How to Use Binance in the US – What Works & Best Alternatives

Binance is a leading centralized cryptocurrency exchange with over 1,500 trading pairs. It is also considered one of the most secure CEXs, particularly because it combines a layered security structure with a Secure Asset Fund for Users (SAFU) to cover losses in the event of a system breach or dispute.

However, Binance does not operate the same way in the United States. Hence, there is often significant confusion among new and experienced US-based traders when navigating Binance's services.

Key Points:

- It is legal to access Binance services in the US

- US citizens cannot use Binance Global, but they can use Binance.us.

- Binance.us is still restricted in some states and regions in the US

- Non-US citizens might use Binance Global with a VPN

- The best alternative to Binance Global in the US is using a DEX like AsterDEX or Apex Omni.

TL;DR

|

Your situation |

Platform |

|

U.S. citizen who wants leverage/futures |

AsterDEX |

|

U.S. citizen who only needs spot trading |

Binance.US |

|

Trader outside the U.S. in a supported country |

Binance Global |

Join AsterDEX and receive 4% discount on your fees with our affiliate link.

Is Binance Global and Binance.us The Same?

Binance US and Binance Global are two different exchanges with distinct legal identities. To operate in the global market and also provide services to US-based traders, Binance created two platforms that operate differently, with traces of similarity.

First, Binance.us offers a limited selection of cryptocurrencies for trading, which often means newer altcoins are unavailable and have low liquidity. For instance, Binance.us has fewer than 200 trading pairs while Binance Global has over 1,500 trading pairs.

Finally, Binance.us also lacks advanced features such as margin and leverage for trading, making it more suited to spot traders.

Binance Global vs Binance.us

|

Features |

Binance Global |

Binance.US |

|

Trading Models |

spot, futures, grid trading,, AI trading and more |

Spot trading |

|

Order Types |

Limit, market, stop-limit, and conditional market orders |

Limit, market, and stop limit orders. |

|

Support Asset |

500+ assets available across USDT-M, USDC-M, and COIN-M markets. |

196 assets mainly USDT-M market. |

|

Passive Earning Products |

staking, liquidity farming, and launchpad |

Staking |

|

Spot trading fee |

|

|

|

Fee discounts |

|

|

|

Liquidity/ slippage |

Deep liquidity across chains/ very low slippage |

Low - shallow liquidity per coin / moderate-high slippage |

|

Best suited for |

Advanced and high-frequency traders interested leverage, or low market-cap altcoins |

Traders interested in spot orders and prioritize clear regulatory guidelines. |

How To Use Binance In The US

Using Binance in the United States is possible through various methods, with the easiest and most legal way being to use the Binance.us website or application.

However, it is essential to note that this version of Binance is also unavailable in some US states or regions. For instance, Binance.us is not yet available in Georgia, Alaska, Washington, New York, and many other states. This means that if you reside in these states or regions, you will not be able to register or verify your Binance.us account.

See the Binance list of supported and unsupported states and regions in the United States to confirm if you are allowed to use Binance in your current location.

If your location falls under a supported state or region, here are two ways to use Binance in the US:

- For US Citizens: Using the Binance.us exchange

- For non-US Citizens temporarily residing in the US: Access the Binance Global exchange using a VPN

Summary: Binance.US is currently not available in Georgia, Alaska, Washington, and New York, meaning residents cannot complete registration or account verification in those states.

Option 1 - For US Citizens: Using the Binance.US

Binance.us was established in September 2019 as a separate centralized exchange for US customers to ensure compliance with US regulations. The United States has strict regulations that make operating a crypto exchange almost impossible. This explains why several centralized exchanges are currently unavailable in the country. With the more-compliant structure maintained by Binance, it was sanctioned in 2023 for violating the Bank Secrecy Act. Essentially, it is clear that Binance Global is not designed to be used in the US, therefore, when you visit the Binance website from a US IP address, the system automatically redirects you to the Binance.us website.

Step-by-Step Guide on How To Set Up a Binance Account in the US

Aside from those interested in exploring the best decentralized exchanges as an alternative to Binance, for traders and residents in the US, using Binance.us is the only legal way to interact with the Binance brand.

- Step 1: Open the Binance.us website or download the Binance US app on the Google Store or Apple Store.

- Step 2: Click 'Sign up'. This takes you to the sign-up page where you will need to input your email address, password, and (referral code). The referral code is optional.

- Step 3: Check the 'I am over 18 years old' box, then click 'Create Account.'

Note: You can use the pop-up notification below to create an institutional account if the account is not for personal use.

- Step 4: After this, complete the reCAPTCHA and verify your email address by entering the verification code sent to your email address.

- Step 5: Once you have completed email verification, Binance.us also requires you to verify your phone number. Note that landlines, toll-free, and virtual phone numbers cannot be used for this purpose.

- Step 6: Enter your phone number and click on 'Send Code 'to get another verification code. Binance uses this to enable 2FA for your account, offering additional protection for your assets by preventing unauthorized withdrawals or transfers.

- Step 7: Now that you have verified your email and phone number, you can start using your account for crypto trading.

Though you can now make a deposit into your account and even start trading, it is recommended that you complete KYC verification using your government-issued Identity Card. Verification approval takes between minutes to a few days.

Tip: Once your identity verification is approved, it is recommended that you activate additional security tools such as 2FA (Two-Factor Authentication), anti-phishing code, and set up a withdrawal address whitelisting to protect against potential hackers.

Option 2 - For Non-US Citizens: Access the Binance Global exchange using a VPN

You should probably not consider using a Binance Global Account with a VPN because while doing that can help you get around the restrictions and access the Binance global from the US, it is a direct breach of the Binance terms of service, and as such, it exposes you to some of the risks below:

- Binance might freeze your account.

- It puts you at risk of losing access to your own funds.

- Your withdrawals might be blocked, especially if you cannot complete the KYC for a permitted jurisdiction.

- Using a VPN also means you do not get any legal protection against Binance, and it also forfeits your access to customer support and the Binance secure asset fund for users (SAFU) insurance.

However, you can circumvent detection if you are an existing Binance global exchange user who only needs to access your account while temporarily staying in the US. That is, you have verified your account using a foreign ID before moving to the United States.

Purchase a strong VPN during your short stay and ensure to always turn the VPN before accessing your Binance account to prevent detection.

Note that this may trigger manual review in the long run, particularly for large withdrawals. Hence, if you are a U.S. citizen who originally opened and verified their accounts outside the U.S you may face compliance reviews once you attempt to log in from within the country.

Alternatives to Binance In The US

Traders in the U.S. who need features that are not available on Binance.US often explore other platforms. Centralized exchanges may provide familiar interfaces, but they typically require identity verification, and many restrict access depending on state regulations.

Decentralized exchanges (DEXs) have become a popular alternative because they allow users to trade directly from their own wallets without relying on a central intermediary. Platforms such as AsterDEX or Apex Omni aim to deliver a trading experience similar to centralized exchanges while remaining accessible in many regions.

However, using a DEX also means you are responsible for wallet security, private keys, and understanding smart-contract risks. For traders who are comfortable with these responsibilities, decentralized platforms can offer access to derivative markets that may not be available on centralized exchanges.

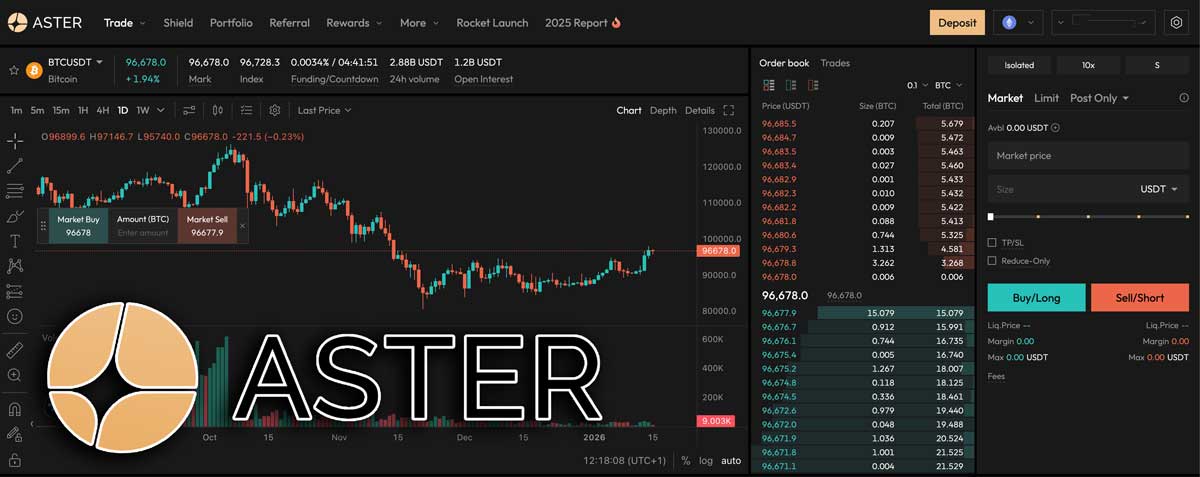

What is AsterDEX?

AsterDEX is a non-custodial decentralized exchange backed by Binance. Though it runs on the BNB chain, AsterDEX offers multi-chain access to crypto, eliminating the bridging risk associated with other trading platforms.

It provides access to a wide array of tokens across the BNB Smart Chain and other supported chains. It also reduces slippage, thanks to its deep liquidity and integration with Binance's broader network.

Key Takeaways

- Does not require KYC (no ID or phone number verification)

- Available in the US and other countries

- Offers deep liquidity and low slippage

What is Apex Omni?

Another decentralized exchange you should consider is Apex Omni, a leading multi-chain exchange designed by Bybit for enhanced perpetual derivative trading.

Apex Omni is particularly suitable for traders who want to trade on different blockchains from a single interface. With Apex Omni, you can execute trades on Ethereum, Arbitrum One, Base, BNB Chain, and Mantle Network.

Key Takeaways

- Does not require KYC or ID verification

- Available in the US and other countries

- Offers advanced trading models such as grid trading, decentralized copy trading, and RWA trading.

It is important to note that while using a decentralized exchange offers borderless access to cryptocurrency trading, its non-custodial nature places the responsibility for securing your assets on you. This means that traders must learn to manage private keys, secure seed phrases, and understand smart contract risks.

Create an Apex Omni account using our affiliate link for 5% discount on your trading fees

Tip: For optimal security, choose Binance.us for a regulated on-ramp and off-ramp with USD and spot trading, use a decentralized exchange for derivative trading, and use a hardware wallet to store significant funds.

Conclusion

For traders based in the United States, Binance.US provides a regulated and compliant way to buy, sell, and hold cryptocurrencies. However, its product selection and access to advanced trading features can be more limited compared to the international platform.

Because of this, some traders explore decentralized exchanges such as AsterDEX and Apex Omni, which may offer broader access to derivative markets and additional trading tools. These platforms require users to manage their own wallets and security, but they can provide greater flexibility for those comfortable with a self-custody environment.

Summary

|

Your situation |

Platform |

|

U.S. citizen who wants leverage/futures |

|

|

U.S. citizen who only needs spot trading |

Binance.US |

|

Trader outside the U.S. in a supported country |

Binance Global |

Join AsterDEX and receive 4% discount on your fees with our affiliate link.

Join Apex Omni and receive 5% discount on your fees with our affiliate link.

If you’d like help deciding which platform fits your trading style, see our in-depth comparison of AsterDEX and Apex Omni.

Frequently Asked Questions

Is Using Binance Global Illegal In The US?

While the Binance global exchange is legal in several countries, due to US regulations, using the platform is not allowed and constitutes a breach of Binance's Terms of Service.

What are the alternatives to Binance.US?

The truth is that many centralized exchanges do not operate in the United States due to stringent regulations. Therefore, the best alternative is to use a decentralized exchange. Since DEXes are borderless, they operate seamlessly across borders and ensure you retain complete control over your assets.

What can I do if Binance flagged my account for VPN usage?

Usually, the best option is to reach out to the customer support team and explain the situation. While resolving this may take days, there is no guarantee that your account will be fully functional again. For instance, an account may be reopened for access, but you may not be able to trade or initiate a withdrawal.

Can you use Binance in the United States?

Yes. U.S. residents can legally trade on Binance.US, but the international Binance platform is restricted. Traders who need futures often use decentralized alternatives.

Related Articles:

- How to Use Bitget in the US – Access & Alternatives

- Can I use Bybit In Canada?

- How To Use Bybit In The US?