How to Use Binance in the UK (Simple Guide)

Binance is one of the leading cryptocurrency exchanges where new and existing users can get some of the best crypto bonuses and access over 1,500 crypto trading pairs. However, Binance halted registrations for new users in the United Kingdom, meaning new users cannot create a Binance account or use any of its services.

Binance stopped operating in several countries, including the UK, due to regulatory issues. This is why many UK-based traders wonder whether they can use Binance securely or if there are better alternatives to explore.

In this article, we explain the two easy ways to use Binance in the UK and the best decentralized exchange you can use as an alternative.

Important: This article is for informational purposes only and does not encourage violating exchange terms or local regulations. Remember to continually evaluate FCA regulations before using crypto-related services.

How To Use Binance In The UK: 2 Easy Options

Because of the current restrictions, new users cannot open or verify a Binance account with a UK identity document.

So if you want to trade and are looking for access to Binance or similar features, most traders usually consider two paths.

Option for visitors or non-UK residents

If you normally live in a country where Binance operates and are only in the UK for a short time, you may still be able to access your account.

Option for UK residents

Many traders choose another exchange. Some pick regulated platforms such as Kraken or Coinbase. Others prefer decentralized trading on platforms like AsterDEX, where you connect a wallet and no identity check is required.

Each option has advantages and trade-offs. The best choice depends on how you want to trade and how much responsibility you want to keep yourself.

Quick Overview

| Situation |

What traders often use |

|---|---|

| UK passport holder, new account |

Kraken, Coinbase |

| Existing Binance user |

Binance with limits |

| Non-UK resident visiting the UK |

Binance (home country rules) |

| Trader who prefers wallet access |

AsterDEX |

Check out AsterDEX and start trading with our affiliate link for 2% discounts on all your trading fees.

Why Is Binance Restricted In The UK?

Binance needs an approved partner to promote and offer services to UK customers.

Binance previously worked with Rebuildingsociety. In October 2023, after action from the Financial Conduct Authority (FCA), new UK users were no longer able to open accounts.

Since then, Binance has been exploring new partnership options.

What Does This Mean For Traders?

Here is what the situation looks like right now.

-

New users cannot register with UK documents.

-

Existing users can still log in, but some products may be limited.

-

Certain services, especially derivatives, might not be available.

-

Transfers to UK banks are not always supported.

Because of these limits, many traders start looking at other exchanges.

Option 1: Access for Visitors Who Already Have a Binance Account

Binance users sometimes travel to the United Kingdom from countries where the platform normally operates.

In those situations, account access may still work.

However, this is usually relevant only for short visits. Long-term residents of the UK are generally expected to follow local availability rules.

Trying to appear as if you are in another country for an extended time can lead to account reviews or restrictions. In some cases, withdrawals or trading access may be paused.

Because of this, many UK residents prefer to explore other exchanges that officially support their location.

Option 2: Using Alternatives to Binance

If Binance is not available for new UK users, traders usually look at two types of platforms.

Some choose regulated centralized exchanges.

Others prefer decentralized trading where they control their own wallets.

Let’s look at both.

Creating an Account on Centralized Exchanges

Several exchanges officially support UK customers and follow local requirements.

Popular examples include:

-

Kraken

-

Coinbase

-

Crypto.com

-

Gemini

-

eToro

With these platforms, users can normally deposit and withdraw using UK banking methods.

The trade-off is that identity verification is required, and certain advanced products or leverage levels may be limited.

For many traders, this is perfectly fine. Others want more flexibility.

Using a Decentralized Exchange Like AsterDEX

Another path traders explore is AsterDEX. AsterDEX is a decentralized exchange that is backed by Binance.

Instead of opening an account, you connect your own wallet and trade from there. No ID upload is needed. Users often like this model because they keep custody of their assets and can move funds whenever they want.

AsterDEX offers spot markets, perpetuals, and access across multiple blockchains. Many traders find the interface familiar if they have used centralized exchanges before.

At the same time, responsibility is higher. If you lose your wallet access or private keys, there is no recovery team that can restore them for you.

For some people, this freedom is ideal. For others, customer support on centralized platforms feels safer.

Step-by-Step Guide on How to Set Up Asterdex

Step 1: Visit the exchange website with our affiliate link to access 2% fee discount

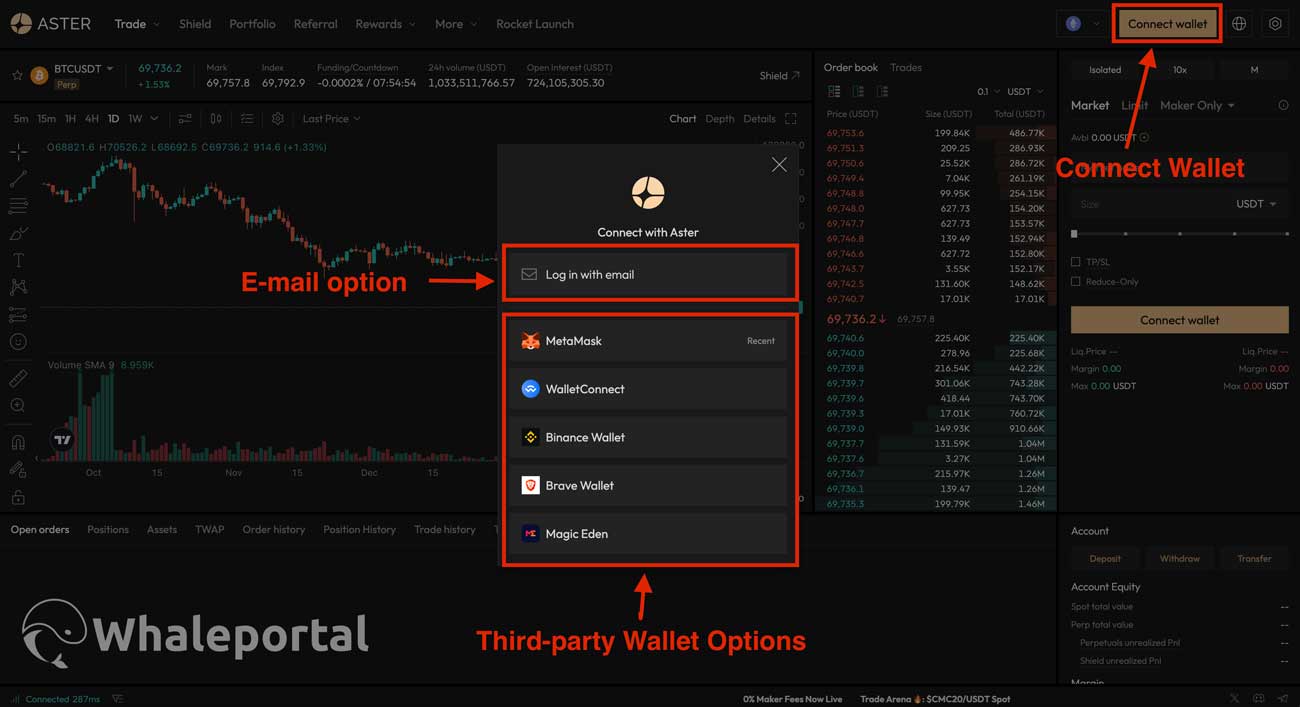

Step 2: Connect your third-party wallet (e.g., Metamask). To do this, click on 'Connect wallet' on the Aster interface.

AsterDEX supports only 4 blockchains (BNB Chain, Ethereum, Arbitrum, and Solana), so you want to use a decentralized wallet that supports any or all of those chains. MetaMask will be a good multi-chain wallet here, but you can also use blockchain-specific wallets like Rabby for Arbitrum and Ethereum, or Phantom for Solana.

Step 3: After that, Aster prompts you to confirm that you want to connect the wallet by asking you to sign a pop-up message. Click on the sign to validate the connection.

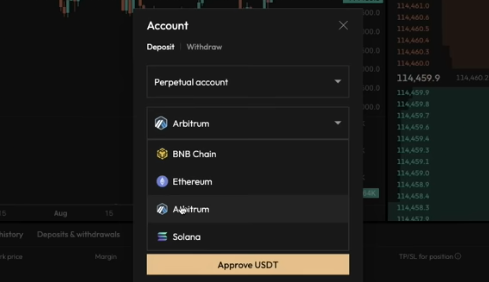

Step 4: To start trading, transfer assets from the connected wallet to Aster by clicking 'deposit', then select a spot or perpetual account, and choose your preferred blockchain.

Note: You need to pay the gas fee for this transaction, so keep a small amount of the blockchain-native coin or gas coin. For instance, you pay gas fees in $ETH on Ethereum, and on the BNB chain, you pay in $BNB.

Step 5: Sign the transfer transaction, then click 'enable trading' on Aster to get started.

Finally, you can now set trading conditions, such as margin type and leverage, to start trading.

Key Features: Why AsterDEX is the best alternative to Binance

- Multi-chain access

- Up to 100x leverage

- Similar feeling to Binance

- Offer spot and perpetual trading

- Lower trading fee (0.01% Maker fee/ 0.035% Taker fee)

- Multiple trading models (spot, perpetual, grid, and more)

Conclusion

Finding the best crypto exchange in the United Kingdom can be challenging because regulations are still developing. This means another centralized exchange, if not all, can be out of the market at any time, since they have to comply with the necessary laws or restrictions imposed on them. This usually puts traders through the stress of finding another alternative, setting up a new account, and making a withdrawal.

Using AsterDEX might be one of the best ways to completely escape the heavy restrictions on Binance and other centralized exchanges. It ensures you can execute trades without any barriers or a long KYC review process. This is mainly for leverage traders; spot traders generally want to look for different centralized exchanges.

Start trading on AsterDEX with our affiliate link to get an extra 4% discount on your trading fee.

Summary

| Situation |

What traders often use |

|---|---|

| UK passport holder, new account |

Kraken, Coinbase |

| Existing Binance user |

Binance with limits |

| Non-UK resident visiting the UK |

Binance (home country rules) |

| Trader who prefers wallet access |

AsterDEX |

Frequently Asked Questions

Is it legal to use Binance in the UK?

Binance remains accessible for users who registered before the October 2023 changes. New UK residents are currently not able to open accounts.

Rules can evolve, so it is always smart to review updates from the Financial Conduct Authority.

Can I use Binance with a VPN in the UK?

Access may still work for people who normally live in countries where Binance operates and are visiting the UK for a short time.

Long-term residents are generally expected to follow local availability. Using tools to appear in another location can lead to account checks or restrictions.

What if I do not want to complete identity verification?

Centralized exchanges normally require it.

Traders who prefer not to upload documents often explore decentralized platforms such as AsterDEX, where you connect a wallet instead of opening an account.

Can I withdraw to a UK bank account?

This depends on the platform.

Exchanges that officially support UK customers, such as Kraken or Coinbase, typically offer local banking methods.

Would you suggest using Binance from the UK today?

For most new users, exploring exchanges that clearly support UK residents is the simpler route.

Others may prefer decentralized trading, where they manage their own wallets and funds.