Bybit Fees vs Binance

Transaction fees seem small but eat a sizable chunk of your profits, especially if you are a frequent trader. Bybit and Binance sometimes waive the fees to attract more users and to reward existing ones. This Bybit fees vs Binance fees review seeks to establish which crypto exchange charges the lowest trading fees in various sections like spot and derivatives markets.

Bybit Fees vs Binance: Bybit Trading Fee Structure

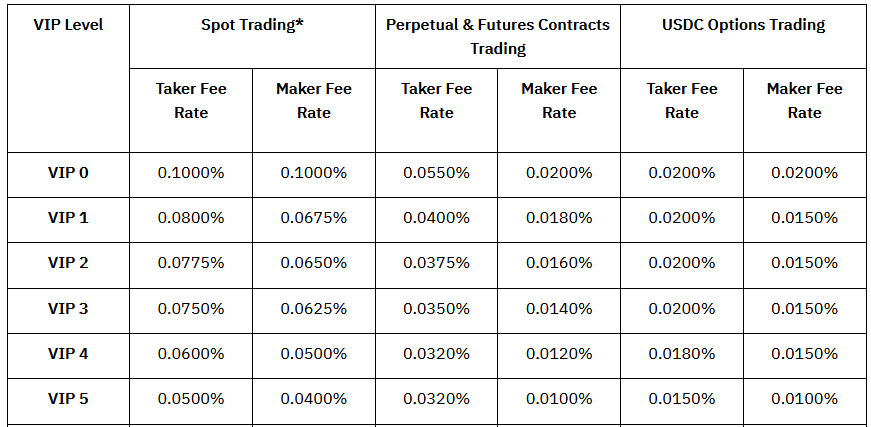

Bybit charges different fees for different services. Some of the factors that determine how much you pay in fees include things like which service you are using on the platform and your trading level. For example, regular users pay 0.1% for both makers and takers on the spot market.

It charges the same users a flat 0.02% for USDC options trading. Bybit also has a 0.055% taker fee and 0.02% maker fee for those trading on the perpetual and futures contracts’ wing.

All the charges, from the spot to the derivative market, drop as the user moves up the levels known as VIP and Pro levels. VIP 5 traders, for example, pay 0.05% and 0.04% as taker and maker fees respectively on the spot market. When trading perpetual and futures contracts, users at this level, part with 0.032% and 0.01% taker and maker fees respectively.

Note that your monthly trading volume or account balance determines your level. Level 5 users, for instance, must have a minimum of $2 million in crypto balances or a minimum trading volume of $10 million, $100 million, and $25 million in either spot, derivatives, or options trading activities.

Binance Trading Fee Structure

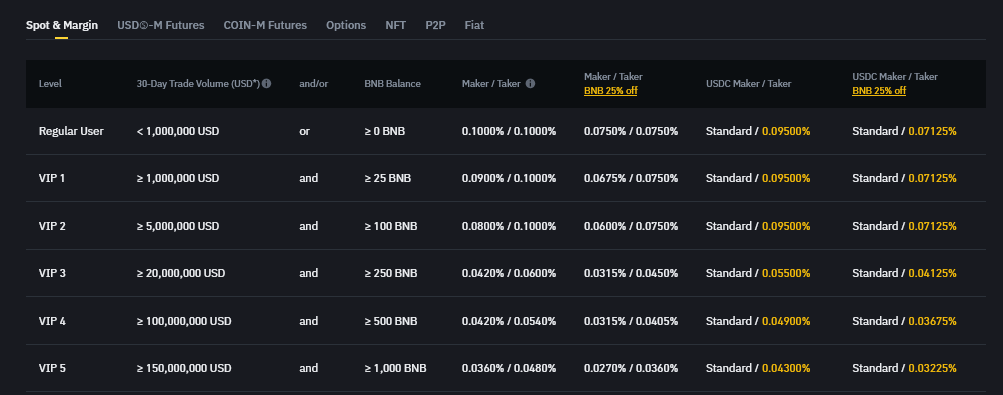

Binance follows the same criteria as Bybit. However, the charges are different in some cases. Regular users on its spot/margin market pay 0.1% whether they’re placing market or limit orders. The fee, however, drops by 25% if paid in the exchange’s own token BNB.

Binance users with a VIP5 badge part with 0.036% / 0.048% maker/taker fees, which drop by a further 25% if paid in BNB. The exchange offers a 10% discount on fees charged on its USDT-based futures contracts when traders pay the fees using BNB.

It charges a flat 0.03% for options trades across all levels. The exchange has higher trading volume and account balance requirements than Bybit. For example, a VIP5 user must have a minimum 30-day trading volume of $150 million and hold a minimum of 1,000 BNB coins.

Bybit Fees vs Binance: Which Crypto Exchange Charges More?

It’s almost a tie. Although Binance charges lower fees as you climb up the VIP levels, users must also hold BNB to enjoy these low fees. The exchange also has higher requirements to climb the VIP ladder.

On the other hand, although you part with seemingly more fees on Bybit, it’s easier to climb up the VIP levels to enjoy low fees.

Also, Bybit tends to organize more promotional periods where they charge for example 0% fees on spot trading for some time.

Final Remarks

The Bybit fees vs Binance battle has no clear winner. However, if you are a beginner crypto trader, Bybit is a good place to start. Both exchanges don’t charge any fees on crypto deposits, while the status of individual blockchains determines crypto withdrawal fees. The main difference in fee structure is that with Binance you need to hold tokens to get a greater discount on your fees, and on Bybit they look at your trading volume.