How to Withdraw Crypto Without KYC (Safe & Legal Guide)

The global laws and regulations for crypto are changing and becoming stricter over time. Many exchanges that previously allowed users to withdraw crypto without KYC are now sometimes demanding full identity verification. As a result, traders often face difficulties when trying to withdraw funds. In many cases, users only discover these restrictions when they attempt to move their crypto or suddenly find their accounts blocked.

Here is where the problem begins. While trading on a centralized exchange, you technically own the crypto, but access to the funds remains under the control of the exchange. Several situations can create issues for users, including sudden policy changes, region-based restrictions, or internal risk checks run by the platform.

This guide explains why this happens, what practical options are available, and how you can withdraw crypto without KYC using centralized exchanges, decentralized exchanges, and Web3 identity solutions.

Note: Always check your local laws and regulations to ensure you remain compliant with the rules in your country.

TLDR:

-

You can withdraw crypto without KYC, but only under certain conditions.

-

Centralized no-KYC exchanges have limits and can still freeze withdrawals.

-

Decentralized exchanges let you withdraw directly from your own wallet with no approval.

-

Web3 IDs may help unlock withdrawals on centralized exchanges, depending on the platform.

Can You Withdraw Crypto Without KYC?

Yes, it is possible, but only in specific situations. Everything depends on the exchange you use and how your account activity appears to its internal risk systems.

Some no-KYC crypto exchanges allow withdrawals up to certain daily limits for unverified users. If account activity looks normal and remains within these limits, withdrawals can often be processed without any identity verification.

However, problems usually begin when risk is detected. Centralized platforms are custodial, meaning they control the private keys. If their systems flag unusual logins, sudden spikes in trading volume, region changes, or compliance updates, withdrawals can be paused immediately. Even older accounts may be flagged, especially if they were inactive for a long period or suddenly start moving larger amounts under new regulations. We do have to mention that it does not happen often, but it does happen.

This is typically the point where users start searching for answers such as “what to do if an exchange asks for KYC to withdraw” or “how to withdraw crypto from a frozen account.” In many cases, exchanges will require identity verification before releasing funds.

This means that even so-called no-KYC centralized exchanges can still request verification during withdrawals. To reduce the risk of this happening, users should avoid unstable VPN connections, frequent region changes, and sudden large withdrawals.

Using a No-KYC Centralized Exchange

The ease of use and familiar interface of non-KYC centralized exchanges make them a popular choice for many traders. However, most of these platforms allow withdrawals without KYC only up to specific limits. These limits are normally enough for the average trader.

Although users enjoy the freedom to trade and move funds, these exchanges still rely on internal risk management systems. As a result, withdrawals are not always guaranteed.

It is important to remember that access does not always guarantee access. Despite this, many traders continue to use these platforms, as their growth and trading volume clearly show.

Below are some commonly used no-KYC centralized exchanges and how their withdrawal systems work.

Bitunix

Bitunix is often considered one of the more generous centralized exchanges when it comes to withdrawal limits without ID verification. It allows unverified accounts to withdraw up to $500,000 per day, which is significantly higher than most competitors.

The withdrawal process itself is straightforward: select the withdrawal option, choose a network, and confirm the transaction. Networks such as TRC20 and Solana are commonly preferred due to faster processing times and lower fees.

One downside frequently mentioned by users is slower response times during high-volume trading hours. Additionally, for large withdrawals, particularly above $50,000, Bitunix may trigger internal risk reviews before processing the transaction.

In some cases, users choose to complete a limited verification step using a Palau Web3 ID to resolve such reviews, depending on the exchange’s requirements at the time.

BloFin

BloFin is popular among futures traders and users who rely on copy-trading features. It allows crypto withdrawals without KYC, but with lower limits compared to Bitunix.

Unverified accounts typically have a daily withdrawal limit of 20,000 USDT. Withdrawals are generally smooth when account activity remains consistent. However, sudden withdrawal increases or frequent IP changes can temporarily trigger restrictions.

Because of this, BloFin is commonly used for small to mid-sized withdrawals rather than large exits.

BTCC

BTCC offers an even lower withdrawal limit for unverified users, usually around 10,000 USDT per day. Users who want to exceed this amount must complete additional verification steps.

The exchange is known for stricter regulatory compliance, which explains its conservative withdrawal limits. While some users report frozen withdrawals, most complaints are related to the low non-KYC limits rather than unexpected blocks.

If these options are not sufficient, you can find a complete and updated overview of no-KYC exchanges in our dedicated comparison guide.

Even when using no-KYC centralized exchanges, it is important to understand the trade-off: these platforms remain custodial, and withdrawals always depend on internal risk systems.

What If Your Account Is Flagged or Withdrawals Are Blocked?

This is one of the main reasons users look for ways to withdraw crypto without KYC. When initiating a withdrawal, some users are suddenly met with a pop-up requesting identity verification.

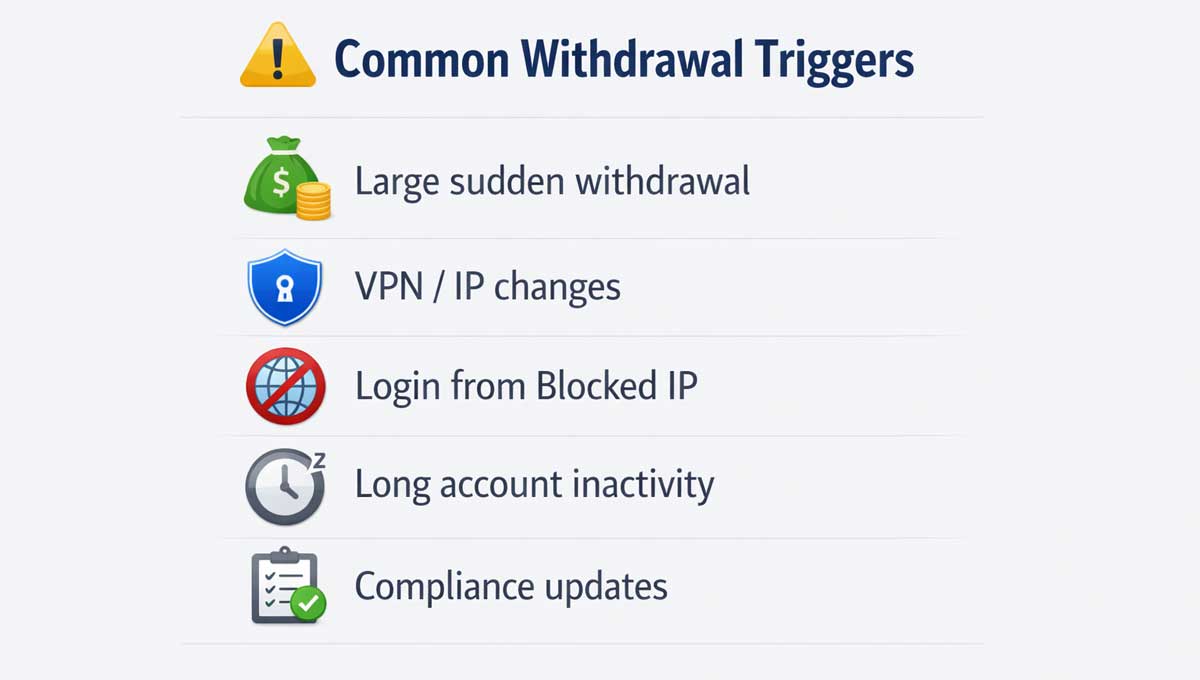

In most cases, this happens because the exchange detects:

-

A login attempt from a restricted region

-

A withdrawal request exceeding unverified limits

-

Unusual trading or account behavior

Once an account is frozen, users often have limited options. Contacting customer support usually results in a request for identity documents. As an alternative, some users explore Web3 identity solutions, such as the Palau Web3 ID, depending on the platform and jurisdiction involved.

This approach is commonly used by traders whose accounts are restricted due to regional limitations or compliance changes.

Diversify Centralized Exchange Risk

One practical way to reduce the risk of running into withdrawal problems is to spread your funds and trading activity across multiple centralized exchanges. By doing this, you lower your exposure to any single platform and reduce the impact if one exchange suddenly changes its policies or introduces new verification requirements.

Spreading funds across multiple exchanges can also help manage withdrawal limits, as unverified limits usually apply per platform. If one exchange temporarily restricts withdrawals or requests additional verification, the issue remains limited in scope. During that time, you can continue trading or accessing funds on other platforms without being fully blocked.

This approach does not remove custodial risk entirely, but it helps reduce dependency on a single exchange and provides more flexibility when moving funds.

Using a Decentralized Exchange (DEX)

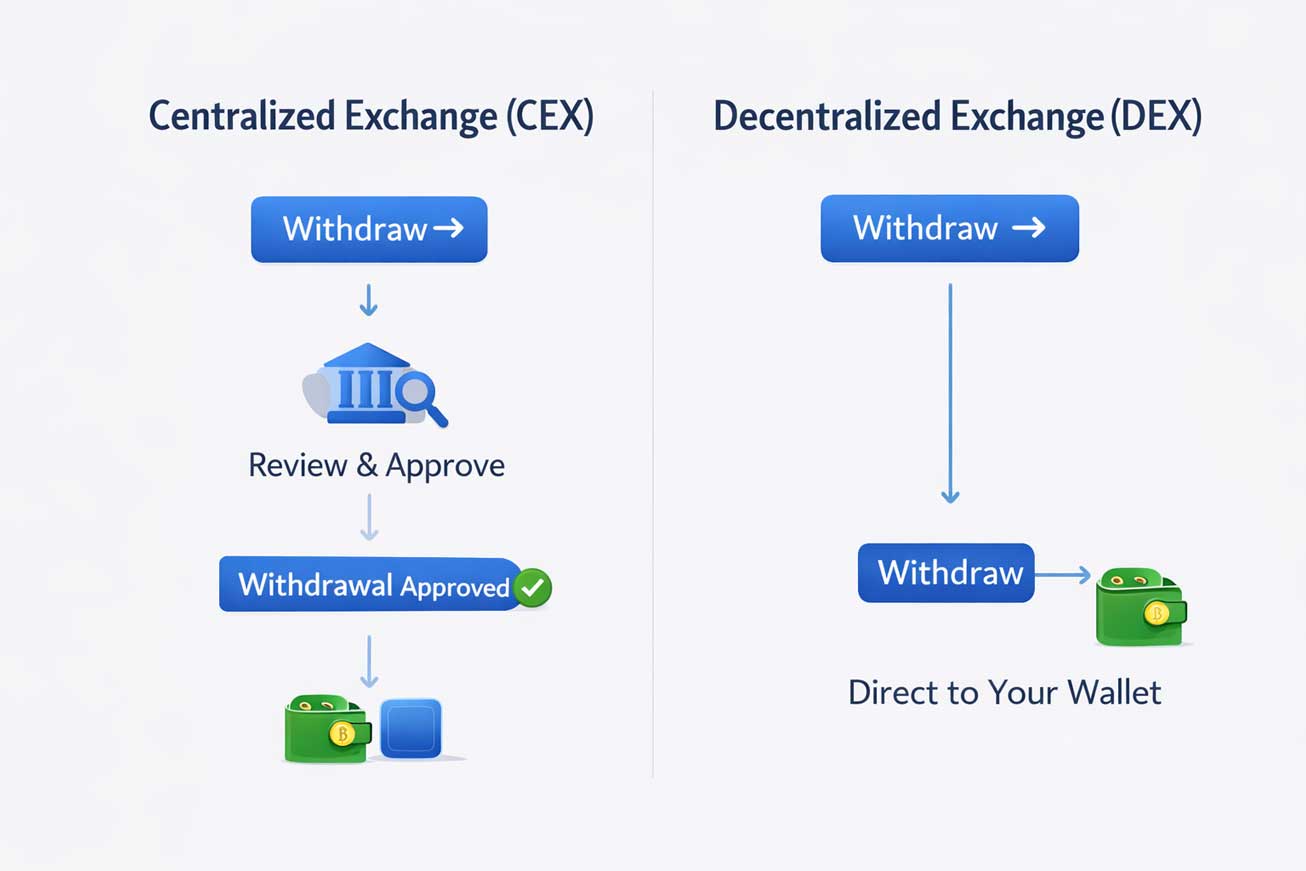

The safest way to withdraw crypto without KYC is by using a decentralized exchange. DEXs remove the withdrawal problem entirely by design because they do not take custody of user funds.

Instead of holding assets, decentralized platforms allow users to connect their own wallets. Funds remain under personal control at all times, and there is no approval process required to withdraw crypto.

ApeX Omni

ApeX Omni offers two withdrawal options. instant withdrawals and regular withdrawals. Instant withdrawals use pre-funded on-chain liquidity to send funds to your wallet almost immediately. Regular withdrawals take longer to complete but remain fully decentralized. In both cases, there is no central entity approving the withdrawal; everything is executed automatically on-chain, and funds are returned directly to your wallet.

It is important to note that withdrawals on ApeX Omni are processed in USDT only. Users who hold other assets must swap them before withdrawing.

Many traders prefer decentralized exchanges because they carry significantly less regulatory risk than centralized platforms. Since there is no custody involved, there is no risk of sudden withdrawal freezes triggered by policy changes.

A detailed step-by-step walkthrough is available in our ApeX Omni withdrawal guide.

Using a Web3 ID as an Alternative

Web3 identity solutions are often mentioned by users searching for ways to regain access to funds on centralized exchanges. The Palau Web3 ID is one of the more commonly used options in this category.

This type of ID is primarily used by users who face regional restrictions or whose accounts have been limited due to compliance updates. In some cases, it can help meet alternative identity requirements accepted by certain platforms.

It is important to understand that a Web3 ID is not a privacy tool and does not replace self-custody. It is best viewed as a recovery or access solution for funds already held on centralized exchanges.

Users who want full control without approval requirements should still rely on decentralized exchanges like ApeX Omni. IF you'd like to know more and compare the best DEXs, you can read our Decentralized Exchanges Compared article.

Why Decentralized Exchanges Eliminate Withdrawal Risk

Centralized exchanges frequently receive complaints about frozen withdrawals, even on no-KYC platforms. This happens because they hold custody of user funds and can restrict access when risk is detected.

Decentralized exchanges eliminate this risk entirely. There is no account creation, no custody, and no approval process. Users interact directly from wallet to wallet, without exposure to policy changes or compliance reviews.

Risks & Legal Considerations

Withdrawing crypto without KYC does not remove legal responsibilities. Users must still comply with tax and financial reporting laws in their country. Privacy does not mean exemption from regulations.

For most users, especially beginners, using a fully KYC-verified exchange can be the safest option. Regulated platforms often provide stronger consumer protections, clearer legal status, and better support in case of disputes. While KYC requirements reduce privacy, they can also lower the risk of sudden account restrictions or compliance issues for users operating within supported regions.

Final Recommendation

The safest and most predictable way to withdraw crypto without KYC is to avoid custodial risk altogether by using a decentralized exchange like ApeX Omni.

For users who prefer centralized platforms, Bitunix and BloFin remain practical options as long as withdrawals stay within unverified limits.

If an account is restricted or blocked due to regional or compliance issues, a Web3 identity solution such as the Palau Web3 ID may help restore access, depending on the platform involved.

Ultimately, the best option depends on how much control, certainty, and independence you want when accessing your crypto.

Frequently Asked Questions (FAQ)

Can you legally withdraw crypto without KYC?

Yes, in many cases it is legal to withdraw crypto without KYC, depending on the platform you use and the laws in your country. Some exchanges allow limited withdrawals for unverified users, and decentralized exchanges do not require identity checks. However, users are still responsible for following local tax and financial regulations.

Why do exchanges suddenly ask for KYC when withdrawing?

Centralized exchanges may request KYC during withdrawals if their systems detect risk. This can happen due to large withdrawal amounts, unusual account activity, IP or region changes, or updated compliance rules. Because these platforms are custodial, they can pause withdrawals until verification is completed.

What is the safest way to withdraw crypto without KYC?

The safest option is using a decentralized exchange, where you withdraw directly to your own wallet. Since the platform does not hold your funds, there is no approval process and no risk of withdrawals being frozen by a centralized entity.

Can a Web3 ID help unlock frozen withdrawals?

In some cases, a Web3 identity solution can help users regain access to funds on centralized exchanges, depending on the platform and jurisdiction. This does not replace self-custody but can act as a recovery option when withdrawals are blocked due to regional or compliance restrictions.

Related Articles:

- Decentralized Exchanges Explained: Which DEX Is the Best?

- BloFin Bonus Explained: How to Earn Up to 5,000 USDT (And When It’s Actually Worth It)

- Best No KYC Crypto Trading App List for Beginners