Best Decentralized Exchanges in 2026: Top 5 DEX Compared (Fees, Liquidity & Features)

(Updated February 2026)

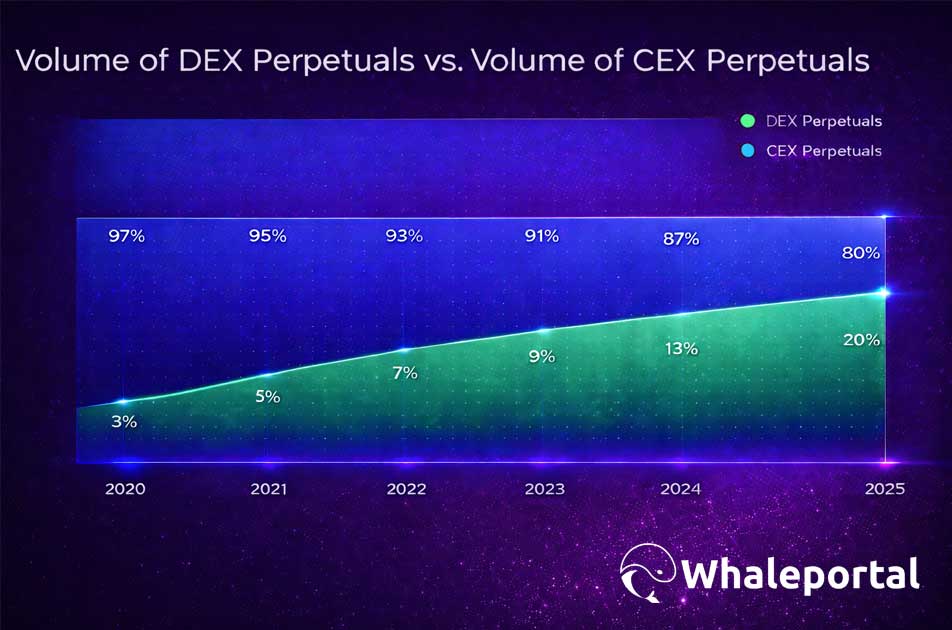

There is a big shift happening in Crypto and it’s accelerating. Traders are leaving centralised exchanges for Decentralised exchanges. If this trend continues we might see the trading volume on DEX’s surpass the trading volume on CEX’s in the coming years. Today, decentralized exchanges already account for roughly 20% of all perpetual futures trading volume.

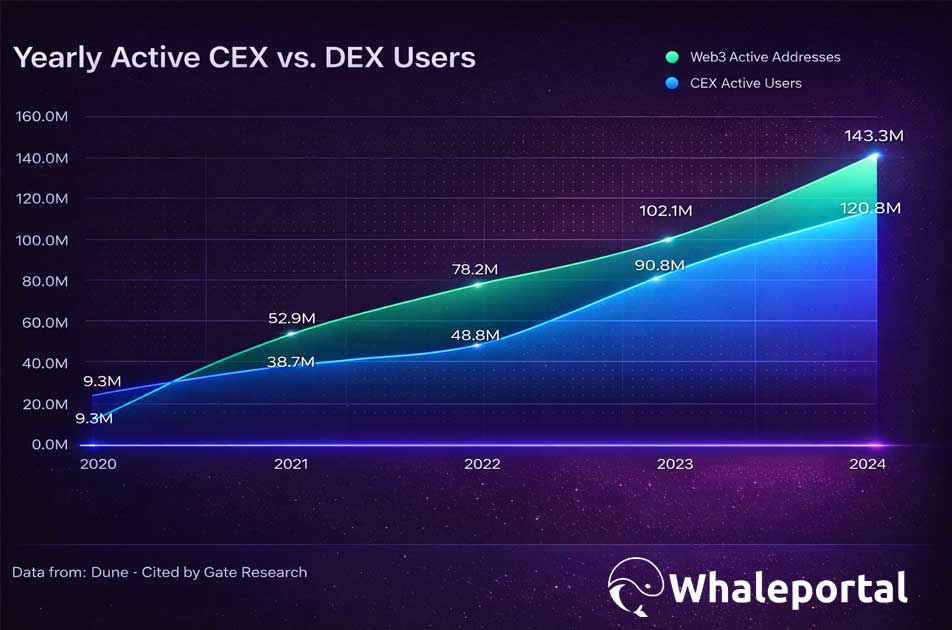

When you focus on the decentralized finance ecosystem, the trend becomes even clearer. The number of active Web3 wallets has already surpassed the number of user accounts on centralized exchanges.

When you focus on the decentralized finance ecosystem, the trend becomes even clearer. The number of active Web3 wallets has already surpassed the number of user accounts on centralized exchanges.

This confirms the big trend from centralised structures to decentralized alternatives. I’ve used the biggest decentralized exchanges myself and will explain exactly what separates one from another so you can check which DEX suits you best. But first:

This confirms the big trend from centralised structures to decentralized alternatives. I’ve used the biggest decentralized exchanges myself and will explain exactly what separates one from another so you can check which DEX suits you best. But first:

Why Traders Shift To Decentralised Exchanges?

Over the last few years, a lot of traders have simply lost trust in centralized exchanges. We’ve all seen situations where people suddenly couldn’t withdraw their funds because their accounts were frozen or flagged as “high risk.” When that happens, it becomes very clear who’s really in control, and it’s not the user.

The problem is simple: with a centralized exchange, a third party controls your account, and they could deny access to your account and funds. With a decentralized exchange, this is not possible.

Another big reason for the shift is how quickly DEX technology has improved. A few years back, decentralized exchanges were difficult to use and had very low liquidity. Today, many of them look and feel almost the same as the top centralized platforms like Bybit, but with the added benefit of decentralization.

So we’re entering a phase where traders can enjoy the user interface and liquidity they’re used to, while also having the freedom and security that comes with a decentralized system. As visible in the numbers, the shift is happening to DEX’s.

Picking The Right DEX

There are now dozens of decentralized exchanges, and each one is built differently. The most well-known platforms are:

- Apex Omni

- AsterDEX

- HyperLiquid

- dYdX

- LighterDEX

Each DEX runs on a different chain, uses different stablecoins, and offers different liquidity, fees, and trading pairs. In the next section, I’ll compare all of them side by side so you can decide which DEX fits your trading style best. I will look at the following metrics:

- Supported chains (Deposits)

- Stablecoins used (USDT, USDC, etc.)

- Liquidity depth

- Number of trading pairs

- Trading fees

- Features (e.g. Copytrading or Grid Bots)

Spoiler: My personal favorite is Apex Omni, mainly because it settles in USDT, has good liquidity, and the interface feels very similar to a top centralized exchange. It’s also backed by Bybit, which gives traders extra confidence. But let’s have a look at all of them as you might even want to use multiple.

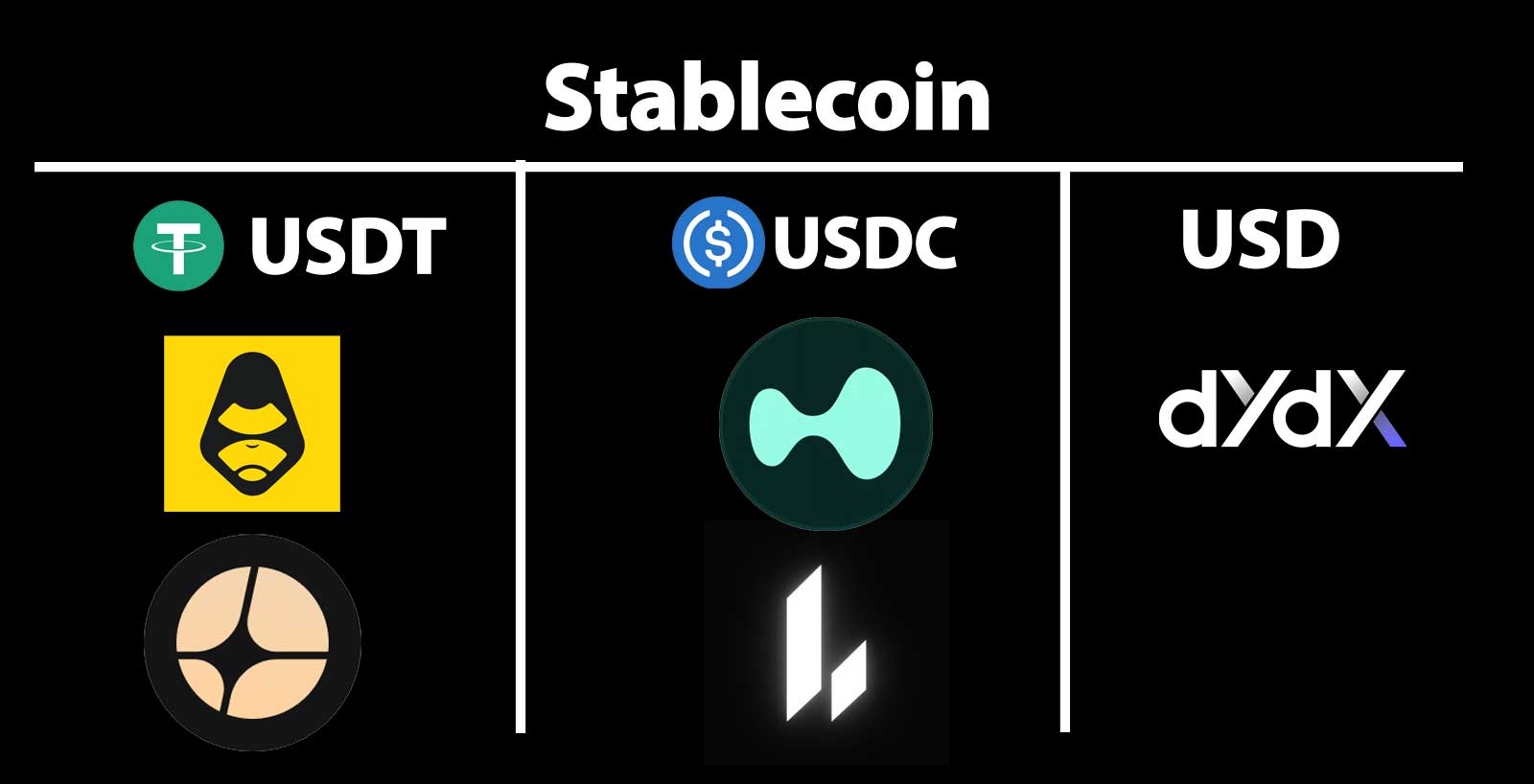

Stablecoins

You want to pick a DEX that supports the stablecoin that you are using or the one you trust the most. So you can easily withdraw your stablecoin and move it to places where you can sell it if necessary. Most exchanges that I personally use do not support USDC, so I would mostly prefer to use USDT.

USDT: Apex omni & AsterDEX

USDC: HyperLiquid & LighterDEX

USD: DyDX

In the end, if you’d really like HyperLiquid, for example, you still can consider using it and working your way around using USDC. The benefits of HyperLiquid might outweigh the hassle of converting USDC to USDT later. It’s just something think about when picking a DEX that fits you.

DyDX is using USD, so they have their own stablecoin. I personally would prefer a DEX using a liquid and settled stable coin like USDT or USDC. But hey, DyDX has other advantages.

Deposit

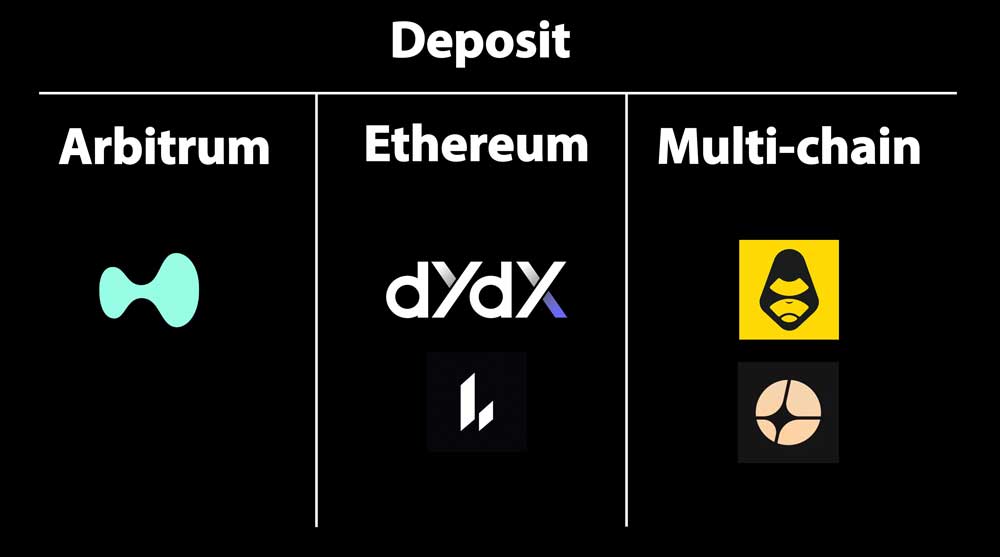

When you connect your wallet with a DEX you need to deposit funds. Not every DEX accepts funds from all chains, so this is also something you need to consider. Are you mainly using the Ethereum chain or maybe Artbitrum chain?

So on HyperLiquid, you can only deposit using the Arbitrum chain. I found this a bit difficult as I did not have funds in my Arbitrum wallet because I mostly use Ethereum. So I had to change my funds into the Arbitrum chain and was able to deposit into HyperLiquid.

DyDX and LighterDEX are using the Ethereum chain, which is probably the most-used chain, but Apex Omni and AsterDEX have multi-chain deposits. Which means that you can just deposit from Ethereum, Arbitrum, BASE or BNB chain. This makes depositing (and withdrawal) a more easy process.

So with the basics of stable coin and chain support, let’s dive into each DEX individually and see what it has to offer.

HyperLiquid

|

Chain |

Arbitrum |

|

Fees |

0.045% (Taker) / 0.015% (Maker) |

|

Pairs |

243 Trading Pairs |

|

Stablecoin |

USDC |

|

Features |

Vaults, Staking, Sub accounts, Testnet |

|

Liquidity |

High (9 Billion past 24 Hours) |

HyperLiquid is one of the most used DEX’s in the space. What makes HyperLiquid unique compared to others is that positions are transparent. You can see the positions of other traders and your own positions are as well visible to others. HyperLiquid has it’s own Layer1 chain and you can deposit only through the Arbitrum chain using USDC. HyperLiquid is highly liquid (as the name implies) and probably is one of the most liquid DEX’s on the market.

Pro’s:

- Lots of Liquidity

- High Amount of Trading Pairs

- Transparent positions

Con’s:

- Due to an attack (November 2025) withdrawals were halted. Traders question the decentralised nature of the exchange.

- Only deposit through Arbitrum

Join HyperLiquid Today and receive 4% Discount on your fees with our unique affiliate link.

DyDX

|

Chain |

Ethereum |

|

Fees |

0.05% (Taker) / 0.03% (Maker) |

|

Pairs |

233 Trading Pairs |

|

Stablecoin |

USD |

|

Features |

DyDX MegaVault, Spot Market |

|

Liquidity |

Low (500 Million past 24 Hours)

|

DyDX one of the more well-known DEX’s known for their big amount of trading pairs and it’s MegaVault which is a way to generate passive income. I think it’s definitely one for the lower ends on DEX’s mainly due to the low amounts of volume. If that would change in the future, DyDX would be a great DEX to trade on, it’s definitely in the top 5 DEX’s.

Pro’s

- Professional user-interface

- Spot Market

Con’s

- Low Liquidity (Might change in the future)

AsterDEX

|

Chain |

Multi Chain |

|

Fees |

0.04% (Taker) / 0.005% (Maker) |

|

Pairs |

231 Trading Pairs |

|

Backed By |

Binance |

|

Stablecoin |

USDT |

|

Features |

Spot Market. Shield Mode, Grid bots, Subaccounts, Testnet |

|

Liquidity |

High (5.7 Billion past 24 hours) |

AsterDEX is the decentralised exchange of Binance. It’s has competitive trading fees, and offers a wide variety of trading pairs. All contracts are settled in USDT and you can deposit from multiple chains (Ethereum, BNB, Arbitrum and Solana). It has some interesting features like Shield trading, where you can trade up to 1000x leverage and AsterDEX also offers grid bots. All and all this is one of the better DEX’s with great liquidity and a smooth experience due to multi-chain deposits and a professional trading interface, similar as to that of Binance.

Pro’s

- Multi-chain Deposit

- Very Liquid

- Low Fees

Con’s

- Binance does not always have the best reputation in the space

Join AsterDEX now with our affiliate link to receive 2% discount on your fees.

Apex Omni

|

Chain |

Multi Chain |

|

Fees |

0.05% (Taker) / 0.02% (Maker) |

|

Pairs |

280 Trading Pairs |

|

Backed By |

Bybit |

|

Stablecoin |

USDT |

|

Features |

Spot Market. Copy-Trading (Vaults), Grid bots, Prediction Markets, Apex Social, Subaccounts, Testnet |

|

Liquidity |

High (1.5 Billion past 24 hours) |

Apex Omni, the decentralised exchange of Bybit. This is in my opinion, the most promising DEX with multi-chain deposits, the most trading pairs, USDT settled contracts and it’s backed by Bybit, one of the best centralised exchanges.

Apex Omni really feels like Bybit, but built on a decentralized infrastructure. Trading is smooth, and the platform offers popular features like copy trading, prediction markets and grid bots. Its liquidity is currently medium to high and has grown significantly over the past year. This is interesting because many other DEXs still have higher liquidity, but theirs has been declining, while Apex Omni’s continues to increase. That’s a strong sign that Apex Omni is still in a growth phase.

Apex also frequently organizes events such as airdrops, and the platform includes Apex Social, where users can earn points simply by trading. These points can later be exchanged for airdrops or other rewards.

Together with multi-chain deposits, USDT settled contracts, Apex Omni is my personal favourite.

Pro’s

- Back by Bybit

- Most amount of Trading Pairs

- Lots of Features (Spot, Grids, Prediction Markets, Copy-Trading)

Con’s

- Less popular trading pairs usually have lower trading volume

Join Apex Omni with our unique affiliate link and receive 5% discount on your fees.

LighterDEX

|

Chain |

Ethereum |

|

Fees |

0% (Temporary) |

|

Pairs |

123 Trading Pairs |

|

Backed By |

RobinHood |

|

Stablecoin |

USDC |

|

Features |

Subaccounts, Testnet |

|

Liquidity |

High (5 Billion past 24 hours) |

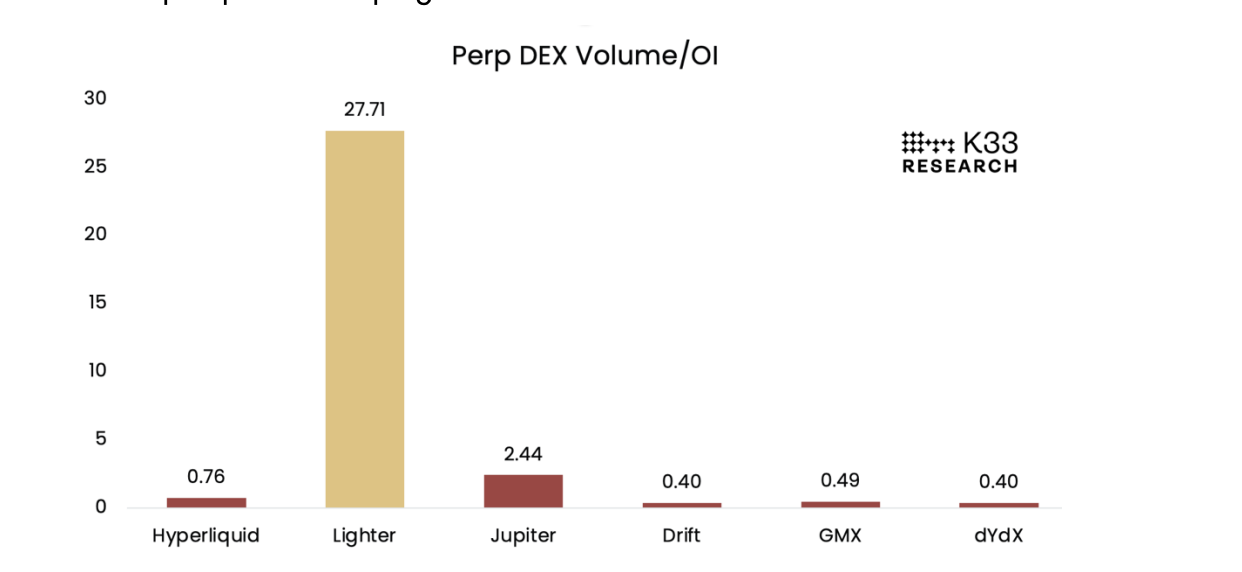

LighterDEX is definitely one of the DEX’s that stands out here as it is not well-known in the crypto space but has impressive statistics in terms of volume and fees. It offers a temporary 0% trading fee for retail users and the volume is one of the highest among all DEX’s.

I find this a bit strange to be honest and after doing some research online there is a paper published which shows that the volume of LighterDEX is not organic. A very strong indicator of wash trading.

I’ve also used LighterDEX and I didn’t find the experience really that smooth, I don’t know anybody else using this platform and the reported volume is a red flag, these are the reasons why I do not use it for my trading.

Pro’s:

- 0% Fees

Con’s:

- Volume/metrics might be a red flag

- No features outside of trading perpetuals

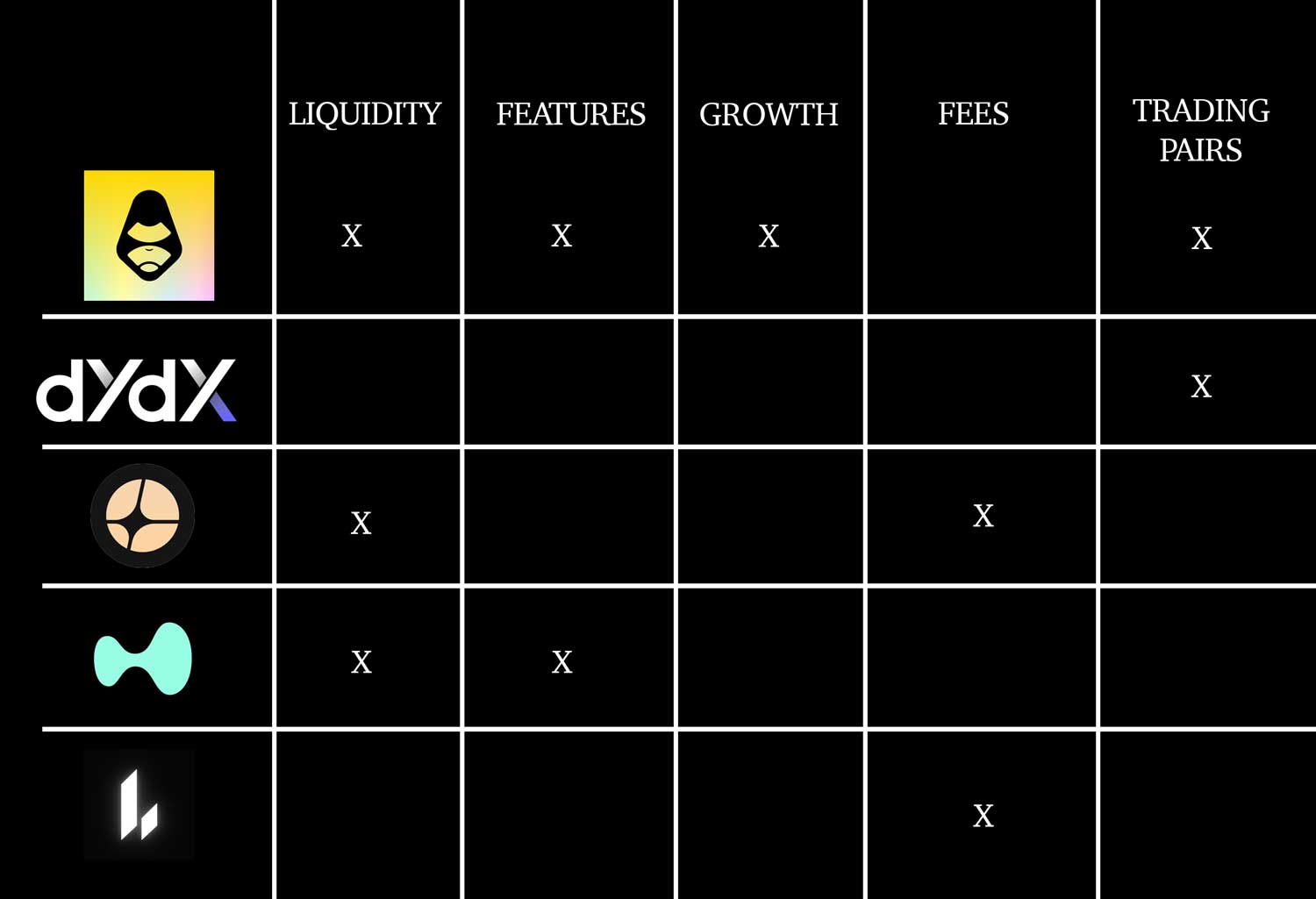

The best DEX

Let’s summarise all the metrics we’ve discussed in this article and make a clear breakdown of the benefits of each DEX and which might suit you best.

These are the best DEXes, ranked from 1 to 5.

Apex Omni is the clear winner when we combine all metrics. It offers the safety of Bybit, the most features, a wide range of trading pairs, and a very user-friendly experience with multi-chain deposits and USDT-settled contracts.

After Apex Omni, the race is tight, but we placed HyperLiquid in second place. It’s one of the most liquid DEXs and offers unique features, such as full transparency of open positions.

In third place comes AsterDEX, Binance’s decentralized exchange, known for its generally lower fees and deep liquidity.

Fourth place goes to dYdX, a well-established DEX with a beautiful trading interface. The only drawback is that its volume is lower compared to the top competitors, which limits its ranking.

Finally, we placed LighterDEX at the bottom. Some of the metrics simply don’t add up, and if there’s one thing I’ve learned in crypto, it’s this: when you see early red flags, don’t ignore them.

I’ve personally used every DEX on this list, and that experience definitely influenced the ranking.

It’s important to note that each DEX offers slightly different services, and traders with different backgrounds or preferences may favor different platforms. I’ve tried to take as many factors into consideration as possible, specifically the things I usually encounter when trading, based on my own preferences and experience.

Conclusion

In short, decentralized exchanges are catching up fast with centralized platforms, both in terms of user experience and liquidity. As more traders move their funds on-chain, DEXs will likely play an even bigger role in the future of crypto trading.

Based on the metrics I’ve compared and my own experience using each platform, Apex Omni comes out on top, especially if you value USDT settlements, multi-chain deposits, and a CEX-like interface backed by Bybit. That said, HyperLiquid, AsterDEX, dYdX, and LighterDEX each have their own strengths, and the “best” DEX for you ultimately depends on your stablecoin preference, favorite chain, and trading style. If you’re serious about trading in a more decentralized way, it’s worth testing a few of them and seeing which one feels right for you.

Join Apex Omni with our Affiliate link to receive 5% discount on your fees

FAQ: Decentralized Exchanges (DEX) Explained

What is the best decentralized exchange (DEX) in 2025?

Based on features, liquidity, stability, and overall user experience, Apex Omni ranks as the best DEX in 2025. It offers USDT-settled contracts, multi-chain deposits, strong liquidity growth, and a user interface similar to Bybit, making it ideal for both beginners and advanced traders.

Why are traders moving from centralized exchanges (CEX) to DEXs?

Many traders no longer trust centralized exchanges due to past withdrawal freezes, account restrictions, and custodial control over user funds. DEXs allow you to trade directly from your own wallet, giving full control of your assets while still offering CEX-level performance thanks to recent technological improvements.

Which stablecoin should I use on a DEX?

It depends on the DEX you choose.

- USDT: Apex Omni, AsterDEX

- USDC: HyperLiquid, LighterDEX

- USD (DYDX’s own stablecoin): dYdX

Choose the stablecoin you prefer or trust, but keep in mind that some platforms may require swapping before depositing.

What’s the biggest difference between the top DEXs?

Each DEX differs in:

- Supported chains (Ethereum, Arbitrum, BNB, Base, Solana)

- Stablecoins used (USDT, USDC, USD)

- Liquidity depth

- Trading fees

- Features (spot markets, copy trading, prediction markets, grid bots)

For example: - Apex Omni → Best all-rounder, USDT settlement, multi-chain deposits

- HyperLiquid → Most liquidity, transparent positions

- AsterDEX → Low fees, Binance-backed

- dYdX → Great interface but lower volume

- LighterDEX → 0% fees but questionable volume

Is it safe to trade on DEXs?

DEXs remove custodial risk because you always control your wallet and private keys. However, safety also depends on:

- Smart contract security

- Platform transparency

- Liquidity depth

- Track record and backing

Apex Omni and AsterDEX score high due to backing from proven CEXs (Bybit and Binance), while HyperLiquid has strong liquidity but has had questions about decentralization after a withdrawal halt. Always trade on platforms you trust.

Unsure if a crypto exchange is legit? Use this 5-minute DEX & CEX safety checklist to spot scams, fake volume, and risky platforms.

Related Articles:

- Crypto Sector Indexes Explained

- Apex Omni Vaults Explained: Copy-trading On a Decentralised Exchange

- Can You Trade on Bybit Without KYC?