CoinW

CoinW

Visit CoinWTrading volume (24h)

$5,970,209,554.55Open interest

$2,339,993,781.432CoinW is a secure and user-friendly cryptocurrency exchange located in the United Arab Emirates. CoinW offers a big variety of services to their users such as, spot trading, futures trading, copy trading, and ETFs. Find here all the specifics of CoinW Exchange.

Rating

69Location

UAEContract types

USDTMaker fee

0.04 %Taker fee

0.06 %Max leverage

200xUS allowed

NoDeposit methods

Crypto, Credit CardsAverage funding fee (BTC)

0.0026%Table of contents

- CoinW Review

- Pros

- Low transaction fees compared to the industry average

- A wide variety of cryptocurrencies available for trading (1000+)

- Secure platform with advanced security protocols

- Great promotions and lucrative referral programs

- Offers futures, ETFs, and copy trading features

- Mobile app available for trading on the go

- Fiat deposit options including wire transfer and credit card

- Cons

- Lack of certain educational resources for beginners

- Not available in some countries due to regulatory restrictions

- Interface may be overwhelming for complete crypto novices

- What is CoinW?

- CoinW’s Core Products and Features

- Mobile App

- CoinW Credit Card

- CoinW Customer Support

- Is CoinW Available to US Investors?

- CoinW Trading Fees

- Security Services on Offer

- Risk Mitigation Practices Being Implemented

- How to Sign Up for CoinW

- Conclusion

CoinW Review

CoinW is a secure, user-friendly cryptocurrency exchange that offers clients a variety of features, including multi-currency support, a built-in exchange, and 24/7 customer support. From the outside looking in, it is an excellent choice for both beginners and experienced users looking to trade a wide range of cryptocurrencies.

|

Withdrawal Fee |

Taker Fee |

Maker Fee |

|

0.0005 BTC |

0.2% |

0.2% |

Pros

-

Low transaction fees compared to the industry average

-

A wide variety of cryptocurrencies available for trading (1000+)

-

Secure platform with advanced security protocols

-

Great promotions and lucrative referral programs

-

Offers futures, ETFs, and copy trading features

-

Mobile app available for trading on the go

-

Fiat deposit options including wire transfer and credit card

Cons

-

Lack of certain educational resources for beginners

-

Not available in some countries due to regulatory restrictions

-

Interface may be overwhelming for complete crypto novices

What is CoinW?

CoinW is a cryptocurrency exchange platform founded in 2017. In the years since its launch, the platform has grown to serve over 10 million users worldwide, establishing itself as a major player in the crypto trading space. The exchange provides users with a secure and user-friendly way to buy, sell, and trade a wide variety of digital currencies. It holds numerous licenses, including the American MSB financial license, the MAS license of Singapore, and the SVGFSA license of Saint Vincent and the Grenadines.

At its core, CoinW aims to be a one-stop shop for cryptocurrency traders and investors, offering spot trading of hundreds of crypto pairs, as well as more advanced products like futures contracts and crypto ETFs. The platform caters to both retail and institutional investors with its range of trading tools and account types.

CoinW’s Core Products and Features

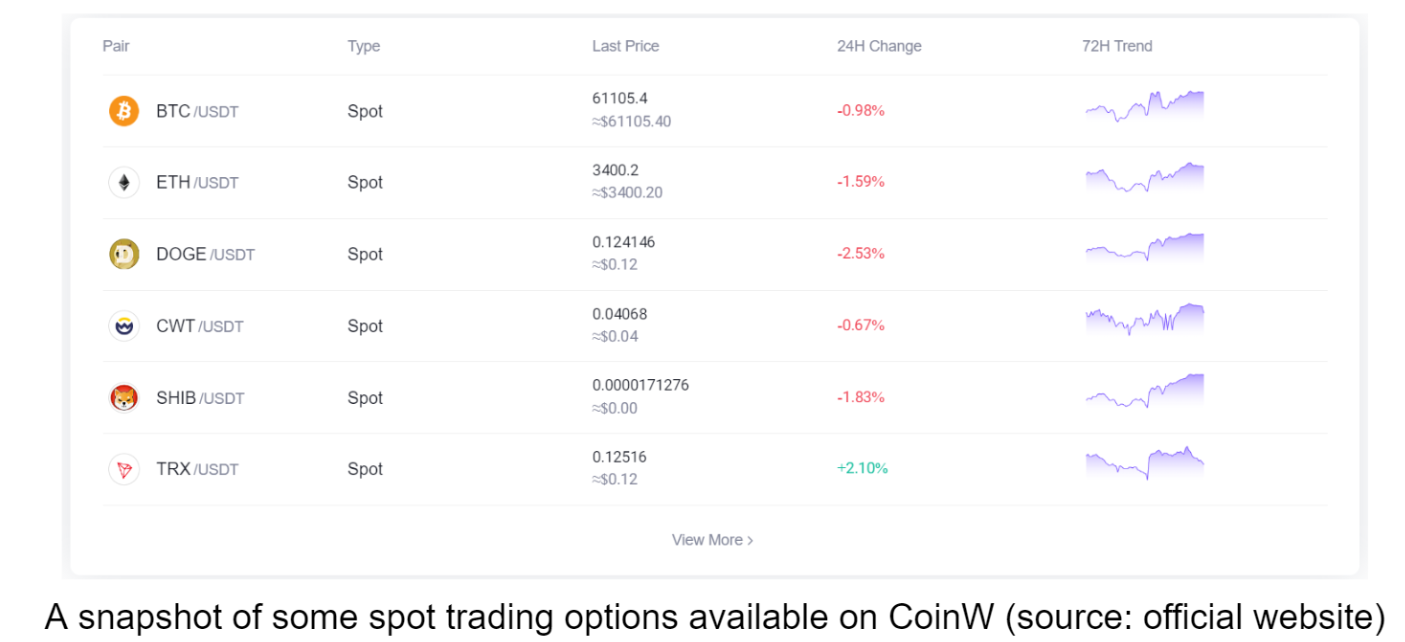

Spot Trading

The spot market is CoinW's bread and butter, allowing users to buy and sell cryptocurrencies at current market prices. With support for over 1000 trading pairs, traders have access to most major coins and many promising altcoins. The order book is typically quite liquid for popular pairs.

A snapshot of some spot trading options available on CoinW (source: official website)

The spot trading interface is clean and intuitive, suitable for beginners while still offering enough depth for more experienced traders. Advanced order types like limit, market, and stop-limit orders are supported.

Futures Trading

For traders looking to use leverage or speculate on price movements, CoinW offers cryptocurrency futures contracts. Users can trade with up to 100x leverage on some pairs, allowing for potentially higher profits (and higher risk). Both USD and coin-margined futures are available.

The futures trading interface includes useful tools like a funding rate indicator, liquidation price calculator, and real-time market depth charts. Risk management features like stop-loss, and take-profit orders help users control their exposure.

ETF Trading

CoinW has introduced cryptocurrency ETFs (Exchange Traded Funds) to its offerings, allowing users to gain exposure to baskets of digital assets through a single tradable product. This can be an attractive option for those looking to diversify their crypto holdings or gain broad market exposure.

Earn & Staking

For users looking to earn passive income on their crypto holdings, CoinW provides several options:

- Flexible savings: Earn interest by depositing coins into flexible savings accounts

- Fixed-term staking: Lock up tokens for a set period to earn higher yields

- Auto-invest: Set up recurring buys to dollar-cost average into chosen assets

The APY rates are generally competitive with those of other major exchanges — even though they are subject to fluctuations based on market conditions.

Copy Trading

CoinW's copy trading feature allows users to automatically mirror the trades of successful traders on the platform. This can be an attractive option for beginners or those who don't have time to actively manage their trades. To elaborate, users can browse the profiles of different traders operating on the platform, allowing them to view their past performance and accordingly allocate funds to copy their strategies.

Mobile App

CoinW offers a fully featured mobile app for iOS and Android devices. The app provides access to most of the exchange's functionality, including spot and futures trading, account management, and market data. Push notifications keep users updated on price movements and account activity.

CoinW Credit Card

In a move designed to foster greater crypto adoption, CoinW has introduced a Visa debit card that allows users to spend their crypto holdings at merchants worldwide. The card automatically converts crypto to fiat at the point of sale, providing users with a seamless spending experience.

CoinW Customer Support

While CoinW offers a robust trading platform, one area where it falls somewhat short is its lack of robust customer support options. For instance, while the exchange provides several channels for getting help, many reviews online suggest that response times and depth of support can sometimes be inconsistent.

That said, support options include:

- Live chat (available 24/7)

- Email support

- FAQ and help center

- Community forums

Notably absent is phone support, which some users may find frustrating for urgent issues. However, the help center landing page does provide a wealth of information on using the platform, but it may not be comprehensive enough for complete novices.

Is CoinW Available to US Investors?

No, CoinW is not available to users in the United States. Due to regulatory restrictions, residents of the US are prohibited from accessing the platform's services. While CoinW does offer a wide range of features globally, US-based users will need to consider other platforms that are compliant with local laws.

For those looking to trade without undergoing identity verification, it may be worth exploring non-KYC exchanges as an alternative. However, always keep in mind the legal implications and consult a tax professional, as the IRS requires specific reporting for digital asset transactions.

CoinW Trading Fees

CoinW offers a competitive fee structure that scales based on a user's 30-day trading volume and CWT (CoinW Token) holdings. The base taker and maker fees start at 0.2%, which is in line with or slightly below the industry average.

Users can further reduce their trading fees by holding CWT tokens. For example, holding 500 CWT reduces fees by an additional 10%, while holding 5000 CWT provides a 30% fee discount. Withdrawal fees vary by cryptocurrency but are generally in line with network transaction costs. For Bitcoin, the withdrawal fee is set at 0.0005 BTC, which is competitive with other major exchanges.

Security Services on Offer

CoinW prioritizes the security of its users and their assets using a comprehensive approach that employs multiple layers of security for user accounts, starting with robust identity verification processes. These include cell phone verification codes, Google Authenticator, Twilio, and U2F security keys for critical actions such as login, API key generation, and coin withdrawals.

Moreover, CoinW records and analyzes IP data for each login, allowing for the detection of any abnormal activities. The platform also implements stringent security protocols for coin recharge and withdrawal operations, utilizing automatic systems that are constantly monitored through operation logs and user behavior pattern analysis. In cases where suspicious activities are detected, manual checks can be triggered to ensure the integrity of transactions.

To manage its crypto reserves securely and transparently, CoinW utilizes advanced approval chains and risk policy engines. The platform incorporates a multi-party computing (MPC) wallet for handling on-chain transactions, while the majority of system funds are stored in offline cold wallets, significantly reducing the risk of unauthorized access.

Risk Mitigation Practices Being Implemented

The exchange’s risk management system is multifaceted, featuring user activity area mapping, risk distribution territory analysis, and configurable risk rules for various event scenarios. This is complemented by an event management system that allows for detailed data queries and a platform linkage mechanism for comprehensive risk identification, analysis, and mitigation suggestions.

The technical infrastructure of CoinW is fortified with multiple layers of protection. These include a web application firewall (WAF), DDoS protection, bot guard mechanisms, and security acceleration features. The platform's system security is further enhanced by an internal firewall mechanism and rigorous database management practices. Daily backups of the database are created, encrypted, and compressed into archives, which are then distributed to servers in multiple locations for redundancy and disaster recovery purposes.

That said, despite these extensive security measures, CoinW emphasizes the importance of user vigilance, encouraging the adoption of strong personal security practices such as using unique and complex passwords, enabling two-factor authentication, and remaining alert to potential phishing attempts. Users are also advised to verify any communication purportedly from CoinW through official channels to ensure authenticity and maintain the highest level of account security.

How to Sign Up for CoinW

Getting started with CoinW is a fairly straightforward process:

- Visit the CoinW website and click "Register" in the top right corner.

- Enter an email address and create a strong password.

- Agree to the terms of service and click "Create Account".

- Verify the email address by clicking the link sent to the inbox.

- Once the email is verified, the user needs to complete the KYC (Know Your Customer) process, which involves providing personal information and uploading identification documents.

- After the KYC process is approved, users can deposit funds and begin trading.

Lastly, users can enable two-factor authentication (2FA) for an extra layer of account security.

Conclusion

As things stand, CoinW has established itself as a feature-rich cryptocurrency exchange suitable for both beginners and experienced traders. Its wide selection of supported assets, competitive fee structure, and advanced trading options like futures and ETFs make it an attractive option in today’s crowded crypto exchange market.

The platform's security measures and regulatory compliance efforts provide users with peace of mind, while features like copy trading and the CoinW Visa card add value beyond basic cryptocurrency trading. Simply put, for anyone looking to access a broad range of crypto assets and trading products, CoinW presents a solid option worth considering. However, as always, it's important that users do their own research and perhaps start with small amounts until they are comfortable with the platform's features and functionality.

Want to start trading on CoinW? Create an account here and receive exclusive bonuses.