How to Copy HyperLiquid Wallets (Whales, Risks & Smart Strategies)

This is not a get-rich-quick article. Copying other traders will not make you instantly wealthy. What it can do, however, is give you a unique peek into how real traders manage risk, size positions, and execute their strategies.

In this article, we’ll explore how to copy traders by tracking Hyperliquid whale wallets, where every trade is fully transparent on-chain. We’ll also briefly compare this approach with alternatives such as copy trading on centralized exchanges, and explain why copying trades, despite strong track records, is often harder than it looks.

Key Takeaways

- Focus on profitable, high-capital wallets

- Observe the core position (direction, size, leverage)

- Combine wallet data with other market indicators

- Be patient with entries and disciplined with exits

How to copy HyperLiquid Wallets

Copy trading on HyperLiquid works very differently compared to centralized exchanges.

On centralized platforms, you usually select a trader or strategy, click “Copy”, and your capital automatically mirrors every trade. HyperLiquid does not work this way.

HyperLiquid is fully on-chain and transparent. Every wallet, trade, and position is visible, but there is no built-in feature to blindly copy a wallet. Instead, copying a wallet on HyperLiquid is a manual process.

Wallet Transparency

Every trader on HyperLiquid trades from a wallet address. These wallets are public, meaning you can see:

- Open positions

- Entry prices

- Position size

- Leverage used

- PnL (profit & loss)

- Historical trades

You can see everything a trader is doing, but no feature allows you to automatically copy their trades. This means you need to follow the wallet manually by observing the trader’s positions and actions. In many cases, this is actually an advantage, because blindly copying any trader without understanding their strategy can introduce significant risk. So the game is slightly different than copy trading on centralised exchanges.

Method 1: Manually Following a Wallet (Beginner Method)

This is the easiest and most common way to copy a wallet on Hyperliquid.

Instead of automated copy trading, you manually observe what a trader is doing and replicate the trades yourself.

Step-by-step:

- Find a profitable wallet address (HyperLiquid Wallet Analysis Guide)

- Open the wallet on Coinglass (Better interface than HyperLiquid)

- Check the positions of the trader

- \Manually open a similar trade in your own wallet

You can monitor the wallet:

- In real time

- Several times per day

- At specific moments (for example, during high volatility)

Important: You will never get the exact same entry or exit. Execution timing, slippage, and funding rates will always differ slightly. This makes this method a little bit flawed.

Method 2: Core-Position Copying

This is, in my opinion, a better, more nuanced way to copy other successful or whale traders on HyperLiquid. The core-position copy method is to look at the wallet's core position, is it long or shorting and how much of the capital is the wallet using? This will give you an idea of the direction the HyperLiquid wallet expects the price of a certain crypto (or other) asset to go. You can then compare this core-position with other whale wallets on HyperLiquid. If you want to know more about HyperLiquid Whale wallets, read our guide on HyperLiquid Whale Wallet Tracking.

Step-by-step:

1. Find profitable wallet address (HyperLiquid Wallet Analysis Guide)

2. Check the core-position of the trader (Long or short? Amount of capital & Leverage)

3. Check the core position of other whale wallets

4. Manually look for a setup using technical analysis for something in the same direction

You can monitor the wallet and data:

- In real time

- Several times per day (every couple of hours)

- Compare it with other metrics

Combine with other data

And here is where you can make this strategy more authentic and increase the profitability ratio, by using other market data to confirm the thesis from the HyperLiquid whale wallet. See this as an extra layer to reduce potential false signals.

Buying and Selling pressure heatmaps

Let’s take the buying and selling pressure heatmaps. These heatmaps show how much buying or selling pressure there is. It’s important to look how the price acts by the data from the heatmaps. But let’s say you see that a HyperLiquid Whale is going long with a 20x leverage, but on the buying and selling pressure heatmaps, you see an increase in selling pressure on the 1-hour timeframe. You then might want to wait with entering, wait for the selling pressure to be less, or do not enter a trade. Your decision might be different when it is a 4x leverage as there is less risk.

Entries and Exits

Another way to apply an extra layer in copying HyperLiquid whale wallets and optimising your profits and minimizing risk is to have a strategy for your entries and exits. So let’s say the wallet has entered a long position, and the price is already trading higher. Instead of chasing that same position and entering a long position, you can also set a limit order around the same entry price as the wallet did. The price might still come down to fill your limit order. Traders often assume that whale wallets know exactly what they’re doing but don’t forget they also just take calculated risks. And with trading in my experience, it is better to have patience and let positions come to you in favourable scenarios rather than chasing the price.

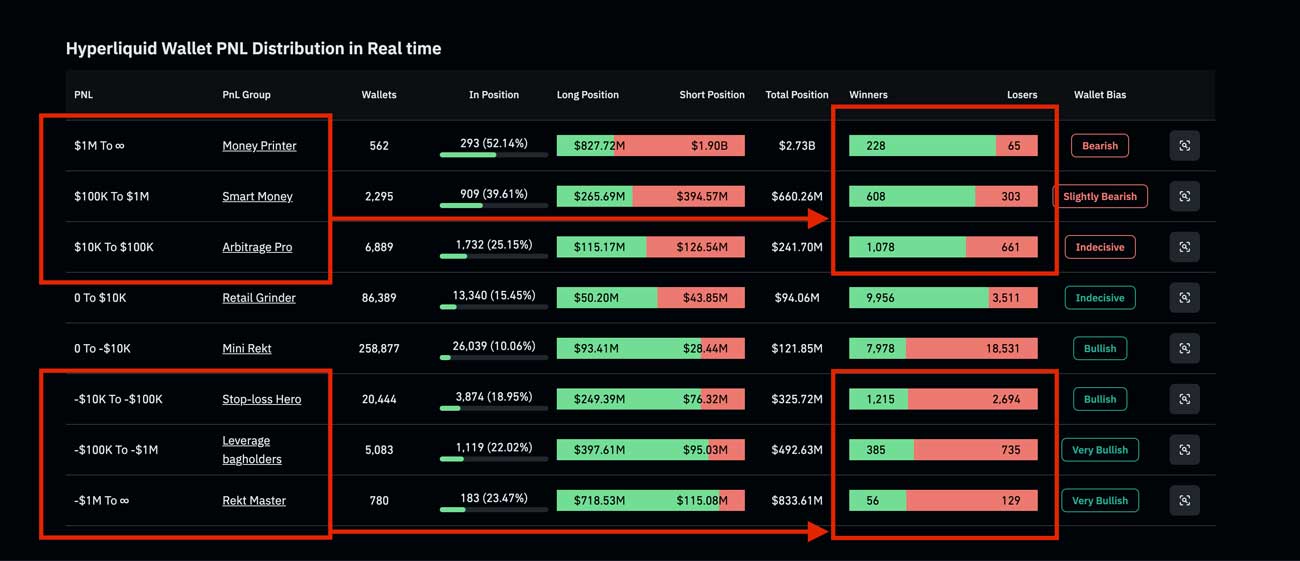

Other Indicators (E.g., Sentiment)

Another indicator that might be good to include before following a trade of a HyperLiquid whale is the sentiment. If sentiment is is for example, extremely bullish, you might want to be careful with following the herd. You can also view what the HyperLiquid whale wallets are doing as a whole, so for example, what is the ratio between long and shorts for all wallets that have more than 1 Million USD. This can give you as well a good overview on what the sentiment is and if the trade that you want to follow is in the camp of the minority of the majority. When it is in the camp of the minority, this can be a good sign as it often serves as a contrarian in the markets, but not always. So always make sure to combine your best indicators before copying any trader, these are just some take into consideration.

Which HyperLiquid Wallets are most profitable?

It is visible in the data that the HyperLiquid wallets with the most capital are often more profitable. They fall into the category of “smart money”. While smaller wallets, often known as “retail” is more often wrong than right because of the tendency to make more decisions based on emotions.

In the image above, you can clearly see that the profit of the HyperLiquid wallets: Money printer, Smart money, and Arbitrage pro are more profitable. These wallets have the most capital. The opposite is visible with the more retail wallets like: Stop-loss hero, Leverage bag holder, and Rekt master. So your chances statistically would increase to make better copy trades by following wallets with more capital. However, do take in mind that nobody can predict the market,s and even copying successful wallets carries a high risk. That brings us to the next section, which is one of the most important ones, and that is risk management.

Risk management

This is probably where most traders go wrong. If you copy someone's trades, you do not automatically know the risk management of that trader. You might not even know where that trader plans to close their positions, either in profit or loss, with a stop-loss. You always have to continue to monitor the trades of the wallet in order to look if they did anything to their positions, if anything has changed.

Before you copy or open any trade, always:

- Define stop-loss (This can also be a signal of an indicator)

- Define Take-profit

You have to know what would invalidate your idea of the trade. Otherwise, you can have a winning strategy, let’s say win 7 out of 10 trades, but if the 3 trades you lose, you won’t cut losses, the strategy will not be profitable.

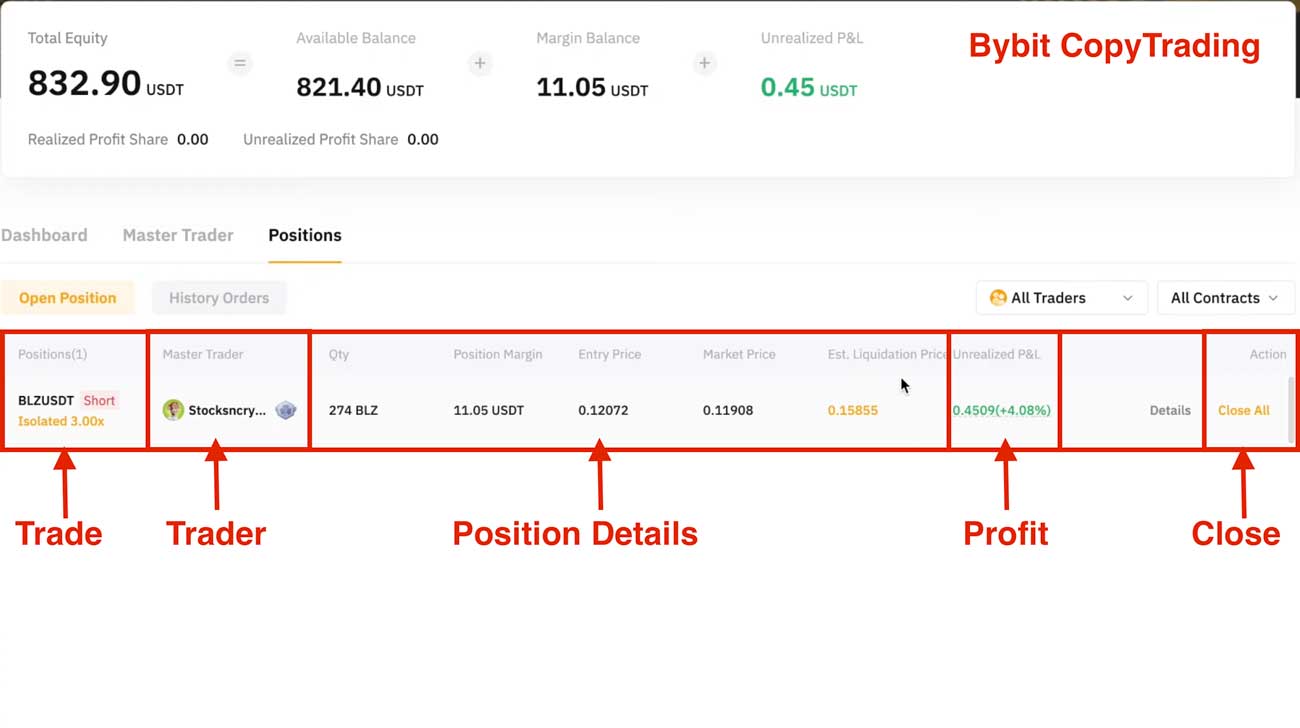

Copy trading on Centralised Exchanges

Copy trading has been around for years, especially on centralized cryptocurrency exchanges. On these platforms, the process is usually straightforward: you select a trader, click “Copy,” and your account automatically mirrors every trade they take.

Copy trading has been around for years, especially on centralized cryptocurrency exchanges. On these platforms, the process is usually straightforward: you select a trader, click “Copy,” and your account automatically mirrors every trade they take.

Over time, these platforms have become much more transparent. Today, you can often see a trader’s open positions, entry prices, position size, leverage, and historical performance. In some cases, you can even manually adjust or close copied positions from your own account. This gives traders more control than earlier versions of copy trading.

This level of transparency introduces an interesting angle. Instead of using copy trading purely as an automated strategy, it can also be used as a research and confirmation tool. For example, you could copy a proven trader on a centralized exchange with a very small amount of capital, not to follow them blindly, but to observe their positioning and timing.

By doing this, you can compare the positions of profitable centralized exchange traders with successful HyperLiquid wallets. When multiple independent and consistently profitable traders point in the same direction, it can strengthen a trading thesis. While this does not guarantee success, combining data from different sources may help filter out weaker signals and improve decision-making.

That said, even with strong track records and transparent data, copying trades remains difficult. Execution timing, risk management, and market conditions can still work against you. This is why understanding the context behind a trade is just as important as the trade itself.

Common Mistakes When Copying HyperLiquid Wallets

Blindly Chasing Entries

One of the most common mistakes is entering a trade simply because a whale wallet has already entered. By the time you notice a position, the price may have moved significantly. Chasing the same entry often leads to poor risk-reward and unnecessary losses.

Instead of copying immediately, consider waiting for a pullback or placing a limit order closer to the wallet’s original entry. Patience often improves execution.

Ignoring Leverage Differences

Not all positions carry the same risk. A whale opening a position with 3x leverage is taking a very different risk than one using 20x leverage. Copying the direction without considering leverage can completely change the outcome of a trade.

Always assess how much capital and leverage the wallet is using before deciding whether the trade fits your own risk tolerance.

Assuming Wallets Know Something You Don’t

It’s easy to believe that large wallets always have superior information. In reality, even the most profitable traders are making calculated guesses. They lose trades too.

Whale wallets provide context, not certainty. Treat their positions as one data point, not as guaranteed outcomes.

Neglecting Risk Management

Copying a trade does not mean copying the trader’s risk management. You don’t know their stop-loss, take-profit, or how much drawdown they are willing to accept.

Before entering any trade:

- Define your stop-loss

- Define your take-profit

- Know what would invalidate the trade idea

Without this, even a strategy that wins most of the time can fail due to a few uncontrolled losses.

Following Too Many Wallets at Once

Tracking too many wallets can create conflicting signals and decision fatigue. One wallet might be long while another is short, leading to hesitation or emotional decisions.

It’s often better to focus on a small number of consistently profitable wallets and understand their behavior over time.

Conclusion

Copying HyperLiquid wallets can be a valuable way to gain insight into how experienced traders position themselves in the market, but it is not a shortcut to guaranteed profits. The real advantage lies in transparency: seeing positions, leverage, and behavior in real time, and using that information as part of a broader decision-making process.

By focusing on profitable wallets, understanding core positions, combining on-chain data with other indicators, and applying strict risk management, you can turn wallet tracking into a structured trading approach rather than blind copy trading.

If you’re still deciding which decentralized trading platform fits your strategy best, make sure to read our Best Decentralized Exchanges Compared article. It breaks down the differences between leading DEXs, including HyperLiquid, and helps you understand where each platform excels depending on your trading style.

Related Articles:

- How to Track Smart Money on Hyperliquid Using Wallet Data (Complete Guide)

- Quantitative Crypto Trading: Strategies, Automation & Backtesting

- Bitcoin CME Gaps and CME Trading Strategy Explained