Phemex BTC Vault Review. A Seamless Way to Earn Passive Bitcoin Income with Up to 15% APY?

Phemex’s BTC Vault is an automated yield/incentive offering allowing Bitcoin holders to earn weekly rewards (in BTC) of up to 15% APY, all while keeping their funds liquid for trading or withdrawals. The vault offers no lock-up periods and comes with a well-designed revenue-sharing model that is ideal for individuals looking to start earning passive income on their Bitcoin holdings.

What is Phemex’s BTC Vault?

Phemex BTC Vault is an exclusive Bitcoin yield program for the platform’s VIP users (including VIP tiers 1–5 as well as Star VIP members). Eligible individuals can earn weekly rewards (in BTC) just by holding the flagship cryptocurrency in their futures account and are free to withdraw or trade their BTC at any time (making it a low-risk, passive income option where a user's principal stays secure and accessible while generating yield).

Additionally, it bears mentioning that the vault doesn’t rely on lending out assets; instead, Phemex shares a portion of its own trading fee revenue with participants, ala distributing earnings back to users in Bitcoin.

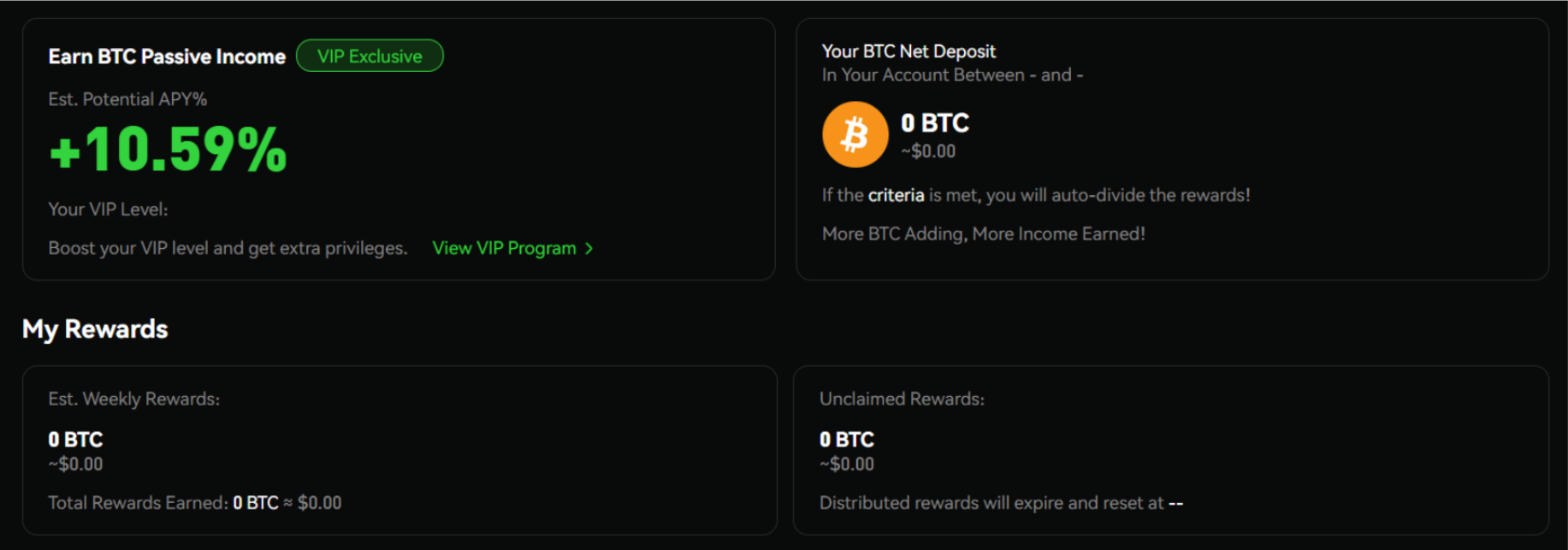

To elaborate, each week, accumulated fees are paid out to users in proportion to how much BTC they have deposited. Initial estimates suggest an APY of anywhere around 10% - 15% (based on historical fee volumes), however, actual returns vary depending on market activity.

How Does Phemex’s BTC Vault Work?

To participate, users must start by depositing BTC into their Phemex futures account (contract account). Only net new deposits from external sources count, which means that the assets should come only via an on-chain transfer or purchase, rather than just transferring from one’s spot account (ensuring the program rewards bringing new assets onto the platform). There is no minimum lock-up or special enrollment required.

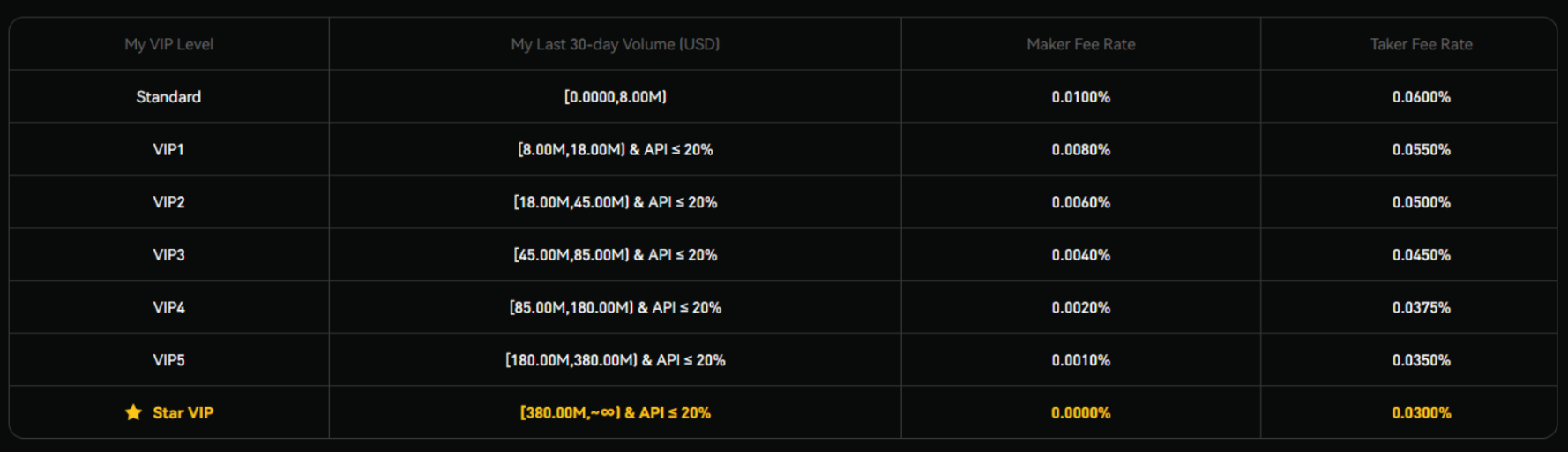

As highlighted earlier, use of the vault is limited to VIP-tier users (VIP 1 through 5 and Star VIP), which means that interested personnel either need to have a significant trading volume or asset balance in their possession.

Alternatively, users can also join if they possess a high VIP status on another exchange; however, the level of this access needs to align with Phemex’s existing standards (something that can be verified easily by having a word with the latter’s customer support team).

That being said, once a sizable amount of BTC has been deposited and an individual has achieved VIP status, rewards start accruing automatically from the next day at 00:00 UTC. There is no need to stake or subscribe manually as the system includes the relevant amount of BTC in its weekly calculations automatically.

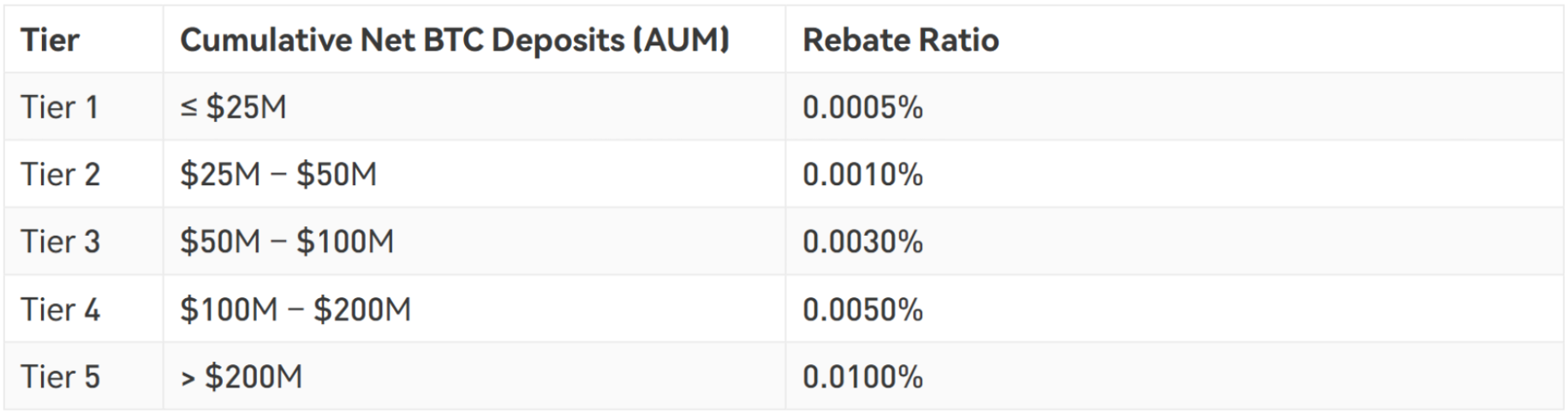

For example, Phemex has set tiered rebate ratios wherein if total vault deposits are under $25M, about 0.0005% of BTC futures trading volume fees go to the pool. However, at higher tiers (over $200M deposited), up to 0.01% of fee volume is shared.

In effect, the more BTC collectively deposited, the bigger slice of fees the vault participants as a whole earn. So, if a person holds 1% of all BTC in the vault, they receive 1% of that week’s reward pool.

Lastly, it bears mentioning that the vault operates on a weekly cycle such that rewards are calculated continuously and distributed every Monday at 04:00 UTC into users’ accounts. However, Phemex requires manual claiming of these incentives, i.e., users need to go into the vault rewards section each week and claim the BTC reward to their spot wallets.

If they are unable to do this by Thursday 23:59:59 UTC of that week, the unclaimed rewards expire, resulting in investors having to forfeit that particular payout.

What are some key benefits?

Sizable passive APY

With an estimated ~15% APY (variable), the vault offers an unusually high yield for Bitcoin. For more context, typical BTC interest accounts on major exchanges or lending platforms stand at 1–5% APY, that too on the condition of locking up one’s funds (typically for 30, 60 or 90 days).

No Lock-Ups, Full Flexibility

Participants can withdraw or move their Bitcoin at any time. This flexibility is crucial as it means the vault can serve as a “yield on idle funds” solution without hampering one’s ability to react to market moves. To put it simply, the deployed BTC remains available for trading/ withdrawal whenever needed.

Weekly Compounding & Payouts

As mentioned previously, rewards are distributed weekly (every Monday), allowing users to achieve a compounding effect if they do decide to reinvest their earnings. In fact, this weekly reward structure serves as a nice psychological boost for users as they are able to see tangible returns every few days.

Principal Protection

Since the yield comes from platform fees, one’s Bitcoin itself isn’t being loaned out or exposed to high-risk DeFi strategies. To elaborate, the principal BTC stays in the user’s account under Phemex’s custody (like any exchange deposit) and isn’t touched. The model is similar to earning a rebate or dividend, i.e. if trading activity is high, users earn more and vice versa.

Phemex explicitly positions the vault as low-risk and designed for stability. There’s no scenario where users can get a negative yield from the vault (at worst, a slow week means minimal rewards).

VIP Perks and Trading Benefits

The vault is tied to Phemex’s VIP program, which means higher deposits can elevate their tier status, unlocking better trading fee discounts and other perks.

User-Friendly

Getting started is straightforward, as there are no complex DeFi interfaces to navigate or swapping required. All one needs to do is deposit their BTC and go; the process is fully automated after that.

Moreover, there are no gas fees or blockchain transactions involved in earning the weekly yield (aside from the initial on-chain deposit), making the overall experience smooth, especially when compared to DIY yield farms where users must actively manage funds across protocols.

Steps to Start

- Create a Phemex Account: For those new to Phemex, a sign-up is required. Users can register with just an email address, Telegram ID or even X account. Furthermore, sign-ups through WhalePortal’s referral link come with the advantage that they don’t need to complete KYC to start.

- Become a VIP (if not already): New users can contact Phemex for a VIP match as mentioned earlier, or simply proceed if they meet the criteria. If one has signed up via a partner link or has made a sizable initial deposit, reaching out to Phemex support may be advisable, as they might even grant a provisional VIP tier.

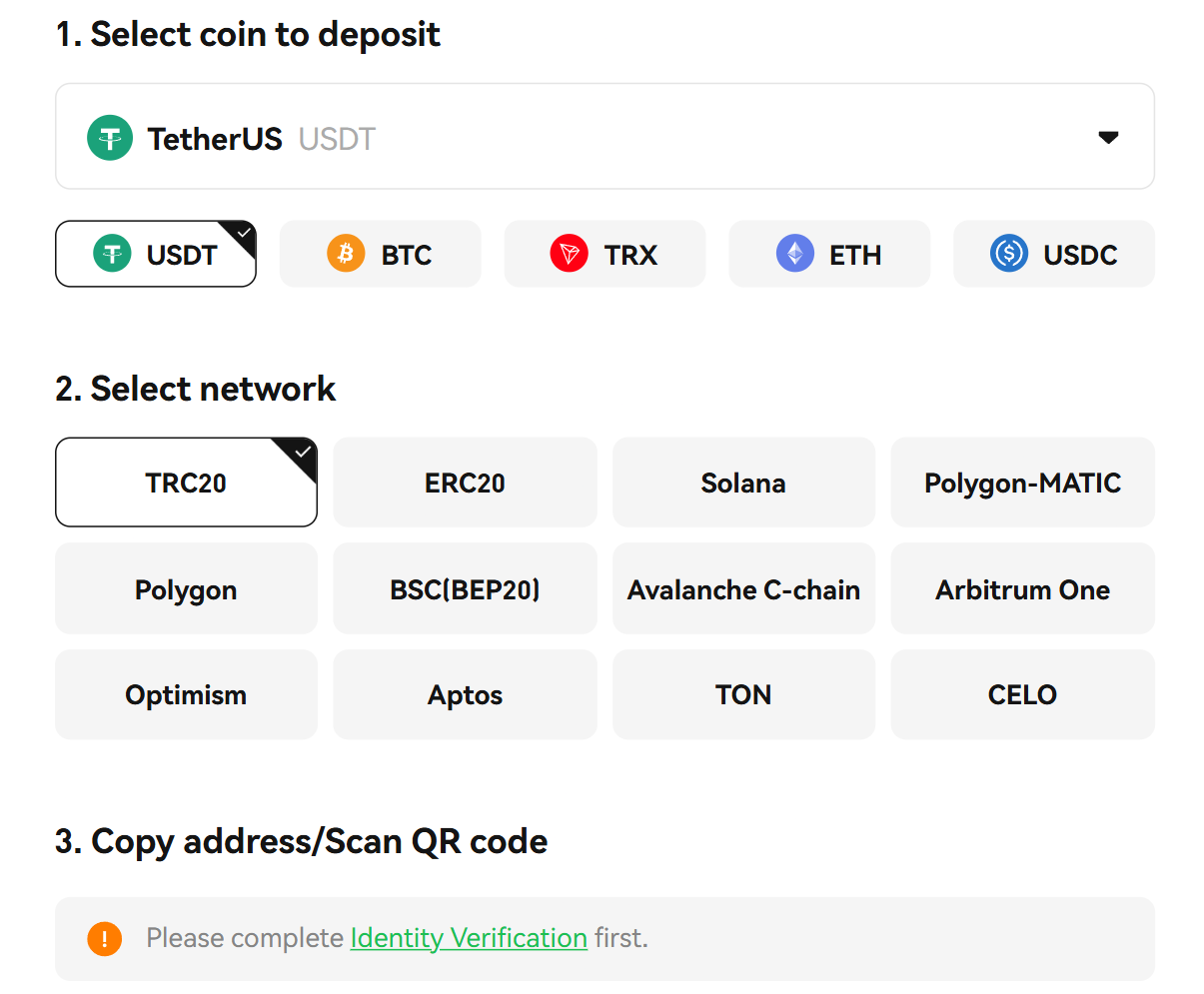

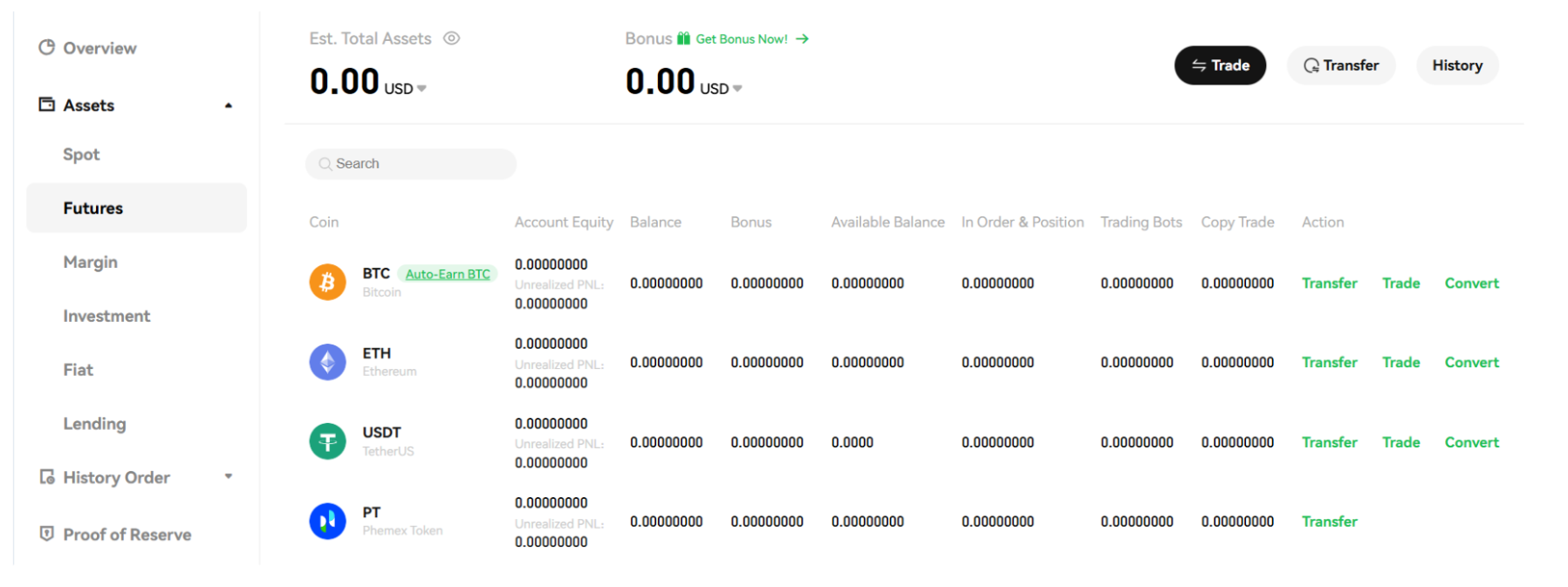

- Deposit BTC into Futures Account: When depositing through Phemex’s interface, users need to choose their Contract Trading Account (BTC) as the destination.

- Hold and Earn: Once the BTC is in a person’s futures account and they have been deemed VIP-qualified, no further action is needed to start earning.

- Claim Weekly Rewards: Every Monday, Phemex credits the designated rewards into one’s account. To access them, one needs to go to the Earn Crypto/BTC Vault section on their profiles and click “Claim” to transfer the reward to their spot wallets

Phemex vs. Apex

As crypto “vaults” have become an increasingly popular means of earning passive income, the market has become flooded with these offerings. However, not all vaults are created equal, and in this section, we will seek to explore why (comparing Phemex’s offerings with those of popular DEX Apex in particular).

From the outside looking in, Phemex’s BTC Vault stands as a centralized, custodial program sharing a slice of its BTC perpetuals fee revenue with its VIP users, paying variable weekly rewards (projected around 15% APY) directly in Bitcoin. There’s no lock-up, and funds remain liquid in your futures account, but access is VIP-only, and you accept standard exchange-custody risk.

By contrast, Apex Protocol’s Omni Vault is a decentralized, non-custodial product that accrues USDT yield from liquidation fees on its perp DEX. Returns float with market volatility and are designed to stay positive, which is to say that there’s no fixed lock, deposits/withdrawals batch at NAV updates, and anyone can join with a Web3 wallet (even though users accept smart-contract risks instead of exchange risk).

The bottom line

Phemex’s BTC Vault provides a novel and enticing way for Bitcoin holders to earn passive income on their coins without giving up control over them. It blends the ease of a centralized exchange (CEX) with a yield mechanism inspired by DeFi (sharing protocol fees), delivering what has been called “the future of yield” by Phemex’s team.

For VIP users already on Phemex, using the vault is almost a no-brainer since it’s essentially free Bitcoin on top of their normal trading and holding activities. That said, potential users should temper expectations and understand the variables at play. The vault’s returns depend on the platform’s overall health, so it’s not magic money but funds coming from actual traders’ daily activities.

Looking ahead, this symbiotic blueprint put forth by Phemex stands to become the norm (one that could be emulated by other exchanges) if its offering proves successful. Therefore, for Bitcoin holders looking to grow their stack effortlessly, the BTC vault offers an appealing mix of professional-grade finance (reliable yields, transparent rules) with a casual ease-of-use.

Start earning weekly Bitcoin rewards with Phemex’s BTC Vault today.

Related Articles:

- Phemex Deposit Bonus Guide

- Bitcoin CME Gaps and CME Trading Strategy Explained

- How and Where to Set Up a Crypto Company. Here’s What You Need to Know