps to $1 million per day.

BTCC also shines with its lower taker fees compared to Bitunix, making it ideal if you’re actively buying from the order book. Just keep in mind that maker fees are slightly higher, so it depends on your trading style.

🎁 Special Offer: Sign up now and enjoy a 10% deposit bonus up to $10,000 with our exclusive link!

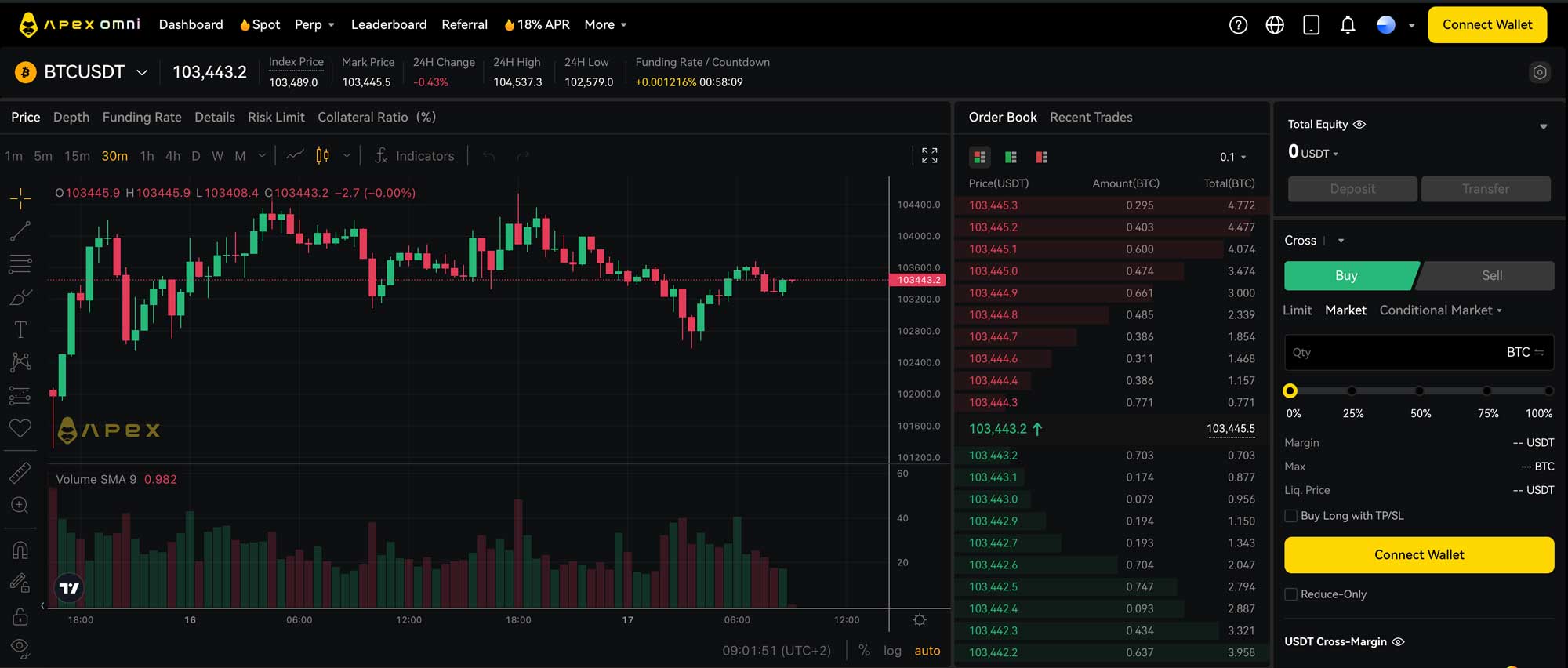

Apex Omni - Trade Privately with Full Control

Apex Omni is a fully decentralized exchange (DEX), which means you stay in complete control of your funds at all times, no KYC, and no account needed. Just connect your MetaMask wallet and you’re ready to trade in seconds! If you prefer to create an account with your email, it’s possible too.

While the liquidity isn’t as deep as on centralized exchanges like Bitunix or BTCC, Apex Omni makes up for it with super-low fees. In fact, maker fees are 0%, and taker fees are just 0.05%, making it one of the most cost-effective platforms for private trading.

Apex Omni also runs regular giveaways and community events, giving you extra chances to earn rewards while trading with their trade-to-earn programs.

🎁 Exclusive Perks: Get started on Apex Omni today and unlock special benefits through our exclusive link!

Conclusion

The great thing about all three platforms: Bitunix, BTCC, and Apex Omni is that you can access them from any country without a VPN and without going through KYC. This makes them perfect for traders who value privacy and freedom.

If you’re after deep liquidity and a smoother trading experience, the centralized options are your best bet. Just keep in mind that their fees can be slightly higher. BTCC stands out with lower taker fees and the unique ability to trade tokenized stocks and commodities directly with USDT. On the other hand, Bitunix offers cheaper maker fees, which is great if you like placing limit orders and providing liquidity.

If privacy and low fees are your top priorities, and you’re comfortable with slightly lower liquidity, Apex Omni is a fantastic decentralized option. With 0% maker fees and just 0.05% taker fees, plus full self-custody through your wallet, it’s perfect for truly private, low-cost trading.

Results:

|

Type of Trader |

Best Exchange |

|

Limit orders |

Bitunix |

|

Market orders |

BTCC |

|

Self-custody |

APEX (but low liquidity) |

FAQ – No-KYC Crypto Exchanges

Is it legal to use no-KYC crypto exchanges?

Yes, using no-KYC exchanges is generally legal, but it depends on your country’s regulations. Always check local laws to ensure compliance.

Which no-KYC exchange has the lowest fees?

If you’re looking for the lowest fees, Apex Omni offers 0% maker fees and just 0.05% taker fees. However, liquidity is lower compared to centralized exchanges like Bitunix and BTCC.

Can I withdraw large amounts without KYC?

Yes, both Bitunix and BTCC allow you to withdraw up to $10,000 per day without KYC. Completing KYC raises the limit to $1 million per day.

Which no-KYC exchange is best for beginners?

If you’re new to trading and prefer a smooth, hassle-free experience, Bitunix and BTCC are great options thanks to their high liquidity and easy-to-use platforms.

Related Articles:

- Apex Omni Step-by-Step Tutorial

- Bitunix Deposit Bonus Guide

- Best Decentralized Crypto Exchanges in 2025