Crypto Bonuses Explained – Welcome, Deposit & Fee Discount Guide

Crypto exchanges advertise thousands of dollars in bonuses, but most traders don’t fully understand how these rewards actually work.

In this guide, we break down the three core crypto bonus types, explain when they are actually useful, and uncover why some bonuses don’t work the way traders expect. We also show which bonus structure fits your trading style, whether you’re a beginner, active trader, or running bots.

Why Crypto Exchanges Offer Bonuses

I know you are excited about the idea of getting free and withdrawable crypto bonuses, but these incentives are not really free money. Crypto exchanges used incentives to gain attention, increase their user base, and attract liquidity. Hence, while a fee discount may reduce trading fees for high-frequency traders, it is only available when traders reach or exceed a certain trading volume threshold or when they sign up using a specific affiliate link.

In short, while welcome bonuses, deposit bonuses, or fee discounts offer traders certain benefits, they are often used to improve the overall performance of an exchange or to shift users' attention to a particular product, like when exchanges offer rewards for derivative trading.

What Is a Crypto Welcome Bonus?

A welcome bonus is one of the free crypto sign-up bonuses available on many exchanges. This is usually an instant crypto bonus given to users when they set up an account. It is often a small amount between $1 and $20 USDT and non-withdrawable, depending on the exchange. For instance, centralized exchanges like Bybit, Binance, and MEXC offer welcome bonuses when users sign up and complete KYC.

Crypto Bonuses In Short:

-

Usually small (but can definitely save money over time)

-

Often non-withdrawable (Profits are often directly withdrawable)

-

Best for testing execution & UI (To let you experience the platform)

On Bybit, new users can get up to $100 USDT in the Bybit instant sign-up bonus when they complete verification. Similarly, MEXC offers a 5 USDT sign-up bonus for new users.

What Is a Crypto Deposit Bonus?

This is another free crypto bonus on Bybit and other exchanges. It is given to new or existing users when they make an actual deposit into the exchange, which can be done by transferring crypto from an existing wallet to the exchange wallet or by buying crypto directly on the exchange. Note that exchanges may specify which deposit types count towards the bonus.

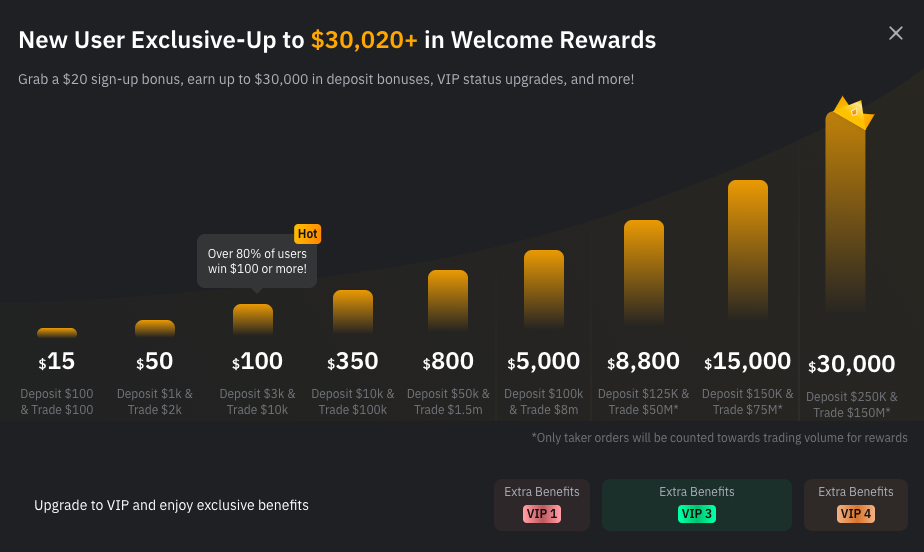

Getting the best deposit bonus in the crypto space depends on the exchange and individual research. While some exchanges may use a deposit bonus to increase the number of active users by offering it to both new and existing users, some offer it as part of their welcome bonus. For instance, new users on Bybit qualify to get the deposit bonus once they sign up, complete L1 verification, and deposit cryptocurrency into their wallet. It's good to note that the deposit bonuses are often advertised as pretty high, and although they are high, in some cases, when you reach the full deposit bonus, you've actually paid more in fees, so it would be more like a fee discount. We calculated the deposit bonus of Bybit and checked where the sweet spot is between free money to trade and when the fees go above the bonus.

We have to see through the advertising and just look at the raw facts. But also do not ignore the fact that exchanges really do their best to get you on their platform and are willing to offer good deals for you as a trader, which really could make a difference in using that specific exchange. But when looking at these bonuses, you want to look at the following things:

Key things to check before claiming a deposit bonus:

-

Required trading volume

-

Spot vs derivatives

-

Maker vs taker fees

-

Withdrawal conditions

-

Expiration date

Why Trading Fees Matter with Deposit Bonuses

While deposit bonuses are often higher than welcome bonuses, a large percentage of the reward is unlocked by trading.

Increasing trading volume exposes users to recurring fees that may be high or low, depending on the exchange's rate and the fee type. For example, the deposit bonus on Bybit mentioned before is based on taker trading volume. That is, trades that are filled at the asset's current trading price (a market order). Bybit charges a taker fee of 0.10% on on spot trading and 0.055% taker fee on future trading. So if you do not read the small letters, you might assume that any trading volume will do for you to reach the full deposit bonus, while in fact, only the volume counts which is done using market orders.

This shows that carefully calculating the trading fee based on the required trading volume before trading helps you determine whether the trading fee is higher than the bonus.

Another example could be a deposit bonus, which you get only for depositing, so it's basically a bonus that you can directly use to trade with. It is, for example, possible that certain exchanges that offer a direct deposit bonus (so without any further conditions like volume) have a higher fee than other exchanges. In that case, you can either do two things, or you can just deposit and only use the bonus for trading and liquidity, and afterwards switch to another exchange, or use a different exchange. The reason why the exchange will offer you free money to trade with is that they hope that by getting introduced to the exchange, you will keep using it for your trading. They are willing to invest in you in order to keep you as a customer and earn long-term. It's actually good and creates a competitive scene for exchanges, which is benefiting the traders, but you, as a trader, need to do your own due diligence in understanding the bonus correctly. We published some articles where we dive into specific deposit bonus such as the Phemex deposit bonus, BTCC deposit bonus and Bitunix deposit bonus.

What Is a Trading Fee Discount?

Another way to earn rewards on a crypto exchange is hidden inside trading fee discounts, and it is often the most overlooked incentive by traders. Unlike welcome or deposit bonuses, fee discounts do not come as bonus credit or trading funds. Instead, they quietly reduce the cost of every trade you place.

On most exchanges, a trading fee discount is applied when users sign up through an affiliate link or meet specific account conditions. The effect is not free money upfront, but a percentage reduction in trading fees, which compounds over time. For example, Apex Omni offers a 5% lifetime trading fee discount for new users who register through an affiliate link. Similar fee discount structures are available on Bybit and other major exchanges.

To get up to a 10% trading fee discount on Bybit, users must register through a qualifying referral link and meet the exchange’s conditions. While the savings may seem small per trade, they become increasingly significant as trading volume grows, especially for active traders.

In some cases, fee discounts are introduced as temporary marketing incentives. Apex Omni, for instance, previously offered fee discounts of up to 28.57% and even 64.29% for users based on taker trading volume thresholds. While these promotions were time-limited, Apex Omni still offers some of the lowest base trading fees in the crypto space, making it particularly attractive for high-frequency and professional traders even without special discounts.

Why Fee Discounts Matter Long Term

The real advantage of a fee discount becomes clear over time. Every trade saved on fees slightly increases net profitability, and this effect compounds with higher volume. For traders who place hundreds or thousands of trades, such as bot users or grid traders, a fee discount can easily outperform small welcome or deposit bonuses that expire or require high trading volume to unlock.

When a Fee Discount Is a Good Deal

Whether a trading fee discount is worth using depends on the trader’s strategy and the specific conditions set by the exchange. In most cases, fee discounts apply to all executed trades, including both maker (limit) and taker (market) orders, which makes them broadly useful for many trading styles.

That said, some exchanges attach additional requirements to unlock or maintain the discount, such as minimum trading volume or activity thresholds. When these conditions align with a trader’s normal behavior, as is often the case for grid traders and bot users, the discount becomes especially valuable.

Over time, consistently lower fees reduce overall trading costs without requiring higher risk, increased leverage, or changes to strategy. This is why, for many active traders, a trading fee discount quietly outperforms short-term bonuses that come with expiration dates or restrictive conditions.

Recently, we've been seeing some decentralised exchanges offering a discount on fees when you sign up using a specific affiliate link. Here are the main deals with the specific link for the most popular decentralised exchanges:

- Apex Omni: 5% Discount on your fees

- HyperLiquid: 4% Discount on your fees

- AsterDEX: 2% Discount on your fees

To learn more about decentralized exchanges and compare the best platforms, read our DEX comparison guide.

Welcome Bonus vs Deposit Bonus vs Fee Discount

|

Features |

Welcome Bonus |

Deposit Bonus |

Fee discount |

|

Deposit |

Not required |

Required |

Required |

|

Trading Volume |

Not required |

Not necessary |

necessary |

|

Bonus size |

It is usually small, between $1-$20 |

It is generally higher than a welcome bonus. |

Fee discount compounds over time, making it more rewarding for high-frequency traders |

|

Main benefit |

To provide new users with free capital for a trial |

To compensate new and existing users for making a deposit |

To help large volume traders reduce trading fees |

|

Eligibility |

New users only |

New and existing users |

New and existing users |

|

Withdrawal |

It is usually non-withdrawable |

It may be withdrawable or non-withdrawable. |

Directly reduce trading fees; hence, it is not withdrawable. |

|

Duration |

It is a one-time offer and usually comes with an expiration date |

It can be a one-time offer or reintroduced as a marketing offer |

It may be used to reduce fees for a short or an extended period. |

|

Exchange |

Bybit, Binance, MEXC |

Bybit, Binance, Phemex, BTCC, Gate.io |

Apex Omni, Bybit, MEXC, Binance |

Which Option Is Best for You?

Crypto bonuses and fee discounts are usually offered based on account activity and trading level. While these incentives can benefit traders, it is important to remember that their primary purpose is to increase user activity and trading volume on the exchange. Understanding this helps you choose the option that aligns with your trading behavior, rather than chasing the largest advertised number.

For beginners, a welcome bonus is often the best starting point. It allows new users to explore the platform, understand order execution, and get familiar with trading mechanics without committing their own capital. However, beginners should focus on learning first, as profits generated from bonus funds depend on trading skill rather than the size of the bonus itself.

For active traders, deposit bonuses can be useful when the required trading volume is reasonable. In these cases, the bonus effectively increases available trading capital. That said, deposit bonuses should always be evaluated against the fees required to unlock them, as high volume requirements can offset the reward.

For high-frequency traders, including bot and grid traders, trading fee discounts are usually the most effective long-term incentive. By reducing the cost of every trade, fee discounts compound over time and directly improve profitability without changing strategy, increasing leverage, or introducing additional risk.

Safety on Crypto Exchanges

Before signing up on any exchange, especially when claiming bonuses or fee discounts, it is important to review the platform’s security practices, transparency, and risk model. Centralized and decentralized exchanges operate very differently, and each comes with its own trade-offs.

Centralized exchanges typically require account registration and identity verification. User funds are held in custodial wallets managed by the exchange, which means the platform is responsible for safeguarding assets. While this setup offers convenience and customer support, it also introduces custodial risk, as users rely on the exchange’s internal security, risk management, and operational integrity.

Decentralized exchanges, by contrast, allow users to retain full custody of their assets by trading directly from their own wallets. This removes custodial risk but shifts full responsibility for security to the user. Private key management, wallet security, and transaction accuracy become critical, as mistakes or losses are usually irreversible.

Neither model is inherently better; they simply involve different risk considerations. Understanding these differences helps traders choose an exchange that fits their experience level, risk tolerance, and trading strategy.

To learn more about how to evaluate exchange safety, transparency, and risk controls, refer to our exchange security checklist, which outlines the key factors to review before committing funds.

Conclusion

Crypto bonuses can be useful, but only when they are understood in context. What matters most is not the size of the advertised reward, but the conditions attached to it, the trading costs involved, and whether the incentive aligns with your trading behavior.

Welcome bonuses, deposit bonuses, and trading fee discounts all serve different purposes. While bonus credits often come with restrictions or expiration dates, fee discounts tend to deliver value quietly over time, which is why many experienced traders prioritize lower fees over short-term rewards.

If you want to apply these insights in practice, explore our detailed guides on the BTCC deposit bonus, Bitunix deposit bonus, and the Bybit $30,000 deposit bonus. You can also compare current offers in our best crypto deposit bonuses guide, where we break down conditions, fees, and real-world usefulness.

Frequently Asked Questions

Can crypto bonuses increase trading fees?

Crypto bonuses do not directly increase trading fees. However, they can encourage traders to increase trading volume in order to meet bonus requirements, which may lead to higher total fees over time, especially when market orders or derivatives are involved.

Why should grid traders prefer trading fee discounts over crypto bonuses?

For grid traders, a trading fee discount is often more valuable than a small welcome or deposit bonus. Lower fees apply to every executed trade, which improves long-term profitability, even when profit margins per trade are relatively small.

How can I get the best crypto bonus?

Getting the best crypto bonus requires careful evaluation of the offer’s conditions. Traders should review verification requirements, required trading volume, withdrawal rules, and expiration dates, rather than focusing only on the advertised bonus amount.

Can crypto bonuses affect trading behavior?

Yes, crypto bonuses can influence trading behavior. Some bonuses require specific trading volume, order types, or derivative activity, which may push traders toward overtrading or higher risk strategies. Understanding these conditions helps traders avoid unintended exposure.