Bitunix

Bitunix

Visit BitunixTired of waiting for KYC verification just to start trading crypto? Bitunix might be the solution you're looking for. This no-KYC, no-VPN exchange offers high liquidity and a hassle-free experience.

Rating

84Location

Saint Vincent and the GrenadinesContract types

USDTMaker fee

0.02 %Taker fee

0.06 %Max leverage

125xUS allowed

NoDeposit methods

Crypto, Bank TransfersAverage funding fee (BTC)

-Table of contents

- Bitunix Review 2025 – Is This Crypto Exchange Worth It?

- TL;DR

- What is Bitunix?

- Is Bitunix Safe and Legit?

- Bitunix Key Features

- Bitunix Fees Explained

- How to use Bitunix

- Bitunix vs Other Exchanges

- Bitunix vs. Bybit

- Bitunix vs Apex Omni

- Bonuses and promotions

- Pros and Cons Summary

- Conclusion: Is Bitunix Right for You?

- Frequently Asked Questions About Bitunix

- Is Bitunix available in the US and Canada?

- Does Bitunix require KYC?

- Is Bitunix safe to use?

- What are the trading fees on Bitunix?

- What cryptocurrencies can I trade on Bitunix?

- Can I buy crypto with a credit card on Bitunix?

- Does Bitunix offer copy trading?

- What is the Bitunix bonus for new users?

- Is Bitunix better than Bybit or Binance?

Bitunix Review 2025 – Is This Crypto Exchange Worth It?

In this article, we’ll quickly discuss the main pros and cons so you can decide if Bitunix is right for you. Then, we’ll dive deeper into its features and tools and how it compares to other popular exchanges.

|

Pro’s |

Con’s |

|

Available Globally (US, Canada, UK etc.) |

Less regulated |

|

Not waiting for account approval (no KYC) |

Daily withdrawal limit ($500’000) |

🕣 No time and want to trade directly? Create your account on Bitunix and receive a 10% bonus

TL;DR

|

Feature |

Summary |

|

Best for |

Beginners to intermediate traders |

|

Available in |

Worldwide |

|

Trading pairs |

350+ pairs |

|

Markets |

Spot, Perpetual, Copy-trading, P2P |

|

Fees |

0.08%–0.10% (spot); 0.02%–0.06% (futures) |

|

KYC |

Not mandatory but will unlock higher limits |

|

Deposit Bonus |

Up to $8’000 |

What is Bitunix?

Bitunix is a centralized cryptocurrency exchange registered in Saint Vincent and the Grenadines. It offers a wide range of services commonly found on major exchanges, including spot trading, perpetual contracts (margin trading), copy trading, as well as P2P transactions and staking.

What sets Bitunix apart is its no-KYC policy, allowing users to trade without undergoing identity verification. This makes it a more privacy-focused option for crypto traders. Additionally, the platform can be accessed without the need for a VPN, making it more convenient for users in various regions.

Is Bitunix Safe and Legit?

Bitunix is licensed as a Money Services Business (MSB) in both the United States (FinCEN) and Canada (FINTRAC). In February 2024, it also obtained a VASP license in the Philippines, allowing it to legally offer crypto services there.

While having these licenses is important, the real sign of a trustworthy exchange is high liquidity and a large user base. Why? Because more liquidity means less slippage and fewer chances of sudden price spikes or wicks that can trigger unwanted liquidations.

Bitunix stands out as one of the highest-liquidity non-KYC exchanges, making it a solid option for traders who value both privacy and performance.

Other security measures in place include two-factor authentication (2FA), which adds an extra layer of protection to your account. With 2FA enabled, the risk of unauthorized access is significantly reduced.

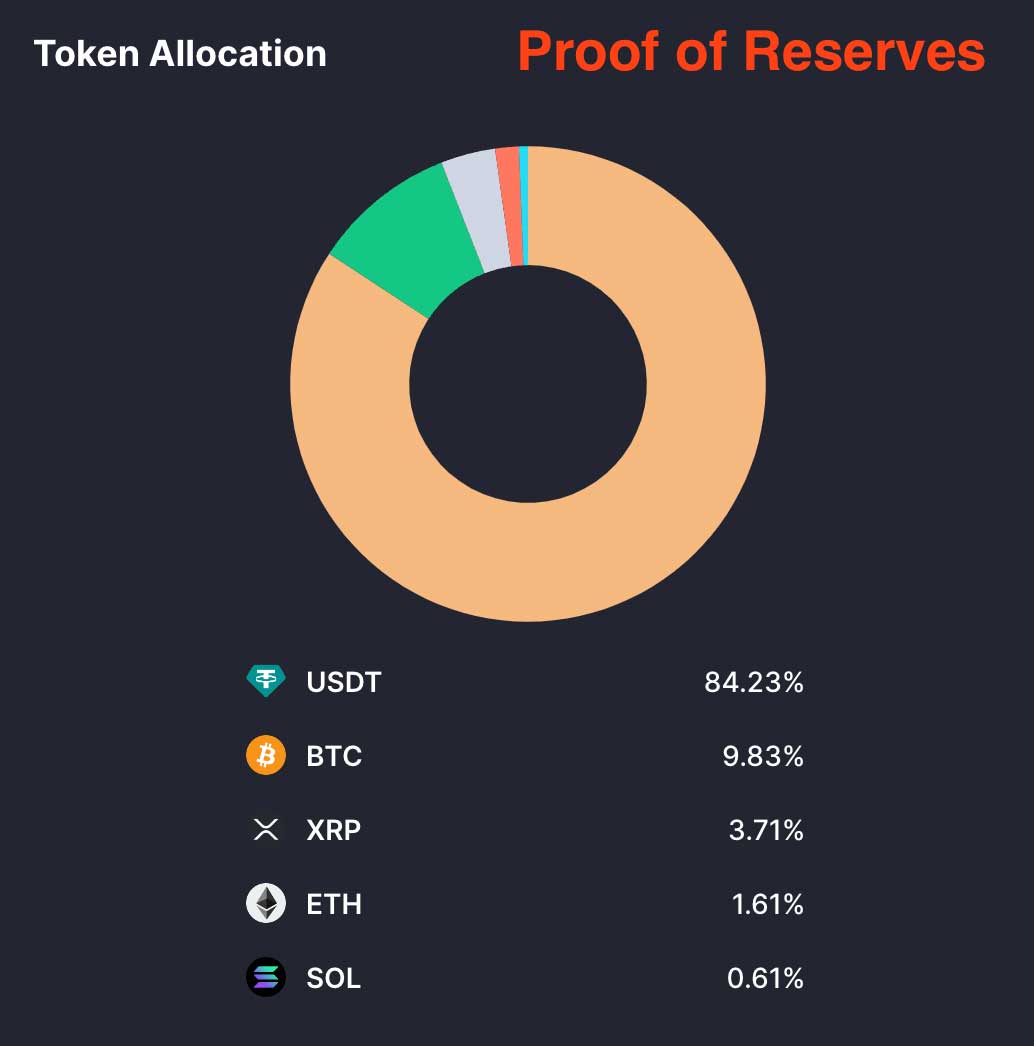

Proof of reserves

Bitunix offers a transparent Proof of Reserves (PoR) feature, allowing users to verify on-chain that all customer assets are fully backed. This commitment to transparency helps build trust with users.

The majority of Bitunix’s reserves are held in USDT, and at the time of writing this review, the platform holds approximately $129 million USD in assets.

Bitunix Key Features

Bitunix has 3 main key features:

- Spot market

- Perpetual/Futures market

- Copy-trading

Side features:

- Buy Crypto (P2P, third Party)

- Staking

Spot market

The Bitunix spot market is impressive, offering high liquidity and support for over 400 trading pairs. A wide range of altcoins is available, catering to both mainstream and niche traders. USDT is the stablecoin used for all contracts.

Some notable examples include TRUMP, AAVE, ETH, SOL, XRP, SUI, and many more. Whether you're trading major coins or exploring new projects, Bitunix provides a solid selection with competitive order book depth.

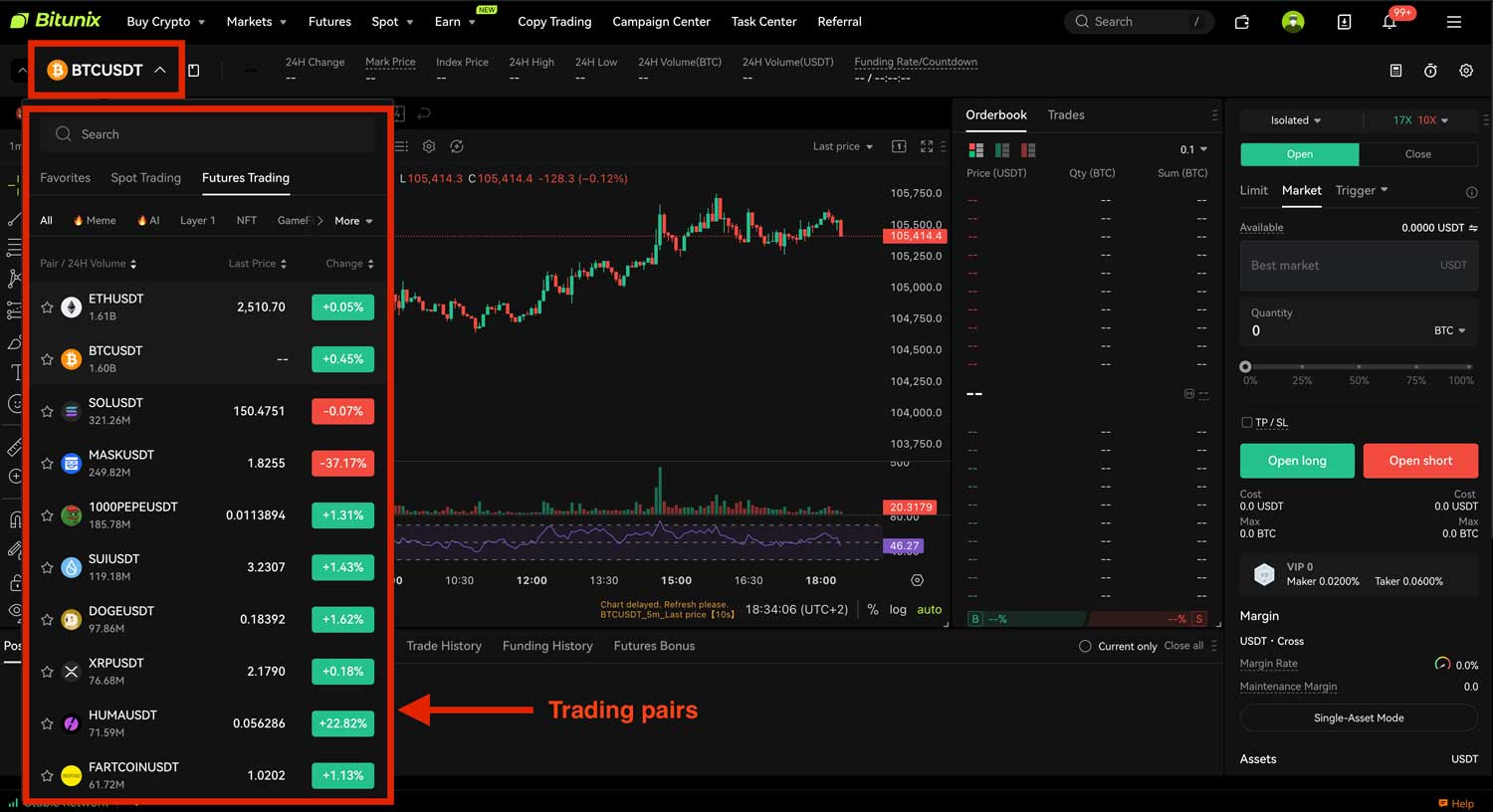

Futures market

With over 350 trading pairs, Bitunix offers one of the most extensive selections among non-KYC exchanges. Liquidity is especially strong on major pairs like Bitcoin (BTC) and Ethereum (ETH), each reaching over $1 billion in 24-hour trading volume.

All perpetual contracts on Bitunix are settled in USDT, making USDT the primary stablecoin used across the platform.

Copy-Trading

Copy trading has become a highly popular feature in the crypto space, as it allows investors to earn passive income by following experienced traders. At the same time, skilled traders can gain access to additional capital by allowing others to copy their trades.

Bitunix offers a dedicated copy trading section, where users can browse and select traders to automatically mirror their strategies. This provides a potential source of passive income for followers, while traders can earn a share of the profits they generate for their followers, creating a win-win opportunity for both sides.

Buy Crypto

You can buy crypto directly on Bitunix using a wide range of payment methods, including Visa, Mastercard, Apple Pay, Google Pay, credit and debit cards, Revolut Pay, and more.

Bitunix partners with a trusted third-party provider to facilitate these purchases, making it easy for users to onboard with fiat — even if they don’t already own any cryptocurrency. This seamless integration helps bridge the gap between traditional finance and the crypto world.

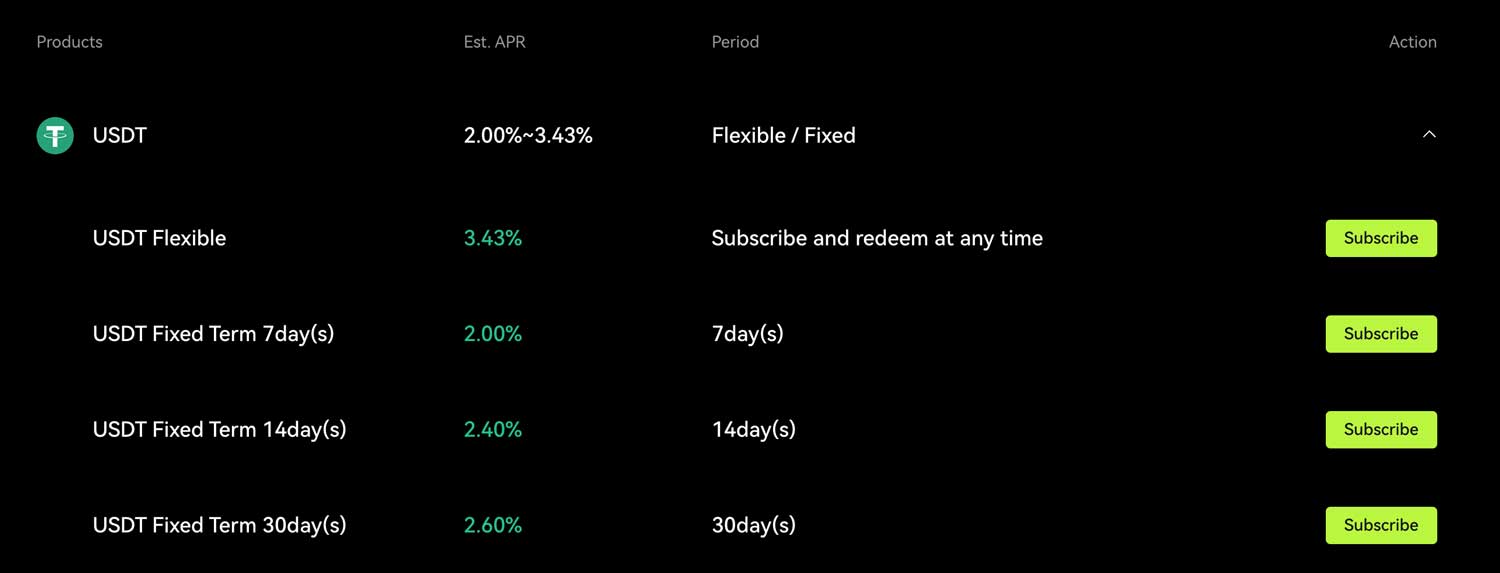

Staking

Bitunix offers users the option to lock their crypto assets for a set period in exchange for earning yield. Lock-up periods typically range from 7 to 60 days, depending on the asset and offer. There's also a “flexible” staking option, which allows you to earn yield while retaining the ability to withdraw your funds at any time.

Yields vary based on the asset, with returns typically around 2–3% for USDT and over 1% for Bitcoin and other cryptocurrencies.

Bitunix Fees Explained

Bitunix offers competitive trading fees that become even more attractive through its structured VIP system. For regular users (VIP 0), spot trading fees start at 0.08% for makers and 0.10% for takers, while futures trading fees are just 0.02% and 0.06%, respectively. As your trading volume or account balance increases, you automatically progress through VIP levels — up to VIP 7 — unlocking reduced fees as low as 0.01% (maker) and 0.0325% (taker) for spot, and just 0.006% / 0.03% for futures. This tiered system rewards active traders and high-balance accounts, making Bitunix a cost-effective platform for both casual and professional users. Whether you're trading $1,000 or $200 million monthly, there's a transparent path to lower costs.

How to use Bitunix

To use Bitunix first you need to:

- Create an account (only need an e-mail & password)

- Deposit Crypto or use a Third-Party to Deposit FIAT

Once your account is funded you can start trading. First, make sure your assets are in the right wallet. If you’d like to trade on spot then your assets would need to be in your spot wallet, if you’d like to trade future, you need to transfer those assets to your futures wallet.

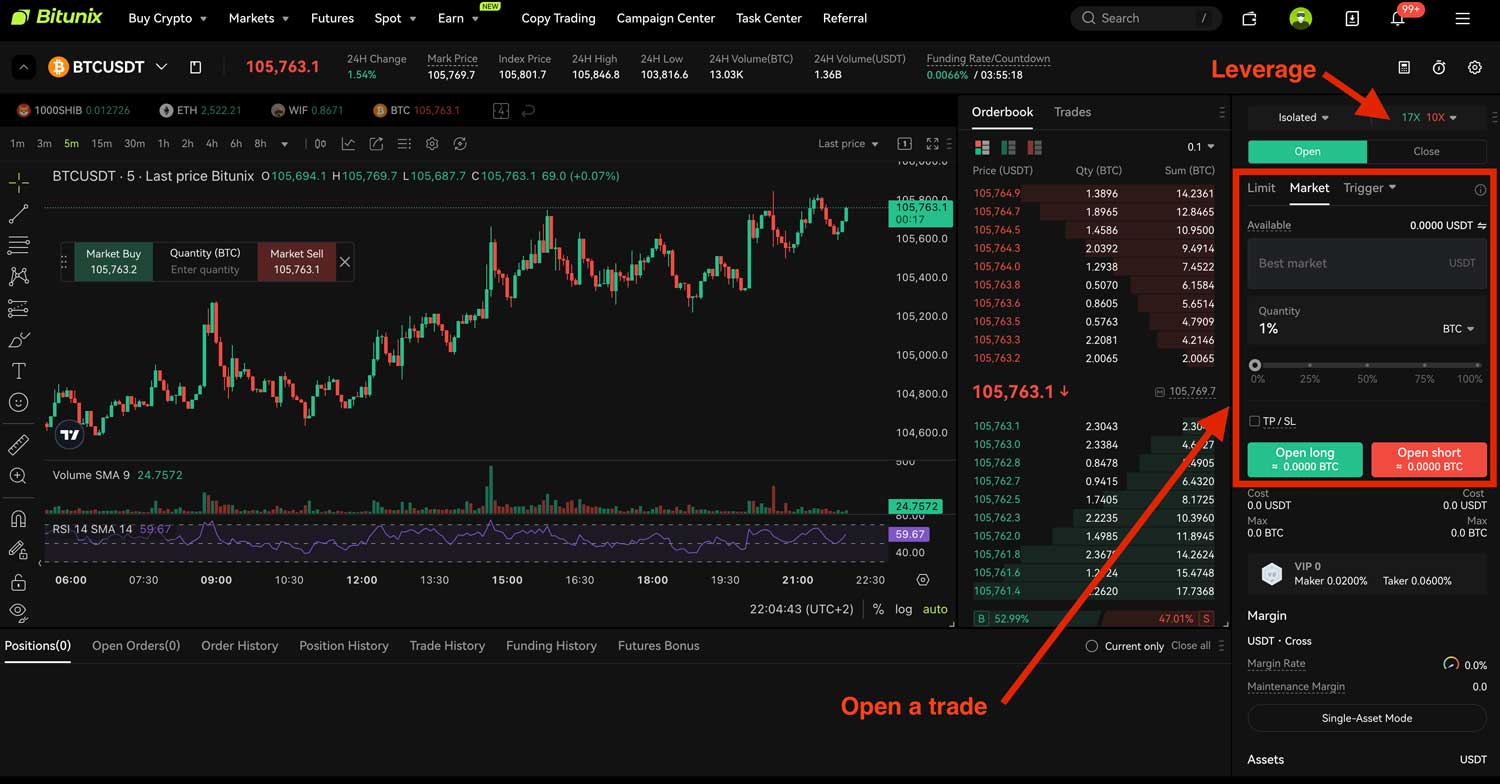

Open a trade

To open a trade go to “Futures” and select your trading pair.

On the right side, you can select the order type.

- Limit order: An order to buy or sell at a specific price.

- Market order: An order to buy or sell immediately at the current market price.

- Trigger: An order that becomes active only when a certain price (the trigger price) is hit.

The easiest way to open a trade is to use a market order, as it will be executed directly.

Select the amount of USDT that you would like to put in the order and choose whether you want to buy (long) or sell (short).

Once this is confirmed, you’re in a position.

Leverage types

Bitunix offers two types of margin settings:

- Cross Margin

- Isolated Margin

The main difference between them lies in how your funds are managed during a trade:

- Isolated Margin limits your risk to only the amount you allocate for a specific position. If the trade goes against you, only that isolated amount is at risk.

- Cross Margin uses all available funds in your futures wallet to maintain your position. This means your entire futures balance can be used to prevent liquidation.

Bitunix vs Other Exchanges

|

Feature |

Bitunix |

Bybit |

MEXC |

Apex Omni |

|

Available in US? |

Yes |

No |

Yes (But with VPN) |

Yes |

|

VPN Needed? |

No |

No |

Yes |

No |

|

Fiat on-ramp |

Yes |

Yes |

Yes |

No |

|

Leverage |

125x |

100x |

125x |

100x |

Bitunix vs. Bybit

Bybit is one of the largest regulated crypto exchanges, making it a secure and trusted platform for trading. However, it’s not available in all regions, countries like the United States, Canada, and the United Kingdom are restricted from using its services.

This is where Bitunix comes in. It provides trading access to users in these restricted countries and emphasizes privacy by not requiring KYC (Know Your Customer) verification. Bitunix also offers slightly higher leverage than Bybit, catering to more aggressive trading strategies.

When it comes to fees, Bybit has a slight edge with lower maker fees (0.01% vs. Bitunix’s 0.02%), while taker fees are equal at 0.06%.

Additionally, Bybit offers a broader range of features, such as grid trading and automated trading bots, which are currently not available on Bitunix. Bybit is also running a deposit bonus campaign where users can earn up to $30,000 in bonuses, although certain conditions apply.

In summary, Bitunix is ideal for traders who prioritize privacy or live in restricted regions, while Bybit is better suited for those who value a regulated and feature-rich platform.

Bitunix vs Apex Omni

Apex Omni is a decentralized exchange developed by Bybit, allowing users to trade without KYC. This makes it accessible to anyone worldwide while maintaining full privacy and self-custody of funds.

The key difference between Apex Omni and Bitunix lies in their structure:

- Bitunix is a centralized exchange, offering greater liquidity, more trading pairs (spot and perpetual), and features like fiat on-ramps.

- Apex Omni, on the other hand, is decentralized, meaning you remain in control of your own assets and don’t need to trust a central authority.

Both platforms offer copy trading-style services, on Apex Omni, this is called Apex Omni Vaults. However, Bitunix provides a broader set of tools for active traders.

In short, Apex Omni is ideal for privacy-focused users and DeFi enthusiasts, while Bitunix caters to traders who value convenience, higher liquidity, and access to more markets.

Bonuses and promotions

New users can unlock a 10% deposit bonus (up to $1,000 USDT) and receive 1-month VIP3 perks, including a 30% trading fee discount, on Bitunix. But here's the catch: this offer is only available when you sign up through a verified affiliate link. Without it, you won’t be eligible for the bonus. If you're looking to trade without KYC and still enjoy solid rewards, this is a great opportunity to start with extra margin. And this is next to the standard bonus they offer for new sign ups of up to $8’000 USDT.

Pros and Cons Summary

|

Pro’s |

Con’s |

|

No KYC |

Less regulated |

|

High liquidity |

Not as well-known as Binance/Bybit |

|

Accessible worldwide |

Slightly higher fee than Bybit |

|

350+ Trading pairs (Spot & Futures) |

|

|

Up to 125x Leverage |

|

Conclusion: Is Bitunix Right for You?

If you're looking for a fast, no-KYC exchange with high liquidity, low fees, and wide global access including in the US and Canada. Bitunix is one of the strongest options available. It offers a seamless balance between privacy and performance, with features like copy trading, futures, and 400+ trading pairs.

While it may not have every advanced tool found on larger platforms like Bybit or Binance, Bitunix excels in simplicity, accessibility, and user-friendly design. It's an excellent choice for beginners, privacy-focused users, or anyone who wants to trade without unnecessary delays or restrictions.

🎁 Ready to trade with fewer limitations and better rewards?

Create your account through our verified Bitunix link and receive a 10% deposit bonus worth up to 1,000 USDT. You’ll also enjoy VIP3 status for 30 days, which includes a 30 percent discount on trading fees.

Frequently Asked Questions About Bitunix

Is Bitunix available in the US and Canada?

Yes, Bitunix is one of the few crypto exchanges that allows full-feature trading in both the United States and Canada. No VPN is required, and users in these regions can trade without limitations.

Does Bitunix require KYC?

No, Bitunix does not require KYC (Know Your Customer) verification for most features. You can deposit, trade, and withdraw crypto without uploading ID. However, completing KYC can increase your withdrawal limits and unlock certain bonuses.

Is Bitunix safe to use?

Yes, Bitunix is licensed in multiple jurisdictions, including the US (FinCEN), Canada (FINTRAC), and the Philippines (VASP). It offers two-factor authentication (2FA), Proof of Reserves, anti-phishing tools, and partners with top-tier custodians like Cobo and Nemean.

What are the trading fees on Bitunix?

For regular users, spot trading fees start at 0.08% (maker) and 0.10% (taker), while futures trading fees start at 0.02% and 0.06%. As you progress through VIP levels, these fees drop significantly, making Bitunix very competitive in the market.

What cryptocurrencies can I trade on Bitunix?

Bitunix supports over 400 trading pairs, including popular assets like BTC, ETH, SOL, XRP, AAVE, and SUI, as well as niche altcoins and trending meme coins like TRUMP.

Can I buy crypto with a credit card on Bitunix?

Yes, Bitunix supports fiat purchases through third-party providers. You can buy crypto using Visa, Mastercard, Apple Pay, Google Pay, Revolut Pay, and other major payment methods.

Does Bitunix offer copy trading?

Yes, Bitunix has a dedicated copy trading feature. You can follow and automatically copy the trades of experienced traders, which is ideal for passive investors.

What is the Bitunix bonus for new users?

New users who sign up through a verified affiliate link can claim a 10% deposit bonus (up to 1,000 USDT) and enjoy 30 days of VIP3 status with a 30% fee discount. Bitunix also offers sign-up bonuses of up to 8,000 USDT through trading activity.

Is Bitunix better than Bybit or Binance?

It depends on your needs. Bitunix is ideal for users who want privacy, fast access, and simple trading without KYC or VPN requirements. Bybit and Binance offer more advanced features, but they restrict users in certain regions and often require KYC.